Securities and Exchange Board of India

OBJECTIVE

1. Participants in the capital market in India have been early adopters of technology. SEBI believes that encouraging adoption and usage of financial technology (‘FinTech’) would have a profound impact on the development of securities market. FinTech can act as an instrument to further develop and maintain an efficient, fair and transparent securities market ecosystem.

2. With a view to facilitate the development and adoption of innovative FinTech solutions, SEBI vide circular SEBI/HO/MRD/ 2019/P /64 dated May 20, 2019, stipulated a framework for an industry-wide Innovation Sandbox. Under this framework, FinTech startups and entities not regulated by SEBI may use the Innovation Sandbox for offline testing of their proposed solution, subject to fulfillment of the eligibility criteria.

3. Moving a step ahead in the same direction, SEBI plans to introduce a framework, to be called the ‘Regulatory Sandbox’. Under this sandbox framework, financial institutions regulated by SEBI shall be granted certain facilities and flexibilities to experiment with FinTech solutions in a live environment and on real customers. These features will be fortified with necessary safeguards for investor protection and risk mitigation.

4. Accordingly, this discussion paper aims to put forth the key principles and proposed approach for operationalizing such ‘Regulatory Sandbox’. SEBI invites written comments on the sandbox framework proposed in this discussion paper. Further, SEBI would like to encourage and invite any general comments on the proposals, including suggestions for additional information/clarification on any particular area of the framework and any alternative proposal that SEBI should consider. In order to facilitate fast assessment and implementation, interested participants are requested to please support each comment with a clear rationale and underlying evidence or illustration, as the case may be.

5. Interested parties are requested to provide their comments latest by June 18, 2019 at the email address : regsandbox@sebi.gov.inor in writing at the following address:

Shri. Bithin Mahanta

Deputy General Manager

Market Regulation Department,

SEBI Bhavan, Plot No. C4-A, G-Block,

Bandra Kurla Complex, Bandra (E),

Mumbai, India – 400051

FRAMEWORK FOR REGULATORY SANDBOX

6. The term “Regulatory Sandbox” shall be defined as a live, testing environment where new products, processes, services and business models can be deployed on a limited set of eligible customers for a specified period of time with certain relaxations in the extant SEBI regulations and guidelines.

7. Innovation through investor-centric experimentation has the potential to create better financial products, lower the costs of transaction for investors and promote financial inclusion especially for Indian investors with limited means. However, there have been instances when innovation without proper regulatory oversight has caused damage to investors and economies. Therefore, it is imperative that new technology intensive business models and innovations are deployed with proper regulatory oversight and risk mitigation safeguards.

8. The purpose of the sandbox environment, as has been discussed in the SEBI’s Committee on Financial and Regulatory Technologies (CFRT), is to start an early dialogue with companies experimenting with innovative technologies, so that more innovation and technologically intensive products may be brought under the purview of SEBI/ regulatory ambit at an early stage and potential adverse events, if any, can be identified and avoided.

9. The sandbox is intended to serve as a testing ground for new business models and technologies that benefit the investors, Indian markets and the Indian economy at SEBI also envisages that the Regulatory Sandbox as a platform would facilitate seamless information sharing between innovative firms and SEBI.

10. By participating in the sandbox, while the companies would get an opportunity to test their solutions on real customers/ investors, on the other hand, it may help SEBI to frame policies that may reduce the time and cost of deploying new investor-centric solutions in the capital market.

11. The following benefits are envisaged through greater FinTech experimentation in the Regulatory Sandbox:

i) Greater participation of investors as well as people who are raising capital or providing services. Increased financial inclusion and penetration of financial products, especially in Tier II/III towns and cities and rural areas;

ii) Ease of accessibility for retail investors (especially those with limited means), resulting in greater convenience, reduced operational costs, lower fees and transaction charges, while at the same time increasing the efficiency and transparency.

iii) Lower risk and more effective supervision.

