The person responsible for paying to a non-resident, not being a company, or to a foreign company, any sum chargeable under the provisions of the Act, shall furnish form 15CA

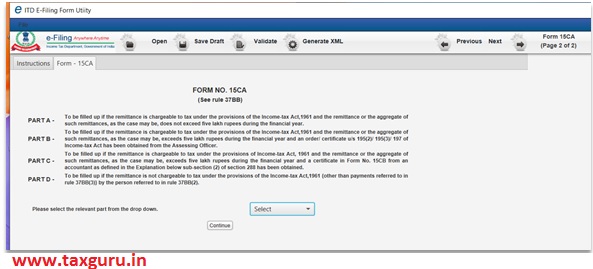

Above it’s the first page of form 15CA utility which can be downloaded from downloads section on www.incometax.gov.in. It has four parts which is explained as below: –

(i) the information in Part A of Form No.15CA, if the amount of payment or the aggregate of such payments, made during the financial year does not exceed five lakh rupees

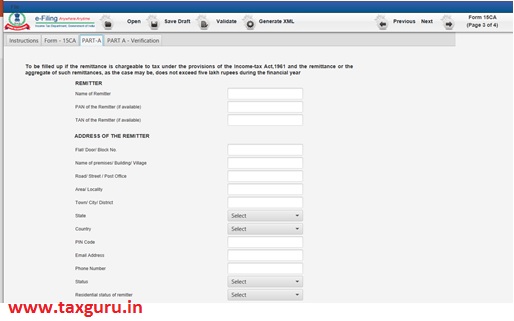

Here in Part A Name of remitter along with PAN and Address should be filled.

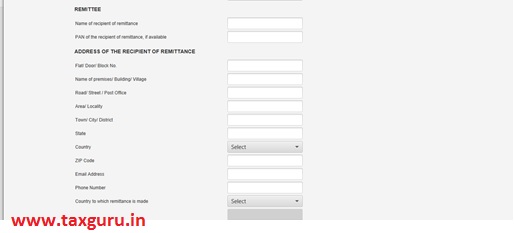

Further Name of recipient of remittance along with address is to be filled.

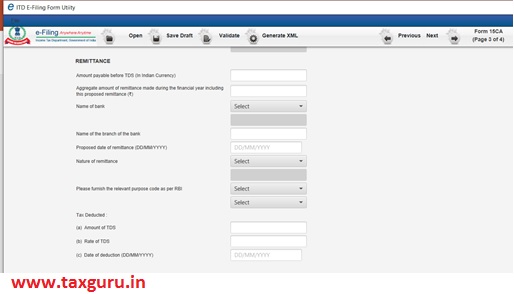

Now details of remittance are to be entered before Tax deducted at source in Indian Currency, aggregate amount of remittance made during the financial year including proposed remittances, bank details, amount, rate, and date of deduction of TDS.

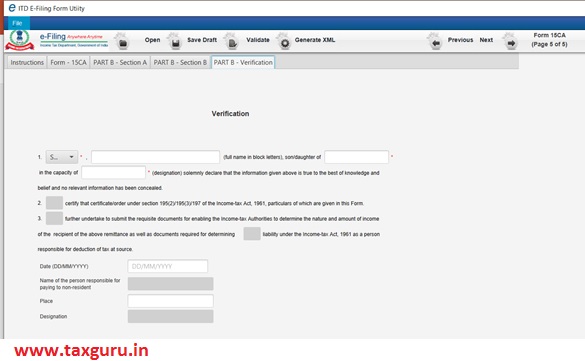

Assessee needs to verify to finish the form.

for payments other than the payments referred in clause (i), the information: –

- In part B of form No. 15CA after obtaining: –

1. A certificate from the Assessing Officer under Section 197(Nil or lower rate of deduction of tax or exemption from tax) or

2. An order from the Assessing Officer under sub-section (2) or sub-section (3) of section 195

sub-section (2) (Where the person responsible for paying any such sum chargeable under this Act (other than salary) to a non-resident considers that the whole of such sum would not be income chargeable in the case of the recipient he may make an application to the Assessing Officer to determine, by general or special order, the appropriate proportion of such sum so chargeable, and upon such determination, tax shall be deducted under sub-section (1) only on that proportion of the sum which is so chargeable.) or

sub-section (3) (any person entitled to receive any interest or other sum on which income-tax has to be deducted under sub-section (1) may make an application in the prescribed form to the Assessing Officer for the grant of a certificate authorizing him to receive such interest or other sum without deduction of tax under that sub-section, and where any such certificate is granted, every person responsible for paying such interest or other sum to the person to whom such certificate is granted shall, so long as the certificate is in force, make payment of such interest or other sum without deducting tax thereon under sub-section (1).

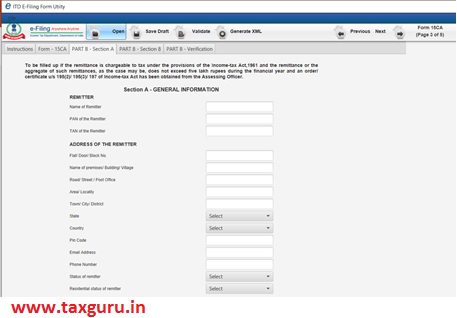

Here in Part B- Section A Name of remitter along with PAN and Address should be filled.

