The NFAR Annual Report for 2022-23 reflects a pivotal year marked by significant achievements and milestones. This comprehensive report, offers stakeholders a holistic view of NFAR operations and activities throughout the year. Notably, the grantee status granted by Parliament in the Supplementary Grants of 2022-23 has bolstered NFRA’s financial autonomy. NFRA focus on audit quality remained unwavering, leading to the initiation of audit quality inspections of firms, underscoring our commitment to systemic improvements. This report details key results, achievements, stakeholder interactions, and our ongoing efforts towards capacity building and international best practices.

National Financial Reporting Authority

FROM THE DESK OF THE CHAIRPERSON NATIONAL FINANCIAL REPORTING AUTHORITY

It is my pleasure to present the Annual Report of the National Financial Reporting Authority for the year 2022-23. I hope this performance report proves useful to our stakeholders in having an overall view of the functioning and activities during the year.

It was a very significant year in more ways than one. NFRA was accorded grantee status by Parliament in the Supplementary Grants of 2022-23 and the first grants were released in March 2023, further strengthening financial autonomy of NFRA.

This year was characterised by widespread engagement with all our stakeholders at various forums. We intend taking this engagement and the ideas exchanged to further the goals and priorities for NFRA. Audit quality continues to be our focus towards which all our activities have been oriented. A number of matters were referred by various agencies and other Regulators highlighting the need for systemic improvements in audit quality framework in the country reflecting concerted effort required to be made at all levels, including by the profession itself.

NFRA took a significant step by initiating audit quality inspections of audit firms, covering both firm wide audit quality and individual audit engagements. Inspection guidelines were published on our website. Five audit firms were covered during the year, optimising available resources, and we feel that there are several takeaways from the exercise for our stakeholders. The inspection cycle covers inspections, issue of observations, responses from audit firms, consideration of responses and further communication, if any, issue of draft inspection reports/draft final observations, meetings/discussions as may be required and issue of final reports. The entire cycle affords various opportunities to the audit firms to initiate remediation as was also witnessed for this cycle.

We issued a consultation paper and format for publishing annual transparency reports by audit firms, aimed at better governance. I thank all our stakeholders for their incisive comments, each of which has been very valuable input and would help us in finalising the requirements.

We continue to take steps towards augmenting human resources at NFRA. Efforts were renewed during the year towards capacity building and learning from international best practices.

I thank our Full-time members, Dr PK Tiwari and Ms Smita Jhingran, for their commitment and devotion to various responsibilities at NFRA and our Part-time members for their constructive involvement with the standards -setting agenda.

(Dr Ajay Bhushan Prasad Pandey)

Chairperson, NFRA

Page Contents

- Chapter I- About NFRA

- Chapter II- Key Results and Achievements

- Chapter III- Interaction with key stakeholders

- 1. NFRA’s Engagement with Ministry of Corporate Affairs (MCA)

- 2. NFRA’s outreach to Life Insurance Entities and IRDAI

- 3. Azadi Ka Amrit Mahotsav (AKAM) Event

- 4. Interaction with CFOs, Independent Directors, Professionals

- 5. Interaction with Indian Corporate Law Service Academy (ICLSA), Ministry of Corporate Affairs

- 6. Stakeholder Consultation Papers

- 7. Participation in International Conference

- Chapter IV – Information Technology Set-up at NFRA

- Chapter V – Resource Management

Chapter I- About NFRA

The National Financial Reporting Authority (NFRA) is a statutory body notified on 1 October 2018 under Section 132 of the Companies Act, 2013. The main objective of NFRA is to protect public interest and the interests of investors, creditors and others associated with companies or bodies corporate by establishing high-quality standards of accounting and auditing and exercising effective oversight of accounting functions performed by the companies and bodies corporate and auditing functions performed by the auditors.

1. Evolution and Background

It was experienced at various forums that the existing regulatory apparatus provided under the Chartered Accountants Act, of 1949 was unable to maintain required discipline and accountability amongst Chartered Accountancy professionals due to the challenges posed by self-regulation of the profession. The Standing Committee on Finance- Companies Bill 2009, while discussing the role of auditors, discussed the need for establishment of an independent audit regulator. Further, the Companies Law Committee Report, 2016, highlighted unsatisfactory oversight over the profession prior to establishment of NFRA.

The Hon’ble Supreme Court of India vide its judgment dated 23 February 2018, in the matter of S. Sukumar vs The Secretary, Institute of Chartered Accountants of India & Ors., stated that the Union of India should consider appropriate legislation and mechanism for oversight of profession of auditors on the lines of Sarbanes-Oxley Act, 2002, and Dodd Frank Wall Street Reform and Consumer Protection Act, 2010 in US.

Therefore, in line with the global trend of regulatory shift from self-regulatory organisations to an independent regulatory and oversight body, the Parliament, after due deliberation and on the recommendations of various expert committees, created an independent regulatory body with the establishment of NFRA in terms of section 132 of the Companies Act, 2013.

2. Mandate and Domain

The objective of NFRA is enshrined in Rule 4 (1) of the NFRA Rules, 2018, which provides that the Authority shall protect the public interest and the interests of the investors, creditors and others associated with the companies or bodies corporate governed under Rule 3 by establishing high quality standards of accounting and auditing and exercising effective oversight of accounting functions performed by the companies and bodies corporate and auditing functions performed by the auditors. Rules 7, 8 and 9 of the NFRA Rules 2018 prescribe the various powers and functions of NFRA as arising from its monitoring, review and oversight functions.

Rule 3 of NFRA Rules 2018, provides for the companies and class of companies over which NFRA has jurisdiction. The Rule states that NFRA shall have power to monitor and enforce compliance with accounting standards and auditing standards, oversee the quality of service under sub-section (2) of section 132 of the Companies Act, 1932 or undertake investigation under sub-section (4) of such section of the auditors of the following class of companies and bodies corporate, namely:-

a) companies whose securities are listed on any stock exchange in India or outside India;

b) unlisted public companies having paid-up capital of not less than rupees five hundred crores or having annual turnover of not less than rupees one thousand crores or having, in aggregate, outstanding loans, debentures and deposits of not less than rupees five hundred crores as on the 31st March of immediately preceding financial year;

c) insurance companies, banking companies, companies engaged in the generation or supply of electricity, companies governed by any special Act for the time being in force or bodies corporate incorporated by an Act in accordance with clauses (b), (c), (d), (e) and (f) of sub-section (4) of section 1 of the Act;

d) any body corporate or company or person, or any class of bodies corporate or companies or persons, on a reference made to the Authority by the Central Government in public interest; and

e) a body corporate incorporated or registered outside India, which is a subsidiary or associate company of any company or body corporate incorporated or registered in India as referred to in clauses (a) to (d), if the income or net worth of such subsidiary or associate company exceeds twenty per cent of the consolidated income or consolidated net worth of such company or the body corporate, as the case may be, referred to in clauses (a) to (d).

3. Functions and Powers of NFRA

As per Sub Section (2) of Section 132 of the Companies Act, 2013, notwithstanding anything contained in any other law for the time being in force, the National Financial Reporting Authority shall-

(a) make recommendations to the Central Government on the formulation and laying down of accounting and auditing policies and standards for adoption by companies or class of companies or their auditors, as the case may be;

(b) monitor and enforce the compliance with accounting standards and auditing standards in such manner as may be prescribed;

(c) oversee the quality of service of the professions associated with ensuring compliance with such standards, and suggest measures required for improvement in quality of service and such other related matters as may be prescribed; and

(d) perform such other functions relating to clauses (a), (b) and (c) as may be prescribed. NFRA shall-

As per Sub Section (4) of Section 132 of the Companies Act, 2013, notwithstanding anything contained in any other law for the time being in force, the National Financial Reporting Authority shall-

(a) have the power to investigate, either suo motu or on a reference made to it by the Central Government, for such class of bodies corporate or persons, in such manner as may be prescribed into the matters of professional or other misconduct committed by any member or firm of chartered accountants, registered under the Chartered Accountants Act, 1949 (38 of 1949):

Provided that no other institute or body shall initiate or continue any proceedings in such matters of misconduct where the National Financial Reporting Authority has initiated an investigation under this section;

(b) have the same powers as are vested in a civil court under the Code of Civil Procedure, 1908 (5 of 1908), while trying a suit, in respect of the following matters, namely: –

(i) discovery and production of books of account and other documents, at such place and at such time as may be specified by the National Financial Reporting Authority;

(ii) summoning and enforcing the attendance of persons and examining them on oath;

(iii) inspection of any books, registers and other documents of any person referred to in clause (b) at any place;

(iv) issuing commissions for examination of witnesses or documents;

(c) Where professional or other misconduct is proved, have the power to make order for-

(A) imposing penalty of –

I. not less than one lakh rupees, but which may extend to five times of the fees received, in case of individuals; and

II. not less than five lakh rupees, but which may extend to ten times of the fees received, in case of firms;

(B) debarring the member or the firm from-

I. being appointed as an auditor or internal auditor or under taking any audit in respect of financial statements or internal audit of the functions and activities of any company or body corporate; or

II. performing any valuation as provided under section 247, for a minimum period of six months or such higher period not exceeding ten years as may be determined by the National Financial Reporting Authority.