APPLICABILITY

12. To begin with, it is proposed that all market participants registered with SEBI under section 12 of the SEBI Act 1992, shall be eligible for testing within the Regulatory sandbox. A market participant can come on its own or use the services of a fintech The registered market participant shall be treated as the principle applicant, even if it uses the services of a fintech firm, and shall be solely responsible for testing of the solution in the sandbox.

13. In the subsequent phases, depending on the response received, SEBI may consider permitting FinTech startups, FinTech firms and other entities that are not regulated by SEBI, to participate in the Regulatory Sandbox. In the interim, the innovation sandbox shall be available to all.

REGULATORY EXEMPTIONS

14. Within the overarching principles of Market Integrity and Investor Protection, no exemptions would be granted from extant principles of Investor Protection framework, Know-Your-Customer (KYC) and Anti-Money Laundering (AML) prescribed by SEBI.

15. With the intention to ensure that the sandboxing environment has minimum regulatory burden, SEBI shall consider exemptions/ relaxations, if any, which could be either in the form of a comprehensive exemption from certain regulatory requirements or selective exemptions on a case-by-case basis.

16. SEBI is considering a separate (new) regulatory regime for sandbox testing wherein exemptions from various SEBI regulations may be provided after analyzing specific sandbox testing applications. This could enable a more flexible regulatory environment for eligible participants to comply.

17. Depending on the FinTech Solution to be tested, SEBI shall determine the specific regulatory requirements which may be considered for relaxation on case-by-case basis. A reference list is placed at Annexure-2 with examples of the regulatory requirements that will be mandatory and those which SEBI may consider relaxing during the sandbox testing.

18. Alternatively, market participants desirous of participating in the regulatory sandbox may make an application for exemption / relaxation from relevant provisions of SEBI regulations. Firms desirous of participating in the sandbox are required to apply for relaxation of specific regulations that they feel are hampering their innovations or are acting as barriers to entry of new products.

ELIGIBILITY CRITERIA FOR THE PROJECT

19. The eligibility criteria shall be as follows:

a) Genuineness of innovation: The solution should be truly innovative or significantly different from existing offering and which adds significant value to the existing offering in the Indian market.

b) Genuine need to test: The applicant should have a genuine need for testing the solution on real customers within the sandbox. The applicant should demonstrate that the solution cannot be developed without relaxing certain regulations within the sandbox.

c) Limited prior testing: Before applying for testing in the regulatory sandbox, limited offline testing of the solution should have been carried out by the applicant.

d) Direct benefits to users: The solution should offer identifiable benefits (direct or indirect) to the investors or capital raising entities and to the capital market and the Indian economy at large.

e) No risks to the financial system: The solution should have proper risk management strategy to incorporate appropriate safeguards to mitigate and control potential risks and contain the consequences, if any, of failure.

f) Testing readiness of the solution: The applicant has the necessary resources to support testing in the sandbox. The applicant must show well developed testing plans with clear objectives, parameters and success criteria.

g) Deployment post-testing: The applicant should demonstrate the intention and ability to deploy the solution in India on a broader scale. To this effect the applicant should share a proposed sandbox exit and transition strategy.

h) Fit and proper person: The applicant shall satisfy the fit and proper criteria including but not limited to the following:

i. Integrity, reputation and character;

ii. Absence of convictions and restraint orders;

iii. Competence including financial solvency and net worth;

iv. Absence of categorization as a willful defaulter.

20. The applicant must demonstrate eligibility to the satisfaction of SEBI by showing clear evidence as listed above.

LIMITATIONS

21. The solutions/products shall not be permitted to be tested in the Regulatory Sandbox under the following circumstances:

a) The proposed FinTech solution is similar to those that are already being offered in the markets, unless the applicant can demonstrate that either an innovative (efficient alternative) technology is being used; or the same technology is used more efficiently (process efficiency).

b) The applicant has not carried out its due diligence, including testing the proposed FinTech solution in an offline test environment.

c) The applicant has no intention of deploying the FinTech solution in India on a broader scale after exiting from the Sandbox.

