Erroneous Adjustments Notices under section 143(1)(a) of Income Tax Act, 1961 and Best Possible Remedy in Some Cases.

Many assessees have received erroneous adjustment notices u/s. 143(1)(a). Surprisingly, the issuer of such notices should have concluded that the above mentioned other income or capital receipts should always be the receipts in the nature of business / profession income. But logically, If they were the business / professional income, they must have been credited to profit and loss account only and not elsewhere. Replies in almost all of such cases would be – “Those amounts are already included in other heads of income or under the schedule of Exempt Income”.

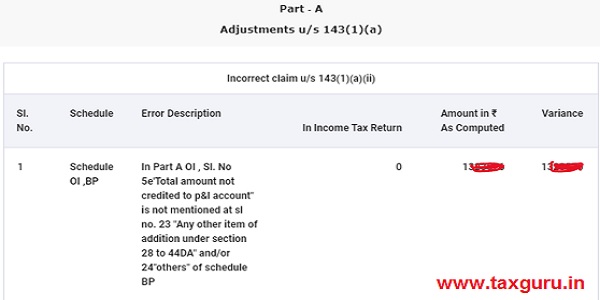

Format of one such Notices under section 143(1)(a) of Income Tax Act, 1961 is as follows:-

But, as instructed in the email, when one go to the new portal of income tax (under e-proceedings option) and give reply, message comes in many cases as “Something seems to have gone wrong while processing your request. Please try again. If error persists quote error number ITD-EXEC2002 when you contact customer care for quick resolution.”

Further, the option of rectification of return is still not made available on this new portal. So, the situation becomes harassing for the innocent taxpayers.

In such cases, what should be the best possible way to reply?

Following is one of such alternative way to give best possible reply.

|

One may lodge a grievance by selecting option as CPC-ITR => Processing => Others – Processing Specimen reply is as under. Even though all the incomes were shown under respective heads of income, adjustment notice is sent to me for AY 2020-21 as Adjustments u/s 143(1)(a). When I went to reply it on portal under E-proceedings option and clicked on disagree option, message box appeared. In that message box, I had written the clarification and had clicked on save button. But there appeared a message as Something seems to have gone wrong while processing your request. Please try again. If error persists quote error number ITD-EXEC2002 when you contact customer care for quick resolution. So, I called on +91-80- 61464700 number, where four numeric of my PAN and Date of Birth in DDMMYYYY were asked by the system. When I entered the same, system replied that there was a mismatch in information I have entered. I have a call recording which proves that I had entered correction information of PAN and DOB. So, I herewith attach that call recording file by changing its extension from mp3 to PDF, as this portal accepts only PDF and JPGs. You are requested to change its extension from PDF to mp3 and listen the same. I have also attached herewith the screenshot of that error and also attached the screenshot showing date of birth as per PAN on new income tax portal. As three files are there, I have prepared a single ZIP file of all. Your system checks zip file also that only PDF and JPG are there in it or not. And finally, I give my explanatory reply to above mentioned adjustment notice as under. Said amount of Rs. 99999 is already included in Schedule OS and Schedule CG and Schedule EI as income. So that amount is already covered under different schedules as it is not in the nature of income from Business or Profession. So you are requested to check the same and you may write us for any further query in this matter. As I have no other remedy available to intimate my reply as described in above paragraph due to technical errors on this new portal and also on telephonic lines of your department, I request you to consider my above explanation as an explanation in reply to adjustment notice under section 143(1)(a) and act upon it before processing my return. |

Addendum to this article Added on 14.09.2021:

As expected, even after going through the detailed reply, they have ignored the fact that due to a faulty portal, we are unable to reply properly and they are giving us the stereotype reply in this scenario also. That stereotype meaningless answer from them in this situation is as under.

Resolution: Dear Taxpayer, It is seen from CPC portal for AY 20-21 during the processing the return filed by you has been caught for proposed adjustments u/s. 143(1)(a) and communication for the same has been sent to your registered email id. You are requested to follow the below mentioned procedure to respond to notice u/s 143(1)(a) ; 1. Log on to www.incometax.gov.in with your credentials. 2. Click on ‘e-Proceedings’ sub menu under ‘Pending Actions’ menu. 3. Under ‘View Notices’ select ‘Adjustments u/s 143(1)(a)’ against ‘Proceeding Name’ and click on ‘Continue’. 4. Click on ‘Agree’ or ‘Disagree’ under ‘Submit Response’. 5. Provide Reason in case of Disagree and Continue. 6. Click on Submit Response. Kindly provide the response in the portal at the earliest and it may enable us to process your return as per Income Tax Act.

But, one should not worry with such meaningless answers from them, as by submitting the evidences of faulty portal and faulty telephone systems through Grievance option, we have already made them aware about these very serious inaccuracies in their system and we have gathered the evidences which we can produce before the court from which we can still expect justice.

*****

Disclaimer: The above mentioned specimen reply is not any opinion to anyone and author is not in anyway responsible to anyone for this. One may use it only at own risk.

ITR for AY 2022-23 and PAN: agsxxxxx0c has been processed at CPC. Intimation u/s 143(1) has been sent to your registered email ID. If not received check in SPAM folder.

INSPITE OF “DISAGREE” BY GIVING REASONS FOR WRONG ADJUSTMENT MADE U/S 143(1)(a),

BY THE CPC. STILL THEY HAVE ADDED BACK ALL THE AMOUNT AND GAVE DEMAND ORDER. NEW IT PORTAL IS NIGHTMERE FOR ALL PESON FILING THEIR I.T RETURN SINCE LAST YEARS.

