Important information on 26QB Correction

- Buyers registered on TRACES only can avail the facility of ’26QB correction’ under ’26QB’ Menu after login.

- Request for 26QB correction can be raised from Assessment Year 2014-15 onwards

- If Buyer files 26QB correction and seller is Known, correction can be submitted through e-Verify (Net Banking) /AO Approval / DSC (If Buyers DSC is registered) for updating PAN details (Buyer Seller)

- If Digital Signature is not registered taxguru.in for Buyer and Seller is non Traceable , the correction request can be submitted through AO Approval option for updating PAN details (Buyer/ Seller)

- If Digital Signature is not registered for Buyer and Seller is known , the correction request can be submitted through e-Verify (Net Banking) /AO Approval option for updating PAN details (Buyer Seller)

- If PAN of Seller requires to be updated, the correction request will require previous Seller ‘s approval if Seller is known otherwise Buyer can opt for AO approval

- If PAN of Buyer requires to be updated, the correction request will require Seller’s and intended (New) Buyer approval. If Seller is known otherwise Buyer can opt for AO approval

- If both PAN of Seller and of Buyer are to be updated, the correction request will require previous Seller ‘s and updated Buyer’s approval from previous. If Seller is known otherwise Buyer can opt for AO approval

- Jurisdictional AO will be decided based on Buyer’s PAN’s (PAN submitting the correction) jurisdiction

- Buyer should be registered with DSC as well as DSC should be installed in the system while submitting the request.

Clarification about status of 26QB Correction:

- AVAILABLE: Once the request of correction is available for correction status will be “available”.

- PENDING For AO Approval: Once the correction taxguru.in is submitted and validated correction will be displayed with status as “ Pending for AO Approval”

- PENDING FOR PAN APPROVAL: Status will be pending for PAN approval if correction is submitted for second party’s approval

- SUBMITTED TO ITD: Status will be submitted to ITD if request is approved by AO or second party

- PROCESSED: Status will be processed if request is get processed by TDS CPC

- CANCELLED: Status will be cancelled if request is cancelled by buyer before approval/processing.

Procedure to E-Verify (Net Banking)

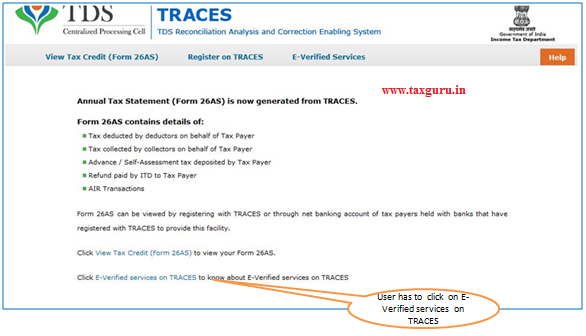

E-Verified Service link is available at banks website:

- Step 1 : When user logs in to Bank website and selects option “Click of view 26AS”

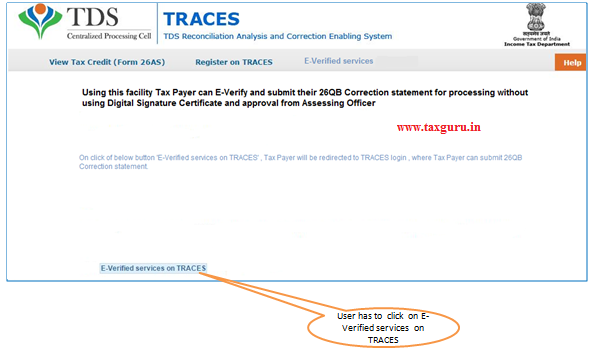

- Step 2 : It gets navigated to a new page which shows link “E-Verified services on TRACES”

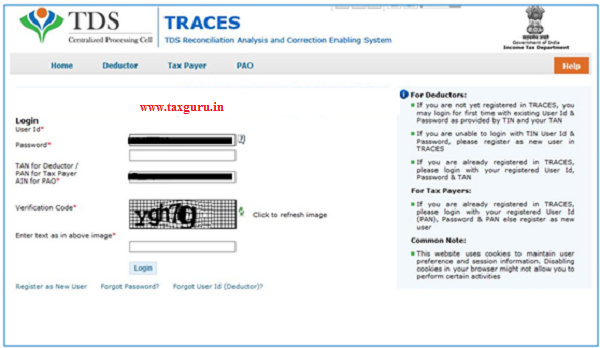

- Step 3 :On click of E-verified button, user gets navigated to the TRACES website with the pre populated username and PAN.