POTENTIAL RISK MITIGATES

22. The applicant must identify the potential risks to any market participants that may arise from the testing of the solution in the sandbox and propose appropriate safeguards to manage the risks and contain the consequences of failure.

23. The applicant will follow appropriate disclosure, protection and compensation requirements related to their users agreed upon, on a case-by-case basis. The applicant is required to have a clearly defined grievance redressal mechanism and user rights.

24. The applicant must provide adequate disclosure of the potential risks to users participating in the sandbox and seek prior confirmation from such users that they fully understand and accept the attendant risks.

25. Market participants participating in the sandbox shall have the same protection rights as the ones participating in the live market.

APPLICATION AND APPROVAL PROCESS

26. Monitoring and administering a Regulatory Sandbox is a resource intensive activity on part of the regulators. A Rolling approach will be followed wherein the applicant can apply anytime for participation in the regulatory sandbox.

27. The applicant should ensure that the eligibility criteria specified under Para 19 are satisfied before submitting the application and Annexure-1 to SEBI.

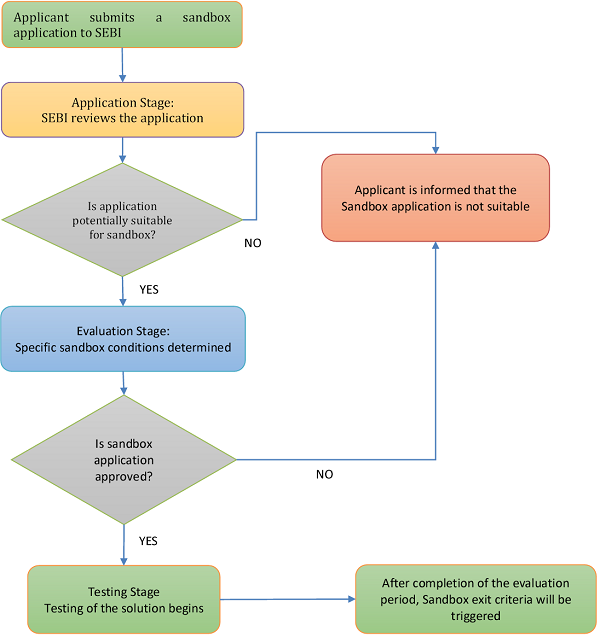

28. The flowchart below depicts the application and approval process. SEBI will communicate with the applicant / sandbox participant in the course of evaluating the sandbox application, and continue to do so during the testing phase.

29. Prior to submitting an application, the applicant can clarify any question regarding the sandbox by contacting SEBI at <email id>

30. If the applicant is a suitable participant for the sandbox and the project meets the eligibility criteria, it can proceed to submit the sandbox application form signed by the Chief Executive Officer (CEO) of the applicant or officer duly authorized by the CEO or registered individual, to SEBI, by email at <email id>.

31. At the “Application Stage”, SEBI shall review the application and inform the applicant of its potential suitability for a sandbox within 30 working days from the submission of the complete application. SEBI may issue individual guidance to the applicant according to the specific characteristics and risks associated with the proposed solution.

Flowchart: Application And Approval Process

32. At the “Evaluation Stage”, SEBI will work with the applicant to determine the specific regulatory requirements and conditions (including test parameters and control boundaries) to be applied to the proposed solution in question. The applicant will then assess if it is able to meet these requirements. If the applicant is able and willing to meet the proposed regulatory requirements and conditions, the applicant will be granted a permission to develop and test the proposed FinTech Innovation(s) in the sandbox within the parameters and control boundaries agreed upon with SEBI.

