Introduction

India being the divergent Country, focused on economic growth and the Financial Institutions (“FI”) play a dominant role in the economy which spread out its surplus fund to the borrower in unbanked regions. Over the last few decades, Non Banking Financial Companies (“NBFC”) have reckoned as one of the most conspicuous and most recognized ingredient in Indian Financial system that contributes to the national growth. NBFCs showed its existence to inscribe fund requirements of every sectors of society from large Corporates to SMEs.

NBFC popularized in the early 1990’s and is heterogeneous group. With its impeccable performance and robust growth, Bankers’ Bank viz., Reserve Bank of India (“RBI”) felt that the need to control the NBFCs. Accordingly, Reserve Bank of India Act, 1934 (“RBI Act”) was amended in the year 1997 that provides for regulatory framework governing NBFCs.

As per Section 45 I (f) of the RBI Act define an NBFC as:

- An FI is a Company;

- A Non Banking institution which is a Company with principal business of receiving deposits or lending in any manner;

- Such other non banking institution or class of such institutions, as the RBI with the previous approval of the Central Government may specify by notification in the official gazette.

The Term ‘Financial Institution’ is defined under Section 45 I (c) of RBI Act. In short, NBFC means

- company registered under the Companies Act, 2013

- engaged in the business of

- loans and advances;

- acquisition of shares/ stocks/ bonds/ debentures/ securities issued by Government or local authority or other marketable securities of a like nature;

- leasing;

- hire-purchase;

- insurance business;

- Chit or kuries business;

- Collecting monies by sale of any instruments and awarding prizes to persons from whom monies are collected or to any other person.

But it does not include any institution whose principal business is that of agriculture activity, industrial activity, purchase or sale of any goods (other than securities) or providing any services and sale/ purchase/ construction of immovable property. Various types of NBFCs are summarized hereunder.

In terms of Section 45-IA of the RBI Act, no NBFC can commence its business as NBFC without obtaining a Certificate of Registration from the RBI and without having a Net Owned Funds (NoF) of at least Rs. 2 Crore. However, following categories of NBFCs which are regulated by other regulators are exempted from the requirement of registration.

- Venture Capital Fund/ Merchant Banking Companies/ Stock Broking Companies controlled by SEBI;

- Insurance Company controlled by IRDA;

- Nidhi companies as controlled by Ministry of Corporate Affairs;

- Chit Companies as controlled by State Registrar of Chit Funds;

- Housing Finance Companies regulated by National Housing Bank.

Regulatory Framework governing ‘Deposit Taking NBFC’ (NBFC-Ds)

| Sl. No. | Regulatory Framework * | Applicability |

| 1 | Reserve Bank of India Act, 1934 (Sec 45I, IA, IB & IC) | all NBFCs |

| 2 | Companies Act, 2013 and its rules | NBFCs are exempted from the provisions of Act and Companies (Acceptance of Deposits) Rules, 2014 as amended from time to time. |

| 2 | Master Direction – NBFCs Acceptance of Public Deposits (Reserve Bank) Directions, 2016 | All NBFCs Except the following:

· Mutual Benefit Financial Company or a Mutual Benefit Company · an insurance company · stock exchanges · stock broking company · NBFC not accepting public deposit · Government Company |

| 3 | Master Direction – Exemptions from the provisions of RBI Act, 1934 | Categories of NBFCs except the following

· Housing Finance Institutions · Micro Finance Companies (subject to conditions) · Securitisation and Reconstruction Companies · Nidhi Companies · Stock Exchanges · Chit Companies · Insurance Companies · Stock brokers or sub-brokers · Venture Capital Fund Companies (To name a few exclusions) |

| 4 | Master Direction – Miscellaneous Non-Banking Companies (Reserve Bank) Directions, 2016 | Every FIs which is a company carries on, any of the types of business, in any place in India referred to in Reg 2 (2) to (4) of this Master Directions viz., Conducting any other form of chit or kuris. |

| 5 | Master Direction – NBFCs Returns (Reserve Bank) Directions, 2016 | all NBFCs including NBFC – Ds |

| 6 | Master Direction – NBFCs Auditor’s Report (Reserve Bank) Directions, 2016 | Auditors of all NBFCs including NBFC – Ds |

| 7 | Master Direction – Monitoring of Frauds in NBFCs (Reserve Bank) Directions, 2016 | Applicable NBFCs including NBFC – Ds |

| 8 | Master Direction – NBFC – Systemically Important Non-Deposit taking Company and Deposit taking Company (Reserve Bank) Directions, 2016. | Apply to following ‘Applicable NBFCs’

