To provide greater relief from complex compliance requirements under GST Law for small businesses for taking credit and issuing Tax Invoice, maintaining various records of inputs and outputs, filling mandatory three returns monthly etc., an option is provided to go for a COMPOSITION SCHEME. This scheme provides much needed procedural simplicity for small dealers, small manufacturers and small restaurants. The GST law provides the option of availing the benefit of Composition Levy under Section 10 of the CGST Act, 2017.

Let us study in this paper how the scheme is useful practically.

> What is Composition Scheme?

♦ A registered person, whose aggregate turnover in the preceding financial year did not exceed Seventy Five Lakh rupees, may opt to pay, an amount as prescribed in lieu of the tax payable by him – Sec 10(1)

◊ That means this is an optional scheme

◊ Available for registered person whose aggregate turnover in the preceding financial year did not exceed Seventy Five Lakh

◊ The amount payable is lieu of the tax, but not tax

♦ As per Sec 2(6) of CGST Act : “aggregate turnover” means the aggregate value of all

◊ taxable supplies (excluding the value of inward supplies on which tax is payable by a person on reverse charge basis),

◊ exempt supplies,

◊ exports of goods or services or both and

◊ inter-State supplies

of persons having the same Permanent Account Number, to be computed on all India basis but excludes central tax, State tax, Union territory tax, integrated tax and cess;

♦ The turnover limit for Composition Levy for CGST and SGST purposes shall be Rs.50 lakh in respect of the Special Category States except Uttarakhand (Arunachal Pradesh, Sikkim, Himachal Pradesh, Assam and the other States of the North-East).

♦ For the State of Jammu & Kashmir the turnover limit for the Composition levy will be decided in due course

♦ The amount payable is as follows :

| As % of Total Turnover | |||

| CGST | SGST | Total | |

| Manufacturer | 1% | 1% | 2% |

| Restaurant | 2.5% | 2.5% | 5% |

| Others (Traders) | 0.5% | 0.5% | 1% |

♦ The GST Council also recommended that the GST rate on dried Singhada and Makhana will be 5%

♦ Conditions for Opting the Scheme : Sec 10(2) of CGST Act :

◊ he is not engaged in the supply of services other than supplies referred to in clause (b) of paragraph 6 of Schedule II;

Means Service Providers are not eligible for the Scheme except Restaurant Services.

◊ he is not engaged in making any supply of goods which are not leviable to tax under this Act; Means the Suppliers of Exempted Goods are not eligible for the Scheme

◊ he is not engaged in making any inter-State outward supplies of goods;

◊ he is not engaged in making any supply of goods through an electronic commerce operator who is required to collect tax at source under section 52; and

◊ he is not a manufacturer of such goods as may be notified by the Government on the recommendations of the Council:

√ As per GST Councils Meeting held on 18th June’2017, Composition scheme not available for manufacturers of:

– Ice cream and other edible ice

– Pan masala

– Tobacco and manufactured tobacco substitutes

◊ The benefit of composition scheme will be available only when all the registered entities under a Same Permanent Account Number opts for such scheme.

That means a Supplier is may opt for the composition scheme only if all businesses under the same PAN are opt for the scheme.

Any intimation for opting composition scheme for any place of business shall be deemed for all other place of business.

♦ The option availed of by a registered person shall lapse with effect from the day on which his aggregate turnover during a financial year exceeds the limit specified – Sec 10(3)

♦ The registered person paying tax under the composition levy may not file a fresh intimation every year and he may continue to pay tax under the scheme subject to fulfilling prescribed conditions.

♦ Filling Quarterly Return : The persons paying tax under composition scheme are required to pay tax on quarterly basis and also required to file a quarterly return in Form GSTR-4 by the 18th of the month following the end of the quarter instead of any statement of outward or inward supplies.

♦ If the supplier has opted for composition scheme then he is not eligible to collect tax from the recipient on supplies made by him – Sec 10(4)

♦ He is also not entitled to any credit of input tax – Sec 10(4)

♦ In violation of the above provisions any person opting for composition scheme collect any tax or avail any credit, be liable to a penalty and the provisions of section 73 or section 74 shall, mutatis mutandis, apply for determination of tax and penalty – Sec 10(5)

♦ Conditions and Restrictions for Composition Levy As per Composition Rules:

◊ The person exercising the option to pay tax under section 10 shall comply with the following conditions:

(a) he is neither a casual taxable person nor a non-resident taxable person;

(b) the goods held in stock by him on the appointed day have not been purchased in the course of inter-State trade or commerce or imported from a place outside India or received from his branch situated outside the State or from his agent or principal outside the State, where the option is exercised under sub-rule (1) of rule 1 (Intimation to pay tax under composition levy (Only for persons registered under the existing law migrating on the appointed day))

