Summary: Financing a wholly owned subsidiary (WOS) through loans or equity has distinct tax implications under Indian law. Section 36(1)(iii) of the Income Tax Act governs interest deduction on loans borrowed for business purposes. If a parent company borrows funds to invest in its subsidiary, interest on such loans may be deductible if the investment serves the business purpose. For example, loans used to invest in subsidiaries operating in the same industry may qualify for deduction, but if the investment serves non-business purposes, deductions can be denied. Section 57 of the Income Tax Act limits interest deductions from dividend income, allowing a maximum deduction of 20% of the dividend received. Additionally, Section 186 of the Companies Act, 2013 limits how much a company can lend to subsidiaries and ensures loans are not interest-free by mandating a minimum interest rate based on government securities. Therefore, loans or equity investments made to fund a subsidiary must comply with these laws. The tax benefits and allowances depend on the nature of the investment and its alignment with business objectives. Companies must carefully navigate these provisions to optimize tax efficiency while funding their subsidiaries.

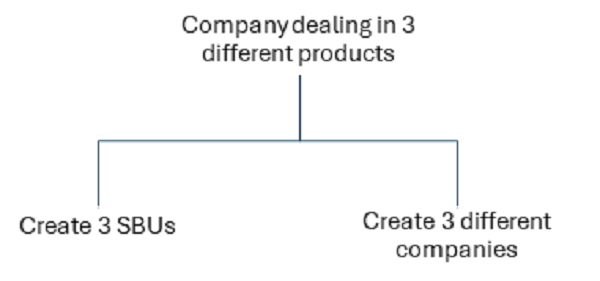

Many companies use to operate in different lines of business. For example- A company may be dealing in grocery items, cosmetics and at the same time in dairy products.

The company may keep all these 3 business (i.e grocery items, cosmetic and dairy products) under the same umbrella company by creating 3 different SBUs (Strategic Business Units) to monitor the operation and performance of these SBUs.

Otherwise, the company can create 3 different subsidiary companies to look after these business.

In this article we will discuss, the allowability of interest on loan taken, to invest in these business under following circumstances:

1) When these business are under the same company (i.e creation of SBUs- Strategic Business Units)

2) When separate subsidiary companies are formed for these businesses and amount is invested in form of loan in these subsidiary companies

3) When separate subsidiary companies are formed for these businesses and amount is invested in form of equity in these subsidiary companies.

The tax treatment of above scenario is dealt by following provisions:

1) Section 36(1)(iii) of Income Tax Act 1961

2) Section 57 of Income Tax Act 1961

3) Section 186 of Companies Act 2013

1) Section 36(1)(iii) of Income Tax Act 1961

Allowability of Interest on Loan is governed by section 36(1)(iii) of the Income Tax Act 1961. It provides as follows:

| Section 36(1)(iii)- the amount of the interest paid in respect of capital borrowed for the purposes of the business or profession (shall be allowed as deduction in computing the income referred in sec 28):

[Provided that any amount of the interest paid, in respect of capital borrowed for acquisition of an asset (whether capitalised in the books of account or not); for any period beginning from the date on which the capital was borrowed for acquisition of the asset till the date on which such asset was first put to use, shall not be allowed as deduction.] Explanation. – Recurring subscriptions paid periodically by shareholders or subscribers in Mutual Benefit Societies which fulfil such conditions as may be prescribed, shall be deemed to be capital borrowed within the meaning of this clause; |

From the reading of above section, it is evident that interest on loan taken for the propose of business or profession is allowed as expenditure while calculating profit for taxation.

The same can be explained with the help of following example:

| Example: A company has made a profit before Interest and tax (PBIT) of Rs 50 Lacs. It has paid an interest of Rs 20 lacs on the amount of loan taken (assuming loan taken for the purpose of business).

In this case the company will have to pay income tax on Rs 30 Lacs (i.e 50 Lacs – 20 Lacs) and not on Rs 50 Lacs. Assuming tax rate of 25%, the company will have to pay tax of Rs 7.50 lacs (i.e 25% of Rs 30 Lacs). So, we can see that a company can save tax of Rs 5 Lacs (i.e 25% of 20 lacs) on the amount of interest paid. |

Many a time there is dispute between assessee and income tax department over allowability of interest as a business expenditure and this interest amount deduction is disallowed by treating them as not for the purpose of business.

