INTRODUCTION

There are certain expenses that are not allowed as the deduction under the income tax and they have to be added back to the net profit in the income. The Income Tax Act outlines two types of provisions: those that dictate allowable expenditures and those that prohibit them. If an expense isn’t permitted by any provision, it’s disallowed. These provisions can be specific or broad, covering activities and revenue within a certain accounting period. Disallowing an expense in PGBP calculations means the tax authority won’t recognize its benefits, requiring the taxpayer to include it in taxable income.

This can happen if taxes weren’t withheld from the expense or if it’s not directly related to the business. To determine deductibility, first, check if the Income Tax Act allows it; otherwise, refer to Section 37[1]. Non-deductible expenses are listed in Sections 40 and 40A[2], outlining specific situations where deductions aren’t permitted.

ISSUES UNDER CONSIDERATION

The following are the research objective of this paper tilted ‘dis-allowed expenses while calculating PGBP’. The paper will be based on the following objectives which will be formulating the issues as:

- What are the criteria and implications of expenses being disallowed for tax purposes in general, and what are there for specified for PGBP?

- To analyse the impact of disallowed expenses on businesses or professionals and to understand the legal and regulatory frameworks governing disallowed expenses, and identifying strategies to minimize disallowed expenses while ensuring compliance with tax laws.

- How to calculate such dis-allowed expenses of PGBP under the Income tax Act,1961[3]?

RULES APPLIED

The rules applicable for this research topic are as follows:

- Under section 37 of the income tax, Act 1961: Expenses disallowed under Sections 37(1) and 37(2B) of the Income-tax Act involve considerations. While certain CSR expenditures are deductible under specific conditions, political advertising expenses are wholly disallowed despite business relevance.

- Under section 40 A of the income tax, Act 1961: Subchapter D of the IT Act, 1961[4] which is PGBP, delineates the process for computing total income. Within this subchapter, specifically outlined under the “amounts not deductible” clause. Section 40 A specifies non-deductible amounts, including those failing to adhere to tax deducted at source (TDS) regulations and certain specified tax payments.

ANALYSIS

MEANING AND BACKGROUND OF “PGBP” UNDER INCOME TAX ACT

Income derived from business and professional activities is subject to taxation under the “Profits and Gains of Business or Profession” category in accordance with the Income Tax Act. The Act permits deductions for various business expenses outlined in Sections 30 to 37, encompassing expenditures such as rent, salaries, repairs, insurance, and depreciation. However, certain expenses may be explicitly disallowed, and the deductibility of expenses typically hinges on actual payment. Furthermore, specific provisions pertain to non-resident or foreign companies, and businesses meeting certain criteria may opt for presumptive taxation. The Act mandates proper record-keeping and auditing procedures. This article provides a concise overview of the various provisions applicable to income derived from business and professional endeavours. In this paper, the main focus is on the dis- allowed expenses under the PGBP, which can be seen u/s 37, 40 ,40A of the income tax act[5].

SECTION 40: AMOUNTS NOT DEDUCTIBLE (CLAUSES MENTIONED UNDER “CHAPTER IV”)

Subchapter D of the “Profit & Gains of Business or Profession” details the computation of total income, focusing on non-deductible expenses. Section 40(a) specifies expenses not deductible due to non-compliance with TDS regulations. It covers payments for professional services, interest, royalty, and fees, charged both within and outside India to non-residents. However, deductions may be allowed if tax is withheld in subsequent years.[6]

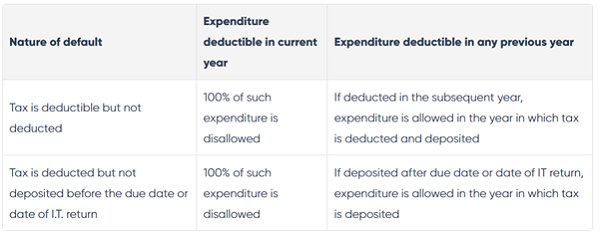

According to the Income Tax Act, expenses are expressly disallowed if the tax deducted at source (TDS) on payments hasn’t been deducted correctly. These circumstances mainly involve payments made outside India or to non-residents or foreign companies, such as payments for interest, royalty, or technical fees.

The consequences of TDS default in different situations are outlined as follows:

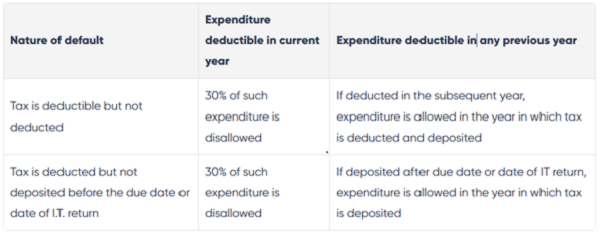

DISALLOWING BUSINESS EXPENDITURE FOR NON-DEDUCTION OF TAX TO A RESIDENT PAYEE ON PAYMENT (SEC. 40(a)(ia))

Expenses such as interest, commission, rent, and fees incurred by a resident contractor are disallowed as deductions in the year of accrual if tax isn’t deducted or the payment deadline isn’t met. The disallowed amount is 30% of the payable sum subject to tax deduction.

