Office of the,

Commissioner of State Tax,

Maharashtra State, 8th Floor, GST

Bhavan, Mazgaon, Mumbai-10

TRADE CIRCULAR

Mumbai, Date-21.11.2019

No. JCST (training)/GST new return/2019-20

Trade Circular (GST) No. 53T of 2019

To,

Subject- Participation of Taxpayers and GST Practitioners in User Acceptance Testing of New Returns Offline Tool and online version of Form GST ANX-1 and Form GST ANX-2

Sir / Gentlemen / Madam,

1. Background:

A new GST return system will be introduced from 1st April 2020 in terms of the decisions of the GST Council in its 31st meeting and 37th meeting. In order to smoothen the transition to the new return system, a transition plan was approved by the Council and the same was released for information vide a press release dated 11.06.2019. Active participation of taxpayers in this outreach program is imperative for the success of the new return scheme. In accordance with the transition plan approved by the Council, GSTN has already implemented the following measure:

a. GST New Return Offline Tool has been released on trial basis on the GST Portal

b. In this trial version of the New Returns Offline Tool, Form GST ANX-1, Form GST ANX-2 (with Matching Tool built in it) and a template for Purchase Register (which will be used to import data of purchase register for matching) has been released.

From 1st April 2020, taxpayers will be required to file the new GST return & they need to be familiar with new return functionality. Active participation of the taxpayers and GST practitioners in this trial return drive will enable to give their proper feedbacks/suggestions to improve the GST new return tool. Department of State Tax of Maharashtra is going to contact the selected taxpayer / GST practitioner through the Jurisdictional Nodal Officers for filing of ANX-1, ANX-2 and new dummy GST return. Taxpayers other than the selected list can voluntarily participate in this new return filing drive and give their valuable suggestion and feedback.

2. The important salient features of new returns are as under:

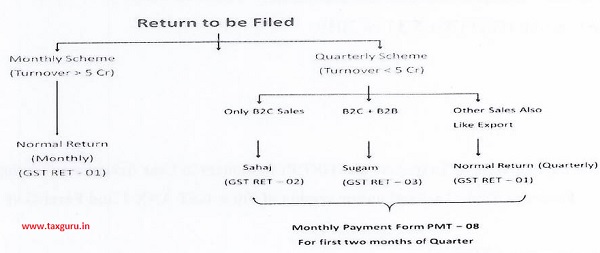

A. Form GST RET-1 (Normal Monthly) – Those taxpayers whose aggregate turnover in the preceding financial year was above Rs.5 crores will have to file monthly return in FORM GST RET-1, this needs to be filed based on FORM GST ANX-1 and FORM GST ANX-2. Taxpayers opting to file monthly return shall be able to declare all types of outward supplies, inward supplies and take credit on missing invoices. Change in periodicity of the return filing (from quarterly to monthly and vice versa) would be allowed only once at the time of filing the first return by a taxpayer.

B. Form GST RET-1 (Normal Quarterly) – Taxpayers whose aggregate turnover in the preceding financial year was up to Rs.5 crores can file this return based on FORM GST ANX-1 and FORM GST ANX-2. This return needs to be filed quarterly. Tax has to be paid on monthly basis through FORM GST PMT-08. Taxpayers opting to file Quarterly (Normal) return shall be able to declare all types of outward supplies, inward supplies and take credit on missing invoices. Taxpayers filing return as Quarterly (Normal) can switch over to Sugam or Sahaj return only once in a financial year at the beginning of any quarter.

C. FORM GST RET-2 (SAHAJ Quarterly) – Taxpayers whose aggregate turnover in the preceding financial year was up to Rs.5 crores and have supplies only to consumers and unregistered persons (B2C supplies) can file this return based on FORM GST ANX-1 and FORM GST ANX-2 on quarterly basis, but pay tax on monthly basis through FORM GST PMT-08. Taxpayers opting to file quarterly return as `Sahaj’ shall be allowed to declare outward supply under B2C category and inward supplies attracting reverse charge only.

The tax payer making supplies through e-commerce operators or making supply other than supply to consumer (unregister person-B2C) are not eligible to file Sahaj return. Such tax payers shall not be allowed to take credit on missing invoices. However, such taxpayers may make Nil rated, exempted or Non-GST supplies which need not be declared in said return. Taxpayers filing return as Sahaj can switch over to Sugam or Quarterly (Normal) return more than once in a financial year at the beginning of any quarter.

D. FORM GST RET-3 (SUGAM Quarterly) – Taxpayers whose aggregate turnover in the preceding financial year was up to Rs.5 crores and have made supplies to consumers and un-registered persons (B2C) and to registered persons (B2B) can file this return based on FORM GST ANX – 1 and FORM GST ANX – 2 on quarterly basis, but pay tax on monthly basis through FORM GST PMT-08. Taxpayers opting to file quarterly return as `Sugam’ shall be allowed to declare outward supply under B2C and B2B category and inward supplies attracting reverse charge only.