The same can be explained with the help of following example:

| Example: A company dealing in tyres (say MRF Ltd) invested into shares of Nestle Ltd (a FMCG company) by taking loan from a bank. The interest paid on loan taken by MRF for investment in shares of Nestle Ltd is disallowed u/s 36(1)(iii) since loan taken by MRF is not for the purpose of business of MRF.

However, if MRF Ltd takes loan and invest the same in any company of same line of business (say a subsidiary or some start up business dealing in tyres) then the same will get covered u/s 36(1)(iii). Various courts in India have held that the expression “for the purpose of business” used in section 36(1)(iii) has wider scope than the expression “for the purpose of earning profits”. So, if MRF is investing in a subsidiary and such subsidiary is a loss making company (i.e no dividend is received by MRF), then also interest on loan taken for investing in such subsidiary will be allowed as expenditure u/s 36(1)(iii). |

2) Section 57 of Income Tax Act 1961

A new proviso has been inserted in Section 57 of IT Act (w.e.f Finance Act 2020) which provides as below:

| Sec 57- The income chargeable under the head “Income from other sources” shall be computed after making the following deductions, namely :—

(i)- in the case of dividends, or interest on securities, any reasonable sum paid by way of commission or remuneration to a banker or any other person for the purpose of realising such dividend or interest on behalf of the assessee … Provided that no deduction shall be allowed from the dividend income, or income in respect of units of a Mutual Fund specified under clause (23D) of section 10 or income in respect of units from a specified company defined in the Explanation to clause (35) of section 10, other than deduction on account of interest expense, and in any previous year such deduction shall not exceed twenty per cent (20%) of the dividend income, or income in respect of such units, included in the total income for that year, without deduction under this section. |

On combined reading of Sec 57(i) with proviso, we can conclude that a taxpayer is eligible to deduct interest costs subject to least of the following:

1) interest paid on money borrowed for share investments or

2) 20% of dividends or income in relation to mutual fund units

Hence if X Ltd has borrowed Rs 10 lacs @ 10% P.A for investment in Y Ltd. Then annual interest payment would be Rs 1 Lac. X Ltd received a dividend of Rs 2.50 Lacs on such investment in Y Ltd during the year.

In this case deduction u/s 57 will be as below:

| Particulars | Am Rs | Am Rs |

| Dividend Income Received | 2,50,000 | |

| Less: Deduction u/s 57 (least of the following) | ||

| (i) Actual Interest paid | 1,00,000 | |

| (ii) 20% of dividend received | 50,000 | 50,000 |

| Taxable Income from other sources | 2,00,000 |

3) Section 186 of Companied Act 2013

Section 186 of Companies Act 2013 is applicable in case of Loan and Investment by a company. The relevant provisions of Section 186 of Companies Act 2013 is reproduced below:

| Sec 186(2)- No company shall directly or indirectly —

(a) give any loan to any person or other body corporate; (b) give any guarantee or provide security in connection with a loan to any other body corporate or person; and (c) acquire by way of subscription, purchase or otherwise, the securities of any other body corporate, exceeding 60% of its paid-up share capital, free reserves and securities premium account or 100% of its free reserves and securities premium account, whichever is more. —- —- 186(7)- No loan shall be given under this section at a rate of interest lower than the prevailing yield of one year, three year, five year or ten year Government Security closest to the tenor of the loan. |

From section 186 of Companies Act 2013, we understand that a company can make investment / loan in other company subject to certain limit (based on amount of paid up capital and accumulated reserves) and it can’t give interest free loan to any other company.

So on combined reading of Sec 36 and 57 of Income Tax Act and Sec 186 of Companied Act 2013, we can conclude the tax treatment of 3 scenario mentioned at the beginning i.e

1) When these business are under the same company (i.e creation of SBUs- Strategic Business Units)

2) When separate subsidiary companies are formed for these businesses and amount is invested in form of loan to these subsidiary companies

3) When separate subsidiary companies are formed for these businesses and amount is invested in form of equity in these subsidiary companies.

Case 1) When these business are under the same company (i.e creation of SBUs- Strategic Business Units)

In case a company has different business and all of them operate under the same company then any interest on loan taken for the purpose of business will be fully allowed as expenditure u/s 36(1)(iii) of Income Tax Act 1961.