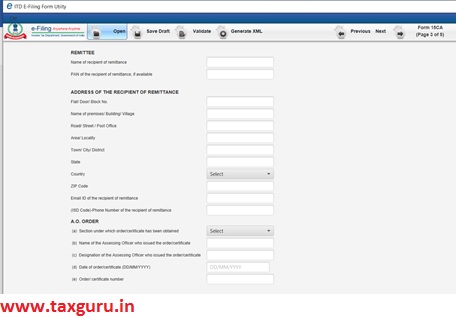

Further Name of recipient of remittance along with address is to be filled.

Moreover, in this part order from the Assessing Officer has to be obtained. Then details of relevant section, name and designation of Assessing Officer who issued certificate, date of the order/Certificate, order/certificate number needs to be mentioned.

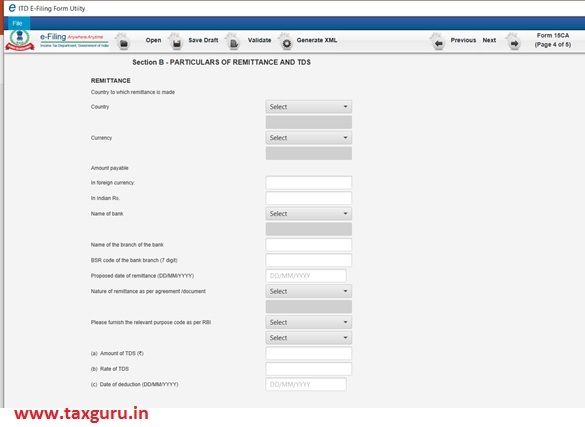

In section B details to be mentioned are :- country in which remittance is made, currency of that country, Amount payable (Indian Currency and Foreign Currency), Bank details, Nature of Remittance, RBI code and details of Tax Deducted at Source.

RBI code in mentioned in rule specified list but it is advisable to confirm code from the concerned bank to avoid any rectification and delay in the process

Assessee needs to verify to finish the form.

- In Part C a certificate from an Accountant in form 15CB needs to be obtained before details in part C of form 15CA.

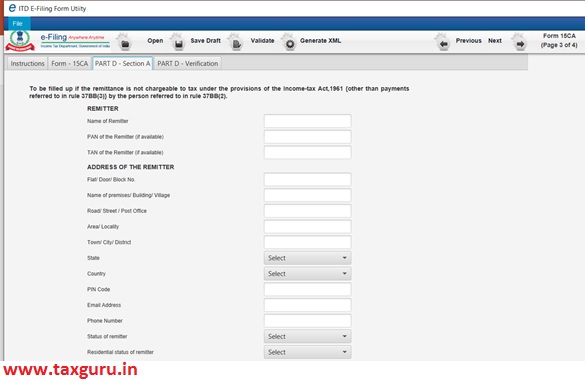

- The person responsible for paying to a non-resident, not being a company, or to a foreign company, any sum which is not chargeable under the provisions of the Act, shall furnish the information in Part D of Form No.15CA.

Here in Part D- Section A Name of remitter along with PAN and Address should be filled.

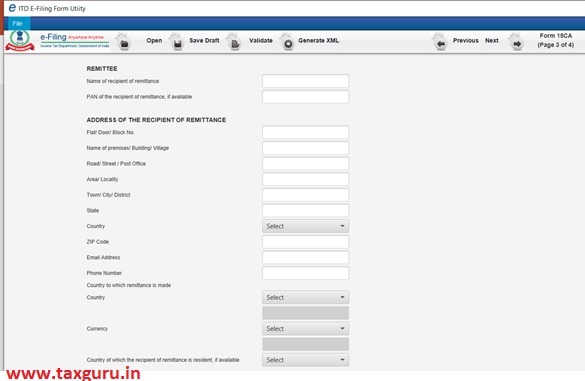

Further Name of recipient of remittance along with address is to be filled.

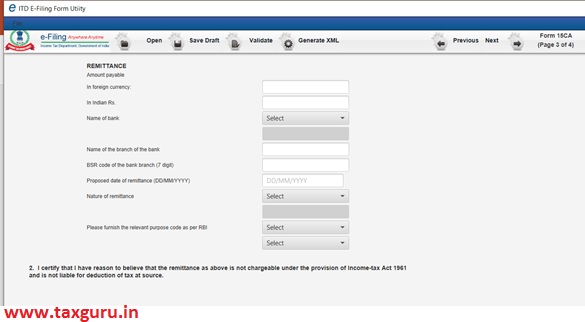

Now details of remittance in Indian Currency and in foreign currency, bank details, proposed date and nature of remittances along with RBI code. RBI code in mentioned in rule specified list but it is advisable to confirm code from the concerned bank to avoid any rectification and delay in the process.

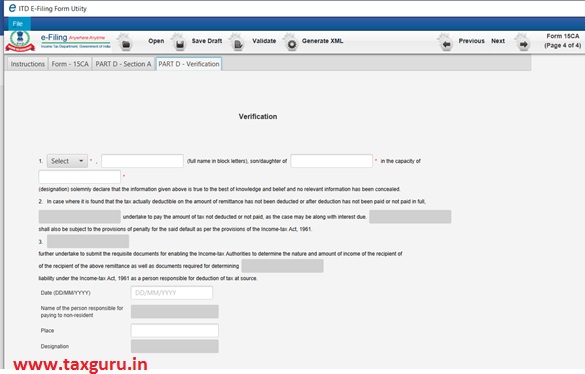

Assessee needs to verify to finish the form.