- Step 4 : Login on TRACES as a taxpayer by entering password(user ID & PAN will be auto populated)

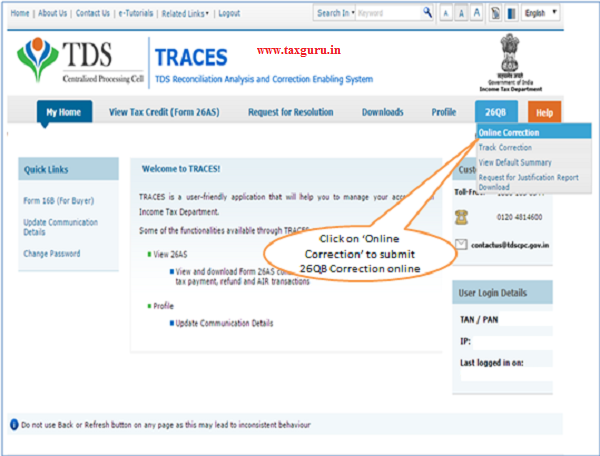

- Step 5: Select option “ online correction” under “26QB” tab to initiate correction request.

- Step 6: Select Appropriate Assessment year, Sellers PAN number and Acknowledgement number of the 26QB for which request of correction is to be placed.

- Step 7: Go to “ Track Correction Request” under “26QB” and initiate correction once the status is “ Available” for the request placed for the correction

- Step 8: After submitting the correction, an correction ID will be generated through which status of correction can be tracked.

If DSC is not registered ,furnish hard copy of acknowledgement of form 26QB correction his Identity Proof, PAN Card, the documents related to Transfer of Property and the proofs of payment made, to Jurisdictional AO for verification

This facility helps taxpayers to get verified through net banking

This can be used for submitting 26 QB Correction request without Digital Signature and approval from Assessing Officer

- This Option is not available for NRI Taxpayers

26QB Correction – Using E-Verification (Net Banking)

When user logs in to Bank website on click of View 26AS, it gets navigated to the below page:

On click of E-verified services link or TAB user gets navigated to the below:

On click of E-verified button, user gets navigated to the TRACES website with the prepopulated username and PAN, User can login and Initiate 26QB correction

Logging request for 26QB correction

26QB Correction (Checklist while applying for correction)

| SL No | Conditions Applicable |

| 1. | 26QB filed by Buyer has been processed |

| 2. | Only Buyer can submit request for 26QB Correction |

| 3. | If Buyer files 26 QB correction and Seller is known, correction can be submitted through e-Verify(Net Banking) / AO approval / DSC (If Buyer is DSC registered) for updating PAN details (Buyer / Seller) |

| 4. | If Digital Signature is not registered for Buyer and Seller is unknown , the correction request can be submitted through AO Approval option for updating PAN Details (Buyer / Seller) |

| 5. | If Digital Signature is not registered for Buyer and Seller is known , the correction request can be submitted through e-Verify (Net Banking) / AO Approval options for PAN Details (Buyer / Seller) update |

| 6. | Software (available in Hard Token) provided by the Digital Signature Vendor is required to be installed on System while submitting 26 QB correction request if Buyer is opting for DSC |

| 7. | If PAN of Seller is updated, the correction submitted will require previous Seller ‘s approval if seller is known otherwise Buyer can opt for AO approval |

| 8. | If PAN of Buyer is updated, the correction submitted will require Seller’s and updated Buyer’s approval. If Seller is unknown Buyer can opt for AO approval. |

| 9. | If PAN of Seller and PAN of Buyer are updated, the correction submitted will require previous Seller ‘s and updated Buyer’s approval. If Seller is unknown Buyer can opt for AO approval. |

| 10. | Jurisdictional AO will be decided based on Buyer’s PAN’s (PAN submitting the correction) jurisdiction |

| 11. | In case there is a difference between 26 QB data and 26 AS generated. Kindly submit a correction statement by updating values in either property address or e-mail id or mobile number |

| 12. | Please enter Assessment Year based on date of Payment / Credit to seller as per 26 QB |

