What is Electronic Way Bill (EWB):

√ Electronic Way Bill (E-Way Bill) is basically a compliance mechanism

√ Wherein by way of a digital interface

√ The person causing the movement of goods uploads the relevant information

√ Prior to the commencement of movement of goods and

√ Generates e-way bill on the GST portal

√ E-way bill is a document required to be carried by a person in charge of the conveyance carrying any consignment of goods of value exceeding Rs 50,000.

√ It is generated from the GST Common Portal by the registered persons or transporters

Need and Benefits of E – Way Bill:

1) Compliance of GST Law : It is mechanism to ensure that goods being Transported, comply with GST Law i.e. Invoicing, disclosure, Tax payment etc.

2) Tracking: It is effective tool to track the movement of Goods.

3) To Check Tax Evasion

4) Uniform Provisions across Nation: The e-way bill provisions under GST will bring in a uniform e-way bill rule which will be applicable throughout the country. Earlier different states prescribed different way bill rules which made compliance difficult and it was major contributor to the bottlenecks at the check posts

5) Reduction in Transport Time: The physical interface will be replaced by digital interface, which will facilitate faster movement of goods.

6) Valid across India : One E-way bill is valid in every State and Union territory. No need to prepare statewise EWB.

7) Beneficial to Economy: Indian economy save up to Rs 2300 crore in transportation which they lost annually due to truck delays at state check posts

8) Increase in Government Revenue: It is expected that due to Eway bill, government revenue is will increase by 20%.

9) Beneficial to logistic Industry: It is bound to improve the turnaround time of vehicles and help the logistics industry by increasing the average distances travelled, reducing the travel time as well as costs.

10) The abolition of check posts : Its a huge relief for truckers who would earlier have to wait in queue for hours to clear the check posts. No need of Transit pass when goods passing through different state.

11) Nature Friendly: It is expected that due to E-way bill, 50 Tons of Paper will be saved Every Day.

24th GST Council Meeting:

This was first kind of GST Council meeting held through Video Conference on 16th Dec 2017. Below decision is taken in meeting:

✓ 16.01.18 – System to be opened for Trial Basis : The nationwide EWB system will be ready to be rolled out on a trial basis latest by 16th January, 2018. Trade and transporters can start using this system on a voluntary basis from 16th January, 2018

✓ 01.02.18 – Applicability for Inter-statement movement : The rules for implementation of nationwide e-way Bill system for inter-State movement of goods on a compulsory basis will be notified with effect from 1st February, 2018. This will bring uniformity across the States for seamless inter-State movement of goods.

✓ 31.05.18 – Applicability for Intra-statement movement : System for both inter-State & intra-State EWB generation will be ready by 16.01.18. States may choose their own timings for implementation of EWB for intra-State movement of goods on any date before 01.06.18. There are certain States which are already having system of EWB for intra-State as well as inter-State movement and some of those States can be early adopters of national e-way Bill system for intra-State movement also. But in any case uniform system of EWB for inter-State as well as intra-State movement will be implemented across the country by 01.06.18.

EWB related Notification:

Below Central Notifications are issued for EWB as of now

✓ Notification No 10/2017 dated 28.06.17 – Just Rule 138 inserted without prescribing various regulation

✓ Notification No 27/2017 dated 30.08.17 – Detailed Rules prescribed

✓ Notification No 34/2017 dated 15.09.17 – Proviso for Job Work and Handicraft inserted

✓ Notification No 74/2017 dated 29.12.17 – Effective date of 01.02.18 notified for applicability of EWB Rules.

✓ Notification No 03/2018 dated 23.01.18 – EWB Rules replaced

EMPOWERING SECTION:

Sec 68 of CGST Act 2017:

Sec 68(1): The Government may require the person in charge of a conveyance carrying any consignment of goods of value exceeding such amount as may be specified to carry with him such documents and such devices as may be prescribed.

