The GST Website, GSTN Portal gst.gov.in is expecting errors since today morning and is down consistently resulting in users not able to file GSTR 3B , make payments. Notable that tomorrow is the last date of filing GSTR 3B for the month of July 2017. Various Users across India are consistently updating about the error and outage of the GSTN Portal. Ministry of Finance & CBEC is also having weekend holidays until tomorrow.

Users are also getting various errors related to payment and adjustment of liability as is updated across social media forums meant to discuss update regarding taxation, legal matter.

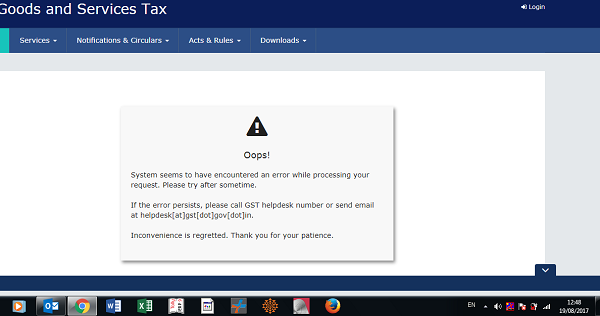

Following are the screenshots of the errors users are experiencing.

VARIOUS WEBSITES ARE ALSO CONFIRMING THAT GSTN PORTAL IS DOWN

THIS IS THE AGE OF TECHNOLOGICAL ADVANCEMENT, ALERT CITIZENS COME TO SOCIAL MEDIA TO LODGE THEIR GRIEVANCES OF LEGAL IMPORTANCE

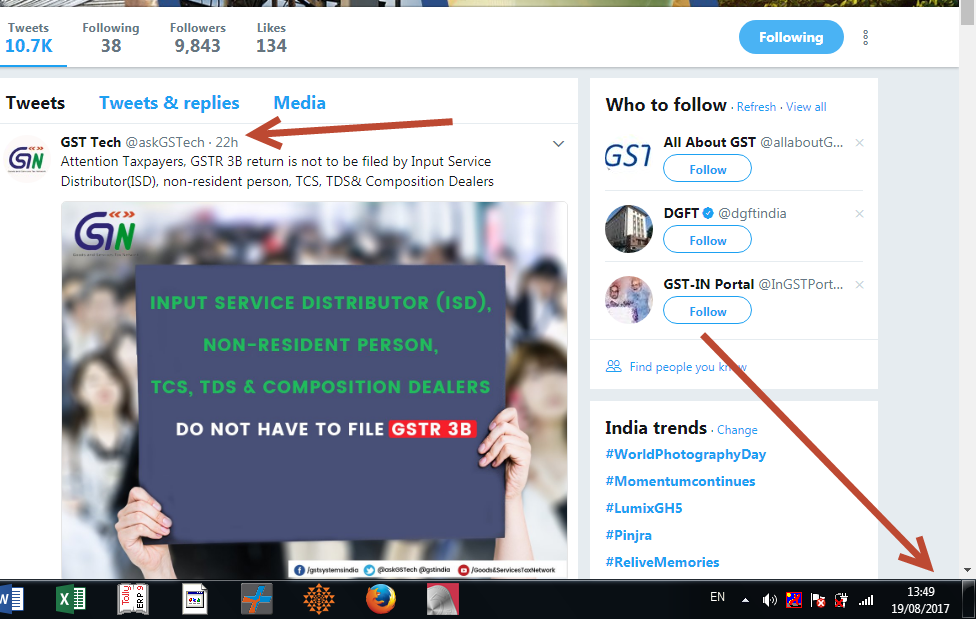

Many Twitter users conveyed the crashing of GSTN Portal issue to Twitter Handles since today morning,

There are numerous tweets however all cannot be shared as the page and article gets bulky.

Irrespective of above tweets, the Official twitter handle for IT related queries on GST has not tweeted anything or replied to queries over Crashing of its website.

Same thing happened with Income Tax E Filing Website for over a week before the due date, however none from Finance Ministry or CBDT took cognizance of same except at last moment extending the due date and blaming Taxpayers for fault of last minute rush rather than looking into own house for errors and improvement.

Bureaucrats sitting in plush offices needs to be aware of ground realities and grievances of taxpayers rather than just focusing on achieving Targets of Tax Collection and in the process TARGETING the taxpayers. EARLIER THE BETTER.

Users can lodge grievance with higher authorities for service related issues of GST. I have already written how to do it, Find it here https://taxguru.in/goods-and-service-tax/how-lodge-gst-related-complains-with-higher-authorities.html

Jay Hind.

The Author can be reached at atul@caclub.in

gst portal not working

Be it Income Tax or GST or other portals, crashes and non accessibility will arise due to many reasons.

