Improved Form 26AS will contain details of taxpayers’ high valued transactions

Filing income tax returns could get even more easier and transparent for individual taxpayers from this assessment year. This is because the newly revamped Form 26AS—which is effective from June 1– will also contain the information on taxpayers high valued financial transactions that could be a ready reckoner for assessees while filing income tax returns.

Put simply, the new Form 26AS will reflect the additional details of taxpayers high valued financial transactions as filed with the income tax department by various entities such as banks, mutual funds and property registrars.

Besides facilitating voluntary compliance, tax accountability and ease of e-filing of returns by calculating the correct tax liability in a feel good environment, this would also bring in further transparency and answer ability in the tax administration, an official release said.

“From this Assessment Year taxpayers will see an improved Form 26AS which would carry some additional details of taxpayers financial transactions as specified Statement of Financial Transactions (SFTs) in various categories.”, the release said.

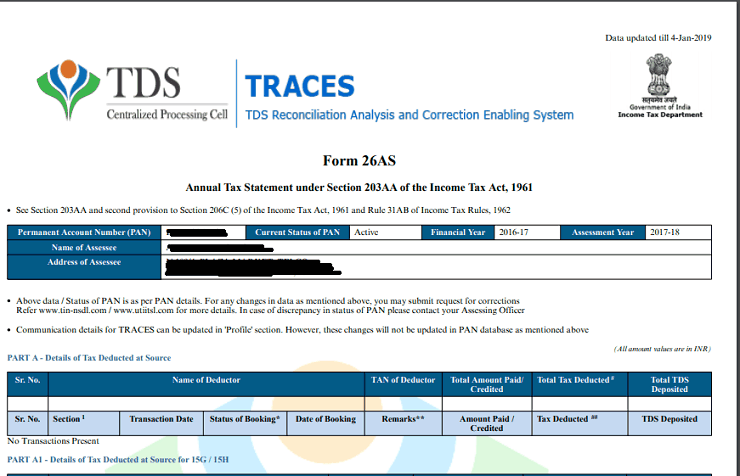

CBDT said that earlier Form 26AS relating to a PAN used to provide information regarding tax deducted at source and tax collected at source besides certain additional information including details of other taxes paid, refunds and TDS defaults. Presently, it will have SFTs as a ready reckoner to help the taxpayers remind their major financial transactions while filing the ITR.

Income Tax department used to receive information like cash deposit/withdrawal from saving bank accounts, sale/purchase of immovable property, time deposits, credit card payments, purchase of shares, debentures, foreign currency, mutual funds, buy back of shares, cash payment for goods and services, etc. under Section 285BA of I-T Act from “specified persons” like banks, mutual funds, and institutions issuing bonds and registrars or sub-registrars, with regard to individuals having high-value financial transactions since the Financial Year 2016 onwards. Now all such information under different SFTs will be shown in the Form 26AS, the release said.

CBDT further said that this would help the honest taxpayers with updated financial transactions while filing their returns, whereas it will desist those who inadvertently conceal financial transactions in their returns. The Form 26AS would also have information, which used to be received up to Financial Year 2015-16, in the Annual Information Returns (AIR) transactions.

CBDT said that the Form 26AS for any taxpayer will now display in part E of the Form fields like type of transaction, name of SFT filer, date of transaction, single/joint party transaction, number of parties, amount, mode of payment and remarks, the release added.