The tax payer making supplies through e-commerce operators or making supply other than supplies to consumers and un-registered persons (B2C) and to registered persons (B2B) are not eligible to file Sugam return.

Such tax payers shall not be allowed to take credit on missing invoices. However, such taxpayers may make Nil rated, exempted or Non-GST supplies which need not be declared in said return.

Taxpayers filing return as Sugam can switch over to Sahaj return only once in a financial year at the beginning of any quarter. Also taxpayers filing return as Sugam can switch over to Quarterly (Normal) return more than once in a financial year at the beginning of any quarter. All Returns are essentially prepared on the basis of two forms namely GSTANX-1 and GST ANX-2.

3. Forms of new GST returns

3.1 GST ANX-1 (Annexure of Supplies) is for reporting details of all outward supplies, inward supplies liable to reverse charge, and import of goods and services etc. Invoice-wise details may be furnished (except for B2C supplies) on a real-time basis as and when the invoices are issued by the supplier and the recipient can view them and take actionon real time basis. Inward supplies attracting reverse charge will be reported only by the recipient. All suppliers with annual aggregate turnover of more than Rs. 5 crore and that in relation to exports, imports and SEZ supplies will upload HSN level data. HSN code shall be reported at least at six digit level for goods and at least at six digit level for services. Other taxpayers (turnover upto Rs. 5 crore) shall have an optional facility to report HSN code in the relevant table or leave it blank.Details of documents of the period prior to introduction of the new return filing system can also be uploaded in the relevant tables of this annexure.

a. Amendment/Edit of uploaded documents in FORM GST- ANX-1 by the supplier: The amendment of details of earlier tax period can be made in FORM GST ANX-1A before the due date of filing of September return following the end of the financial year or the actual date of furnishing relevant annual return, whichever is earlier.

b. Editing of documents can be done only by supplier: Editing by supplier is allowed only if recipient has not accepted such supply. If already accepted, unless `reset/unlock’ by recipient details cannot be edited by supplier.

c. Recipient filing monthly returns can accept details uploaded by supplier till 10th of following month. Recipient filing Quarterly returns can accept details uploaded by supplier till 10th of the month succeeding the quarter for which the return is being filed.

d. Documents rejected by the recipient shall be conveyed to the supplier only after filing of the return by the recipient. Supplier may edit the rejected documents before filing any subsequent return. However, credit will be made available to recipient through the next FORM GST ANX-2 for the recipient. The tax liability for such edited documents will be accounted for in the same tax period.

3.2 GST ANX-2 (Annexure of Inward Supplies): Details of documents uploaded by the corresponding supplier(s) will be auto populated in FORM GST ANX-2 and recipient(s) can take action on the auto populated documents to – accept, reject or to keep pending on continuous basis after 10th of the following month on which it was uploaded by supplier. Accepted documents would not be available for amendment at the corresponding supplier’s end. Supplier may edit rejected documents before filing subsequent return. However, credit will be available to recipient through next FORM GST ANX-2. The tax liability will be accounted for in the same tax period. Pending invoices will not be available for amendment by the supplier until rejected by the recipient.

a. Status of return filing (not filed, filed) by the supplier will also be made known to the recipient in FORM GST ANX-2 of the tax period after the due date of return filing is over. Recipients would be able to check the return filing status of the suppliers. This status, however, does not affect the eligibility or otherwise of input tax credit which will be decided as per the Act read with the rules made thereunder.

b. Returns not filed for consecutive two months by the supplier- Indication in FORM GST ANX-2 to the recipient that credit shall not be available. However, uploaded invoices will be visible but recipient can not avail ITC on such invoices. Recipient to reject or keep such invoices pending till the supplier files return. For suppliers filing return on quarterly basis, this period will be one quarter i.e. if return of one quarter has not been filed, then recipient will not be able to claim credit on the invoices uploaded during next quarter.

c. FORM GST ANX-2 will be treated as deemed filed upon filing of the main return

(FORM GST RET-1) relating to the tax period.

4. To download and open the GST New Return Offline Tool:

The GSTN has released an interactive web-based trial version of the New Returns (Trial) Offline Tool of Form GST ANX-1, Form GST ANX-2 (with Matching Tool built in it) and a template for Purchase Register to be used to import data from purchase register for matching. The purpose behind release of GST New Return Offline Tool on trial basis is to enable familiarization of stakeholders with tool’s functionalities and to get their feedback/suggestions to improve the tool further, before its actual deployment.

GSTN has also provided online version of GST ANX-1 and GST ANX-2 on its portal. This prototype will also allow a taxpayer or user to experience various functionalities by navigating across different sections, upload of invoices, matching of invoices received through ANX-2 with invoices of his books of accounts etc.

The documents containing the features of all types of new returns may be obtained from “Download” of the portal: www.gst.gov.in.

