Sponsored

The facility of SMS filing of NIL statement of FORM GSTR-1 is going to start from 1st week of July 2020

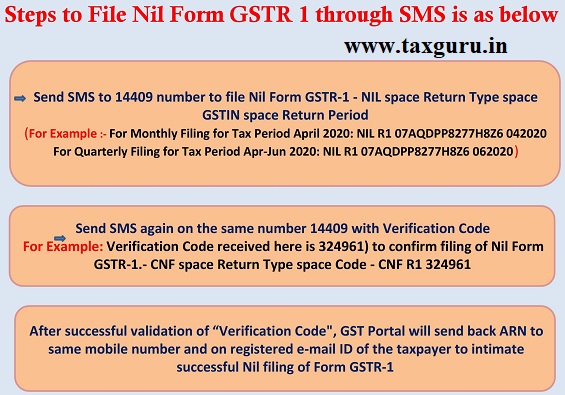

A taxpayer may now file NIL Form GSTR-1, through an SMS, apart from filing it through online mode, on GST Portal.

To file NIL Form GSTR-1 through SMS, the taxpayer must fulfil following conditions:

- They must be registered as Normal taxpayer/ Casual taxpayer/ SEZ Unit / SEZ Developer.

- They have valid GSTIN.

- Phone number of Authorized signatory is registered on the GST Portal.

- No data should be in saved or submitted stage for Form GSTR-1 on the GST Portal, related to that respective month.

- NIL Form GSTR-1 can be filed anytime on or after the 1st of the subsequent month for which the return is to be filed.

- Taxpayer should have opted for the filing frequency as either monthly or quarterly.

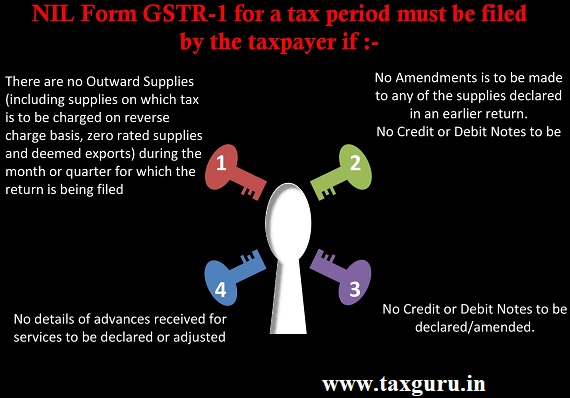

NIL Form GSTR-1 for a tax period must be filed by the taxpayer if:-

-

- There are no Outward Supplies (including supplies on which tax is to be charged on reverse charge basis, zero rated supplies and deemed exports) during the month or quarter for which the return is being filed.

- No Amendments is to be made to any of the supplies declared in an earlier return.

- No Credit or Debit Notes to be declared/amended.

- No details of advances received for services to be declared or adjusted.

Sponsored

Kindly Refer to

Privacy Policy &

Complete Terms of Use and Disclaimer.