Sec 68(2): The details of documents required to be carried under sub-section (1) shall be validated in such manner as may be prescribed.

Sec 68(3): Where any conveyance referred to in sub-section (1) is intercepted by the proper officer at any place, he may require the person in charge of the said conveyance to produce the documents prescribed under the said sub-section and devices for verification, and the said person shall be liable to produce

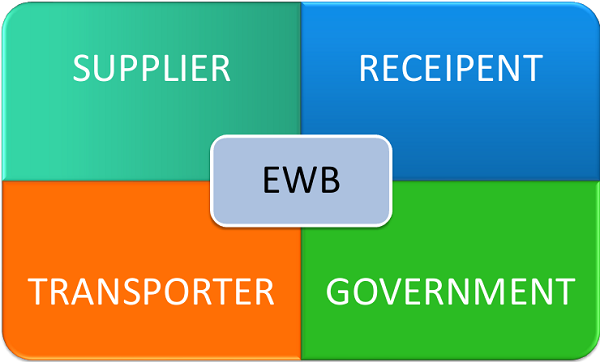

STAKE HOLDER OF E-WAY BILL SYSTEM:

When and Who should prepare Part A of EWB [ RULE 138(1) ] :

▪ Every Registered person

▪ Who CAUSES MOVEMENT of GOODS

▪ of CONSIGNMENT VALUE exceeding Rs 50,000/-

✓ In relation to a supply or

✓ FOR REASONS OTHER THAN SUPPLY or

✓ Due to inward supply from an unregistered person,

▪ Shall before commencement of such movement, furnish information relating to the said goods as specified in Part A of FORM GST EWB-01, electronically, on the common portal along with such other information as may be required at the common portal and a unique number will be generated on the said portal

When and Who should prepare Part A of EWB [ RULE 138(1) ] :

▪ JOB WORK : where goods are sent by a Principal located in one State to Job worker located in any other State, the e-way bill shall be generated by the principal irrespective of the value of the consignment.

▪ HANDICRAFT GOODS: where handicraft goods are transported from one State to another by a person who has been exempted from the requirement of obtaining registration, the e-way bill shall be generated by the said person irrespective of the value of the consignment

▪ CONSIGNMENT VALUE: It means value,

✓ Determined as per Sec 15, declared in an invoice / bill of supply / delivery challan and

✓ Includes the central tax, State or Union territory tax, integrated tax and cess charged, if any, in the document.

Part B of EWB & GENERATION OF EWB [ RULE 138(2) ] :

( EWB is not valid and usable, unless its Part B is filled. Part-B is a must for the e-way bill for movement purpose. Otherwise printout of EWB says it is invalid for movement of goods.)

▪ CASE I – WHERE GOODS ARE TRANSPORTED IN OWN CONVEYANCE OR HIRED ONE OR BY RAILWAYS OR BY AIR OR BY VESSEL :

✓ Where the goods are transported By

✓ Registered person as a consignor or the recipient of supply as the consignee,

✓ Whether in his own conveyance or a hired one or by railways or by air or by vessel,

✓ the said person or the recipient may generate the e-way bill in FORM GST EWB-01 electronically on the common portal after furnishing information in Part B of FORM GST EWB-01.

Part B of EWB & GENERATION OF EWB [ RULE 138(3) ] :

▪ CASE II – THE GOODS ARE HANDED OVER TO A TRANSPORTER FOR TRANSPORTATION BY ROAD:

✓ Where the goods are handed over to a transporter for transportation by road,

✓ Registered person shall furnish the information relating to the transporter on the common portal and

✓ E-way bill shall be generated by the transporter on the said portal on the basis of the information furnished by the registered person in Part A of FORM GST EWB-01

CONSIGNMENT VALUE LESS THAN RS 50,000 [ PROVISO TO RULE 138(3) ] – Registered person/Transporter, at his option, can generate and carry EWB even if value of consignment is less than Rs 50,000.