To download and open the GST New Return Offline Tool in system from GST Portal, perform following steps:

a. Access the GST Portal: www.gst.gov.in.

b. Go to Downloads > Offline Tools > New Returns Offline Tool (Beta) option and click on it.

c. Select Downloads

d. Click Proceed.

e. Unzip the downloaded Zip file which contain GST New Return Offline Tool.exe.

f. Open the New Returns GST Offline Tool.exe by double clicking on it.

g. Select the folder where you intend to install the New Returns GST Offline Tool.

h. Click Next

i. Click Install.

j. Click Finish.

k. Open the GST New Return Offline Tool by double clicking on it.

Note: Downloading the GST New Return Offline Tool is a one-time activity. However, the Tool may get updated in future. So, always use the latest version available on the GST Portal.

Detailed User Manual and help is also available on the GST Portal under “Help” section (click here for details https://www.gst.gov.in/help/newreturns).

5. Option to file NIL return through SMS will be provided.

6. Harmonized System of Nomenclature (HSN) code will be needed in order to submit details at invoice level.

7. Inward supplies which are liable to RCM have to be declared in FORM GST ANX-1 atthe GSTN level, by the recipient of supplies.

8. Matching tool is available which will help the taxpayer to match their Input Tax Credit based on their FORM GST ANX – 2 and purchase register.

9. The issues and problems being encountered at the time of testing of ANX-1 and ANX- 2 can be shared as feedback or suggestions with the GSTN by filling in the template(a special sheet that has been provided in GST portal) and mailing the same to Feedback.NewReturn@gstn.org.in marking a copy to Jurisdictional Nodal Officer.

10. Taxpayers are requested to use the New Return Offline Tool extensively and give their feedback on the functionality available in the Tool at the Grievance Redressal Portal by clicking on https://selfservice.gstsystem.in/ and selecting FEEDBACK ON NEW RETURNS Tab. It may be noted that the feedback given by taxpayers will be used for making changes/ enhancements in the tool. They are also requested to attach screenshots and other relevant material while giving their feedback. Taxpayer may also suggest inclusion of any feature (with details) to make the Tool more useful for the end-users.

11. In this background, the GSTN has provided List of Taxpayers [Supplier and Recipient] as received from GSTN who have made supplies to or received supplies from multiple tax payers. The said list will be shared with the concerned Jurisdictional Nodal Officer. Nodal Officer will contact these Taxpayers and request them to participate in this user acceptance testing.

12. The Jurisdictional Nodal Officer shall initiate the follow up for the filing of ANX-1 by the supplier and of the recipient as well under his jurisdiction. He will also follow up the supplier and recipient under his jurisdiction for downloading the ANX-2. The taxpayer will match the documents, upload the ANX-2.Thus the Jurisdictional Nodal Officer shall follow up for filing the Return under his jurisdiction for supplier as well as recipient. The Jurisdictional Nodal Officer should personally supervise the functions of such selected taxpayers and assist them and handhold at all stages. The experience, issues encountered, steps to be taken to simplify the process, if required, suggestions, feedback, positive criticism including appreciations shall be recorded and submitted to the Joint Commissioner (Training) at following email id- gstnewreturn@gmail.com

13. Taxpayers need to file their regular returns as per periodicity (GSTR 3B and GSTR 1). By using same data taxpayers can upload ANX 1 and ANX 2. It will be treated as dummy data and it will be deleted by the GSTN later on. Please note that this activity of filing ANX1 and ANX 2 is an independent activity and it will not affect current credit or cash ledgers of the taxpayers.

14. A training on features and functionalities of New Returns (Trial) Offline Tool of Form GST ANX-1 and Form GST ANX-2 will be imparted to Master Trainers and Master trainers will provide training to the Nodal Officers of each division to assist the tax payers.

15. If necessary Nodal Officer will visit the POB of taxpayers or office of practitioners to assist them for filing of trial return.

16. The Joint Commissioner of State Taxes of respective nodal division shall supervise through the Nodal Officers the progress of User Acceptance Testing carried out by the taxpayers.

17. This exercise shall begin forthwith, and shall be completed by February 29th,2020.

18. If you need assistance in respect of return tiling. you are requested to contact Nodal Officer or the GSTN Help Desk.

19. This circular is clarificatory in nature and should not be interpreted legally.

Yours Faithfully,

(RAJIV JALOTA)

Commissioner of State Tax

(GST) Maharashtra State, Mumbai

No. JCST (training)/GST new return/2019-20

Trade circular (GST) No. 53T of 2019

Mumbai, Date-21.11.2019

Copy forwarded for the information to,

(1) Joint Commissioner of State tax, (MAHAVIKAS) with a request to upload this circular on the MGSTD website.

(2) Deputy Secretary, Finance Department. Mantralaya. Mumbai.

(Nitin Shaligram)

Joint Commissioner of State Tax

Training Division, Maharashtra

very useful matters and simple words easy understand ,thank you sir