CS S. Dhanapal

Companies Act, 2013 (Act) has introduced many new concepts and Key Managerial Personnel is one of them. While the Companies Act, 1956 recognised only Managing Director, Whole Time Director and Manager as the Managerial Personnel, the Companies Act, 2013 has brought in the concept of Key Managerial Personnel which not only covers the traditional roles of managing director and whole time director but also includes some functional figure heads like Chief Financial Officer and Chief Executive Officer etc. These inclusions are in line with the global trends. “Company Secretary” has also been brought within the ambit of Key Managerial Personnel giving them the long deserved recognition of a Key Managerial Personnel of the Company. Another noteworthy feature of this concept is that it combines the important management roles as a team or a cluster rather than as independent individuals performing their duties in isolation to others.

Companies Act, 2013 (Act) has introduced many new concepts and Key Managerial Personnel is one of them. While the Companies Act, 1956 recognised only Managing Director, Whole Time Director and Manager as the Managerial Personnel, the Companies Act, 2013 has brought in the concept of Key Managerial Personnel which not only covers the traditional roles of managing director and whole time director but also includes some functional figure heads like Chief Financial Officer and Chief Executive Officer etc. These inclusions are in line with the global trends. “Company Secretary” has also been brought within the ambit of Key Managerial Personnel giving them the long deserved recognition of a Key Managerial Personnel of the Company. Another noteworthy feature of this concept is that it combines the important management roles as a team or a cluster rather than as independent individuals performing their duties in isolation to others.

In the current write up, we have explored this concept of Key Managerial Personnel as put forth in the Companies Act, 2013 read with the relevant rules made thereunder.

WHO IS A KEY MANAGERIAL PERSONNEL?

The definition of the term Key Managerial Personnel is contained in Section 2(51) of the Companies Act, 2013. The said Section states as under:

“key managerial personnel”, in relation to a company, means—

(i) the Chief Executive Officer or the managing director or the manager;

(ii) the company secretary;

(iii) the whole-time director;

(iv) the Chief Financial Officer; and

(v) such other officer as may be prescribed;

The above definition is an exhaustive definition but point number (v) gives the power to the legislature to include some other personnel also within the definition of Key Managerial Personnel as may be deemed fit by them from time to time. As of now, no further prescription has been made pursuant to point number (v) and therefore, as on date, the definition is confined to the six personnel mentioned above.

Let us now proceed to understand how these six personnel are defined under the Act.

The above definitions depict that in the case of CEO and CFO, the designation is crucial to deem the person as CEO and CFO whereas in the case of MD and Manager the functions discharged or the role performed by an individual is taken as the test to deem them as the MD or Manager. The definition of whole time director is an inclusive definition and CS is defined to mean a CS as per the Company Secretaries Act, 1980who is duly appointed to perform the functions of a company secretary.

WHICH COMPANIES ARE MANDATORILY REQUIRED TO APPOINT KEY MANAGERIAL PERSONNEL

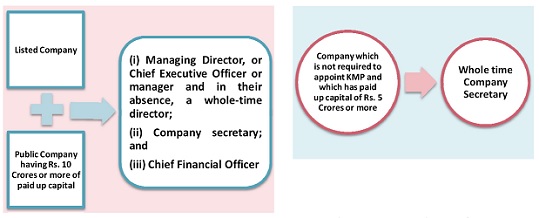

As per Section 203 of the Companies Act, 2013 read with the Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014, the following class of Companies, namely

- Every listed company, and

- Every other public company having paid up share capital of Rs. 10 Crores or more

shall have the following whole-time key managerial personnel,—

(i) Managing Director, or Chief Executive Officer or manager and in their absence, a whole-time director;

(ii) Company secretary; and

(iii) Chief Financial Officer

Further, as per recently notified Rule 8A of the Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014, a company other than a company which is required to appoint a whole time key managerial personnel as discussed above and which is having paid up share capital of Rs. 5 Crores or more shall have a whole time Company Secretary.