Explanation.— For the purposes of this sub-section, the expression “professional or other misconduct” shall have the same meaning assigned to it under section 22 of the Chartered Accountants Act, 1949 (38 of 1949).

4. NFRA Charter

NFRA has adopted a charter outlining its aims and commitments, which states the following;

a) The objective of the National Financial Reporting Authority (NFRA) is to continuously improve the quality of all corporate financial reporting in India.

b) The quality of corporate financial reporting will be measured and evaluated essentially by its compliance with the law and the statutorily notified accounting standards and auditing standards.

c) NFRA will strive for continuous improvement of corporate financial reporting across all types of Public Interest Entities (PIEs) and across all size categories of audit firms.

d) NFRA aims to be an organization noted for integrity, industry, and competence.

e) Persons who work for NFRA will adhere to the highest standards of uncompromising integrity, possess a vision of transforming the quality of corporate financial reporting, and display high levels of initiative and an unflagging drive for their work.

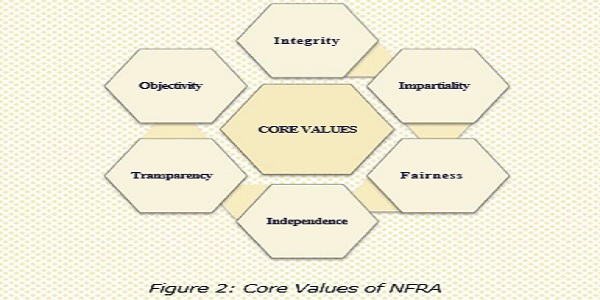

5. Core Values

The core values of NFRA are as follows:

a) Objectivity – No subjective action from either members or staff, openness to all facts/views/ opinions without any pre-conceived conclusions or pre-judging any matter.

b) Integrity – Across cases/persons/firms, absence of multiple standards, uniform treatment of all those identically/similarly placed.

c) Impartiality – Discharge of its functions without fear or favour.

d) Independence – Equidistant from all stakeholders.

e) Fairness – Not imposing unfair burdens especially with the benefit of hindsight.

f) Transparency– Fair and open processes.

NFRA’s functioning will at all times be mindful of the need to promote the ease and speed of doing business and will be guided always by the overall public interest, with all its actions being strictly anchored by and lying within, its legal mandate.

6. Organisational Structure

The National Financial Reporting Authority (Manner of Appointment and other Terms and Conditions of Service of Chairperson and Members) Rules, 2018 provides that the National Financial Reporting Authority shall consist of the following persons to be appointed by the Central Government, namely:-

a) Chairperson.

b) Three Full Time Members and

c) Nine Part Time Members.

All monitoring, oversight, adjudication, and enforcement functions are performed by the Executive Body comprising Chairperson and Full Time Members, as per subsection (3B) of section 132 of Companies Act, 2013. However, the responsibility to make recommendations to the Central Government on the formulation and laying down of accounting and auditing policies and standards for adoption by companies or class of companies or their auditors, is entrusted to the full Authority which includes the Executive Body and part-time members.

Chapter II- Key Results and Achievements

NFRA Rules 2018 lay down how NFRA shall protect the public interest and the interests of investors, creditors and others associated with the companies or bodies corporate falling within its jurisdiction. NFRA Rules 2018 empower the Authority to monitor and enforce compliance with accounting and auditing standards, oversee the quality of audit services and carry out disciplinary proceedings. Section 132(4) of the Companies Act also empowers NFRA to investigate, either suo motu or on a reference made to it by the Central Government, for such class of bodies corporate or persons, in such manner as may be prescribed into the matters of professional or other misconduct committed by any member or firm of chartered accountants, registered under the Chartered Accountants Act, 1949 (38 of 1949).

1. Audit Quality Review Reports (AQRs)

During the year under report, AQR in respect of a large company audit was published:

a) Audit Quality Review (AQR) Report in respect of Statutory Audit done by SRBC & Co LLP, Chartered Accountants Firm Registration Number (FRN:324982E(slash)E300003) of Infrastructure Leasing & Financial Services Limited (IL&FS) for the Financial Year 2017-18

The following is a summary of important observations of the AQR:

i) The initial appointment of SRBC & Co LLP, and the continuation of SRBC & Co LLP, as statutory auditor of IL&FS Limited, was prima facie illegal and void. Nevertheless, NFRA has proceeded to examine compliance by the audit firm with the SAs in their performance of this audit engagement without prejudice to this finding.

ii) In assessing the Risks of Material Misstatements (ROMM), the audit firm did not assess the susceptibility of the financial statements to material misstatement due to fraud, did not identify and assess revenue recognition and management override of controls as serious potential risks, which ultimately resulted in several violations of applicable Ind AS and SAs, as highlighted in the AQR, thus making the financial statements subject to serious material misstatements and therefore unreliable.

iii) The audit firm failed to properly evaluate the fair value of the investments amounting to `12,320 crore, out of which investments amounting to `1,637 crore were not verified by them at all. There was no evidence in the audit file that SRBC had ensured that the management had tested each investment individually for impairment.

iv) The audit firm failed to notice that the Related Party Transactions (RPT) were approved by the audit committee post-facto which was a clear violation of Section 177 of the Companies Act, 2013.

v) The audit firm failed to perform audit procedures to mitigate risks associated with sanctioning of loans worth `8,124 crore, ignored potential cases of evergreening and rollover of loans.

vi) The audit firm failed to evaluate the management assertion that related party transactions were conducted on terms equivalent to those prevailing in an arm’s length transaction.

Around 93% of the total revenue (`1,899 Crore in the standalone financial statements) of the company was from related parties. However, the transactions were made in violation of section 177 of the Companies Act, 2013.

vii) The audit firm’s EQCR (Engagement Quality Control Review) partner failed to report material misstatements known to him and did not exercise due diligence to obtain sufficient information to objectively evaluate the significant judgements of the engagement team and conclusions reached by them.

viii) The audit firm did not determine the persons comprising TCWG (Those Charged with Governance). Further NFRA did not find any communication to TCWG relating to auditor’s independence and the relationships and other matters between the firm and its network firms.

2. Financial Reporting Quality Review Reports (FRQRs)

During the year under report, two FRQRs were published.

a) Financial Reporting Quality Review report (FRQR) in respect of PSP Projects Limited for the Financial Year 2019-20

PSP Ltd. is a company listed on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) and is a multidisciplinary construction Company offering a diversified range of construction and allied services across industrial, institutional, Government, Government residential and residential projects in India.

Key observations:

i) The company’s disclosure of the initial measurement policy with respect to Trade Receivables (which was a material item, being 23.35% of the Total Assets) was not in accordance with Ind AS 109, Financial Instruments.

ii) The company had not made impairment allowance using Expected Credit Loss (ECL) approach, as required by Ind AS 109 in respect of Contract Assets and Other Financial Assets such as deposits with banks, and other deposits, which constituted 19% and 22.95% respectively of the Total Assets.

iii) The disclosure made by the company in relation to credit risk exposure of its financial instruments was not in accordance with the requirements of para 35M and para 35N of Ind AS 107 as it did not give information of the provision matrix used for computing impairment loss allowance for Trade Receivables and the credit risk grades used for managing the credit risk of Other Financial Assets.

iv) The full particulars of the terms and conditions of the loans to related parties had not been disclosed in the financial statements as per requirements of Section 186(4) of the Companies Act 2013 and Schedule III of the Companies Act, 2013.

v) The company’s disclosures with regard to Ind AS 115 were not adequate and clear. This standard requires an entity to disclose the significant payment terms (for example 30 to 90 days etc.) and the basis of determination of the existence of a significant financing component.

vi) The company had not adhered to the disclosure requirements of Para 114 and Para B87-B89 of Ind AS 115, which requires the company to disaggregate revenue.

vii) The company had not adequately complied with the disclosure requirements of Fair Value of the Financial Instruments, as required by Ind AS 107.

