1. The ITR-2 is filed by the individuals having a salary of more than Rs 50 lakhs, HUFs not having income from profit or gains of business or profession, and to whom ITR-1 is not applicable. It includes income from capital gains, foreign income, or any agricultural income more than Rs 5,000.

2. In view of the outbreak of Covid-19, the Government vides Income Tax notification dated 24 June 2020, has extended the deadline for filing return of income for A.Y. 2020-21 from the original due date of 31st July 2020 to 30th November 2020.

3. However, the taxpayers having self-assessment tax liability exceeding Rs. 1 lakh are advised to file their ITR 2 in time as there will be no extension of date for the payment of self-assessment tax for them. In the case where the self tax assessment liability exceeds Rs 1 Lakhs, the whole of the self-assessment tax shall be payable by the due date (31st July 2020) specified in the Income-tax Act, 1961 and delayed payment would attract interest under section 234A of the IT Act.

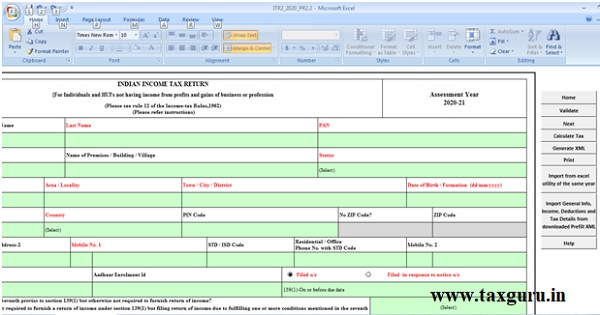

4. In this article, an attempt has been made to explain Step by Step procedure to the online filing of ITR 2 with the help of screenshots.

Page Contents

Step by Step procedure to the online filing of ITR 2

Step 1 Go to incometaxindiaefiling.gov.in

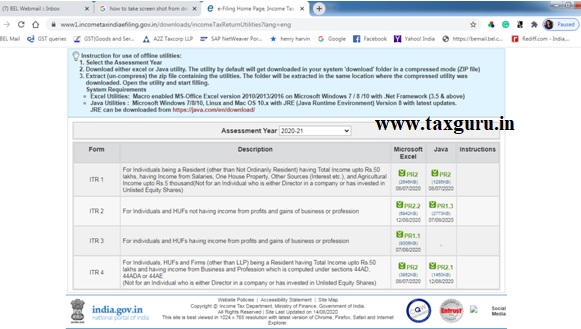

Step 2 Click on IT Return Preparation Software (Right side / Download/ IT Return preparation Software)

Step 3 Download Microsoft Excel & Java Utility (in the same folder). PC should have Java Run Environment (JRE) version 8 with latest updates :

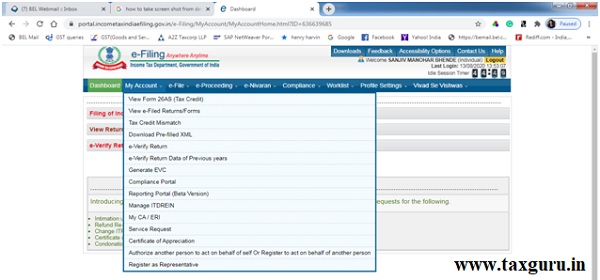

Step 4 Login to account (incometaxindiaefiling.gov.in). Go to My Account. Download Pre-filled XML (Auto captures the basic details, tax paid from Form 26AS and Form 16, etc)

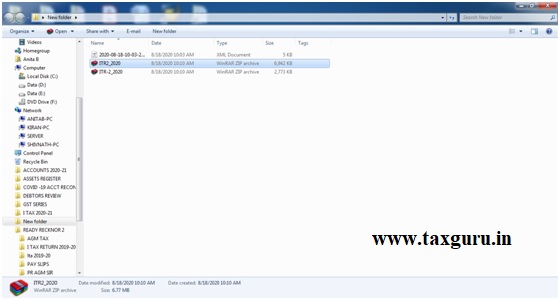

Step 5 Go to the folder (where you downloaded Microsoft Excel, Java & Pre-fill XML File)

Step 6 Click on Zip File (ITR2_2020). Click on Next

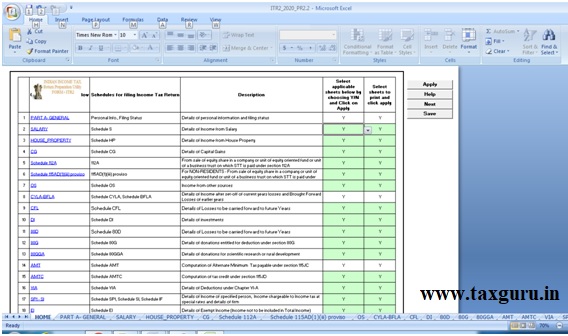

Step 7 Click on import general file from pre-fill XML (last table at Extreme right – above help table)

Step 8 Verify the details in pre-filled XML and entered other requisite details.

Click on Calculate tax, Validate and Generate XML File.

Step 9 Log in to incometaxindiaefiling .gov.in

Go to e-file, upload the XML file. Verify Income Tax Return

Step 10 The last step in filing an income tax return (ITR) is to verify it. If you do not verify your tax return, then it will not be considered valid according to income tax laws.