▪ CASE III – WHERE THE MOVEMENT IS CAUSED BY AN UNREGISTERED PERSON:

✓ Where the movement is caused by an unregistered person

✓ Either in his own conveyance or a hired one or through a transporter,

✓ he or the transporter may, at their option, generate the e-way bill in FORM GST EWB-01 on the common portal in the manner specified in this rule

[ The unregistered transporter can enroll on the common portal and generate the e-way bill for

movement of goods for his clients – Empowering Provision Sec 35(2) ]

▪ EXPLANATION 1 TO RULE 138(3) :

✓ Where the goods are supplied by an unregistered supplier to a recipient who is registered,

✓ The movement shall be said to be caused by such recipient, if the recipient is known at the time of commencement of the movement of goods.

▪ CASE IV – WHERE TRANSPORTER TRANSPORT GOODS IN ONE VAHICLE TO HIS PLACE OF BUSINESS FOR FURTHER TRANSPORTATION:

✓ Where the goods are transported for a distance of less than 10km within the State or Union territory

✓ From the place of business of the consignor to the place of business of the transporter

✓ For further transportation,

✓The supplier or recipient or the transporter may not furnish the details of conveyance in Part B of FORM GST EWB-01.

Unique E Way Bill Number – EBN [ RULE 138(4) ] :

• Unique EBN Number :

✓ Upon generation of the e-way bill on the common portal,

✓ a unique e-way bill number (EBN) generated by the common portal,

✓ Shall be made available to the supplier, the recipient and the transporter on the common portal.

▪ EBN number is 12 digit numeric unique number.

▪ AUTHENTICITY OF EBN/E WAY BILL – Any person can verify the authenticity or the correctness of e-way bill by entering EWB No, EWB Date, Generator ID and Doc No in the search option of EWB Portal.

Multiple Vehicle Used For Transportation [ RULE 138(5) ] :

▪ UPDATION IN PART B OF FORM GST EWB – 01 – REQUIRED :

✓ Where the goods are transferred from one conveyance to another,

✓ the consigner or the recipient, who has provided information in Part- A of the FORM GST EWB-01, or the transporter shall,

✓ before such transfer and further movement of goods, update the details of conveyance in the e-way bill on the common portal in FORM GST EWB-01

▪ UPDATION IN PART B OF FORM GST EWB – 01 – NOT REQUIRED :

✓ Where the goods are transported for a distance of less than 10 Km within the State or Union territory

✓ From the place of business of the transporter finally to the place of business of the consignee,

✓ The details of conveyance may not be updated in the e-way bill.

Transporter Changed [ RULE 138(5A) ] :

✓ The consignor/ recipient, who has furnished the information in Part-A of FORM GST EWB-01, or the transporter,

✓ May assign the e-way bill number to another registered/ enrolled transporter for updating the information in Part-B of FORM GST EWB-01 for further movement of consignment

✓ Provided that once the details of the conveyance have been updated by the transporter in Part B of FORM GST EWB-01, the consignor or recipient, as the case maybe, who has furnished the information in Part-A of FORM GST EWB-01 shall not be allowed to assign the e-way bill number to another transporter.

Consolidation of EWBs [ RULE 138(6) ] :

✓ Where multiple consignments are intended to be transported in one conveyance,

✓ Transporter may indicate the serial number of e-way bills generated in respect of each such consignment electronically on the common portal and

✓ a consolidated e-way bill in FORM GST EWB-02 may be generated by him on the said common portal prior to the movement of goods

Ultimately Transporter to be Responsible for EWB [ RULE 138(7) ] :

▪ TRANSPORTER TO GENERATE EWB: Where the consignor or the consignee has not generated FORM GST

EWB-01 in accordance with the provisions of sub-rule (1) and

✓ Value of goods carried in the conveyance is more than Rs 50,000,

✓ Transporter shall generate FORM GST EWB-01 on the basis of invoice/ bill of supply/ delivery challan, and may also generate a consolidated e-way bill in FORM GST EWB-02 on the common portal

✓ Prior to the movement of goods.