33. In the event that an application is rejected at any stage, the applicant will be informed The reasons for rejection could include failure to meet the objective of the sandbox or any of the eligibility criteria. The applicant may re-apply for the sandbox when it is ready to meet the objective and eligibility criteria of the sandbox, subject to a suitable cooling-off period.

34. Upon approval, the application proceeds towards the “Testing Stage”. The participant shall notify its users that the solution is operating in a sandbox and disclose the key risks associated with the financial service. The applicant is also required to obtain the user’s acknowledgement that they have read and understood these risks.

35. During the testing stage, if the applicant intends to make material changes to the solution, the applicant should apply to SEBI at least 1 month in advance and provide details of the proposed changes with reasons. SEBI’s approval will be required before the proposed changes can be implemented.

36. Participant must submit interim reports on the progress of the test.

37. At the end of the testing period, the sandbox participant shall exit the sandbox and the regulatory relaxations provided by SEBI shall expire.

38. SEBI shall assign a designated officer to each of the applicants. Similarly, each applicant shall assign a contact person to coordinate with SEBI.

39. For a rejected application, a suitable cooling off period shall be observed before the applicant is allowed to resubmit the application.

40 The complete application must be submitted to: Chief General Manager, Market Regulation Department, SEBI Bhavan, Plot No.: C4-A, G-Block, Bandra Kurla Complex, Bandra (E), Mumbai – 400051.

41. The duration of the sandbox testing stage is proposed to be a maximum of nine months with a maximum extension (upon request) of three months.

EVALUATION CRITERIA

42. The applicants will be evaluated using a scoring process based on the information submitted in the application form.

43. The Market Regulation Department, under the guidance of the CFRT, shall be the secretariat for the complete duration of the sandbox.

44. The concerned departments of SEBI may perform initial evaluation of the sandbox applications and present the same to the above-mentioned committee for final evaluation and confirmation.

TABLE 2: DISTRIBUTION OF MARKS

| Sr.No. | Evaluation Criteria | Weightage (%) |

Evaluated by | |

| Department | Committee | |||

| 1 | Profile of the Applicant | 10 | ||

| 2 | Usage of innovative solution including technology and/or processes |

10 | ||

| 3 | Identified benefits to the investors and/or the securities/commodities markets |

10 | ||

| 4 | Compilation of meaningful testing scenarios and expected/desired outcomes |

10 | ||

| 5 | Risk measured/graded testing conditions and parameters so as to ensure safety and protection of the Markets | 10 | ||

| 6 | Risk mitigation for high risk testing conditions and parameters |

10 | ||

| 7 | Intent and feasibility to deploy the proposed FinTech Solution post Sandbox testing | 10 | ||

–

| Sr.No. | Evaluation Criteria | Weightage (%) |

Evaluated by | |

| 8 | Post Sandbox testing deployment, monitoring and exit strategy (in case of non-viability of solution) | 10 | ||

| 9 | Other miscellaneous factors considered relevant by SEBI |

20 | ||

| Total | 100 | |||

45. The applicant has to score minimum marks in each parameter and achieve a minimum overall score to qualify for testing in the sandbox.

46. Since these are the early stages of implementation of the regulatory sandbox and the learning curve, SEBI shall reserve the right to modify the parameters, weightages and cut-offs as and when necessary. Further, SEBI shall reserve the right to reject the project based on its evaluation and judgment.

SUBMISSION OF INFORMATION AND REPORTS

47. During the testing period in the sandbox, SEBI may require the participant to submit information relating to the test.

48. The participant must ensure proper maintenance of records during the testing period to support reviews of the test by SEBI. Further, the participant shall also maintain such records for a period of five 5 years from completion of testing/ exit from the

INTERIM REPORTS

49. The participant must submit interim reports to SEBI on the progress of the test, which includes information on the following:

i) Key performance indicators, key milestones and statistical information;

ii) Key issues arising as observed from fraud or operational incident reports; and

iii) Actions or steps taken to address the key issues identified above

50. The frequency and specific details to be included in interim reports will be agreed between SEBI and the participant, taking into account the duration, complexity, scale and risks associated with the test.

