FAQs on Accessing and Responding to Communications Received as part of Enforcement Case Proceedings

General

Q.1 What are Enforcement Case Proceedings?

Ans. The entire gamut of actions undertaken by tax officials to curb tax evasion is generally referred as ‘Enforcement’. The process mainly involves steps such as gathering intelligence, calling for documents, issue of summons, recording of statements, inspection/search of premises, seizure of documents/goods, detention of goods/conveyance (including those in transit), confiscation of goods/conveyance, etc.

The process may lead to issuance of demand notice (SCN) to the concerned person/Taxpayer, unless the liability determined as part of enforcement proceedings is paid in full, along with applicable interest and penalties.

Q.2 As part of the Enforcement proceedings, if any, initiated by Tax Officials, what are all the different kinds of communications that I, as a taxpayer, may receive on GST Portal (Taxpayer’s Dashboard)?

Ans. The following are the various kinds of communications which you may receive on GST Portal:

| Nature of Communication | Purpose of Communication | Navigation Path for Taxpayer to Access the Communication |

| Notice for Calling Information | For directing a registered taxpayer or third party to provide specific information regarding books of accounts, supporting documents etc. | Dashboard > Services > User Services > View Additional Notices/Orders > Notice Calling Information > NOTICES |

| Reminder 1 Notice | For reminding first time a registered taxpayer or third party in case they have not replied to the issued “Notice Calling Information” by the due date specified in the Notice | Dashboard > Services > User Services > View Additional Notices/Orders > Reminder 1-Notice Calling Infor-mation > NOTICES |

| Reminder 2 Notice | For reminding 2nd time a registered taxpayer or third party in case they have not replied to the issued “Notice Calling Information” by the due date specified in the Notice | Dashboard > Services > User Services > View Additional Notices/Orders > Reminder 2-Notice Calling Information > NOTICES |

| Reminder 3 Notice

|

For reminding 3rd time a registered taxpayer or third party in case they have not replied to the issued “Notice Calling Information” by the due date specified in the Notice | Dashboard > Services > User Services > View Additional Notices/Orders > Reminder 3-Notice Calling Information > NOTICES |

| Notice to Summon | For directing the Taxpayer or third person (Identified person e.g. suppliers) to be present in person or through authorized representative in order to provide specified information/ evidence/ documents etc. | Dashboard > Services > User Services > View Additional Notices/Orders > Notice To Summon > NOTICES |

| Notice for Adjournment of Summon | For intimating the Taxpayer or third party regarding Adjournment of Summon | Dashboard > Services > User Services > View Additional Notices/ Orders > Notice For Adjournment of Summon > NOTICES |

| Personal Hearing | For directing the Taxpayer or third person (Identified person e.g. suppliers) to be present in person or through authorized representative for the hearing in the case | Dashboard > Services > User Services > View Additional Notices/Orders > Personal Hearing > NOTICES |

| GST INS-02 ORDER OF SEIZURE | Tax official can use this form to issue an order of seizure of the goods, documents, books or things | Dashboard > Services > User Services > View Additional Notices/ Orders > GST INS-02 ORDER OF SEIZURE > ORDERS |

| GST INS-03 ORDER OF PROHIBITION | Tax official can use this form to issue an order of prohibition to owner or custodian of goods to not to remove, part or otherwise deal with goods, except with the previous permission of officer, in case it is not practicable to seize the goods | Dashboard > Services > User Services > View Additional Notices/Orders > GST INS-03 ORDER OF PROHI -BITION > ORDERS |

| GST INS-04 BO-ND FOR REL-EASE OF GOODS SEIZED | Tax official can use this form to release seized goods on provisional basis upon execution of bond and furnishing of security | Dashboard > Services > User Services > View Additional Notices/Orders > INS-04 BOND FOR RELEASE OF GOODS SEIZED > PROCEEDINGS |