▪ E – COMMERCE: Where the goods to be transported are supplied through an e-commerce operator, the information in Part A of FORM GST EWB-01 may be furnished by such e-commerce operator

EWB helpful for GSTR 1 [ RULE 138(8) ] :

✓ The information furnished in Part A of FORM GST EWB-01

✓ Shall be made available to the registered supplier on the common portal

✓ Who may utilize the same for furnishing details in FORM GSTR-1:

Cancellation of E Way Bill [ RULE 138(9) ] :

✓ Where an e-way bill has been generated,

✓ But goods are either not transported or are not transported as per the details furnished in the e-way bill,

✓ E-way bill may be cancelled electronically on the common portal, within 24 hrs of its generation

✓ However, an e-way bill cannot be cancelled if it has been verified in transit in accordance with the provisions of rule 138B of the CGST Rules, 2017

• Deletion of E-Way Bill – The e-way bill once generated cannot be deleted. However, it can be cancelled by the generator within 24 hours of generation

• Modification of EWB : The e-way bill once generated, cannot be edited or modified. Only Part-B can be updated to it. Unique number generated under sub-rule (1) shall be valid for 72 hours for updation of Part B of FORM GST EWB-01.

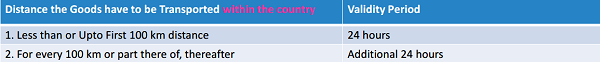

Validity of E Way Bill [ RULE 138(10) ] :

✓ E-Way Bill is valid as under :

✓ Validity start from: Validity period will start from time of generation of EWB. The validity of the e-way bill starts when first entry is made in Part-B. That is, vehicle entry is made first time in case of road transportation or first transport document number entry in case of rail/air/ship transportation, whichever is the first entry. It may be noted that validity is not re-calculated for subsequent entries in Part-B.

✓ Extention for Validity: Commissioner may, by notification, extend the validity period of Eway bill for certain categories of goods as may be specified therein.

Acceptance of E Way Bill [ RULE 138(11),(12) ] :

ACCEPTANCE BY COUNTER PARTY: The details of EWB generated under sub-rule (1) shall be made available to

(a) supplier, if registered, where the information in Part A of FORM GST EWB-01 has been furnished by the recipient or the transporter; or

(b) recipient, if registered, where the information in Part A of FORM GST EWB-01 has been furnished by the supplier or the transporter,

on the common portal, and the supplier or the recipient, as the case maybe, shall communicate his acceptance or rejection of the consignment covered by the e-way bill.

▪ DEEMED ACCEPTANCE: Where the recipient/supplier as the case may be does not communicate his acceptance or rejection within 72 hours of the details being made available to him on the common portal, it shall be deemed that he has accepted the said details.

E Way Bill not required [ RULE 138(13) ] :

▪ E-WAY BILL IS NOT REQUIRED TO BE GENERATED IN THE FOLLOWING CASES :

a) Transport of goods as specified in Annexure to Rule 138 of the CGST Rules, 2017

b) Goods being transported by a non-motorised conveyance;

c) Goods being transported from the port, airport, air cargo complex and land customs station to an inland container depot or a container freight station for clearance by Customs;

d) in respect of movement of goods within such areas as are notified under sub rule (14)(d) of respective state GST Rules;

e) Exempted goods, as per Notification No 2/17CT(Rate), as amended, EXCEPT DE-OILED CAKE.

f) Goods being transported are alcoholic liquor for human consumption, petroleum crude, high speed diesel, motor spirit (commonly known as petrol), natural gas or aviation turbine fuel; and

g) where the goods being transported are treated as no supply under Schedule III of the Act

Documents Required with E-Way Bill [ RULE 138A ] :

▪ The person in charge of a conveyance shall carry :

a) Invoice or bill of supply or delivery challan, as the case may be; and

b) Copy of the e-way bill (Form EWB- 01) or the e-way bill number (Form EWB- 02), either physically or mapped to a Radio Frequency Identification Device embedded on to the conveyance in such manner as may be notified by the Commissioner

▪ E-way bill not required in Exceptional Situation – However, where circumstances so warrant, the Commissioner may, by notification, require the person-in-charge to carry only documents as as per Sr. No. (a) above only.