FINAL REPORT

51. The Sandbox Participants must submit a final report containing the following information to SEBI within 30 calendar days from the expiry of the testing period:

i) Key outcomes, key performance indicators against agreed measures for the success or failure of the test and findings of the test;

ii) A full account of all incident reports and resolution of user complaints; and

iii) In the case of a failed test, lessons learnt from the test.

CONFIRMATION OF REPORTS

52. The interim and final reports must be confirmed by the CEO/Registered individual or by an officer duly authorized by the CEO! Registered individual.

MONITORING AND SUPERVISION OF THE SANDBOX

53. An officer of SEBI shall be assigned to supervise and guide each applicant during the course of product!solution deployment and testing in the sandbox.

EXTENDING OR EXITING THE SANDBOX

54. At the end of the testing period, the permission granted to the Sandbox Participant as well as the legal and regulatory requirements relaxed by SEBI will expire, and the sandbox participant must exit from the Sandbox.

55. Upon completion of testing,

i) SEBI shall decide whether to permit the product, process, service or solution to be introduced in the market on a wider scale. Where allowed, participants intending to carry out regulated businesses will be assessed based on applicable licensing, approval and registration criteria under various SEBI regulations, as the case may

ii) Or the applicant may employ an exit strategy.

iii) Or the applicant may request for an extension period to continue testing in the The extension period shall be limited to a maximum of three months.

56. In the event an extension of the testing period is required, the applicant should apply to SEBI at least two months before the expiration of the testing period and state the additional time required and clearly explain reasons for requiring the extension.

57. SEBI shall review the application and approval for extension of the testing period shall be granted on a case-by-case basis. SEBI’s decision on the application for extension shall be final.

58. The applicant may exit the sandbox on its own by giving SEBI a two-month notice in writing of its intention to exit the sandbox. In such cases, upon exiting the sandbox, the applicants must take the same actions outlined above.

59. The applicant shall ensure that any existing obligation to the users of the FinTech Innovation(s) under testing are completely fulfilled or addressed before exiting the sandbox or discontinuing the sandbox.

60. The applicant is required to maintain records of acknowledgement of all its users stating that obligations have been met, for a period of five years from the date of exit from the sandbox.

RIGHTS AND OBLIGATIONS OF THE USER

61. Before signing up, the user shall read the full documentation provided by the applicant and confirm that he/she is aware of the risks of using the solution.

62. The applicant is required to furnish complete details of its obligations to the user during the testing phase.

63. In the event the user encounters a serious issue or problem while using the solution, the user shall report the same to SEBI, immediately.

REVOCATION OF THE APPROVAL

64. SEBI may revoke an approval, to participate in the sandbox, at any time before the end of the testing period, if the applicant:

i) Fails to carry out risk mitigates as mentioned in Paras 22-2 5 above.

ii) Submits false, misleading or inaccurate information, or has concealed or failed to disclose material facts in the applications;

iii) Contravenes any applicable law administered by SEBI or any applicable law in India or abroad;

iv) Loss of reputation

v) Is undergoing or has gone into liquidation;

vi) The digital security and integrity of the service or product is compromised and the risk of a cyber-security attack is high.

vii) Carries on business in a manner detrimental to users or the public at large; or

viii) Fails to effectively address any technical defects, flaws or vulnerabilities in the product, service or solution which gives rise to recurring service disruptions or fraudulent activities.

ix) Fails to implement any directions given by SEBI.