· Systemically Important Non-Deposit taking NBFCs; · NBFC – Ds; · NBFC-Factor having an asset size of Rs. 500 Crore and above; · Infrastructure Debt Fund – NBFC; · NBFCs – Micro Finance Institutions registered having an asset size of Rs. 500 Crore and above; · Every NBFCs – Infrastructure Finance Company having an asset size of Rs. 500 Crore and above. |

| 8 | Raising Money through Private Placement of Non-Convertible Debentures (NCDs) by NBFCs – RBI Guidelines (to the extent applicable) | All NBFCs including NBFC – Ds |

| 10 | Master Circular – NBFCs – Corporate Governance (Reserve Bank) Directions, 2015 | Apply to following applicable NBFCs

· every non-deposit accepting NBFC with asset size of Rs. 500 Crore and above (NBFCs-ND-SI) · NBFC – Ds |

* considered only Regulatory Framework that are applicable to the NBFC-Ds.

(RBI has started issuing Master Directions on all regulatory matters beginning January 2016. The Master Directions consolidate instructions on rules and regulations framed for each subject matter by the RBI under various Acts. Any change in the rules, regulation or policy is communicated during the year by way of circulars/press releases. The existing set of Master Circulars issued on various subjects will stand withdrawn with the issue of the Master Direction on the subject.)

DEFINITION OF TERMS ‘DEPOSIT’ & ‘PUBLIC DEPOSIT’ UNDER RBI ACT/ NBFC DIRECTIONS

As per section 45 I (bb) of the RBI Act, the term ‘Deposit’ includes any receipt of money by way of deposit or loan or in any other form. However the following are excluded from the definition of deposits:

- Money received by way of Share Capital;

- Contribution to capital of partnership firm by partners;

- Money received from scheduled banks, co-operative banks or any other banking company;

- Monies received from –

- State Finance Corporation;

- Specified financial institutions;

- Other financial institutions specified by the RBI;

- Amounts received in ordinary course of business by way of –

- Security Deposit;

- Dealer Deposit;

- Earnest Money;

- Trade advances;

- Monies received from entities not being body Corporates and registered under money lending act of the state;

- Subscription amounts to chit (Chit Funds).

As per Reg 3 (XV) of Master Direction – NBFC – Acceptance of Public Deposits (Reserve Bank) Directions, 2016 defines the term ‘Public Deposit’ as a deposit as defined under section 45-I (bb) of the RBI Act excluding the following:

- Monies received from Central/ State government including guarantee provided by the State / Central Government;

- Monies received from Notified financial institutions;

- Inter-Company Deposits;

- Amounts received towards subscription to securities as per Companies Act 2013;

- Amounts received from directors, amounts received by private companies from shareholders provided the amount has not been borrowed by the director/ shareholder;

- Amounts received by issue of compulsorily convertible bonds / debentures;

- fa) Amount raised by issuance of non-convertible debentures with a maturity of more than one year and having the minimum subscription per investor at Rs. 1 Crore and above;

- Amounts brought in by promoters by way of unsecured loans subject to certain conditions;

- Amounts received from Mutual Funds;

- Amounts collected by way of hybrid debt or subordinate debt with minimum maturity of not less than 60 months;

- Amounts received from relative of director of NBFCs;

- Amounts received by issuance of commercial papers;

- Amounts received by Systemically Important Non-Deposit taking NBFC (NBFC-ND-SI) by issuance of perpetual debt instruments;

- Amounts raised by infrastructure finance companies by issuance of infrastructure bonds.

KEY PROVISIONS UNDER VARIOUS NBFC DIRECTIONS

A. MASTER DIRECTION – NBFCs ACCEPTANCE OF PUBLIC DEPOSITS (RESERVE BANK) DIRECTIONS, 2016

| Clause | Particulars |

|

Reg 6: Requirement of Maintenance of Liquid Assets

|

Every NBFC-D shall invest in unencumbered approved securities valued at the price not be less than 15% of public deposit.

