Understand the process of rectifying errors in GST orders. Explore Section 161 of the CGST Act, 2017, learn which mistakes can be rectified, who can inform the errors, and the time limits for rectification. Get insights from tax expert Sudhir Halakhandi.

At present lot of orders are coming from the GST department and some of these orders may be have some mistakes or errors. These errors may be factual , legal or clerical if these mistakes are apparent from the face of the records, then one can apply for rectification of such mistakes or errors. These provisions are given in Section 161 of the CGST Act, 2017 . Let us see which type of mistakes can be rectified and how a dealer can apply for rectification of Mistakes under the GST Laws.

The errors can be rectified in any decisions or order or notice or certificate or any other document as per section 161 but since on most of the cases dealers / asseseee are concerned with the orders hence we should try to understand the concept with Rectification of Mistakes/errors in Orders .

– SUDHIR HALAKHANDI

The errors are inevitable in any human act hence rectification procedure of the same should be there. The rectification of errors provisions is there in Income tax laws and these provisions were also there in Central Excise laws , service tax Laws and all the state VAT Laws. Let us have a look at the Rectification provisions as contained in the present Goods and Service Tax Laws.

The AO who made the order can rectify the order himself or the Mistake can be informed to him by any other GST authority or the affected person . The GST authority other than the AO and the affected person can apply for rectification within 3 Months from the date of Such Order etc.

Please have a Look at Section 161 of the Central Goods and Service Tax Act, 2017 :-

Section 161 :- Without prejudice to the provisions of Section 160, and notwithstanding anything contained in any other provisions of this Act, any authority , who has passed or issued any decisions or order or Notice or certificate or any other document, may rectify any error which apparent on the face of record in such decision or order or notice or certificate or any other document , either on its decision or order or certificate or any other document, either on its own motion or where such error is brough to its notice by any officer appointed under this Act, or an officer the state Goods and Service Tax Act or an officer appointed or an officer under the Union Territory Goods and Service Tax Act or by affected person within a period of three Months from the date of issue of such decision, order or notice or certificate or any other document, as the case may be.

Proviso First

Provided that no such rectification shall be done after a period of Six Months from the date of Such decision, order or notice or certificate or any other document.

Proviso Second

Provided further that the said period of Six Months shall apply in such cases where the rectification is purely in the nature of correction of a clerical or arithmetic error , arising from any accidental slip or omission.

Proviso Third

Provided also that where such rectification adversely affects any person, the principals of natural justice shall be followed by the authority carrying out such rectification.

Let us first have a look at section 160 which is mentioned in the opening phrase of the Section 161 . The summery of Section 160 is as under :-

Section 160 provides that no such assessment , re-assessment , adjudication , review , revision , appeal , rectification , notice , summons, or other proceedings done accepted, made , issued , initiated or purported to have been done, accepted , made , issued, initiated in pursuance of any of the provisions of this Act, shall be invalid or deemed to be invalid merely by reason of any mistake , defect or omission.

1. WHICH TYPE OF ERROS CAN BE RECTIFIED UNDER GST.

Errors which are apparent from face of the records can only be rectified. The heading of the section is clear and according to it and the words written in the section mistakes which are apparent on the face of the records can only be rectified.

The mistakes which need arguments, further clarifications, new facts are not mistakes apparent from the face of the records hence are not rectifiable as per this section.

The mistake can be factual , Legal, or clerical but it should be apparent from the face of the records. The records as available on the records have to be relied upon and no new documents or evidence which were not on the records are not allowed to the dealer to produce to substantiate the claim of rectification of order etc.

Let us have some observation regarding the Mistakes apparent from the face of the Records for better understanding of the subject :-

1. Mistake apparent from the face of the record can not mean error which has to be fished out and searched.

2. An error which is not self-evident and has to be detected by the process of reasoning can hardly be said to be an error apparent on the face of records.

3. An error or mistake which does not require elaborate discussion of evidence or arguments to establish it, can be said to be an error apparent from records.

4. An error which has to be established by a long-drawn process of reasoning on points where there may conceivably be two options can hardly be an error apparent from the records.

2. WHO CAN INFORM THE MISTAKE.

The mistake apparent from the face of the record can be rectified by the authority after receiving the information from any of the above: –

| S.NO. | MODE OF INFORAMTION OF MISTAKE |

| 1. | By any office Appointed under CGST Act, SGST Act, or UGST Act. |

| 3. | Affected Person |

The GST officers and affected person can apply for rectification of order, Notice, certificate etc. within 3 Months from the date of issue of such order , Notice , certificate etc but this limit of 3 Months is not applicable to the officer who made the order wants to rectify his own order as per the provisions of section 161 of the Act.

3. TIME LIMIT FOR RECTIFICATION OF OFFICIAL DOCUMENTS

These orders , certificates , decisions etc. can only be made within 6 Months from the date of issue of such order , Notice , certificate , Decision etc. but in case of clerical or Arithmetical error arising of arising from any accidental slip or omission.

4. HOW TO APPLY FOR RECTIFICATION.

Now a very important aspect of this subject. How to file an application for rectification by the dealer. It will be an online activity on the GST portal . Let us have a look at the whole system.

Let us have a Look at the whole System at GST Portal .