NFRA directed the company to rectify the deficiencies as pointed out in the FRQR.

b) Financial Reporting Quality Review report (FRQR) in respect of ISGEC Heavy Engineering Limited for the Financial Year 2019-20

Key observations:

i) Deficiencies were observed in implementing the provisions of Ind AS 109 Financial Instruments relating to impairment loss allowance (provisioning) for some of the financial assets viz. Trade Receivables and other financial assets by the company.

ii) The company did not evaluate impairment loss allowance on ‘Unbilled Revenue’ (under Other Current Asset) despite it being a contract asset for which the company was required to evaluate impairment loss in accordance with the requirements of Ind AS 109.

iii) The company did not make the required disclosure for Employee Benefits-Pensions in accordance with Para 135 of Ind AS 19 regarding defined contribution plans.

iv) The company had given corporate guarantees to the banks to secure the credit facilities granted by the banks to three of its subsidiaries. These corporate guarantees should have been accounted for as financial guarantees in accordance with Para 4.2.1 of Ind AS 109.

v) The company acquired another overseas company through one of its wholly owned subsidiaries during the year but did not disclose this transaction in the consolidated financial statements of the company in accordance with the requirements5 of Ind AS 103 Business Combinations.

vi) ISGEC gave loans to two of its foreign subsidiaries but did not disclose the purpose of giving loans to its foreign subsidiaries in its Board Report in accordance with the provisions of section 186 of the Companies Act, 2013.

vii) Certain information regarding ‘significant payment terms’ (e.g. when a payment is due) as required by Ind AS 115 Revenue from contracts with customers was not disclosed in the notes to the financial statement of the company. Also, disclosure regarding ‘obligations for returns, refunds, and other similar obligations’ was not made by the company. This disclosure is mandatory as per Ind AS 115.

viii) According to Ind AS 115 Revenue from contracts with customers, an entity is required to disclose its method used to recognise revenue and why this method provides a faithful depiction of transfer of goods and services. The company’s disclosures fell short of the above requirement insofar as the explanations why the method used provides a faithful depiction of the transfer of goods and services is concerned.

ix) The company took a loan under a government scheme in which a part of the interest shall be borne by the government in the form of interest subvention. Ind AS 20 Government Grants specifically requires certain disclosures, but ISGEC did not comply with these disclosures.

3. Disciplinary Orders

In pursuance of powers under section 132 (4), NFRA passed the following disciplinary orders during the year. As at the end of March 2023, a total of 74 disciplinary cases were in progress at various stages of the disciplinary process.

a) Orders issued in the matter of DHFL Branch Audit against CA Ayna Tamton and CA Akash Goel

DHFL, a housing finance company listed on both NSE and BSE and operating through a network of branches, was reportedly involved in financial fraud. NFRA took suo motu notice of the matter and conducted an Audit Quality Review (AQR) of the statutory audit of DHFL for FY 2017-18. Audit was conducted by Chaturvedi & Shah (CAS), a Mumbai-based Chartered Accountant Firm. During the review, NFRA also noticed that several engagement partners (EP) or branch auditors had signed the “Independent Branch Auditors’ Report” for nearly 250 branches. These branch auditors had violated both the Companies Act, 2013 and the Chartered Accountants Act, 1949 by (a) accepting the appointment that lacked a valid approval and (b) had also violated the SAs while carrying out the branch audit.

In exercise of powers under Section 132(4)(c) of the Companies Act, 2013, two penalty orders were concluded during the year, in respect of CA Ayna Tamton and CA Akash Goel for irregularities in the audit of branches of Dewan Housing Finance Corporation Limited for F.Y. 2017-18. The order imposed on each a monetary penalty of Rs.1 Lakh and debarred them for one year from being appointed as an auditor or internal auditor. The findings covered professional misconduct in respect of acceptance of an invalid audit engagement, portraying themselves as “Branch Statutory Auditor” and issuing “Independent Branch Auditors’ Report” in disregard of Chartered Accountants Act, 1949, Standards on Auditing (SAs) and ICAI Code of Ethics. The Chartered Accountants were also charged for failure to comply with SAs in the conduct and conclusion of the audit.

b) Order issued in the matter of Prabhu Steel Industries Limited (PSIL) against CA Gulshan Jagdish Jham.

PSIL is a company listed in Bombay Stock Exchange. In India, listed companies are required to follow Indian Accounting Standards (Ind AS) while preparing and presenting financial statements. However, PSIL has provided contradictory disclosures in Director’s Report and Notes to Annual Accounts regarding the fundamental aspect of applicable accounting framework followed in preparation of financial statements for the financial year 2019-20.

Certain key observations in respect of the financial statements were–

-

- Non-compliance with Ind AS while presenting financial statements.

- In the financial statements of the company, Statement of Changes in Equity was not presented making the financial statements incomplete.

- Companies Act requires preparation of Consolidated financial statements including all subsidiaries and associates. PSIL, despite having existence of an associate company, did not prepare a consolidated financial statement.

Despite these inconsistencies in the financial statement of PSIL, the CA in his independent auditor’s report had given a clean report. The auditor failed to exercise due diligence while carrying out his professional duty and failed to report the inconsistencies in the financial statements.

NFRA, under the powers conferred to it under section 132 of the Companies Act 2013 and NFRA Rules 2018, issued a show cause notice to the auditor. The auditor admitted all the charges made in the SCN and submitted that he did not know about the Ind AS requirements.

As a result, NFRA in exercise of its powers under Section 132(4)(c) of the Companies Act, 2013 ordered: (i) Imposition of a monetary penalty of Rs 100,000 (One Lakh only) and ii) CA Gulshan Jagdish Jham was debarred for one year from being appointed as an auditor or internal auditor or undertaking any audit in respect of financial statements or internal audit of the functions and activities of any company or body corporate.

c) Order in the matter of Trilogic Digital Media Limited (TDML) against CA Rajiv Bengali Key observations and main lapses:

Auditor falsely reported the audit of cash flow statement despite the fact that TDML’s Financial Statements did not include a cash flow statement. Auditor also attempted to mislead NFRA with a fabricated cash flow statement.

i) Auditor was grossly negligent in issuing unmodified audit opinion on the financial statements which did not reflect true and fair view of the state of affairs of the company.

ii) TDML had recognised other miscellaneous expenditure of crores and had written off ` 14.87 crores of sundry balances, which constituted 54.50% of total expenses of ` 71.43 crores. Such expenses were 3041% higher than previous year’s similar expenses of ` 1.28 crores. Auditor had failed to exercise due diligence and maintain professional skepticism towards possibility of material misstatements due to fraud despite existence of such abnormal/unusual transactions.

iii) Auditor was negligent in evaluating the appropriateness of Management’s assumption of ‘Going Concern’ despite existence of adverse indicators like revenue from operations decreased from ` 51 crores to ` 06 crores, TDML incurred loss of ` 54.37 crores resulting in erosion of net worth from ` 58.89 crores to ` 4.52 crores and reduction in inventory from ` 12.71 crores to Nil etc.

iv) TDML recognised Deferred Tax Assets (DTA) of ` 96 crores without any certainty of sufficient future taxable income, against which such DTA can be realised. Auditor failed to report inappropriate recognition of DTA.

v) Auditor had violated a large number of Standards on Auditing, accordingly, audit of a listed company was performed in a perfunctory and casual manner.

vi) Auditor failed to ensure compliance with six Accounting Standards.

vii) TDML did not give disclosure regarding details of transactions in Specified Bank Notes, a requirement mandated subsequent to demonetization in November 2016. Similarly, TDML did not give complete disclosure regarding related party details and transactions. Auditor was grossly negligent in ensuring compliance with important disclosure requirements as per the Act.

viii) Auditor had falsely reported that TDML, a media and content syndication company, is registered as Non-Banking Finance Company under section 45 IA of the RBI Act 1934.