Failure in compliance will lead to a penal interest @ 3% p.a. above the bank rate and where the shortfall continues in the subsequent quarters, the rate of penal interest shall be 5% p.a. above the bank rate. |

| Reg 8:

Minimum Credit Rating

|

Must be obtained minimum investment grade from any one of the approved credit rating agencies at least once a year and a copy of the rating is sent to the RBI along with return on prudential norms.

In case of any change of rating, it shall within fifteen working days of its being so rated inform to the RBI. |

| Reg 11:

Period of Public Deposit: |

NBFC shall accept public deposit with minimum period of 12 months and maximum period shall not be later than 60 months from acceptance/ renewal date. |

| Reg 14:

Ceiling on the rate of interest |

NBFCs shall not invite or accept or renew public deposit at a rate of interest exceeding 12.5% p.a. |

| Reg 22: Advertisement and statement in lieu of advertisement: | NBFCs shall comply with the provisions of the NBFCs and Miscellaneous Non-Banking Companies (Advertisement) Rules, 1977 |

| Reg 23: Minimum lock- in period | No NBFCs shall grant any loan against a public deposit or make premature repayment of a public deposit within a period of three months (lock-in period) from the date of its acceptance. |

| Reg 29:

Register of deposit

|

Every NBFCs shall keep such register at each branch and a consolidated register for all the branches taken together at the registered office of the company and shall be preserved for not less than 8 calendar years |

| Reg 35: Information to be included in the Board’s report | Requisite information like total no of accounts of public deposit which have not claimed by depositors or not paid by the Company etc…. shall be disclosed in Board Report. |

| Reg 38:

Cover for public deposits – creation of floating charge on Liquid Assets |

NBFCs accepting/ holding public deposits shall create a floating charge on the statutory liquid assets invested in terms of section 45-IB of the Act, in favour of their depositors through the mechanism of ‘Trust Deed’. |

B. MASTER DIRECTION – NBFC – RETURNS (RESERVE BANK) DIRECTIONS, 2016

Details of returns to be submitted by NBFCs-D:-

| Sl. No. | Name of the Return | Applicability | Periodicity | Purpose | Reporting Time |

| 1 | NBS-1

(Quarterly Returns) |

NBFCs-D | Quarterly | To capture financial details, viz. components of Assets and Liabilities, Profit and Loss account, Exposure to sensitive sectors | 15 days from quarter end. |

| 2 | NBS-2

(Quarterly Statement of Capital Funds, Risk Assets etc as required) |

NBFCs-D * | Quarterly | To capture compliance with various prudential norms, e.g. Capital Adequacy, Asset Classification, Provisioning, NOF etc. | 15 days from quarter end. |

| 3 | NBS–3

(Quarterly Return on Statutory Liquid Assets as per Section 45 IB of the Act) |

NBFCs-D | Quarterly | To capture details of Statutory Investments in Liquid Assets | 15 days from quarter end. |

| 4 | NBS-4

(Annual Return on Repayment of Deposits by the Rejected Companies holding Public Deposits) |

NBFCs holding public deposits whose application for Certificate of Registration under Section 45-IA of the RBI Act have been rejected |

annual basis | To know the repayment status of public deposits of rejected NBFCs- D | 30 days from year end. |

| 5 | ALM (NBFC-D)

(Asset-Liability Management Return) |

NBFCs-D having public deposit of Rs. 20 Crore and above and/or asset size of Rs. 100 Crore and above | Half yearly | To address concerns regarding Asset Liability mismatches and interest rate risk exposures | 30 days from half year end. |

| 6 | Statutory Auditor Certificate | All NBFCs-D | Annual | To ensure continued regulatory compliance. | 1 month from the date of finalisation of Balance Sheet |

| 7 | Branch Information Return | All NBFCs-D * | Quarterly | To capture the reach and geographical spread of NBFCs. | 15 days from quarter end. |

| 8 | Return on FDI & Certificate on compliance with FDI norms | All NBFCs-D * | Half yearly | To capture compliance with the stipulated minimum capitalization norms under FEMA. | 30 days from half year end. |

| 9 | Return on

Overseas Investments & annual certificate from statutory auditors |

All NBFCs-D * | Quarterly | To capture details on overseas investment by NBFCs. | Within 15 days from quarter end. |

| 10 | Reporting to Central Repository of Information on Large Credits (CRILC) | All NBFCs-D * | Quarterly | The data includes credit information on all the borrowers having aggregate fund-based and non-fund based exposure of Rs. 5 Crore and above with them and the SMA status of the borrower. | 21 days from quarter end. |

| 11 | Reporting of Special Mention Account status (SMA-2 return) | All NBFCs-D * | Weekly | To facilitate early Recognition of Financial Distress, Prompt Steps for Resolution and Fair Recovery for Lenders. | On Every Friday |