Documents Required with E-Way Bill [ RULE 138A ] :

▪ Requirement of RFI Devices for Transporter:

✓ Commissioner may, by notification, require a class of transporters to obtain a unique Radio Frequency Identification Device and

✓ Get the said device embedded on to the conveyance and

✓ Map the e-way bill to the Radio Frequency Identification Device prior to the movement of goods.

IRN – Invoice Reference Number [ RULE 138A ] :

▪ IRN Number, instead of Physical Invoice:

✓ Registered person may obtain an Invoice Reference Number from the common portal

✓ By uploading, a tax invoice issued by him in FORM GST INV-1 and

✓ Produce the same for verification by the proper officer in lieu of the tax invoice and such number shall be valid for a period of 30 days from the date of uploading.

▪ Auto Populated FORM EWB-01:

✓ Where the registered person uploads the invoice IN Form GST INV 01,

✓ Information in Part A of FORM GST EWB-01 shall be auto-populated by the common portal on the basis of the information furnished in FORM GST INV-1.

Verification of documents and conveyances [ RULE 138B ] :

▪ Verification of E Way Bill:

✓ The Commissioner or an officer empowered by him in this behalf May authorise the proper officer

✓ To intercept any conveyance,

✓ To verify the e-way bill or the e-way bill number in physical form for all inter-State and intra-State movement of goods.

▪ Verification through RFID Reader:

✓ The Commissioner shall get Radio Frequency Identification Device (RFID) readers installed at places where the verification of movement of goods is required to be carried out and

✓ Verification of movement of vehicles shall be done through such device readers, where the eway bill has been mapped with the said device.

Verification of documents and conveyances [ RULE 138B ] :

▪ Physical Verification of Conveyance by Proper Officer:

✓ The Commissioner or an officer empowered by him in this behalf may authorise the proper officer

✓ To carry out physical verification of Conveyance

▪ Physical Verification of Conveyance by Any Officer :

✓ Physical verification of a specific conveyance can also be carried out by any other officer,

✓ On receipt of specific information on evasion of tax,

✓ After obtaining necessary approval of the Commissioner or an officer authorised by him in this behalf.

Inspection and Verification of goods- [ RULE 138C ] :

▪ Inspection Report of Verification:

✓ A summary report of every inspection of goods in transit shall be recorded online

✓ By the proper officer in Part A of FORM GST EWB-03 within 24 hours of inspection and

✓ The final report in Part B of FORM GST EWB-03 shall be recorded within 3 days of such inspection.

▪ No further Verification of Conveyance :

✓ Where the physical verification of goods being transported on any conveyance has been done during transit at one place within the State or in any other State,

✓ No further physical verification of the said conveyance shall be carried out again in the State, unless a specific information relating to evasion of tax is made available subsequently.

Information of Detained Vehicles – [ RULE 138D ] :

✓ Where a vehicle has been intercepted and detained for a period exceeding 30 minutes,

✓ The transporter may upload the said information in FORM GST EWB-04 on the common portal.

(Author is associated with S M Munot & Associates and can be reached at munotswapnil@gmail.com)

“Goods being transported from the port, airport, air cargo complex and land customs station to an inland container depot or a container freight station for clearance by Customs” – What about the reverse way for exports – From the customs station or an inland container depot or from a shipper factory to the port?

50000 Se kam hai to eway bill register karana padega mere ko