65. Further, severe penalty in addition to revocation of approval will be levied on those firms which implement solutions in the Sandbox that, in spite of SEBI’s guidance and caution:

i) Undermine Know Your Customer (KYC) principles

ii) Violate user’s/investor’s privacy

iii) Promote selling of Fraudulent/illegal products or services

iv) Promote mis-selling of products or services

v) Violate Anti-Money Laundering (AML) norms

vi) Create difficulty in establishing an audit trail

vii) Create financial stability risk

viii) Are based on Intellectual Property theft

66. Before revoking an approval to participate in the sandbox, SEBI shall:

i. Give the participant 30 days’ notice in writing of its intention to revoke the approval; and

ii. Provide an opportunity for the participant to respond to SEBI on the grounds for revocation.

iii. Immediately suspend trials on new users i.e. no new users shall be permitted to sign up for using/testing the solution.

67. Where any delay in revoking the approval would be detrimental to the interests of the applicant, their users, the financial system or the public in general, SEBI shall revoke the approval immediately and provide the opportunity for the participant to respond after the effective date of revocation. If the response is accepted by SEBI, SEBI may reinstate the approval to participate in the sandbox.

68. Upon revocation of an approval, the participant must –

i) immediately implement its exit plan to cease the provision of the product, process, service or solution to new and existing users;

ii) notify its users about the cessation and their rights to grievance redressal wherever applicable;

iii) comply with obligations imposed by SEBI to dispose of all confidential information including user’spersonal information collected over the duration of the testing;

iv) compensate any users who had suffered financial losses arising from the test in accordance with the safeguards submitted by the participant under paragraphs 22-25 above; and

v) submit a report to SEBI on the actions taken, under paragraphs 49-5 1 within 30 days from the revocation.

vi) Comply with any other directions given by SEBI.

ADDITIONAL ISSUES FOR WHICH COMMENTS ARE BEING SOUGHT

69. Monitoring and administering the regulatory sandbox will require considerable resources from SEBI. Should SEBI charge a minimal fee for every applicant participating in the sandbox? If yes, what should be the quantum of such a fee? If no, why? Please justify your view with supporting rationale.

70. The frequency for submission of interim reports should be such that SEBI gets adequate information and time to monitor the testing process while at the same time not posing a hurdle or burden on the applicant’stesting What should be the frequency for submission of interim reports?

71. For a rejected application, what should be the duration of the cooling-off period? Please suggest a suitable time period with detailed rationale.

72. Any other comments / suggestions that SEBI should consider for encouraging innovation through sandbox testing.

***

ANNEXURE 1- REGULATORY SANDBOX APPLICATION FORM

Please note that the regulatory sandbox is meant to enable testing of innovative FinTech solution that are regulated by SEBI. For Clarification, if any Applicant may write to <email id>

| 1. Applicant’s Information | ||

| Name of the Organization | ||

| Address | ||

| Telephone No. | ||

| Website URL | ||

| SEBI Registration no. | ||

| Provide details of the fintech firms involved, if any | ||

| Name of the Authorized Representative | ||

| Designation | ||

| Contact No | ||

| Email id | ||

| 2. Overview: Profile of the Applicant | ||

| Sr. No. | Description | Response |

| 2.1 | Provide a brief description of the organization and its core businesses including but not limited to:

a. registration with other regulators, b. affiliation to prominent societies, c. Accreditations, d. significant achievements e. financial standing including avenues for funding f. Profile of key personnel |

|

| 2.2 | Does the applicant have presence in India? If yes then please provide details. | |

| 2.3 | Does the applicant’s business is already active abroad? If yes

then please provide details. |

|

| 2.4 | Current orders or proceedings against the applicant in India and abroad (if any) | |

| 3. About the proposed solution | ||

| Sr. No. | Description | Response |

| 3.1 | Provide a short summary of the proposed solution to be tested in the sandbox including but not limited to:

a. Objective of the proposed FinTech solution or the statement of purpose b. Key benefits to the users and markets c. Business Model, including asset deployment and sources d. Target users e. Compliance obligations f. Time period for testing |

|

| 3.2 | Summary of technical Solution including but not limited to:

