Sponsored

Brief Introduction:

> TDS section 194Q has been introduced in Budget 2021 and will get applicable from 1st July, 2021

> TCS section 206C(1H) has been effected from 1st October, 2020

> Let us see both the sections in detail.

DISCUSSION

| PARTICULARS | SECTION 194Q | SECTION 206C(1H) |

| Purpose | Tax to be deducted | Tax to be collected |

| Applicability | Buyer/Purchaser | Seller |

| Counter party | Resident Seller | Resident Buyer |

| Trigger point |

|

|

| W.E.F | 1st July, 2021 | 1st October, 2020 |

| Timing of tax deduction | Payment or credit whichever is earlier | At the time of receipt |

| Advances | TDS shall be deducted on advance payment made | TCS shall be collected on advance receipts |

| Rates |

|

|

| Not applicable to |

|

|

| Exclusion | Yet to be notified by Government |

|

| TAN requirement | YES | YES |

| When to deposit/collect

|

|

|

| Form | 26Q | 27EQ |

| Certificate to be issued to seller/buyer | Form – 16A | Form – 27D |

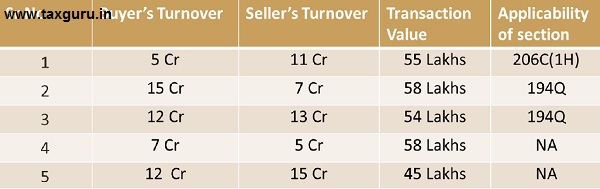

Example:

Sponsored

Kindly Refer to

Privacy Policy &

Complete Terms of Use and Disclaimer.

Methodicaly well presented.

How can we make control on it, if buyer and seller

have same turnover, what is the loop hole in this section?

As per the notification, Buyer and seller achieve turnover above 10 Cr. then first prioritize 194Q. that means only TDS 194Q applicable.

Can you Ans. of Explain example No. 3

How would seller knows whether the buyer is going to deduct TDS or not ? because sale/advance is the first instance. Any declaration is required from buyer if he wants to avoid TCS (Assume both achieved 10Cr turnover in PY)

i have the same Question have u got some solution for this please suggest for the same.

Can u explain what about for ther period 1st april 20 to 30th june 20?

Which section is applicable?

What is transaction limit in this case?

Good information, i have checked various article but no one is able to conclude whether both section is applicable on single transaction or not. You made it clear that in case 194Q is applicable then section 206C (1H) is not applicable.

Best Part of your presentation is the Example shared by you

Keep it up.

Thank You Mr. Atul Sir

Yes it’s very informative article with very quick overview with great presentation.. seriously you’r affords are deserved appreciation..

Fantastic!. Superb Parth, Very well explained. Keep posting articles. Keep it up.

tds is deducted by the buyer if seller is charge the tcs

Informative

Nice one bhai keep it up like this I am proud of you brother

Very good article. Need some more in future.