| GST INS-05 ORDER OF RELEASE OF GOODS | Tax official can use this form to release the seized goods, which are of hazardous / perishable nature, after making payment as required under law | Dashboard > Services > User Services > View Additional Notices/Orders > GST INS-05 ORDER OF RELEASE OF GOODS > ORDERS |

| Detention/Seizure Memo | Tax official can use this form to seize the goods. | Dashboard > Services > User Services > View Additional Notices/Orders > Detention/Seizure Memo > NOTICES |

| ORDER OF RELEASE OF GOODS | Tax official can use this form to release the seized goods, in case he/she is satisfied with the Taxpayer’s or third party’s reply to the issued Detention/Seizure Memo | Dashboard > Services > User Services > View Additional Notices/ Orders > ORDER OF RELEASE OF GOODS > ORDERS |

| SHOW CAUSE NOTICE | Tax official can use this form to issue SCN in case he/she is not satisfied with the Taxpayer’s or third party’s reply to the issued Detention/Seizure Memo | Dashboard > Services > User Services > View Additional Notices/Orders > SHOW CAUSE NOTICE > NOTICES |

| ORDER OF RELEASE OF SECURITY | Tax official can use this form to release the security of the seized goods, in case he/she is satisfied with the Taxpayer’s or third party’s payment of the related Tax/Interest/Penalty | Dashboard > Services > User Services > View Additional Notices/Orders > ORDER OF RELEASE OF SECURITY > ORDERS |

| MOV-01 STATEMENT OF OWNER/ DRIVER/ PERSON-IN-CHARGE | Tax official can use this form to record Statement of the OWNER/DRIVER/PERSON-IN-CHARGE whose goods and/or conveyance were intercepted | Dashboard > Services > User Services > View Additional Notices/Orders > MOV-01 STATEMENT OF OWNER/DRIVER/ PERSON-IN- CHARGE > PROCEEDINGS |

| MOV-02 ORDER FOR PHYSICAL VERIFICATION OF G/C | Tax official can use this form to issue Order for physical verification of goods and/or conveyance were intercepted and the Taxpayer fails to produce the required documents | Dashboard > Services > User Services > View Additional Notices/Orders > MOV-02 ORDER FOR PHYSICAL VERIFICATION OF G/C > ORDERS |

| MOV-03 EXTENSION OF INSPECTION TIME | Tax official can use this Form to allow extension of inspection time of the intercepted goods and/or conveyance (when in movement) | Dashboard > Services > User Services > View Additional Notices/Orders > MOV-03 EXTENSION OF INSPECTION TIME > PROCEEDINGS |

| MOV-04 PHYSICAL VERIFICATION REPORT | Tax official can use this Report to provide details of physical verification of the intercepted goods and/or conveyance (when in movement) | Dashboard > Services > User Services > View Additional Notices/Orders > MOV-04 PHYSICAL VERIFICATION REPORT > PROCEEDINGS |

| MOV-05 RE-LEASE ORDER | Tax official can use this Form to allow release of intercepted goods and/or conveyance (when in movement) | Dashboard > Services > User Services > View Additional Notices/Orders > MOV-05 RELEASE ORDER > ORDERS |

| MOV-06 DETENTION ORDER | Tax official can use this Form to detain or seize the intercepted goods and/or conveyance (when in movement) | Dashboard > Services > User Services > View Additional Notices/Orders > MOV-06 DETENTION ORDER >ORDERS |

| MOV-07 NOTICE UNDER SECTION 129(3) of GST ACT | Tax official can use this Form to issue notice to the taxpayer calling him/her to appear for a personal hearing after detaining or seizing the intercepted goods and/or conveyance (when in movement) | Dashboard > Services > User Services > View Additional Notices/Orders > SHOW CAUSE NOTICE > NOTICES |