It may be even due to the Service Provider’s site being down or a telephone line fault.

Instead of penalising Assessees or Customers, the Govt will do well to prescribe an office to receive manual Returns on the last day and give an acknowledgment Number to prove that it is NOT the fault of iler when he uploads the Return on a subsequent date.

The software company responsible for the GST have failed on home turf and this is not an isolated case. The hardware for the portal, whether designed and implemented according to the needs of very large tax payers, is in question. All over the world such portals do not seem to have problems as in India. Where and what is the glitch in the hardware or software? Someone from the technical side should come out with a honest answer to the tax paying public.

In the course of extending and pushing the dates August is coming to end and as per the present due dates September also completes and the tax audits will be pushed to a corner which is more tension full job to complete. Till last minute Govt will not announce the extension and takes decision only when their websites crashes. By that time the professionals will be loosing the energy. At last they will extend for a week or few days which is of no use. The remedy for this is only unitedly all professional colleagues should take a decision and shut down their systems like earlier pen down strike. Other wise no remedy for this mischief. Shameful on the part of all respective departments for not taking care of the technical problems and requirements of servers etc to which can take the load even on last day. It is easy to advice for early filing without knowing the ground realities.

It is not new for the tax paying public; formerly you will not be able to the pay ST on the last day; you will not be able to file ST Return on the last day; You will not be able to file the IT Return and Tax Audit Reports on the last day. Try and Try again and if you are not able to suceed you client will be fined for the fault of the exchequer and you will be scolded by the client.

read my petition and provide your valuable suggestions

https://taxguru.in/goods-and-service-tax/whats-harm-making-gst-return-quarterly-returns.html

It is a pity that tax payers and professionals who assist them day and night are never respected. Their difficulties and problems are not addressed in due time. The Authorities say that due to last minute rush their systems are not able to take the load. This exactly is the situation with the professionals and the tax payers. The least requested from the Authorities is an ear to listen to the issues with a broader perspective and solve it for the better governance of this county. Ego of any one should not find a place any where in attempting a solution to the problems.

WE ARE DOING OUR BEST WE DON’T HAVE ANY RIGHT TO ACT AGAINST CALAMITIES LIKE FLOODS , ACCIDENTS ETC.

WE WILL SOLVE EVERY THING IN PROPER TIMES .DON’T WORRY . PLEASE WAIT.

WE WILL PUSH INDIA FORWARD . NO DOUBT ABOUT IT.

Go to GST council and our Respected BOSSES.

What PM said ?

Try try try again you will win the race .

This is machine , how those persons discard the newly installed software ?

Digital India must move faster than Satapdi/ Rajdhani Express , wait please , when in 70 years nothing happened , you must have to wait for the years to come .

GSTR-3B is a summary and requires furnish very few details. What will happen when GSTR-1 is to be uploaded. Yet Govt officials tries to hide their weakness in email informing extension.

LET THE GST COUNCIL HAVE MORE POWERS TO MONITOR GST WEBSITE. IT SHOULD WORK PROPERLY. THEN ONLY DEAD LINES INSISTED THE DEALERS FOR FILING RETURNS.I HOPE THAT THERE WILL BE LOT OF GST ACT AMENDMENTS IN FUTURE TO EASIER THE TAX PAYER FOR NOT HAVING DOUBTS ABOUT TAXATION OF GST.

I REQUEST YOU SIR I HAVE SUBMITTED GST 3B IN GST PORTAL CENTRAL TAX AND STATE TAX THEIR IS EXCESS TAX INPUT AVAILABLE SO I REQUEST HOW CAN I RECTIFY THE OUR DEALERS ARE BLAMES AND ALSO BADLY SPEAKING I AGED PERSON I AM DEPENDING THE ACCOUNTS WRITING AND ALSO I MEET MY FAMILY PLEASE HELP ME HOW CAN I RECTIFY THE ABOVE REGARD REPLY SIR TO DO NEEDFUL

Regarding GST site crushing, what the Govt has said is “Due to flood in Bihar and other states, due to situation in Jammu & Kashmir, and as requested by dealers and professionals, the date has been extended. The blame is entirely on the people. The Govt should have accepted the reason for crush that the site was not working properly. Flood in Bihar and other states and situation in JK has not arisen on 19.08.2017 but the same is going since long. Why they have extended due date for all India instead of the affected states. The Govt should accept its fault.

What happen if someone will not able to file gstr1 due to some saviour illness .,…..

Website is Ok no crashes.

What if GST portal crashes at time of gstn1?

At last this is great India. This the way of getting extra revenue as per Government view this the only way to trouble public

At last this is great India. This the way of getting extra revenue

DIGITAL INDIA MISSION IS WORKING SUPERB