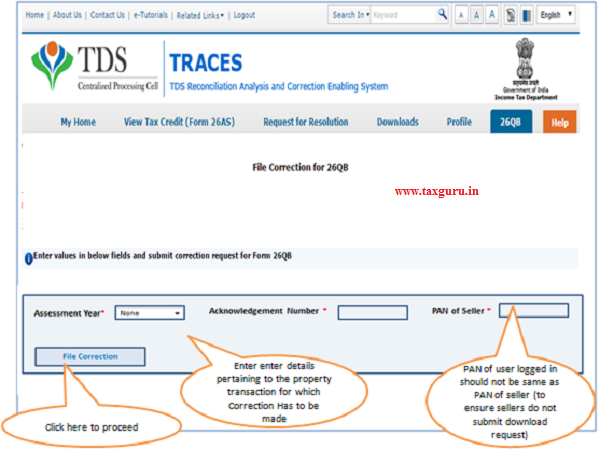

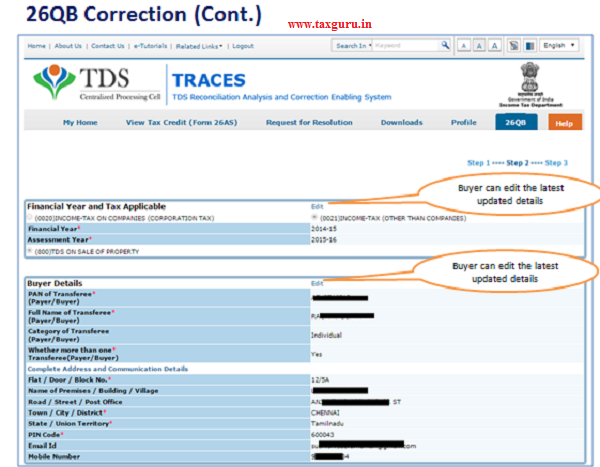

26QB Correction (Cont.)

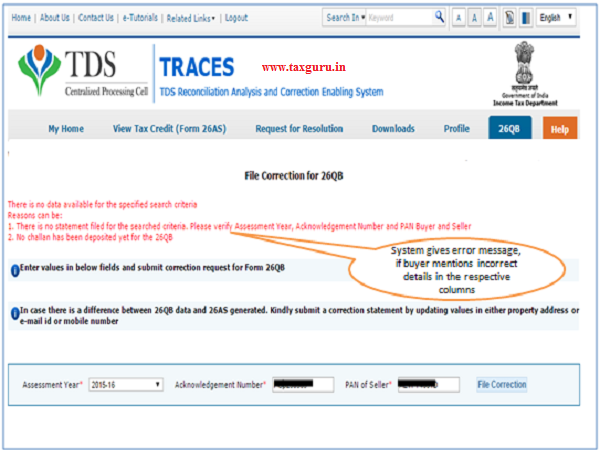

26QB Correction (Possible Error Message)

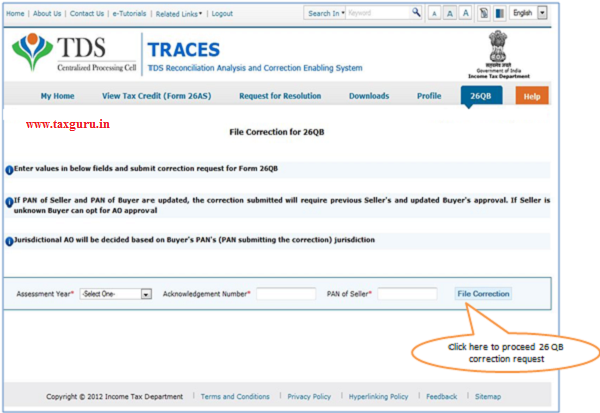

26QB Correction (For Buyer)

