What is needed by a GST certifier in the pressing times of completing GSTR-9C?

What are the essentials of a GST practitioner to advise a client?

What does a GST taxpayer need to know to effectively comply with the law?

What does a GST administrator need to implement the law?

May be common answers to above questions could be as under:

√ A complete database of all the provisions of law

-

- GST Acts

- Orders (Including removal of difficulty orders)

- Amendment Acts

- Relevant provisions of other Laws

√ Compilation of all the Rules including forms: Rules undergo changes quite often. Many a times it becomes a task to track all the changes made to a single Rule and get the most updated version of Rules

√ Database of all including updated notifications: Notifications are getting issued on every alternate day on an average. To Keep a track of all the notifications and also to see the amended notifications as it appear as on the date, is a challenge. Getting most updated set of all the notifications is certainly the most needed support for any taxpayer/advisor

√ All the Departmental clarifications are indeed useful for understanding the view of the Government. For departmental officers, circulars are like mandates/instructions – a must to follow. A complete database of all such clarifications is certainly a need of the Taxman/advisor. Departmental views are also found in various forms such as:

-

- Circulars

- FAQs

- Press releases

- Flyers

√ To search a particular word or a phrase in the sea of all these documents is almost an impossible task without the help of software or electronic means. An intelligent search engine is an extremely useful tool for any person related to tax

√ Also, a facility to insert and save notes electronically, is like a cherry on the cake.

Is it possible to get all the above at one place and that too free of cost?

Answer to the above question is- Yes

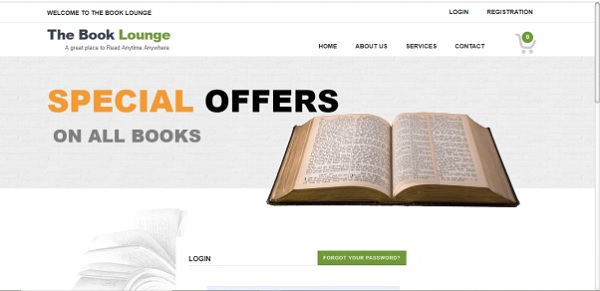

Our team at GSC Intime Services Pvt. Ltd with the help of thebooklounge.com has come out with a free electronic library of Acts, Rules, Notifications, Orders, Departmental clarifications with the facility of search and note making.

One simply needs to subscribe (free of cost) to: http://thebooklounge.in and search for ‘MY GST E-BOOK”. Having subscribed once, one can use the library freely (Please note that the main page of the website reads as ’90 days free’ which is not applicable to this book). The library will be updated on daily basis at the backend so that the user gets the most updated version in the least possible time.

Following steps can be followed for subscribing to this Electronic Library:

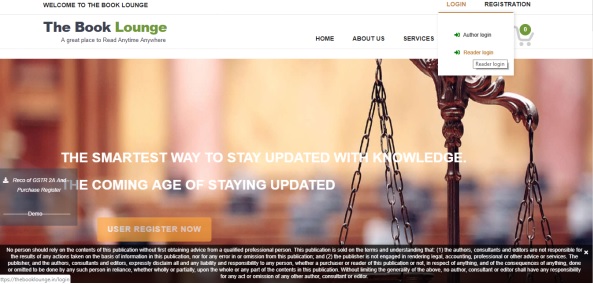

Step 1: Visit www.thebooklounge.in

Step 2: Go to ‘Registration tab and click on ‘Reader Registration’. Enter the required details viz.

- Name

- Username

- Password

- Mobile No.

- Address

And then click on ‘Register at the end…

–

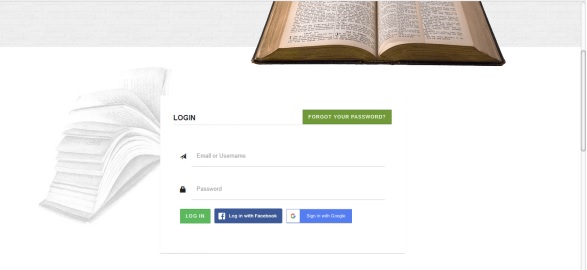

Step 3: After successfully registering yourself, please select ‘Login’ Tab near ‘Registration Tab on the top of the screen, provide your credentials and click on ‘Log-in’

Step 4: Once you are logged-in, ‘My GST E=Book’ cover page will be displayed on your screen. You may visit ‘My GST E-Book’ just by clicking on the cover page. In case, it does not appear directly, please scroll down in ‘My Books’ section and click on ‘My GST E-Book’ and ‘View Book Details’

Step 5: To revisit the E-book, go to ‘Log-in’ and click on ‘Reader Login’ to view your own GST electronic library free of cost anytime anywhere with internet connectivity. For ease of use, you may bookmark this website or may save the webpage shortcut on desktop

Wish you all a happy reading!!!