- Every whole-time key managerial personnel of a company shall be appointed by means of a resolution of the Board containing the terms and conditions of the appointment including the remuneration.

- If the office of any whole-time key managerial personnel is vacated, the resulting vacancy shall be filled-up by the Board at a meeting of the Board within a period of 6 months from the date of such vacancy.

RESTRICTIONS REGARDING APPOINTMENT OF KEY MANAGERIAL PERSONNEL:

♣ Same person not to act as Chairman and MD/CEO

It has been provided under the Act that the role or designation of Chairman and Managing Director or Chairman and Chief Executive Officer should not be assigned to the same person. In other words, the same person should not act as both Chairman and Managing Director or Chief Executive Officer of the Company.

However, in the following circumstances, the above restriction will not apply:

(a) the articles of the company contain provision for appointment of same person, or

(b) the company carries only a single business, or

(c) the company is engaged in multiple businesses and has appointed one or more Chief Executive Officers for each such business as may be notified by the Central Government

♣ Whole time KMP not to hold office in more than one company

It has been provided under the Act that a whole-time key managerial personnel shall not hold office in more than one company at the same time, except:

o In the company’s subsidiary company,

o As a director in any other company with the permission of the Board

o As a MD, if he is the managing director or manager of one and of not more than one other company and such appointment or employment is made or approved by a resolution passed at a meeting of the Board with the consent of all the directors present at the meeting and of which meeting, and of the resolution to be moved thereat, specific notice has been given to all the directors then in India.

Further, it has also been provided that a whole-time key managerial personnel holding office in more than one company at the same time on the date of commencement of this Act, shall, within a period of 6 months from such commencement, choose one company, in which he wishes to continue to hold the office of key managerial personnel.

OTHER PROVISIONS REGARDING KMP

- A KMP is included within the meaning of “Officer in Default” under the Act.

- A document or proceeding requiring authentication by a company; or contracts made by or on behalf of a company, may be signed by any key managerial personnel or an officer of the company duly authorised by the Board in this behalf.

- Details regarding KMP, changes therein and the remuneration paid to them are required to be disclosed in the Annual Return of the Company.

- Explanatory statement should disclose the nature of concern or interest, financial or otherwise, of every key managerial personnel, in respect of each items of special business to be transacted at a general meeting.

- A person whose relative is employed as a KMP in a company is disqualified to be appointed as auditor in that company.

- A person is disqualified to be appointed as an independent director if he either himself or through his relative holds or has held the position of a key managerial personnel of the company or its holding, subsidiary or associate company in any of the 3 financial years immediately preceding the financial year in which he is proposed to be appointed.

- Company is required to maintain a register of the KMPs at its registered office containing particulars which shall include the details of securities held by each of them in the company or its holding, subsidiary, subsidiary of company’s holding company or associate companies.

- A return of every appointment and change in KMP has to be filed with the ROC within 30 days of the appointment or the change as the case may be.

- The key managerial personnel shall have a right to be heard in the meetings of the Audit Committee when it considers the auditor’s report but shall not have the right to vote.

- The remuneration policy of the KMP is to be recommended by the Nomination and Remuneration Committee who should ensure that the policy involves a balance between fixed and incentive pay reflecting short and long-term performance objectives appropriate to the working of the company and its goals. Such policy shall be disclosed in the Board’s report.

- Every key managerial personnel shall, within a period of 30 days of his appointment, or relinquishment of his office, as the case may be, disclose to the company the particulars specified in sub-section (1) of section 184 relating to his concern or interest in the other associations which are required to be included in the register under that sub-section or such other information relating to himself as may be prescribed.

- Key Managerial Personnel are prohibited to make forward dealings and insider trading in securities of the company.

- Financial statements of a company are required to be signed either by the Chairperson of the company (where he is authorised by the Board) or by two directors out of which one shall be managing director and the Chief Executive Officer, if he is a director in the company, the Chief Financial Officer and the company secretary of the company, wherever they are appointed.