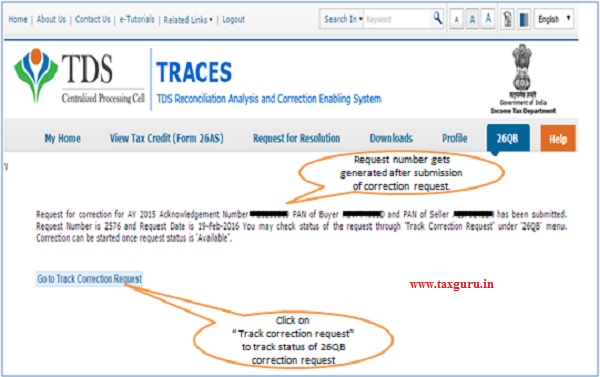

26QB Correction (Request Number Generated)

26QB Correction (View Request Status)

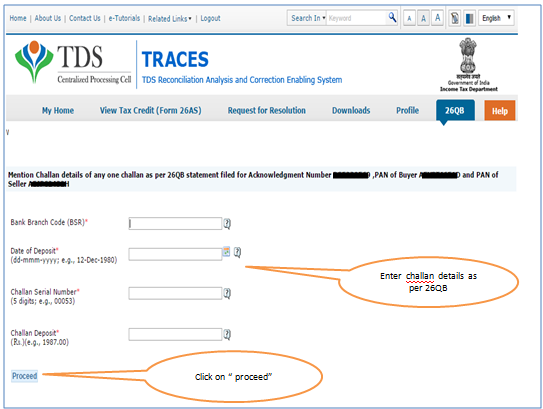

26QB Correction (Enter Challan Details)

26QB Correction (Enter Challan Details)

26QB Correction (Financial Year and Tax Applicable)

26QB Correction (Financial Year and Tax Applicable)

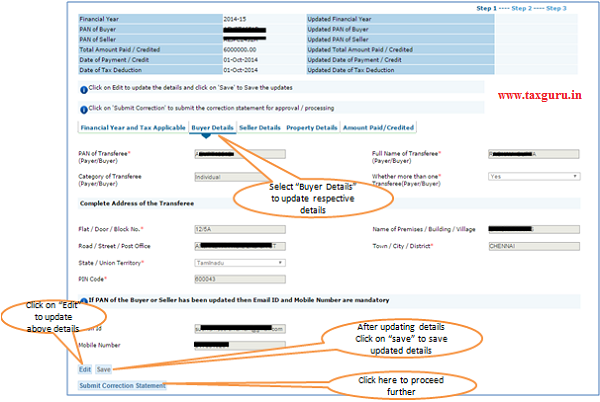

26QB Correction (Updating Buyers Details)

On applying correction to Buyer or Seller or both, user will be asked to confirm if seller is known or unknown.

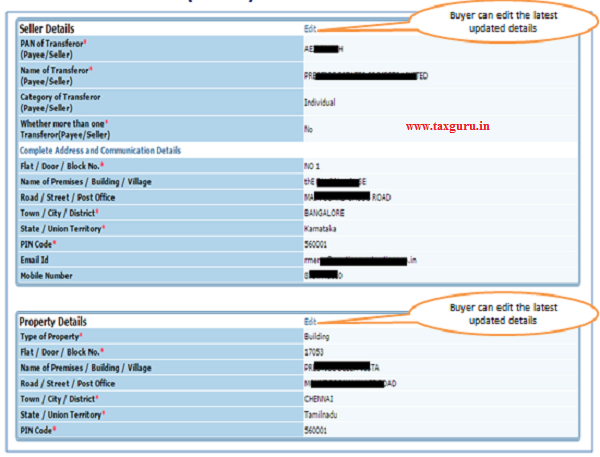

26QB Correction (Updating Seller Details)

On applying correction to Buyer or Seller or both, user will be asked to confirm if seller is known or unknown.