NFRA in exercise of powers under Section 132(4)(c) of the Companies Act, 2013, ordered: (i) Imposition of a monetary penalty of Rs five lakh and, (ii) CA Rajiv Bengali was debarred for five years from being appointed as an auditor or internal auditor or from undertaking any audit in respect of financial statements or internal audit of the functions and activities of any company or body corporate.

d) Order in the matter of Vikas WSP Limited against CA Som Prakash Agarwal

The Order passed against CA Som Prakash Agarwal related to his failure to comply with the Indian Accounting Standards (Ind AS) while auditing the financial statements of Vikas WSP Limited, a listed company, for FY 2019-20. The main lapse was that he did not verify or report the interest cost on the loans declared as NPAs by the lending banks, which resulted in a significant overstatement of profit.

He also relied on a Management Representation Letter that had several inconsistencies and did not reflect the true and fair view of the financial position of the company.

The order also pointed out other lapses in his conduct of audit, such as absence of audit documentation, poor quality of audit documentation, absence of crucial audit evidence, and absence of external confirmation from the banks regarding the loans. These lapses showed a lack of professionalism and due diligence on his part and constituted professional misconduct. He provided an unmodified opinion on the financial statements of the company, which was not justified by the facts and circumstances of the case.

NFRA in exercise of powers under Section 132(4)(c) of the Companies Act, 2013, ordered: (i) Imposition of a monetary penalty of Rs 3,00,000 (Three Lakhs only) upon CA Som Prakash Aggarwal, and (ii) CA Som Prakash Aggarwal was debarred for three years from being appointed as an auditor or internal auditor or undertaking any audit in respect of financial statements or internal audit of the functions and activities of any company or body corporate. Further, CA Som Prakash Aggarwal was advised to undertake training on Standards on Auditing and Ind ASs from ICAI or any institution recognized by the ICAI or equivalent International Institution and submit the proof of completion of such training to this Authority within one hundred eighty (180) days from the date of the order becoming effective.

4. Audit Firm-wide Quality Inspections

During the year under report, NFRA commenced audit firm-wide quality inspections programme, which is integral to the functioning of independent audit regulators world-wide. An inspection generally consists of firm-wide quality reviews and/or test-check of individual audit assignments to evaluate the level of compliance with applicable auditing standards and quality control policy and processes.

Inspections by NFRA are intended to identify areas and opportunities for improvement in the audit firm’s system of quality control. Firm-wide inspections are also an important regulatory tool for overseeing the quality of service of the professionals and drive systemic change in the audit profession.

An inspection guideline was published on NFRA website outlining the objective, scope, methodology of inspections. It was specified that inspections would involve a review of the quality control policy, review of certain focus areas, test check of the quality control processes, and test check of audit engagements performed by the audit firm/auditor during the year, as may be identified by the inspection teams.

During December 2022 and January 2023, five large audit firms namely B S R & CO LLP, Price Waterhouse Chartered Accountants LLP, S R B C & CO LLP, Walker Chandiok & Co LLP, Deloitte Haskins & Sells LLP were inspected. Field work of the inspection was completed during 2022-23.

5. Circulars and Advisories

One of the important roles and responsibility of NFRA as an independent regulator is to protect the public interest and the interest of investors, creditors etc., by exercising effective oversight of accounting and auditing functions performed by companies and their auditors, respectively. During the course of its various monitoring and investigation activities, it was decided to issue circulars to reiterate provisions of law and standards, in areas where non-compliance of the standards and/or laws and rules was observed across cases. Accordingly, circulars were initiated to be issued with a view to prevent recurrence of such non-compliances and bring in systemic improvement in the quality of financial reporting in India, towards advising and guiding various stakeholders.

During the year 2022-23, NFRA issued two circulars as follows:

a) Circular dated 20.10.2022 in respect of non-accrual of interest on borrowings by the Companies in violation of Indian Accounting Standards.

During the course of NFRA’s investigation and disciplinary activities, it was observed that a company had discontinued accrual of interest on its borrowings from banks, which were reportedly classified as Non-Performing Assets (NPAs) by the lender banks and the company was in the process of negotiating a one-time settlement with the lender banks and expecting waiver/concession in the liabilities payable to the lender banks. However, this accounting treatment was not in accordance with the principles of applicable Indian Accounting Standard viz. Ind AS 109, Financial Instruments. Considering the potential of similar non-compliances by other companies, this circular was intended to draw attention of key stakeholders i.e., preparers and auditors to the underlying principles of Ind AS 109 for recognition and measurement of financial liabilities which, inter alia, requires that financial liabilities shall be removed from the balance sheet when and only when it is extinguished i.e., only when the borrower company is legally released from its primary responsibility for the liabilities either by process of law or by the creditor.

b) Circular dated 29.03.2023 in respect of non-compliance with Indian Accounting Standards (Ind ASs) on accounting policies for measurement of revenue from contracts with customers and trade receivables.

One of the tools of NFRA’s monitoring of compliance with accounting standards is periodic review of the disclosures and information contained in the financial statements published by the companies. By way of this periodic review, NFRA identifies certain areas of non-compliances with the applicable financial reporting framework which may indicate need for NFRA’s guidance or advise to companies and auditors at large. During the financial year 2022-23, NFRA’s review of significant accounting policies disclosed by a sample of companies noted erroneous accounting policies in respect of two critical areas viz. revenue from contracts with customers and trade receivables initial measurement.

i) Revenue from contracts with customers: Accounting policy for recognition and measurement of revenue was erroneously stated as ‘Fair Value of the consideration received or receivable’, instead of correct accounting policy of measurement based on ‘Transaction Price’. The erroneous accounting policy disclosed was in non-compliance with the prescriptions of Ind AS 115, revenue from contracts with customers.

ii) Trade receivables initial measurement: Trade receivables are financial assets within the scope of measurement requirements of Ind AS 109. As an exception to general principles of initial measurement of financial assets at fair value or fair value plus or minus the transaction costs, as applicable based on classification of the financial assets, the trade receivables other than those containing significant financing component have to be initially measured at transaction price which is defined in Ind AS 115. However, there were many companies which erroneously stated in their significant accounting policies that trade receivables are initially recognized (or measured) at fair value, which is contrary to the requirements of Ind AS 109.

The circular also cited examples of correct accounting policies as required by the applicable Ind ASs.

6. Professional Standards recommended for notification

Subsection 2(a) of section 132 of Companies Act 2013 prescribes that NFRA shall make recommendations to the Central Government on the formulation and laying down of accounting and auditing policies and standards for adoption by companies or class of companies or their auditors, as the case may be.

a) Indian Accounting Standards (Ind AS) Amendment Proposals Reviewed and Approved:

During the year, NFRA continued its mission to enable the Nation with high quality financial reporting framework by reviewing and recommending the proposals sent by the Institute of Chartered Accountants of India, on convergence with high quality globally accepted IFRS Standards. The proposals on Ind AS and SAs are required to be sent by ICAI for consideration of NFRA before recommendation to Central Government for notification. NFRA reviewed and approved a total of four (4) proposals of ICAI dated 18.02.2022 for amendments in Ind ASs pursuant to amendments in corresponding IFRS Standards. An Authority meeting was held on 30.05.2022 to deliberate on these Ind AS amendment proposals. The amendments mainly related to the three (3) Ind ASs and consequential amendments in a few other Ind ASs.