*Apart from other type of NBFCs

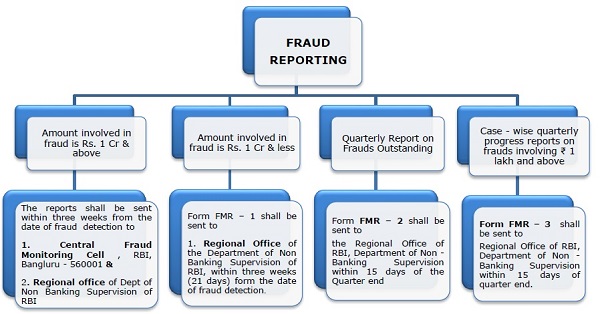

C. MASTER DIRECTION – MONITORING OF FRAUDS IN NBFCS (RESERVE BANK) DIRECTIONS, 2016

DMASTER DIRECTION – NBFC – SYSTEMICALLY IMPORTANT NON-DEPOSIT TAKING COMPANY AND DEPOSIT TAKING COMPANY (RESERVE BANK) DIRECTIONS, 2016

| Clause | Particulars |

| Reg 6.

Capital Requirements |

Every applicable NBFCs shall maintain a minimum capital ratio consisting of Tier I and Tier II capital which shall not be less than 15 % of its aggregate risk weighted assets on-balance sheet and of risk adjusted value of off-balance sheet items. |

| Reg 13. Provisioning requirements

(applicable to every NBFC except NBFC-MFIs) |

(i) Loss Assets: The entire asset shall be written off. If the assets are permitted to remain in the books for any reason, 100% of the outstanding shall be provided for;

(ii) Doubtful Assets: (a) 100% provision shall be made; (b) in addition to item (a) above, depending upon the period for which the asset has remained doubtful, provision to the extent of 20% to 50% of the secured portion shall be provided (iii) Sub-standard assets: A general provision of 10 percent of total outstanding shall be made. |

CONCLUSION

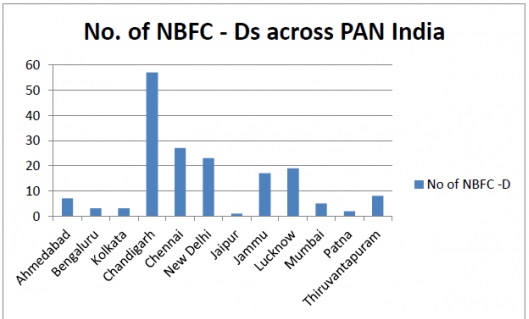

Indian NBFCs have shown magnificent growth history in past few years and is expected to touch nearly 18% by FY 2018–19. As on October 31, 2017, there were 172 Deposit accepting NBFCs (refer graph below) registered with RBI.

| Region | No of NBFC -D |

| Ahmedabad | 7 |

| Bengaluru | 3 |

| Kolkata | 3 |

| Chandigarh | 57 |

| Chennai | 27 |

| New Delhi | 23 |

| Jaipur | 1 |

| Jammu | 17 |

| Lucknow | 19 |

| Mumbai | 5 |

| Patna | 2 |

| Thiruvantapuram | 8 |

| Total | 172 |

As the banking system tinkered with NPAs (viz., IDBI Bank (with gross NPA ratio of 24.11 % of gross advances), Indian Overseas Bank – 23.6% and Indian Bank has the lowest GNPA ratio of 7.21%: CARE Rating Agencies said based on June 2017 quarter ended statistics), NBFCs succeeded (due to better product lines, effective cost, extensive reach, effective risk management system, to restraint Bad loan etc) with their presence in various segments.