| MOV-08 BOND FOR PROVISIONAL RELEASE OF G/C | Tax official can use this Form to report the submission of original Bond for provisional release of goods/ conveyance that were detained or seized | Dashboard > Services > User Services > View Additional Notices/Orders > MOV-08 BOND FOR PROVISIONAL RELEASE OF G/C > PROCEEDINGS |

| MOV-09 ORDER OF DEMAND – TAX & PENALTY | Tax official can use this Form to issue speaking Order for tax or penalty related to goods/ conveyance that were detained or seized | Dashboard > Services > User Services > View Additional Notices/Orders > MOV-09 ORDER OF DEMAND – TAX & PENALTY > ORDERS |

| MOV-10 NOTICE FOR CONF-ISCATION & LEVY OF PENALTY | Tax official can use this Form to issue Notice for confiscation and levy of penalty related to goods/ conveyance that were detained or seized | Dashboard > Services > User Services > View Additional Notices/Orders > MOV-10 NOTICE FOR CONFI -SCATION & LEVY OF PENALTY > NOTICES |

| MOV-11 ORDER OF CONF-ISCATION | Tax official can use this Form to issue Order for confiscation on goods/ conveyance that were detained or seized | Dashboard > Services > User Services > View Additional Notices/Orders > MOV-11 ORDER OF CONFI-SCATION > ORDERS |

Note: Taxpayers are advised to check on daily basis, for notices/orders/communications issued to them, if any, from the tax officers.

Viewing and Taking Actions on NOTICES Tabs

Q.3 What happens on the GST Portal if a Notice is issued by the Enforcement Officer?

Ans. Following actions take place on the GST Portal once a Notice is issued by an Enforcement Officer:

- An intimation of the issued Notice is sent to the Taxpayer on his/her registered email ID and mobile number.

- Issued Notice is updated on the dashboard of the taxpayer, concerned tax Official and Enforcement Officer.

- Taxpayer can view the issued Noticefrom the following navigation: Services > User Services > View Additional Notices/Orders > View > Case Details.> NOTICES

Note: In case Third Party is the Recipient of the Notice, the Notice will be sent to them via post or special messenger. No other intimation will be sent to them.

Q.4 In case a Notice is issued to the third party, can the Taxpayer view it on his/her dashboard?

Ans. No, in case a Notice is issued to the third party, the Taxpayer cannot view it on his/her dashboard.

Viewing and Filing Reply or Counter-Reply

Q.5 What happens on the GST Portal once I file Reply or a Counter-reply?

Ans. Once you file Reply or a Counter-reply, following actions take place on the GST Portal:

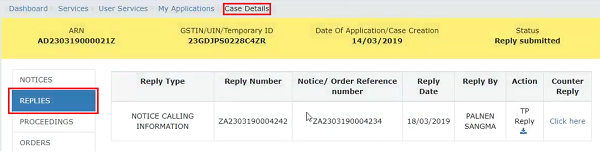

- ARN/Case ID Status is updated as “Reply submitted“.

- Dashboard of Taxpayer, concerned tax Official and Enforcement Officer is updated with the record of the filed Reply.

- Taxpayer can view the filed Reply from the following navigation: Services > User Services > View Additional Notices/Orders > View > Case Details.> REPLIES

Q.6 What happens on the GST Portal once the concerned Tax Official files Reply or a Counter-reply?

Ans. Once the concerned Tax Official files Reply or a Counter-reply, following actions take place on the GST Portal:

- ARN/Case ID Status is updated as “Reply submitted“.

- Dashboard of Taxpayer, concerned tax Official and Enforcement Officer is updated with the record of the filed Reply. Taxpayer can view the filed Reply from the following navigation: Services > User Services > View Additional Notices/Orders > View > Case Details.> REPLIES

- An intimation of the submitted Reply is sent to the Taxpayer on his/her registered email ID and mobile number.

Q.7 Against a particular communication, is there any limit on number of replies or counter-replies, I can file?

Ans. No, there is no limit on number of Replies or Counter-replies which you can file against a single communication.