Table 1

| Sl. No. | Title of Ind AS | Amend-ment Title | ICAI Proposal Date | NFRA Meeting Date | Date of recommen- dation to MCA, GOI | Gazette Notif-ication |

| 1 | Ind AS 1, Presentation of Financial Statements | Amendment -Disclosure of Accounting Policies | 18.02.2022 | 30.05.2022 | 08.08.2022 | 31.03.2023 |

| 2 | Ind AS 8, Accounting Policies, Changes in Accounting Estimates and Errors. | Amendment -Definition of Accounting Estimates |

18.02.2022 | 30.05.2022 | 08.08.2022 | 31.03.2023 |

| 3 | Ind AS 12, Income Taxes | Amendment -Deferred Tax related to Assets and Liabilities arising from a Single Transaction | 18.02.2022 | 30.05.2022 | 08.08.2022 | 31.03.2023 |

| 4 | Ind AS Editorial Corrections to Ind AS 101, Ind AS 102, Ind AS 103, Ind AS 109 and Ind AS 115 | Editorial Corrections |

18.02.2022 | 30.05.2022 | 08.08.2022 | 31.03.2023 |

Table 1: Ind AS amendment proposals reviewed, approved and notified

b) Proposals under Review

i) New Standard on insurance contract viz. Ind AS 117, Insurance Contracts. Internationally, a new standard on Insurance Contracts viz. IFRS 17 was issued in May 2017 and was amended in 2019 and 2020. IFRS 17 is a complete overhaul of the approach and principles of accounting and reporting of insurance contracts and introduces a paradigm shift in the way the insurance contracts are accounted and reported presently. IFRS 17 is the first comprehensive and truly international IFRS Standard that will help investors and others better understand insurers’ risk exposure, profitability and financial position. Internationally, IFRS 17 has become effective from 1st January 2023.

It is proposed to issue a corresponding standard in India viz. Ind AS 117, Insurance Contracts. Ind AS 117. Although, Ind AS 117 is not an Insurance Industry specific standard, but it has high relevance to insurance sector entities, especially those dealing in long term insurance contracts. Therefore, NFRA reached out to the relevant and critical stakeholders of this Ind AS.

NFRA requested for the views and opinion of the Insurance Regulatory and Development of India (IRDAI) as this new standard is expected to have significant impact on the accounting, reporting and operational aspects of the insurance companies in India.

NFRA held an outreach with seven major Life Insurance Entities and IRDAI on 22.02.2023, as many entities from Life Insurance segment had offered comments on the exposure drafts of Ind AS 117. Officials from the finance and actuary departments of these Life Insurance Entities attended and deliberated on the various operational and technical topics of the implementation of Ind AS 117. Ind AS 117 was recommended by the Authority to MCA for notification later in the year.

ii) Standards on Auditing (SAs): During June 2022, NFRA received drafts of 35 SAs from ICAI for its review and recommendation to Central Government for notification under section 143 (10) of the Companies Act 2013. NFRA, based on its preliminary review of the draft SAs, requested the views of the ICAI regarding the differences between the draft SAs and the corresponding International Standards on Auditing (ISA) e.g., SA 220, SA 250, SA 315, SA 540, SA 600, and SQC 1 from the point of view of making the SAs more contemporary. Consequently, later in the year, ICAI issued exposure drafts for public consultation.

Chapter III- Interaction with key stakeholders

Auditors impart credibility to the information presented in the financial reports. Preparers produce the financial reports and are primarily responsible for the accuracy and reliability of the information in them. Users are the raison d’être of financial reporting and, therefore, are central to its purpose. Academicians use financial reports in their teaching and research. Auditors, preparers, users, and academia have significant stakes in the development of accounting and auditing regulations and in their effective monitoring and enforcement.

The primary stakeholders of NFRA include the Parliament, Ministry of Corporate Affairs, financial statement preparers, auditors, users of financial statements, academia. Other key stakeholders include government departments and ministries as well as organisations and individuals with specific interest in the subjects of the accounting and audit quality like SFIO, SEBI, RBI, etc and media.

1. NFRA’s Engagement with Ministry of Corporate Affairs (MCA)

NFRA welcomed Secretary, MCA, Shri Manoj Govil, following assumption of charge, to NFRA, in January 2023 and apprised the ambit of NFRA’s work. Throughout the year, and from time to time, NFRA effectively liaised with MCA on various aspects of its functioning.

Picture 1: NFRA’s presentation to Secretary, MCA

2. NFRA’s outreach to Life Insurance Entities and IRDAI

NFRA held an outreach with several Life Insurance Entities and IRDAI on 22.02.2023, on the proposed Ind AS 117-Insurance Contracts. Officials from Finance and Actuary Departments of life insurance entities interacted extensively with Executive Body, NFRA and deliberated on the various operational and technical topics of the implementation of Ind AS 117.

3. Azadi Ka Amrit Mahotsav (AKAM) Event

NFRA conducted a seminar on 11.06.2022 as part of Nationwide commemoration of 75th Year of India’s Independence. The theme of this iconic event was ‘High Quality Financial Reporting Framework through Effective Independent Oversight’.

a) Inaugural Session

The event witnessed gracious presence of Rao Inderjit Singh, Hon’ble MoS (IC) Ministry of Statistics & Programme Implementation; Planning and MoS, M/o Corporate Affairs as the Chief Guest. Shri Rajesh Verma, Secretary, Ministry of Corporate Affairs was the Guest of Honour.

Welcome address was delivered by Chairperson, NFRA Dr. Ajay Bhushan Prasad Pandey. Chairperson, NFRA while emphasizing the role of High Quality Financial Reporting Framework in a progressive and developing economy like India, highlighted four building blocks of this high quality framework. He said Independent Standard-Setters and Independent Oversight Bodies are the two critical parts of these four building blocks.

Chairperson drew attention of the audience to the benefits of setting up of NFRA stated in the MCA’s Annual Report 2018-19 (para 2.7.1):

“In the wake of accounting scams and frauds in the corporate sector National Financial Reporting Authority (NFRA) was notified as an independent regulator for auditing profession which is one of the key changes brought in by the Companies Act 2013…..The decision is expected to higher the foreign/domestic investments, acceleration of economic growth while supporting greater globalization of business by confirming to International Standards and assisting in the evolution of audit profession…”

Rao Inderjit Singh, Hon’ble MoS (IC) Ministry of Statistics & Programme Implementation; Planning and MoS, M/o Corporate Affairs congratulated the citizens of India and the audience on the achievements of our nation during the last 75 years since our Independence from the British Rule. Hon’ble Chief Guest said now it is opportune time for us to develop a roadmap for the progress and development over next 25 years so that our Nation will regain its glorious past when we celebrate 100 years of Independence. He expressed his pleasure at the good progress made by NFRA during a short span of 3 years of existence and noted that NFRA is moving in the right path to fulfill its role successfully like its global peer in the U.S.

Shri Rajesh Verma, Secretary, Ministry of Corporate Affairs (MCA), in his special address, reminded the audience about the historical importance of accounts and audit in India’s corporate law since the enactment of Indian Companies Act, 1913. He also mentioned about progressive steps in the Indian Company Law such as additional reporting requirements for the Auditors in ‘Manufacturing & Other Companies (Auditor’s Report) Order, 1975’ and statutory recognition to Accounting Standards under section 211(3C) in 1999. While mentioning the developments since the start of the 21st Century, he highlighted three path breaking reforms viz. establishment of India’s First Independent Accounting and Auditing Regulator i.e., the National Financial Reporting Authority, implementation of Indian Accounting Standards (Ind AS) converged with International Financial Reporting Standards (IFRS), high quality globally acceptable standards and statutory recognition to Standards of Auditing under Indian Companies Act 2013. He said NFRA is unique among its peer group, since its functions cover the financial reporting process in its entirety, i.e., from recommendation of accounting and auditing standards to performing the role of an Independent Regulator to ensure compliance with the said standards.

b) Nationwide Quiz Contest and Prize Distribution

To commemorate 75 years of India’s Independence and as a part of Azadi Ka Amrit Mahotsav, NFRA conducted a quiz contest on Auditing and Accounting Standards in India through MyGov Portal of Government of India in which it received an overwhelming response from all over the country with a total participation of 27, 299 people. This quiz was also a part of NFRA’s initiative to spread awareness regarding its primary objective of continuously improving the quality of financial reporting framework in India.

During the Iconic event of AKAM held on 11 June 2022, winners (top 20 participants) of the NFRA’s Nationwide Quiz on Accounting and Auditing Standards in India were awarded prizes by the Chief Guest of the Iconic event Rao Inderjit Singh, Hon’ble MoS (IC) Ministry of Statistics & Programme Implementation; Planning and MoS, M/o Corporate Affairs.

c) Technical Sessions

This segment had two programmes. One part comprised two panel discussions and the second part was a special session by Mr. Shuhei Noro, Deputy Director, CPAAOB, Japan on the subject of Global experiences about review of Audit Quality and Financial Reporting.

i) Independent Audit Regulator – India and Global Scenario, moderated by Dr. Praveen Kumar Tiwari, Member, NFRA and the two panelists were eminent accountancy professionals Dr. Ashish Bhattacharyya, Distinguished Professor at Department of Finance, Accounting and Control, Shiv Nadar University and Member, Accounting Standards Board, ICAI and CA P R Ramesh, Former Chairman, Deloitte, India and Independent Director.

