Ankur Vora

Business restructuring may be defined as the cross-border redeployment by a multinational enterprise of functions, assets and/or risks. A business restructuring may involve cross-border transfers of valuable intangibles, although this is not always the case. It may also or alternatively involve the termination or substantial renegotiation of existing arrangements.

Business restructurings that are within the ambit of Indian transfer pricing regulations primarily consist of internal reallocation of functions, assets and risks within a Multinational Enterprise (“MNE”), although relationships with third parties (e.g. suppliers, sub-contractors, customers) may also be a reason for the restructuring and/or be affected by it.

Business restructuring was inserted as part of the explanation to the definition of ‘international transaction’ [Explanation to Section 92B of the Income-tax Act, 1961 (“Act”) inserted by the Finance Act, 2012 with retrospective effect from 1 April 2002], as under:

“The expression “international transaction” shall include –

…

(e) “a transaction of business restructuring or reorganisation, entered into by an enterprise with an associated enterprise, irrespective of the fact that it has bearing on the profit, income, losses or assets of such enterprises at the time of the transaction or at any future date”

However, the term ‘business restructuring’ or ‘restructuring’ itself finds no definition in the Act leading to lack of clarity on what specific circumstances are sought to be covered under the Act.

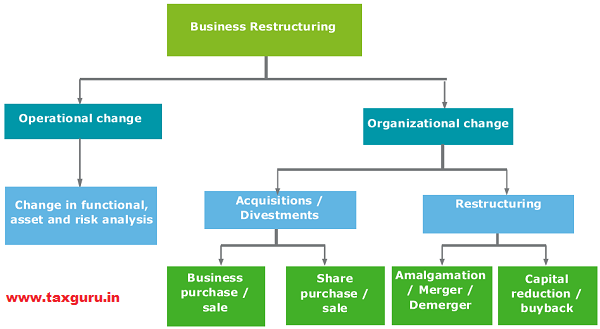

Per ICAI Guidance note for reporting in transfer pricing certificate in Form 3CEB, restructuring could be in the form of operational change (in functional, asset and risk profile of the entity) or organizational change (in ownership structure/management of the entity). It could include a change in the nature or scope of transactions among controlled entities, a shift in the allocation of risks, a change in responsibility for specific functions or commencement or termination of a relationship, etc. (Para 4.3.3).

A diagrammatic representation of the business restructurings is as under:

In view of the above, business restructurings typically constitutes-

- Cross-border reorganisation of the commercial or financial relations between associated enterprises (“AE”), for e.g., conversion of a full fledged manufacturer into a contract manufacturer;

- Amalgamation / merger of two AEs to form a single entity or demerger of a business unit of an enterprise with an AE;

- A business restructuring may involve cross-border transfers of something of value, although this is not always the case, for e.g., centralisation of ownership of all Intangible Property in MNE;

- Termination or substantial renegotiation of existing arrangements:-

- Change in pricing policy, for e.g., change in mark-up on operating cost from 20% to 15%

- Change in remuneration model, for e.g., fixed hourly rate to cost plus

- Renewal of agreement with changes in terms and conditions.

Transfer pricing compliance to be undertaken by tax payer in case of business restructuring

The tax payer would have to comply with governing laws i.e., disclosure in Form 3CEB and a robust documentation providing business rationale, pre and post functional analysis along with arm’s length pricing of such business restructuring.

- Reporting in the Accountant’s Report in Form 3CEB in Clause 18

The Clause 18 of the Form 3CEB requires disclosure of international transactions arising out/being part of any restructuring or reorganization entered into by the MNEs. Notably, Clause 18 only requires the description of the transaction in terms of its nature, terms of arrangement, etc. and not the amount of such transactions. Accordingly, an exit charge / compensation is not warranted for the purpose of reporting in Form No. 3CEB.

| Name and address of the associate enterprise with whom the international transaction has been entered into | Nature of transaction | Agreement in relation to such business restructuring / reorganisation | Terms of business restructuring/ reorganisation | Method used for determining the arm’s length price (See section 92C(1) | |

| Name | Address | ||||

Master file requirement

A MNE is required to provide a description of important business restructuring transactions, acquisitions and divestitures occurring during the fiscal year.

- TP documentation (local file)

A detailed description on whether the local entity has been involved in or affected by business restructurings or intangibles transfers in the present or immediately past year and an explanation of those aspects of such transactions affecting the local entity.

In this regard, it would be pertinent to document commercial rationale such as type of expected synergies, decisions and intentions of the management regarding business restructurings, evaluation of the consequences on profit potential of significant risk allocations resulting from the restructuring, evaluation of the options realistically available including the reasons for business restructuring being the best option available.

Further, the arm’s length compensation for the restructuring would require to be justified and documented as per Indian transfer pricing regulations.

In conclusion, business restructurings are likely to attract increasing attention and scrutiny from tax authorities and therefore, undertaking the aforesaid transfer pricing compliances and maintaining robust documentation will be critical for taxpayers to defend their transfer pricing positions.