Q.8 In case third party sends a reply to an issued Notice offline, will I be able to see it?

Ans. In case, third party sends a reply to an issued Notice offline and the Tax Officer uploads it on GST Portal in the REPLIES tab, you can view it from there. No separate intimation is sent to anyone about the filed reply in such a case.

Viewing and Taking Actions on PROCEEDINGS tab

Q.9 Can I furnish security in Form INS-04 BOND FOR RELEASE OF GOODS SEIZED on the GST Portal?

Ans. No, you cannot furnish security in Form INS-04 BOND FOR RELEASE OF GOODS SEIZED, on the GST Portal. You must submit the physical copy to the Enforcement Officer. Once you furnish the hard copy, Enforcement Officer will upload the bond/security copy on the GST Portal.

Status of Enforcement Case ID

Q.10 What are the various Status changes that an Enforcement Case ID will undergo during proceedings?

Ans. Status types using which you can search for an Enforcement Case ID on the Search Screen are:

| Status of Case ID | Action Taken on the Case ID that Results in this Status |

| Notice for Adjournment of Summon issued | When an Enforcement Officer issues Notice for Adjournment of Summon to the Taxpayer or the Third Party |

| Notice for Summon issued | When an Enforcement Officer issues Notice for Summon to the Taxpayer or the Third Party |

| Notice for personal hearing issued | When an Enforcement Officer issues Notice for personal hearing to the Taxpayer or the Third Party |

| Notice for production of supporting docs | When an Enforcement Officer issues Notice for production of supporting documents to the Taxpayer or the Third Party |

| Notice issued | When an Enforcement Officer issues Notice to the Taxpayer or the Third Party |

| Other notice issued | When an Enforcement Officer issues other Notice to the Taxpayer or the Third Party |

| Reminder 1 Notice issued | When an Enforcement Officer issues Reminder 1 to the Taxpayer or the Third Party |

| Reminder 2 Notice issued | When an Enforcement Officer issues Reminder 2 to the Taxpayer or the Third Party |

| Reminder 3 Notice issued | When an Enforcement Officer issues Reminder 3 to the Taxpayer or the Third Party |

| Reply Received | When Reply is submitted by the Taxpayer or the Concerned Tax Official |

| GST INS-02 Issued | When an Enforcement Officer issues “GST INS-02 ORDER OF SEIZURE” in the case |

| GST INS-03 issued | When an Enforcement Officer issues “GST INS-03 ORDER OF PROHIBITION” in the case |

| GST INS-04 Accepted | When an Enforcement Officer accepts the “Form INS-04 BOND FOR RELEASE OF GOODS SEIZED”, which was physically submitted by the Taxpayer |

| GST INS-05 issued | When an Enforcement Officer issues “GST INS-05 ORDER OF RELEASE OF GOODS” to the Taxpayer on goods which are of hazardous/perishable nature |

| Detention memo issued | When an Enforcement Officer issues “Detention/Seizure Memo” Notice to the Taxpayer or the Third Party on goods/books/documents/conveyance (when not in movement) |

| Order of Release of Goods issued | When an Enforcement Officer issues “Order of Release of Goods” to the Taxpayer or the Third Party after their satisfactory reply to the issued Detention/Seizure Memo |

| Show Cause Notice issued | When an Enforcement Officer issues “Show Cause Notice” to the Taxpayer or the Third Party after examining their reply to the issued Detention/Seizure Memo |

| Order of Release of Security issued | When an Enforcement Officer issues “Order of Release of Security” to the Taxpayer or the Third Party after their payment of the Tax/Interest/Penalty with regard to the goods seized |

| MOV-1 issued | When an Enforcement Officer issues “MOV-01 STATEMENT OF OWNER/DRIVER/PERSON-IN-CHARGE” to the Taxpayer |

| MOV-2 issued | When an Enforcement Officer issues “MOV-02 ORDER FOR PHYSICAL VERIFICATION OF G/C” to the Taxpayer |