Different ways to verify income tax:-return-

(a) Via Aadhaar-based OTP

To verify your ITR using the Aadhaar-based one-time password (OTP), your mobile number must be linked to Aadhaar and registered as such in (UIDAI) database and your PAN must be linked with Aadhaar

Enter the OTP received in the box where it is required and click on submit. On successful submission, your ITR will be verified. One must remember that the Aadhaar based OTP is valid only for 30 minutes.

If your mobile number is not linked to your Aadhaar, then there are other ways to electronically verify your ITR.

(b) Generating EVC via Net-banking:

You can verify your ITR if you have availed the Net banking facility of your bank account. Before logging in to your bank account, ensure that you are not already logged in on the e-filing website. Your PAN must be registered with the bank as well.

To verify your ITR using Net banking facility, login to your bank account on the bank’s website. Select the e-verify option which is usually under the ‘Tax’ tab. You will be redirected to the e-filing website of the income tax department.

Click on the ‘My Account’ tab and select the ‘Generate EVC’ option. A 10-digit alpha-numeric code will be sent to your email and mobile number. This code is valid for 72 hours. Now, go to .. the ‘e-verify’ option under the ‘My Account’ tab to verify your return. Select the option ‘I have EVC already’.

Enter the OTP that you have received on your mobile number registered with the bank. Click on ‘Submit’ and your ITR will be verified.

(c) Sending signed ITR-V/Acknowledgement receipt:

You can also choose to download it manually from the income tax website. You are then required to sign it and send it to the Income Tax Department’s CPC office in Bangalore within 120 days of e-filing. ITR-2 is an annexure-less form i.e. you do not have to attach any documents when you send it.

The Author can be approached at caanitabhadra@gmail.com

Dear Madam, I am an NRI who do not have any income in India other than the house rent that i get from my own house. The house rent is 252000 per year. As myself and my husband are co-owners (50-50 share), and both are NRIs, do we have to file ITR2? Or is it some other ITR form? As our individual benefit is less than 2lakhs, can we skip ITR filing?

my home loan interest component is more than 4Lakh yearly . To get carry forward do i need to file ITR2? i dint have rental income

My cousin sold some unlisted shares in FY 2018-19 and deposited the gains in Capital gains account to claim exemption u/s 54F. He is using those gains to buy an under-construction residential property whose possession he will get in this FY 2020-21. While filing his return for FY2019-20, is he required to show how much amount was utilised in 2019-20 for property construction of Cap gains account ?

The CG schedule – Item no 10- of ITR 2 has some rows asking for details of utilisation of Capital gains account but the drop down gives option of FY 2016-17 and 2017-18 only ! How to enter amount utilised in Fy 2019-20 is the problem. Can you pl advise. Thanks.

Madame,

While I was filing Itr-2- schedule 112 , for my wife, who has income from interest on FDR’s only. But last year we required fund, so that we had redemed some mf. After filling first four rows, I am struck up, as it does not allow me to add one more row. And asking for a password, and doesn’t allow to enable macros either. I have Ms excel 2007 version. I have download Ed this file from income tax department’s web site. Incidentally 26 as does not show any items for redemption, since capital gains amount is hardly 60 thousands. Will you please guide me as to how to add one more raw and how to enable macros. Thanking you. Haresh Patel. 20/10/20

GOOD DAY MAM,

I WANT TO KNOW WHERE TO ENTER CURRENT YEAR CAPITAL LOSS FOR CARRY FORWARD

Thanks for this step-by-step guidelines. Can you please tell me where I can enter RSU details I received from my company. As of now RSUs are vested, I am yet to sell them. It’s there in Form-16 as perquisite. So, I believe I need to enter FMV, date of vesting etc, somewhere in the excel. Please let me know.

ON ITR – 2 IN SALARY SECTION, NAME OF THE EMPLOYER,ADDRESS, STATE, NATURE OF EMPLOYER ARE TO BE FILLED. THESE CAN BE FILLED BY AN EMPLOYEE IN SERVICE NOW. HOW CAN A PENSIONER NOT GETTING PENSION DIRECT FROM THE EMPLOYER FILL THESE COLUMNS. THERE IS AN OPTION IN THE”NATURE OF EMPLOYER” -Pensioners- How can an employer become Pensioner.

Dear Anita ji

I have long term capital gain by selling plots which were bought in 1996 but not reflected in 26 as n form 16( drawing defence pension). So I need to fill this under capital gains. However, I couldn’t get fair price as on Apr 2001 being base year. Can I assume a figure. Secondly even after filling it, the tax liability shown is zero and the entire tax deducted at source as tds is shown as refund. I have not been able to comprehend. If I use ITR 1, it is taxable but in ITR 2 it’s refund.

ITR-2 Schedule TDS-2 Head of Income and income are required to be filledup.But the relevant column 11&12 are in grey colour not allowing to fill up. How to proceed.

Dear Anita ji, I hope you are doing well. Can an NRI file ITR 1 (as he has only Bank Int and everything has been reflected in 26AS). However, he submitted ITR 2 last year. Thanks and regards.

But TDS AMOUNT NOT show in prefil xml file

Sir

Your initiative to provide awareness will help many

persons at large.