Theme of this technical session was ‘Contemporary international developments in the area of Independent Audit Regulators’.

The session commenced with an introduction to the 11 core principles developed by the International Forum of Independent Audit Regulators (IFIAR) to promote effective independent audit oversight globally, thereby contributing to Members’ overriding objective of serving the public interest and enhancing investor protection by improving audit quality. Further to set the tone for panel discussion, an high level overview of the functions and duties of Independent Audit Regulators (IAR) in ten international jurisdictions and ten areas of major observations by some of prominent IARs was also provided.

In this technical session, the panel discussion revolved around two broad topics based on IFIAR Core Principles viz. Legal and Institutional Requirements with reference to Indian framework and secondly on the operational and functional requirements of IFIAR Core Principles. The panel discussion touched upon various critical areas such as the following:

-

-

- Statutory status of Independence Standards and Code of Ethics

- Challenges in compliance with restrictions on Non-Audit Services, Accountabilities of Principal and Component Auditor, Engagement Quality Control Reviews, Audit Documentation (Resource constraint or Mind-set Constraint)

- Independence of Regulator vis-à-vis Audit Profession

- Regulatory approaches for risk-based inspection regime

- How to drive systemic improvement in audit quality

- Pros-Cons of Audit Rotation, Joint Audit Systems

-

ii) Enhancing Financial Reporting Quality-Role of Independent Oversight Bodies, moderated by Ms. Smita Jhingran, Member, NFRA and the two panelists were eminent authorities on accounting standards CA. Vijay Kumar M P, CFO Sify Technologies Limited, Former Chairman, Accounting Standards Board, ICAI and Dr. Avinash Chander, Former Technical Director, ICAI.

Theme of this panel was ‘Enhancing Quality of Financial Reporting: Role of Independent Oversight Bodies’. The discussion topics were of contemporary importance and centered around the following critical areas:

-

- Ind AS Convergence with IFRS Standards: Review of Carve-outs for full convergence

- Consolidated Financial Statements versus Separate Financial Statements (SFS): Ind AS application challenges to SFS and need for review of Indian Legal and Statutory Framework on mandatory requirements of SFS.

- Ind AS Framework: Is it comprehensive to address contemporary economic transactions/ event? Is there scope for revision of some standards?

- Principle-based versus Industry Specific or Rule based standards. Is there need for prescribing Industry-specific standards?

- Need for higher implementation guidance.

- NFRA tools for monitoring compliance – Financial Reporting Quality Review of individual company financial statements; other approaches like thematic reviews

4. Interaction with CFOs, Independent Directors, Professionals

An effective two-way communication and dialogue between the Independent Regulators and their stakeholders is essential for driving system-wide improvement in the quality of financial reporting framework. Accordingly, NFRA considers it important and relevant to actively participate in the well-established channels of dialogue such as conferences, seminars, round table meetings organised by the stakeholders. During the year 2022-23, NFRA interacted widely and Chairperson spoke and engaged with the diverse set of stakeholders, as below:

a) Amrit Kaal: Roadmap for Capital Markets for India’s century, FICCI’s 19th Annual Capital Market Conference 2022 on 14 September 2022

b) Top Trends for Building Tomorrow’s Corporate Boards, Annual Directors’ Conclave – 2022 of Institute of Directors on 23 Sep 2022

c) Regulatory expectations from the Professions in India, Forum of Firms on 17th November 2022

d) Plenary Session Accountancy Profession: Partner in Nation Building at 21st World Congress of Accountants on 19th November 2022

e) Roundtable with Finance Professionals, CII National Committee on Financial Reporting on 1st December 2022

f) Financial Reporting & Governance Framework – Building Trust, Conference of Confederation of Indian Industry on 2nd December 2022

g) Indian Accounting Standards (Ind AS)- Recent Developments, Evolving Global Trends, Challenges and Way Forward, 5th National Conference of ASSOCHAM on 20th January 2023

h) Rebuilding Trust in the Financial Ecosystem at CFO Board on 9th February 2023

At these forums, Chairperson NFRA spoke and interacted with the audience on various significant matters relevant to financial reporting eco-system in India and the World, as given below.

(i) Reforms in Institutional and Regulatory structures

Dr Ajay Bhushan Prasad Pandey, Chairperson, NFRA spoke about the origin of recent digital revolution in India i.e., Aadhar, the biometric identity facility to over 1 billion citizens of India, which paved the way for many other socio-economic reforms and creation of digital public infrastructure which is unique to India. He highlighted other reforms powered by digital infrastructure such as Goods and Services Tax (GST), which brought in a multitude of tax collection systems under one platform. Direct tax regime has also witnessed a few tectonic reforms such as substantial reduction in corporate tax rate and faceless assessment.

These were accompanied by other fundamental reforms in the institutional and regulatory architecture of the country i.e with the introduction of Insolvency and Bankruptcy Code, establishment of forums such as National Company Law Tribunal and National Company Law Appellate Tribunal for speedy resolution of corporate law matters and of course, the constitution of National Financial Reporting Authority in 2018, which is the India’s first independent regulator for Accounting and Auditing matters.

While emphasizing the fact that all critical building blocks for the Nation’s economic growth and development have been laid down, Chairperson, NFRA reminded the pivotal role that NFRA needs to play in enabling investor, creditor and public’s trust and confidence in the financial reporting system in the country.

(ii) Background of setting up of independent audit regulator

In the beginning of 20th century, U.S. witnessed two major corporate scandals and audit failures viz, Kreuger and Toll in 1932 and Mckesson and Robbins in 1938. These corporate failures played a significant role in the enactment of U.S. Securities Exchange Laws in 1933 and establishment of U.S. Capital Market Regulator, Securities and Exchange Commission (SEC) in 1934. However, at the start of new millennium confidence in the U.S. capital markets was shaken yet again by the disastrous effect of corporate accounting scandals and audit failures such as the collapse of Enron, Arthur Andersen and WorldCom. In the aftermath of these corporate failures, U.S. capital market lost almost US$ 8 Trillion. This led to the US Congress enacting a path breaking law known as the Sarbanes Oxley Act, and setting up of the Public Company Accounting Oversight Board (PCAOB).

The establishment of PCAOB in U.S. in 2002 marked the arrival of an audit regulator independent of the accountancy profession across the globe. The Certified Public Accountants and Auditing Oversight Board (CPAAOB) in Japan in 2004, Public Accountants Oversight Committee (PAOC) in Singapore in 2004, Financial Reporting Council (FRC) in UK in 2005, Committee of European Auditing Oversight Bodies (CEAOB, formerly EGOB) in 2005 and The Audit Oversight Board (AOB) in Malaysia in 2010 followed the setting up of the PCAOB.

Indian economy and society are no exception to the kind of corporate audit failures that have occurred in other parts of the world. A few noteable ones are Haridas Mundra scam of 1950s, Harshad Mehta securities scam of 1992, PACL scam 1990s, Ketan Parekh and Global Trust Bank case in 2000, Satyam case of 2008, NSEL case of 2013, Punjab National bank-Nirav Modi case of 2018, Yes Bank case and unexpcted collapse of an infrastructure financing behemoth IL&FS in the middle of 2018. Further, there have been numerous cases of corpoate failures in the real estate sector.

Chairperson drew attention to the recommendation in the Brydon Review Report to redefine the audit as “The purpose of an audit is to help establish and maintain deserved confidence in a company, in its directors and in the information for which they have responsibility to report, including the financial statements.”

He said if this definition is accepted, it is going to expand the scope and objective of audit in the future especially, in the area of going concern to viability of the audited company. In this regard, it may be pertinent to note that latest amendments to Schedule III of Companies Act require disclosures of many financial ratios by the management which will strengthen the auditors’ ability to comment upon the going concern status of the company and move from the ‘concept of control of audit risk to the concept of control of business risk’ which is a much wider scope.