I filed return on 23.7.21 for the AY 2021-22 and same day i paid tax due of Rs.9940. Now after nearly 5 months, i received an intimation u/s 143(1) to pay the tax due of Rs.9940. my question is how for all these months it remains unreconciled? How the Assessing officer did not bother to check AS26 in which this 9940 is reflected? The notice doesn’t give option to register a dispute in the matter. How to overcome this unreasonable demand? The new website is only ludicrous in nature as i see many are finding teething problems..

C.R.Ravi

the most irritating thing about the return filing portal is most of the time despite being an individual , the payment options reflect corporation code 0020 and not 0021. No salaried individual can pay the taxes post that as the portal keeps those radio buttons greyed out and you can’t change them. Only option that is left is to submit return with option pay later…and then the stupid respond to outstanding demand formality needs to be completed which again is bug ridden. It’s just pathetic using this portal and I wonder what kind of quality checks are done in the IT end to address these issues. Utter carelessness leading to waste of time/energy and money of crores of online e filers.

I had responded with ‘agree’ by mistake for 143(1) intimation notice for HRA calculation instead of ‘disagree’. Now I am not able to modify it. What are the next steps for it? Can I rectify it otherwise I need to pay lot of tax.

My HRA specified in my returns is matching with Form 16 furnished by Employer.

But received following notification from IT Dept.

Sec 10(13A) is more than minimum of :a) 50% of (Basic + DA) orb) HRA .Hence amount exempt u/s 10(13A) is recomputed accordingly. In the computed section, IT Dept specified as “0”. But, I could not assess the reason . Please clarify.

Today some new proposed adjustment email are received , where the Deduction under section 80TTA and 80TTB is in variance.

Strange who checks and approve such proposed adjustment calculation and now it is very difficult to trust this online system.

The Person who prepares do understand Income Tax Rules or not i doubt…

now i think it is better to not mentioned anything in other information of ITR and at the same time now to show any Other Income and Capital Receipt detail in Other Information and Audit Report, since anyway it is part outside Audit.

But even Taxes pending as on 31st March but paid before filing ITR and Audit Report are also getting disallowed even though the same is not a disallowable item and even the Auditor has mentioned under proper column, still Department are adding this figure and creating issue for assessee , that too when the option for rectification is not available on new portal.

Can a personal loan shown in return is taxable . please advice

I have submitted response to the adjustments but when we try to see the response its showing error. I hv logged a grievience for same. My personal loan is being added to my income . from when personal lian have become taxable.

Till date 30.09.2021 there is error in portal

now i cant see the option to disagree and comment on this issue. it is giving option to direct select that Response cannot be modified once submitted.

no option to disagree now.

strange portal….

Till date 30.09.2021 there is error in portal

now i can see the option to disagree and comment on this issue. it is giving option to direct select that once reply filed same cannot be modified and submit button.

no option to disagree now.

strange portal….

I hv received similar notice they are adding my personal loan shown in audit report to my income .

In response to some questions here raised by some persons, I want to say – those who don’t know income tax or GST in depth, should not try to do every procedure under these acts themselves by just searching on web or asking questions on web. They must contact to well knowledgeable tax professional. Someone is freelancer or on some high post in some company, doesn’t mean he can do even tax procedures also himself.

I have received similar 143(1) intimation notice for HRA calculation. My HRA calculation is correct (as mentioned in Form 16 by employer)

Do I need to file revised return or submit ‘Disagree’ response ?

Same case! What course of action have you taken in this regard.. please help me too

My HRA specified in my returns is matching with Form 16 furnished by Employer.

But received following notification from IT Dept.

Sec 10(13A) is more than minimum of :a) 50% of (Basic + DA) orb) HRA .Hence amount exempt u/s 10(13A) is recomputed accordingly. In the computed section, IT Dept specified as “0”. But, I could not assess the reason . Please clarify.

My HRA specified in my returns is matching with Form 16 furnished by Employer.

But received following notification from IT Dept.

Sec 10(13A) is more than minimum of :a) 50% of (Basic + DA) orb) HRA .Hence amount exempt u/s 10(13A) is recomputed accordingly. In the computed section, IT Dept specified as “0”. But, I could not assess the reason . Please clarify.

Got similer notice..

I got similar notice. My HRA amount is as per Form 16. What did you do to resolve this?

You can file a rectification on the IT portal. This happens due to incomplete disclosure in the return

Which Section to be quoted in XML while filing for rectification for intimation order u/s 143(1). Ideally, it should be done under section 154, however, in XML there are option of following sections only 139(9), 142(1), 148, 153A, 153C ??

I have received this notice:

“In Schedule part B TI, Sl. No. 11 ‘ Income chargeable to tax at special rate under section 111A, 112, 112A etc. included in 10’ is not equal to sum of the incomes taxed at special rates in Schedule SI.Hence amount at Sl. No. 11 of PartB-TI is recomputed by adopting the amount mentioned in schedule SI.

₹21,679 – Amount entered in the Income tax return

₹0- Amount in ₹ As Computed

₹21,679-Variance”

This amount was SI pertaining to LTCG u/s 112A wherein 1 lac is exempted. That is the reason system is not calculating any tax. Also SI and PartB are system fed data. Please help what to reply in 500 words.

I had similar notice for my assesses. AS stated in your we cannot file any reply. Only negative figure of hp schedule can be carried to 2i of cyla schedule; but the notice regards even positive hp income not carried to cyla schedule as variance; please enlighten the public what will be done to these variances??

Wow. So now the intension seems to earn more Revenue by denying any possibility of any correction/reply by an assessee and then washing off their hands as that they are not responsible and one should sue against the computer machine.

faceless interaction brings us to this stage.

Sir my FCRA renewal it returns online filing 12A 80G renewal sarvice I am dehli please Dehli contact address share me