(c) the goods held in stock by him have not been purchased from an unregistered supplier and where purchased, he pays the tax under sub-section (4) of section 9 – Reverse Charge

(d) he shall pay tax under sub-section (3) or sub-section (4) of section 9 on inward supply of goods or services or both – Reverse Charge also applicable for Composition Scheme

(e) he was not engaged in the manufacture of goods as notified under clause (e) of subsection (2) of section 10, during the preceding financial year; (items to be notified)

(f) he shall mention the words “composition taxable person, not eligible to collect tax on supplies” at the top of the bill of supply issued by him; and

(g) he shall mention the words “composition taxable person” on every notice or signboard displayed at a prominent place at his principal place of business and at every additional place or places of business. (2) The registered person paying tax under section 10 may not file a fresh intimation every year and he may continue to pay tax under the said section subject to the provisions of the Act and these rules.

List of Forms under Composition Scheme :

> Composition Scheme – Restrictions Galore

Though the scheme is intended to provide easy compliance route for small businesses, because of imposition of so many restrictions for availing the scheme, defeats the purpose.

As seen above the scheme is not available for service providers except restaurant services. Persons making inter-state transactions, exempted goods, supply to e- commerce operators are not eligible for the scheme. Also persons manufacturing Ice cream and other edible ice, Pan masala, Tobacco and manufactured tobacco substitutes are not eligible. Additional restrictions are also imposed in the Composition Rules like non-eligible categories : a casual taxable person nor a non-resident taxable person; for conversion restrictions on stock holding – not been purchased in the course of inter-State trade or commerce or imported from a place outside India or received from his branch situated outside the State or from his agent or principal outside the State.

That means the scheme is eligible only for Intra-state Transactions (within the state), where the business confines its outward transaction to State boundaries only. The scheme is useful only for B2C type businesses. In B2B transactions it is found to be disadvantageous. Let us discuss with example:

> Composition Scheme – B2B Transactions

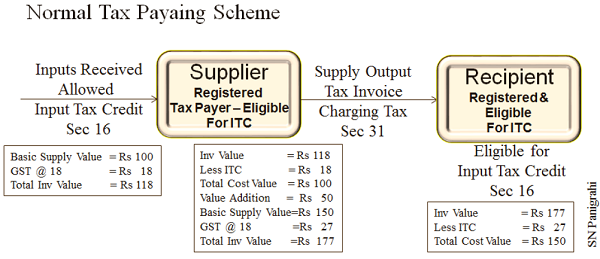

The scheme is not suitable for B2B type business because of non-availability of credit. Let us take an example and compare composition scheme and normal tax paying. See the examples below where assumptions are made similar in both the cases in respect of supply, basic value, value addition and applicable taxes.

Supplies from Person Opting Composition Scheme

Normal Tax Paying Scheme

From the above it is clear that in case of composition scheme the coat to the recipient is more (Rs 171.36) than in the case of normal tax paying (Rs 150). This is because of seamless credit availability in the normal case. Therefore the scheme is not advisable to opt in case of B2B type business.

The composition scheme may proof to be beneficial for B2C type business since the ultimate customer is not bothered about credit.

(Author can be reached at snpanigrahi@rediffmail.com)

Sir iam a composition holder iam issued tax invoice bill or bill of supply please clarify.

Very useful presentation with chart

to understand the full concept in one shot

Thanks for providing such nice explanation.

What is the limit on turnover. At one place it is 75 Lacs and other place Rs.50 Lacs

My yearly turnover is 65 lacs…im b to c trader mean selling goods to customer ..but i purchased goods from outside state..and on 30 june also i cant empty my whole stock..i want to became composite scheme dealer…kindly suggest …plz

Explanation with full clarity. Good & useful effort.

very useful article. thanks.

very very well

SIR

GOOD ARTICLE

U CAN ATTACH BILL OF SUPPLY FORMAT TO COMPLETE THE ARTILE

Will a restaurant owner, opting for Composition scheme, have to pay GST on inputs on reverse charge where many of the inputs like vegetables, milk, etc are exempt?

Nice Explanation. very clear.

very well explained.thanks

Very well explained..

Sir

Under composition scheme if the rate is .5%, it will be .5+.5 for CGST & SGST as per the your views. Why it is not 0.25% +0.25%?

When we say that GST rate is 18% it means 9%+9% for CGST & SGST or 18% for IGST, Why you are doubling the rate sir? Please clear the matter regarding the % of GST for CGST & SGST and the related notification. Regards