Chairperson emphasized the criticality of communication between stakeholders and auditors was emphasized, via the audit committees. The role of audit committees which has the majority of independent directors is very crucial in ensuring the integrity of financial information of the company. While emphasising the role of private sector and the corporate sector in the India’s march towards US$ 5 Trillion economy, Dr Pandey said that the Corporate Boards and NFRA have lot of commonalities in their objectives as both are supposed to promote and protect shareholders’ interest and ensure good corporate governance.

(iii) Accountancy profession and Reforms in the standards

At the 21st World Congress of Accountants, Chairperson spoke about the contribution of the Indian accountancy profession in the growth and development of economy and business activities in India. In this regard he highlighted three key areas of their contribution. The accountancy profession has been instrumental in reforming and aligning these corporate failures, U.S. capital market lost almost US$ 8 Trillion. This led to the US Congress enacting a path breaking law known as the Sarbanes Oxley Act, and setting up of the Public Company Accounting Oversight Board (PCAOB).

The establishment of PCAOB in U.S. in 2002 marked the arrival of an audit regulator independent of the accountancy profession across the globe. The Certified Public Accountants and Auditing Oversight Board (CPAAOB) in Japan in 2004, Public Accountants Oversight Committee (PAOC) in Singapore in 2004, Financial Reporting Council (FRC) in UK in 2005, Committee of European Auditing Oversight Bodies (CEAOB, formerly EGOB) in 2005 and The Audit Oversight Board (AOB) in Malaysia in 2010 followed the setting up of the PCAOB.

Indian economy and society are no exception to the kind of corporate audit failures that have occurred in other parts of the world. A few noteable ones are Haridas Mundra scam of 1950s, Harshad Mehta securities scam of 1992, PACL scam 1990s, Ketan Parekh and Global Trust Bank case in 2000, Satyam case of 2008, NSEL case of 2013, Punjab National bank-Nirav Modi case of 2018, Yes Bank case and unexpcted collapse of an infrastructure financing behemoth IL&FS in the middle of 2018. Further, there have been numerous cases of corpoate failures in the real estate sector.

Chairperson drew attention to the recommendation in the Brydon Review Report to redefine the audit as “The purpose of an audit is to help establish and maintain deserved confidence in a company, in its directors and in the information for which they have responsibility to report, including the financial statements.”

In this background, Indian policy makers incorporated a provision in the Companies Act 2013 to establish a regulator over accounting and auditing matters who would be independent of the accountancy profession.

5. Interaction with Indian Corporate Law Service Academy (ICLSA), Ministry of Corporate Affairs

During July 2022, a comprehensive Five (5) day training programme was conducted for the officers of 10th Batch of Indian Corporate Law Service of Government of India. Overall objective of the training programme was to provide a holistic exposure to the newly joined ICLS officers regarding the role, responsibilities and functioning of the NFRA. The training programme structure covered the following key aspects

a) Statutory mandate, purpose and objective of setting up of the NFRA.

b) 21st Century era of independent audit and accounting regulators- Global perspective: International Forum of Independent Audit Regulators (IFIAR), NFRA peer group in U.S., U.K., Australia.

c) Role of NFRA in corporate governance.

d) Policy and process of review and recommendation of accounting and auditing standards in line with international standards.

e) NFRA database of companies and auditors.

f) Techniques and tools for monitoring compliance with auditing standards – Audit Quality Reports.

g) Techniques and tools for monitoring compliance with accounting standards – Financial Reporting Quality Reports.

h) Enforcement and disciplinary mechanisms for compliance with the applicable standards

6. Stakeholder Consultation Papers

A consultation paper was issued for public consultation on ‘Annual Transparency Report’ to be submitted by Statutory Auditors of PIEs

Regulators and oversight authorities in some overseas jurisdictions require audit firms carrying out audit of PIEs to prepare and publish information in the form of transparency reports on annual basis.

It was proposed to prescribe publication of Annual Transparency Report containing certain critical information about the auditor’s operational activities, management, governance and ownership structures, policies, and procedures necessary to deliver

7. Participation in International Conference

Secretary, NFRA represented NFRA at the annual PCAOB (Public Company Accounting Oversight Board), USA, conference on “Sarbanes Oxley at 20 years and the future of Audit Regulation” on 16-17 November 2022 held at Washington DC. The conference was widely attended by participants from international standards setters and international independent audit regulators. The two-day conference comprised several insightful sessions such as “An exchange on effective enforcement”, “Emerging audit oversight opportunities and challenges”, discussions on scope and practices in inspections across jurisdictions. PCAOB also provided an update on its standard setting agenda. The conference provided a wonderful opportunity to interact with peer organisations and exchange notes on best practices, and organisational procedures and processes and an opportunity to interact with representatives of Independent Audit Regulators from across the world & from IFIAR (International Forum of Independent Audit Regulators).

Chapter IV – Information Technology Set-up at NFRA

1. Data Management

Database of Companies

NFRA’s role and responsibility is to the protect public interest and the interest of investors, creditors and others associated with financial Statements of certain prescribed class of companies called ‘Public Interest Entity (PIE)’. In order to discharge the above responsibilities, one of the important pre-requisites is to compile and establish a comprehensive master database of the PIEs & their auditors within the purview of NFRA.

During the year, NFRA continued its efforts to develop a master database of companies/ auditors as of each financial year by obtaining/reconciling data from various sources such as Corporate Data Management/MCA21, stock exchanges and other regulators like RBI, IRDAI, etc.

NFRA published the list of companies for the year ending 31.03.2019, 31.03.2020 and 31.03.2021. Further, the database of companies under NFRA’s domain for the year ending 31.03.2022 and 31.03.2023 was under process, which was completed later in the year.

Also, NFRA continued its task of monitoring of submission of an annual return (NFRA-2) by the auditors of companies within NFRA domain. During October-November 2022, it reviewed the position for NFRA 2 returns for Reporting Period 2019-20 and published the list of non-filers on its website. Additionally, NFRA published the list of non-filers of NFRA 2 returns for the Reporting Period 2020-21 on 07.02.2023.

2. Monitoring Filing of Annual Return – NFRA 2

Rule 4(2) of the NFRA Rules 2018 requires the Authority, inter alia, to maintain details of particulars of auditors appointed in the companies and bodies corporate specified in Rule 3 of NFRA Rules 2018. Further, Rule 5 of the aforesaid Rules requires every auditor of the companies prescribed under Rule 3 to file an annual return by 30 November each year in the form specified by the Central Government. Accordingly, the Central Government has specified filing of annual return in ‘Form NFRA – 2’ which contain certain important details about the auditors.

The details required to be filed in Form NFRA 2 relate to details of the companies audited, audit fees and non-audit fees received, particulars of the partners and employees of the audit firm, affiliation or membership of any audit firm network, details of disciplinary proceedings initiated against the auditor and quality control policies of the audit firm.

NFRA, based on its database of companies as of the end of its first financial year i.e., 31.03.2019, commenced monitoring the filing of Form NFRA – 2 by the auditors for the Reporting Period 01.04.2018 to 31.03.2019 (2018-19). NFRA released the list of non-compliant firms for the Reporting Period 2018-19, 2019-20 and 2020-21.

3. Data security

During the year NFRA took many initiatives to enhance security checks like:

a) Transfer of data from auditors and preparers on secured NIC server with enhanced security protocol. NFRA uses SFTP at secured port number 22 for transferring files from Auditors and Audit Firms.

b) NFRA has been running its all applications on secured SSL protocol.

4. Cloud-based IT tool for its operations management

NFRA Core Application System (NCAS) is being developed for paperless working and workflow within the organization. NCAS is designed to enable the collection, handling and processing of high volumes of documents, end-to-end management of quality review, investigation, and enforcement activities.

The entire infrastructure is hosted on cloud servers and user access is enabled through highly secured web interfaces. NCAS is designed to ensure that required documents and workspaces are created/stored/enabled within the application.

NCAS is being developed by the National Informatics Centre (NIC) under the Ministry of Electronics and Information Technology of the Government of India.