If payments made as salaries to individuals residing outside India or non-residents lack proper TDS deduction, these amounts are not recognized as valid expenditures. Similarly, any payments to residents with TDS default, including salaries, face disallowance.:

EXAMPLE: During the PY 2021-2022, tax is deducted from commission payments made to a contractor, Mr. Y. The tax amount is scheduled for payment by January 31, 2022, ensuring that the 30% commission tax is not disallowed when computing income for the assessment year 2022-2023. If the tax deducted in the previous year 2021-2022 for this commission payment is paid after January 31, 2022, 30% of the commission in the payment year will be permitted as a deduction.

LANDMARK JUDGEMENTS RELATED TO THE DISALLOWANCE PROVISION OF PGBP:

> In the case, CIT vs Chandabhoy and Jassobhoy[7], the case emphasized that a slight underpayment of TDS shouldn’t result in disallowance if it occurs due to differing interpretations or opinions.

> In the case, B. Developers and Builders vs ITO[8], the court in this case explained that any income arising from the disallowance under this clause can be deducted under 80IB, provided the enterprise is eligible under 80IB, which covers profits and gains from certain commercial ventures.

> In the case, HCC Pati Joint Venture vs CIT[9], the ruling by the Mumbai tribunal holds importance as it emphasizes that when an assessee deducts TDS on payments, they must remit it to the government within the specified timeframe. Failure to comply will trigger Section 40(a)(ia) of the Income Tax Act of 1961[10], resulting in the denial of expenditure disallowance.

The Income Tax Act provides relief if TDS isn’t deducted, with conditions met: timely income return filing, payment inclusion, tax payment, and Chartered Accountant certificate submission.

SECTION 40 A: IN CERTAIN CASES, EXPENSES OR FEES ARE NOT DEDUCTIBLE

Section 40A of the Income Tax Act holds authority over other provisions, ensuring that any allowance or expenditure permitted under the business or profession category elsewhere in the Act is not deductible if Section 40A[11] is applicable. Specifically, payments to relatives and associates are scrutinized by assessing officers, who disallow any deemed unnecessary or extravagant expenditures. Additionally, if payments are made through modes other than account-payee cheques or drafts, 100% of the expenditure is disallowed, with specific thresholds set for different payment methods and transactions.[12]

Section 40A (7) of the Income Tax Act[13] outlines conditions for the deduction of gratuity liability. It permits deduction when gratuity was payable to employees during the previous year or when provisions for donation to an authorized gratuity fund have been made. Contributions to non-statutory accounts are disallowed under Section 40A(9)[14] to prevent misuse of deductions for purported worker welfare. Payments must be made by the due date specified for filing income tax returns under Section 139(1)[15] to claim deductions. Section 40(b)[16] disallows deductions for LLPs or assessable firms, including remuneration to non-working partners, unauthorized remuneration or interest to working partners, and excessive interest payments or remuneration.

CONCLUSION

In conclusion, understanding the disallowed expenses under the “Profits and Gains of Business or Profession” (PGBP) is crucial for taxpayers to ensure compliance with tax regulations. The Income Tax Act delineates provisions for disallowance, particularly regarding tax deducted at source (TDS) defaults. Case laws further clarify interpretations and implications, while relief measures offer recourse for non-deduction scenarios. Proper adherence to these regulations is essential for minimizing disallowed expenses and maximizing tax efficiency.

In addition to TDS default, various other defaults can occur, such as failure to deduct securities transaction tax, fringe benefits tax, or wealth tax for previous years, along with income tax and provident fund payments without tax deduction. In such instances, if the required deduction or deposit to the government is not made, the corresponding expenditure is disallowed for the assessee. Simply put, any payments requiring deduction and deposit to the government, if left un-deducted or unpaid, lead to disallowance. However, at a later stage, when the required amount is deducted or deposited, the allowance for the expenditure can be claimed. This underscores the importance of timely compliance with tax regulations to avoid disallowances while ensuring that corrective actions can rectify any initial oversights.

Notes:-

[1]. The Income Tax Act, 1961 (Act no.43 of 1961), s.37.

[2]. The Income Tax Act, 1961 (Act no.43 of 1961), s.40, 40A.

[3]. The Income Tax Act, 1961 (Act no.43 of 1961), Refer to s. 30-36 for PGBP, S.37,40, 40A for disallowance.

[4]. The Income Tax Act, 1961 (Act no.43 of 1961), sub-chapter D.

[5]. The Income Tax Act, 1961 (Act no.43 of 1961), s. 37, 40, 40A.

[6]. DR. K. SINGHANIA, DIRECT TAXES LAW & PRACTICE 381-396 (Taxmann, 66th ed. 2022).

[7]. (1986) 161 ITR 692 (Bom).

[8]. (2007) 288 ITR 315 (SC).

[9]. (2018) 91 taxmann.com 147 (Mumbai – Trib.).

[10]. The Income Tax Act, 1961 (Act no.43 of 1961), s. 40(a)(ia).

[11]. The Income Tax Act, 1961 (Act no.43 of 1961), s. 40A.

[12]. DR. K. SINGHANIA, DIRECT TAXES LAW & PRACTICE 378 (Taxmann, 66th ed. 2022).

[13]. The Income Tax Act, 1961 (Act no.43 of 1961), s. 40A (7).

[14]. The Income Tax Act, 1961 (Act no.43 of 1961), s. 40A (9).

[15]. The Income Tax Act, 1961 (Act no.43 of 1961), s. 139(1).

[16]. The Income Tax Act, 1961 (Act no.43 of 1961), s. 40(b).