PENALTY FOR CONTRAVENTION

| On Company: | Fine which shall not be less than Rs. 1,00,000/- but which may extend to Rs. 5,00,000/- |

| On every director and key managerial personnel of the company who is in default | Fine which may extend to Rs. 50,000/- and where the contravention is a continuing one, with a further fine which may extend to Rs. 1,000/- for every day after the first during which the contravention continues. |

(Written by S.Dhanapal, Senior Partner, S Dhanapal & Associates, A firm of Practising Company Secretaries, Chennai.)

Sir, If a KMP of a Public limited company is a Doctor, Can he practice individually in his professional capacity?please guide.

Thank You.

Sir,

This article is very informative and touched upon every aspect of MD / WTD. It will be appreciated if you please express your valuable views on the following point:

“Whether MD appointed as KMP within the meaning of Section 2013 can hold position as employee in other company ”

Your views are solicited.

Why key managerial person not retired after a fixed tenure as a directorship.

Co. Act should include a provision regarding retirement of KMP. If they hold office more and more year they can do a blunder in a company because BOD of directors wants only profit no one is in co. to view of work of KMP.

Is KMP barred from holding COP of other professional bodies like the Instirute of CA etc?

In Listed Company CS appointed in there Subsidiary Company and same person can be appoint CS in there Holding Company????

if a person is MD in one company, can he become CEO in another company

Can Director of Same Company be appointed as a CFO in that company..

Can c person b appointed as CS CFO n MD in same co

Can same person be appointed as CS CFO n MD/CFO in a co

Can a KMP , say a Manager , be appointed as Alternate Director of the same company??

Can a KMP of the company ,say a, Manager, be appointed as alternate director of the company??

We appointed CFO as our pub co’s paid up capital is above 10 crore. But Status of Company is changed to Private Company. So What requirement to remove CFO as its not requirement to hold on.

Whether WTD of Public Co can be appointed as CEO / KMP in the subsduary Company?

Whether Whole time director of Public Co can be appointed as CEO / KMP in the subsduary Company?

Sir,

I have a query.

A qualified CS who is working in Holding company as Assistant CS (Not KMP). Now Company wants to appoint him on subsidiary company as CS is requirment for subsidiary company. CS will continue on the roll of holding company.

Is it contravention of S. 203 as KMP cannot hold office in any other Company?

Excellent presenation.

Suppose a Pvt Ltd co has paid up share capital of more than 5 crores and a Whole Time CS is not appointed, does it require mention in the audit report?

Thanks Sir,

Very lucid presentation.

very useful.

regards,

R.Saravanan

what to do when the tenure of cmd extends for 3 mnths in case of public company

Whether the same person can be appointed in the same company as Whole time Company Secretary cum CFO?

Whether same person can occupy two / multiple KMP positions in the same Company?

A private company is not required to appoint MD/WTD since the KMP Rules apply only to a listed company or a public company with a paid-up capital of Rs.10 crs or more or for apointing a CS for a company with a paid-up capital of Rs.5 crs or more

is the KMP have any reservation of women in the board / related persons restrictions / or if any representation by Bank by virtue of funding / NRI / any retired director can be taken as advisor on the day to day management of the company , kindly explain in the new companys act context

Tku

if a company is not required to have KMP but having paid up capital of more than 5 crores and mandatory to have company secretary then what procedure shall be followed for the appoint of whole time company secretary? is it the same as the appointment of KMP?

I am the Chairman of GLOBAL LEGAL SERVICES. Section 5 of the Companies,Act, 1956, Meaning of “officer who is in default.” The company Act, 2013 Section 2 (51), Meaning of “officer who is in default.” ?

Are the provisions regulating appointment, resignation etc.applies to a company which is not mandatorily required to appoint KPMs but has a managing director.