Chapter V – Resource Management

1. Finance and Budgeting information

Parliament authorised grants to NFRA in the Supplementary Budget 2022-23. Grants were released subsequently to NFRA by Ministry of Corporate Affairs in March 2023. Accordingly, NFRA has prepared its accounts in the applicable form i.e., Uniform Format of Accounts for Central Autonomous Bodies for March ‘23.

Prior to NFRA becoming a grantee organisation, NFRA’s receipts and disbursements were part of accounts of Ministry of Corporate Affairs which in turn were a part of Union Finance and Appropriation Accounts.

During the financial year 2022-23, the total budgeted expenditure of NFRA was `29.61 crores, and the allocated revised estimates was ` 36.49 crores. The total expenditure incurred by NFRA during the financial year 2022-23 was ` 35.21 crores. Out of this total expenditure, the expenditure amounting to ` 7.418 crore was incurred from the Grants-in-Aid, leaving the unspent balance of ` 0.012 crores in Grants-in-aid.

The details of Grants-in-Aid received during the year 2022-23 is as follows

Table 2

| Head of Account | Object Head | Amount |

| Grant-in-Aid Salaries | 3475.00.105.06.00.36 | 1.67 |

| Grant-in-Aid General | 3475.00.105.06.00.31 | 5.76 |

| TOTAL | 7.43 |

Table 2: Statement showing Grant in Aid received by NFRA during the FY 2022-23

The head wise details of total expenditure incurred during the financial year 2022-23 is shown at Table No 3.

Table 3

| Description | Expenditure |

| Salaries | 9.19 |

| Domestic Travel Expenses | 0.19 |

| Foreign Travel Expenses | 0.04 |

| Professional Fee | 0.78 |

| Rent Rates and Taxes | 18.84 |

| Advertisement & Publicity | 0.00 |

| Outsourcing Staff/ Wages | 1.31 |

| Publications | 0.01 |

| Office Expenses | 2.64 |

| Library Books | 0.00 |

| Membership Fee | 0.00 |

| Other Adm. Exp. | 0.05 |

| Information Technology- Office Expenses | 2.16 |

| TOTAL | 35.21 |

Table 3: Statement showing expenditure incurred by NFRA in the FY 2022-23

The financial performance of NFRA, after becoming a grantee organisation, in the FY 2022-23, has been shown in Table 4 below:

Table 4

|

Income |

Amount |

| Grants/ Subsidies | 7.43 |

| Fees/ Subscriptions | – |

| Income from Investments (Income on investment, from earmarked/ endowment funds transferred to fund). | – |

| Income from Royalty, Publications, etc. | – |

| Interest Earned | 0.01 |

| Other Income | 0.001 |

| Total (A) | 7.44 |

| Expenditure | |

| Establishment Expenses | 2.77 |

| Other Administrative Expenses, etc | 3.27 |

| Expenditure on Grants, Subsidies, etc. | – |

| Interest | 0.01 |

| Total (B) | 6.05 |

| Balance being excess of Income over Expenditure (A-B) | 1.39 |

| Transfer to Special Reserve | – |

| Transfer to/ from General Reserve | – |

| Balance being Surplus (Deficit) carried to Corpus/ Capital Fund | 1.39 |

Table 4: Income and Expenditure statement for the period 3rd March to 31st March 2023

The accounts for the year ending 31 March 2023 (Balance Sheet as on 31 March 2023, Income and Expenditure Statement for the period 03 March 2023- 31 March 2023 and other statements and schedules as required) have been prepared in the Uniform Format of Accounts for Central Autonomous Bodies.

Internal Finance Wing is in place in NFRA and all the payments and proposals (which require IFA concurrence) are routed through the Internal Finance Wing.

The Annual Accounts of the Authority for FY 2022-23 (3 March 2023 to 31 March 2023) were finalised and approved by the Executive Body of the Authority. The approved Annual Accounts were forwarded to the Comptroller & Auditor General of India (C&AG) for certification audit. The C&AG vide their letter number NFRA/2022-23/2023-24/352-54 dated 01-11-2023 has certified the accounts of NFRA for the financial year 2022-23. The audited annual accounts, as certified by the C&AG, together with the audit report thereon, have been forwarded to the Central Government for laying before both the Houses of Parliament. The audit of the accounts of NFRA for the period of 2022-23 prior to NFRA becoming a grantee organisation will be part of the audit of the Union Finance & Appropriation Account, carried out by the Controller & Auditor General of India.

2. HR Management

The overall mandate is to create a work environment that can continuously identify, nurture and utilize the capabilities of its officers and staff through appropriate policies in the area of training, career development and performance management.

a) Manpower

NFRA’s sanctioned strength as on 31.03.2023 was 69. The total strength of officers and staff as on 31.03.2023 was 29. Recruitment efforts are ongoing.

b) Recruitment

Key importance is laid to the competency requirements of the individuals, required for contributing effectively and efficiently towards realization of the organizational goals and resulting achievements. Hence stringent recruitment process is adopted to ensure quality personnel are inducted into the system and greater importance is attached towards continuous development of the human resources, periodically in tune with the programmatic requirements.

i) Direct Recruitment: NFRA completed the exercise of direct recruitment of 6 Managers and 7 Assistant Managers.

ii) Deputation/Short Term Contract: Vacancy circulars for posts of ED to AM on deputation/short-term contract were issued on 16th December 2022. As on 31 March 2023, the recruitment process was ongoing. And Vacancy circulars for the posts of Sr. PS, PS, PA (Grade I, II & III) for deputation/short-term contract were issued on 9th January 2023.

c) Training and Human Resources Development

In today’s dynamic world, regular training is essential for any organization. It has become vital to maintain pace with technological evolution and meet rising expectations of its stakeholders. Suitable training ensures that human resources operate at peak performance levels. It makes the employees creative, constructive, imaginative, innovative, professional, and technologically enabled. The main objectives for conducting the training programmes are as follows:

a. Keep updated and enhance professional knowledge, skills and attitude needed for better performance of our employees and organization.

i. Promote better understanding of professional requirements and sensitization to the professional, socio-economic, and political environment.

ii. Bring about right attitudinal orientation.

d) Highlights of training activities during the Year 2022-2023

i) Technical and Induction Training Programme– July to August 2022 NFRA launched a Technical Training and Induction Programme for its newly recruited officers and other officials. The induction programme was aimed to provide a solid foundation in developing the required talent and technical skill sets required to discharge the larger and vital role of NFRA in protecting public interest and achieving India’s national goals.

During this training programme many expert/eminent faculty delivered technical sessions. Induction Training Schedule comprised five modules and the sessions were taken by eminent professionals. Topics covered included Evolution of International Accounting & Auditing Standards, Audit & Assurance Framework and Sustainability Reporting Standards.

ii) Talk by Prof R. Narayanaswamy on “NFRA-Past, Present and Future” on 29.08.2022.

Professor R. Narayanaswamy talked about the comprehensive nature of AQRRs and FRQRRs issued by NFRA in the past which were by far above international standards in terms of quality, precision, details and coverage. He stressed that accounting and auditing profession should not be marred by silo effect and there should be effective communication between regulator and stakeholders.

iii) CDM Training

Corporate Data Management infrastructure of MCA, GOI, has been identified as an important source of data and information for the operational activities of the NFRA, starting from establishment of primary database of companies and auditors which are within the ambit of NFRA’s monitoring and supervisory functions. In order to gain greater insights into the functionalities and utilities of the CDM, interactive training session was conducted on 24.08.2022 between the officials of NFRA and the Division handling CDM infrastructure of MCA, GOI.

e) Performance Evaluation

Performance Evaluation is a vital element of employees’ growth and development and realization of diverse need of each individual. The objective of performance evaluation in NFRA are:

i) Training and Placement Function: To assess the officer’s professional capabilities, with a view to determining capacity building needs and suitability for particular areas of responsibility/assignments.

ii) Feedback and Counselling Function: To counsel the officer on directions for improving performance, professional capabilities, and conduct with peers, juniors, etc.

iii) Planning of Work Function: To be a tool for developing a work plan for the year.

iv) Promotion Function: To make an objective assessment of the officer’s performance in the current assignment, including performance in training, study courses and deputation outside the government, based on monitorable inputs, relative to his/her peers, with a view to determining suitability for higher responsibilities and special assignments.

v) Recognition Function: To identify genuinely exceptional work accomplished, including innovations, with a view to giving due recognition.