Case 2) When separate subsidiary companies are formed for these businesses and amount is invested in form of loan to these subsidiary companies

As per section 186(7) of the Companies Act interest free loan can not be given to any other Company. Minimum rate of interest is also prescribed under this section.

The amount of interest received on loan given to subsidiary company will be treated as Income from Business (since this is in relation to the business) and whole amount of interest paid on loan taken to provide this loan to subsidiary company will be allowed as expenditure u/s 36(1)(iii).

For Example: X Ltd took a loan of Rs 10 Lacs at an interest rate of 12%. It provided the whole amount of Rs 10 lacs as loan to its subsidiary company Y Ltd for a period of 5 years at an interest rate of 9% (i.e prevailing yield of five year Government Security).

In this case income computation in hands of X Ltd is as below:

| Particulars | Am Rs |

| Interest Received from Y Ltd (9% of 10 lacs) | 90,000 |

| Less: Interest paid on loan taken (12% of 10 lacs) | 1,20,000 |

| Difference (to be set off against other business Income) | (30,000) |

Case 3) When separate subsidiary companies are formed for these businesses and amount is invested in form of equity in these subsidiary companies.

If the amount is invested in equity in a subsidiary company, financed by way of taking loan, then tax treatment of interest paid on such loan depends upon as to how this investment is treated i.e

a) Whether this investment in equity of subsidiary company is treated as for the purpose of business, or

b) Whether this investment in equity of subsidiary company is NOT treated as for the purpose of business,

Case a) When this investment in equity of subsidiary company is treated as for the purpose of business

In the given case whole amount of interest paid on loan will be allowed as business expenditure u/s 36(1)(iii) of Income Tax Act

Case b) When this investment in equity of subsidiary company is NOT treated as for the purpose of business,

In the given case it will be governed by provisions of section 57 of Income Tax Act and interest on loan will be allowed to be deducted from dividend income subject to maximum of 20% of Dividend Income. In case no dividend is received, the whole amount of interest will not be allowed as deduction under any of the provisions of Income Tax Act.

The above can be summarised as below:

| Particulars | Income Tax Treatment in hands of Company making Investment | Income Tax Treatment in hands of Subsidiary Company |

| Case 1) When these business are under the same company (i.e creation of SBUs- Strategic Business Units) | Interest on loan is fully allowed as expenditure u/s 36(1)(iii) of Income Tax Act 1961. | Not Applicable |

| Case 2) When separate subsidiary companies are formed for these businesses and amount is invested in form of loan to these subsidiary companies | Interest on loan is fully allowed as expenditure u/s 36(1)(iii). However since loan can’t be given interest-free, so amount of interest received on loan given to subsidiary company will be treated as Income. |

Interest paid on loan is treated as business expenditure u/s 36(1)(iii) |

| Case 3) When separate subsidiary companies are formed for these businesses and amount is invested in form of equity in these subsidiary companies. | ||

| a) subsidiary company is treated as for the purpose of business | Interest on loan is fully allowed as expenditure u/s 36(1)(iii). Dividend Received (if any) will be treated as Income. |

No income tax treatment for equity investment received from parent Company |

| b) subsidiary company is NOT treated as for the purpose of business | Interest on loan allowed as least of following a) 20% of Dividend Received or b) Actual amount of Interest paid for this investment in equity |

No income tax treatment for equity investment received from parent Company |

In this age of competition, a company wants to diversify into different fields. However, in order to keep their liability limited, they use to form separate companies which remains loss making for the initial few years.

These loss making subsidiary companies find it difficult to raise loan from bank and financial institutions and the rate of interest is relatively higher. Beside it no immediate income tax benefit is available on these interest payment in the absence of profit and these losses are carried forward for a maximum period of 8 years and many a time they are lapsed.

Hence in these cases it make sense for the parent company to invest the amount in this subsidiary company as equity as it will lead to following tax advantages:

1) The loan can be raised by parent company at favourable terms (i.e relatively lower rate of interest than the rate applicable for loss making subsidiary company).

2) Parent company (assuming sufficient profit and investment is treated as for the purpose of business) can claim the whole amount of interest as business expenditure u/s 36(1)(iii).

3) This immediate tax benefit to parent company saves time value of money (i.e money now is more valuable than money after a year) and also reduces the possibility of losing whole tax benefit in case subsidiary company continues to make losses.