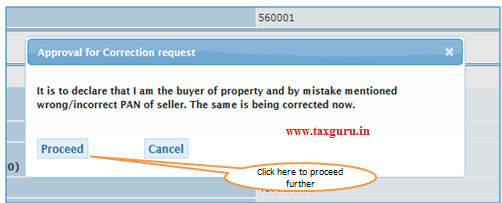

26QB Correction (Updating PAN of the Seller)

26QB Correction (Updating PAN of the Seller)

If user updates PAN of the seller, by clicking on “ AO” Tab user is prompted with the below dialogue box:

User is navigated to final submission page where taxguru.in buyer is prompted with the below dialogue box and on continuing, the request gets submitted to AO for approval post PAN’s approval if needed.

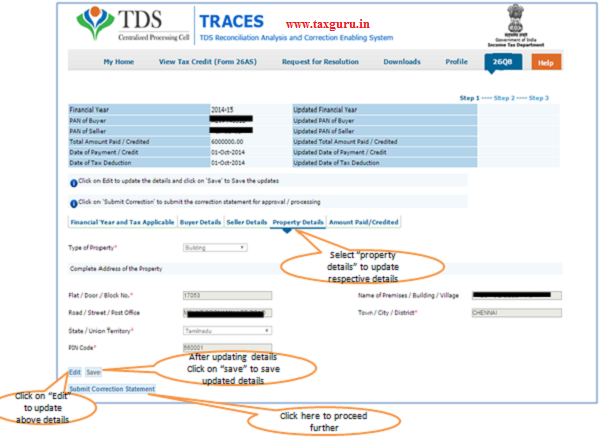

26QB Correction (Updating Property Details)

26QB Correction (Updating Amount Paid / Credited)

26QB Correction (Cont.)

–

–

–

–

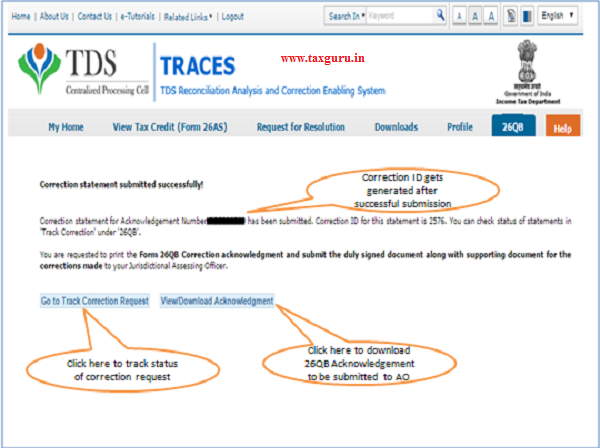

26QB Correction – Request submitted

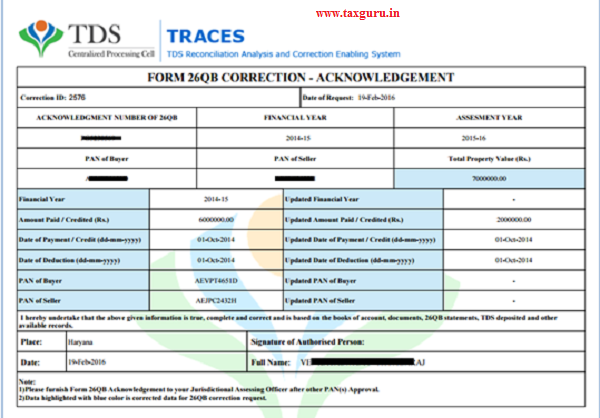

26QB Correction – Acknowledgement:-It will be generated, only if buyer opts for AO approval

26QB Correction – Tracking correction request(Buyer has selected E-verification)

![]()

26QB Correction – Tracking correction request(Buyer has selected approval from AO)

![]()

On my 26qb correction request, from last 1 month status shows “Pending for AO approval” but no further progress. Can you please suggest me that how much time it takes for approval and who approves it.

In Form 26 QB Correction – Acknowledgement, at the bottom under Note, it reads as under;

1) Please furnish Form 26 QB Acknowledgement to your Jurisdictional Assessing Officer after other PAN(s) Approval.

What does it mean?

How to know who the Assessing Officer is?

Thanking You in anticipation,