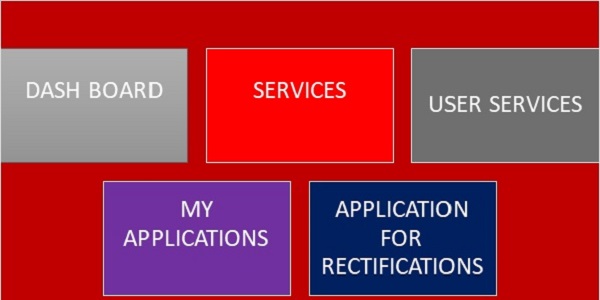

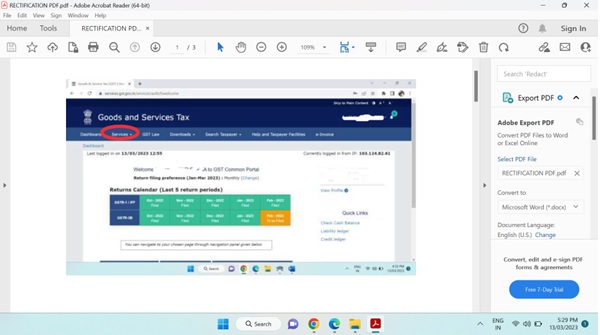

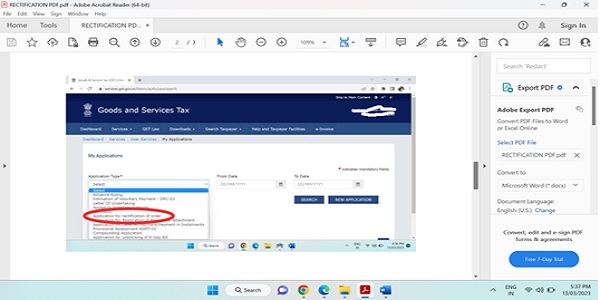

1. DASH BOARD> SERVICES

2. SERVCES> USER SERVICES

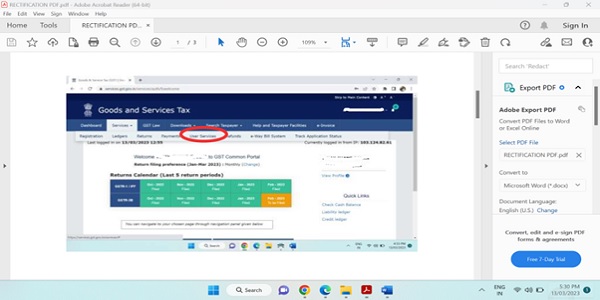

3. USER SERVICES > MY APPLICATION

4. MY APPLICATION > RECTIFICATION APPLICATION

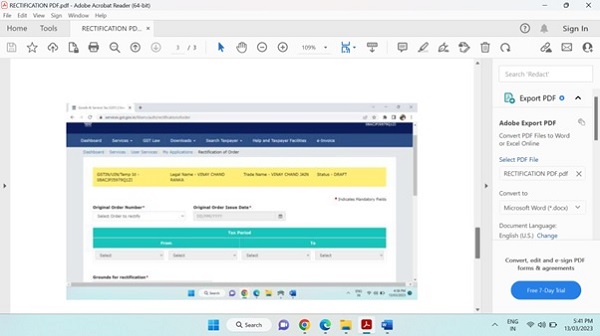

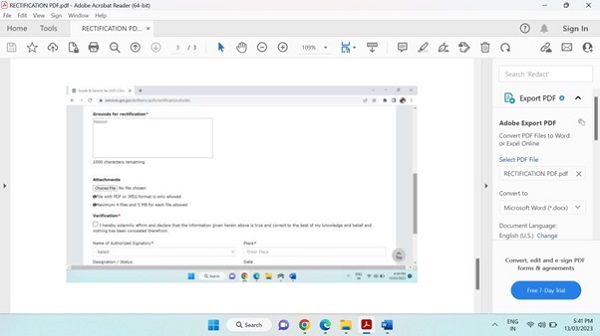

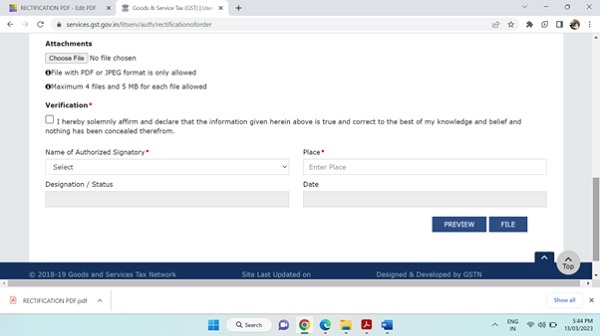

In the Rectification Application one will find the order to be rectified and there is a place to give ground of Application by using maximum of 1000 words and further one can attach files in PDF and/or JPEG format. See the screen shots :-.

–

One can attach maximum of 4 Files in PDF and/or JPEG format each file can have maximum of 5MB data.

By Sudhir Halakhandi | Sudhirhalakhandi@gmail.com

Dear sir,

I send load with out e invoice I dont any Idea e invoice by my mistake so received penalty notice and lock the lorry and material I make e way bill that lorry that me minur mistake but 200% immediately paid after release said sucad officer that’s how to possible release my material with out penalty sir