Introduction: Foreign Direct Investment (FDI) plays a significant role in shaping the economic landscape of a country. In India, FDI regulations are subject to periodic revisions, with the FDI Policy of 2020 providing updated guidelines for various sectors, including Real Estate and Hotel Business. This article aims to dissect the implications of the FDI Policy 2020 on investments in these sectors, drawing insights from the regulatory framework and its interpretation.

Foreign Direct Investment (FDI) in Real Estate & Hotel Business (Ref: FDI Policy, 2020)

Summary of Below Detailed Analysis

“Real estate business” means dealing in land and immovable property with a view to earning profit there from and does not include development of townships, construction of residential/ commercial premises, roads or bridges, educational institutions, recreational facilities, city and regional level infrastructure, townships. Further, earning of rent/ income on lease of the property, not amounting to transfer, will not amount to real estate business

For Carrying out business in India there are various prohibited sectors listed under FEMA but it does not include Hotel Business. Thus, the same is allowed. However, Real Estate Business is a prohibited sector as per FEMA Regulation, 2017. However, the definition of Real Estate Business is as above itself & hence, the same would not include development of townships, construction of residential/ commercial premises & rent/lease of the property. Accordingly, we conclude that the same is also allowed under FEMA.

Detailed Analysis:-

FDI in Real Estate allowed? (Ref-5.2.10.1)

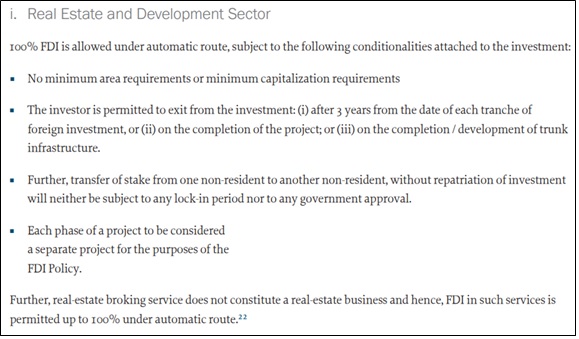

FDI is allowed in India in Construction-development projects Sector upto 100% Equity Cap. This would include development of townships, construction of residential/commercial premises, roads or bridges, hotels, resorts, hospitals, educational institutions, recreational facilities, city and regional level infrastructure, townships.

It is clarified that FDI is not permitted in an entity which is engaged or proposes to engage in real estate business, construction of farm houses and trading in transferable development rights (TDRs).

“Real estate business” means dealing in land and immovable property with a view to earning profit there from and does not include development of townships, construction of residential/ commercial premises, roads or bridges, educational institutions, recreational facilities, city and regional level infrastructure, townships. Further, earning of rent/ income on lease of the property, not amounting to transfer, will not amount to real estate business

Consequent to foreign investment, transfer of ownership and/or control of the investee company from residents to non-residents is also permitted. However, there would be a lock-in-period of three years, calculated with reference to each tranche of FDI, and transfer of immovable property or part thereof is not permitted during this period.

Exit from such project? (Ref-5.2.10.2)

Each phase of the construction development project would be considered as a separate project for the purposes of FDI policy. Investment will be subject to the following conditions:

(i) The investor will be permitted to exit on completion of the project or after development of trunk infrastructure i.e. roads, water supply, street lighting, drainage and sewerage.

(ii) Notwithstanding anything contained at (A) (i) above, a foreign investor will be permitted to exit and repatriate foreign investment before the completion of project under automatic route, provided that a lock-in-period of three years, calculated with reference to each tranche of foreign investment has been completed. Further, transfer of stake from one non-resident to another non-resident, without repatriation of investment will neither be subject to any lock-in period nor to any government approval.

Condition of lock-in period at (ii) above will not apply to Hotels &Tourist Resorts, Hospitals, Special Economic Zones (SEZs), Educational Institutions, Old Age Homes and investment by NRIs.

The Indian investee company will be permitted to sell only developed plots. For the purposes of this policy “developed plots” will mean plots where trunk infrastructure i.e. roads, water supply, street lighting, drainage and sewerage, have been made available.

The Indian investee company shall be responsible for obtaining all necessary approvals, including those of the building/layout plans, developing internal and peripheral areas and other infrastructure facilities, payment of development, external development and other charges and complying with all other requirements as prescribed under applicable rules/bye-laws/regulations of the State Government/Municipal/Local Body concerned.

Acquisition/ transfer by a Non- Resident Indian (NRI) / Overseas Citizen of India (OCI)

An NRI or an OCI can acquire by way of purchase any immovable property (other than agricultural land/ plantation property/ farm house) in India.

An NRI or an OCI may transfer any immovable property in India to a person resident in India. An NRI or an OCI may transfer any immovable property (other than agricultural land or plantation property or farmhouse) to an NRI or an OCI.

For the purpose of the above 2 paras, the payments, if any, for transfer of immovable property out of funds received in India should be through banking channels by way of inward remittance from any place outside India or by debit to their NRE/ FCNR (B)/ NRO account. Such payments cannot be made either by traveller’s cheque or by foreign currency notes or by other mode except those specifically mentioned above.

Acquisition of immovable property in India by a branch, office or other place of business of persons of Pakistan or Bangladesh or Sri Lanka or Afghanistan or China or Iran or Hong Kong or Macau or Nepal or Bhutan or Democratic People’s Republic of Korea origin/ nationality/ ownership requires the prior approval of the Reserve Bank.

Carrying on the business of Hotel

Under FEMA, the prohibited activities for investment by a person resident outside India are:

1. Lottery Business including Government/ private lottery, online lotteries

2. Gambling and betting including casinos

3. Chit funds

4. Nidhi company

5. Trading in Transferable Development Rights (TDRs)

6. Real Estate Business or Construction of Farm Houses.

Explanation: For the purpose of this regulation, “real estate business” shall not include development of townships, construction of residential /commercial premises, roads or bridges and Real Estate Investment Trusts (REITs) registered and regulated under the SEBI (REITs) Regulations 2014. Further, earning of rent/ income on lease of the property, not amounting to transfer, will not amount to real estate business

7. Manufacturing of Cigars, cheroots, cigarillos and cigarettes, of tobacco or of tobacco substitutes

8. Activities/ sectors not open to private sector investment e.g. (I) Atomic energy and (II) Railway operation

9. Foreign technology collaboration in any form including licensing for franchise, trademark, brand name, management contract is also prohibited for Lottery Business and Gambling and Betting activities

Conclusion: The FDI Policy 2020 introduces significant changes to the regulatory landscape for investments in Real Estate and Hotel Business in India. By delineating permissible activities and setting out conditions for FDI, the policy aims to facilitate foreign investment while safeguarding national interests. Understanding these regulations is crucial for investors and stakeholders seeking opportunities in these sectors, ensuring compliance and maximizing potential benefits.