a. Technical architecture b. Usage of Artificial Intelligence and Machine Learning, if any c. Cyber resilience: VAPT results, if any d. Certification from Common Criteria Recognition e. Business Continuity Plan, if any f. Any other certifications, if any |

|

| 3.3 | Genuineness of innovation: Explain how applicant’s solution

constitutes a significantly different offering in the market place |

|

| 3.4 | Awareness of similar offering in other countries or for other than securities/commodities markets | |

| 3.5 | Timelines for pan-India Deployment post Sandbox testing | |

| 4. Sandbox readiness | ||

| 4.1 | Illustrate the aspect of FinTech Solution that will be tested during the Sandboxing | |

| 4.2 | Mention the test criteria and expected outcomes | |

| 4.3 | Describe the use case that you are proposing to test in the sandbox. | |

| 4.4 | Define success for a test. What are the Key Performance Indicators that will indicate a successful test | |

| 4.5 | Probable start and end date of sandbox testing | |

| 4.6 | Customer Details including but not limited to:

a. Number of participating customers b. Profile of customers (retail, institutional, etc.) c. Process for enrollment and acquisition of customers d. Requirement of KYC? e. User awareness required/conducted f. Is consent required /has consent been obtained? |

|

| g. Arrangements to limit loss if applicable e.g. Margin, stop loss thresholds etc.

h. User compensation if any? i. Value at risk per user j. Transaction thresholds per user |

||

| 4.7 | Risk assessment and mitigation options including but not limited to:

a. Failure of sandbox testing b. Financial loss to the customers c. Cyber attack d. AML and terrorism financing |

|

| 4.8 | Any legal and regulatory non-compliance for any other regulator during the sandbox testing | |

| 5. Legal and Regulatory Assessment : other regulators | ||

| 5.1 | Applicant’s legal and regulatory status (registration, licensing,

authorization, approval, recognition etc.) |

|

| 5.2 | Legal opinion sought on the proposed FinTech Solution, if any | |

| 5.3 | Does the applicant currently have the relevant license to deploy the proposed solution in the production environment? Please provide the details. | |

| 6. Deployment post-testing | ||

| 6.1 | Describe how the regulatory requirements will be met post successful sandbox testing | |

| 6.2 | Please provide a pan-India deployment strategy, post successful Sandbox testing | |

| 6.3 | Please provide monitoring strategy to monitor the outcomes in the live scenario. | |

| 6.4 | Please provide exit and transition strategy if the deployed solution turns unviable. | |

| 7. Relaxation of SEBI regulations and guidelines | ||

| 7.1 | Outline the list of rules, regulation, guidelines, circulars etc. of SEBI that you feel may act as an impediment to the proposed FinTech Solution, along with detailed rationale. | |

| 7.2 | Does the applicant require SEBI to relax any specific regulatory requirements prescribed by SEBI, for the duration of the sandbox? Please provide the details along with rationale. | |

| 7.3 | In the event of a successful test and before exit from the sandbox, provide details on how the applicant intends to comply with

SEBI’s regulatory requirements |

|

Annexure 2- Regulatory Requirements for the Sandbox

Depending on the application of the participant and the proposed FinTech Solution, SEBI shall determine the specific legal and regulatory requirements which may merit relaxation during the sandbox testing.

The examples provided below are for illustrative purposes only and are not exhaustive.

REQUIREMENTS FOR WHICH RELAXATION WILL NOT BE CONSIDERED

i. Confidentiality of customer information

ii. Fit and proper criteria particularly on honesty and integrity

iii. Handling of customer’s moneys and assets by intermediaries

iv. Prevention of money laundering and countering the financing of terrorism

v. Risk checks (like price check, order value check, etc.)

vi. Principles of KYC

REQUIREMENTS THAT MAY MERIT RELAXATION

i. Net worth

ii. Track record

iii. Registration fees

iv. SEBI Guidelines, such as technology risk management guidelines and outsourcing guidelines

v. Financial soundness