| MOV-3 issued | When an Enforcement Officer issues “MOV-02 ORDER FOR PHYSICAL VERIFICATION OF G/C” to the Taxpayer |

| MOV-3 issued | When an Enforcement Officer issues “MOV-03 EXTENSION OF INSPECTION TIME” to the Taxpayer |

| MOV-4 issued | When an Enforcement Officer issues “MOV-04 PHYSICAL VERIFICATION REPORT” to the Taxpayer |

| MOV-5 issued | When an Enforcement Officer issues “MOV-05 RELEASE ORDER” to the Taxpayer |

| MOV-6 issued | When an Enforcement Officer issues “MOV-06 DETENTION ORDER” to the Taxpayer |

| MOV-7 issued | When an Enforcement Officer issues “MOV-07 NOTICE UNDER SECTION 129(3) of GST ACT” to the Taxpayer |

| MOV-8 issued | When an Enforcement Officer issues “MOV-08 BOND FOR PROVISIONAL RELEASE OF G/C” to the Taxpayer |

| MOV-9 issued | When an Enforcement Officer issues “MOV-09 ORDER OF DEMAND – TAX & PENALTY” to the Taxpayer |

| MOV-10 issued | When an Enforcement Officer issues “MOV-10 NOTICE FOR CONFISCATION & LEVY OF PENALTY” to the Taxpayer |

| MOV-11 issued | When an Enforcement Officer issues “MOV-11 ORDER OF CONFISCATION” to the Taxpayer |

B. Manual on Accessing and Responding to Communications Received as part of Enforcement Case Proceedings

How can I take action during Enforcement Case proceedings initiated against me by the Tax Officer?

To take action during Enforcement Case proceedings initiated against you by the Tax Officer, perform following steps:

A. Navigate to View Additional Notices/Orders page to view Notices and Orders issued against you by the Enforcement Officer

B. Take action using NOTICES tab of “Case Details” screen:

B (1). View issued Notice

B (2). File Reply to the issued Notice

C. Take action using REPLIES tab of “Case Details” screen:

C (1). View the Filed Replies

C (2). File Counter-replies

D. Take action using PROCEEDINGS tab of “Case Details” screen: View Proceeding Details

E. Take action using ORDERS tab of “Case Details” screen: View issued Order

A. View Additional Notices/Orders

To view issued Notices and Orders, perform following steps:

1. Access the www.gst.gov.in URL. The GST Home page is displayed.

2. Login to the portal with valid credentials.

3. Dashboard page is displayed. Click Dashboard > Services > User Services > View Additional Notices/Orders

4. Additional Notices and Orders page is displayed. Click the View hyperlink to go to the Case Details screen of the issued Notice/Order.

Note: All orders/notices are displayed in descending order. You can search for the orders/notices you want to view using the Navigation buttons provided below.

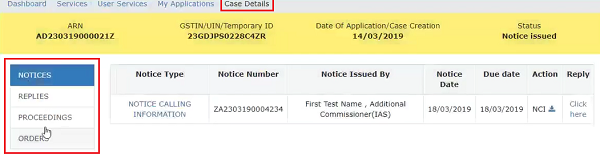

5. Case Details page is displayed. The NOTICES tab is selected by default. Click the tabs provided on the left hand side of the page to view more details about each tab.

B(1). Take action using NOTICES tab of Case Details screen: View issued Notices

To view issued Notices, perform following steps:

1. On the Case Details page of that particular Case ID, select the NOTICES tab, if it is not selected by default. This tab displays all the notices issued by the taxguru.in Enforcement Officer to you.

B(1). Take action using NOTICES tab of Case Details screen: View issued Notices

To view issued Notices, perform following steps:

1. On the Case Details page of that particular Case ID, select the NOTICES tab, if it is not selected by default. This tab displays all the notices issued by the Enforcement Officer to you.

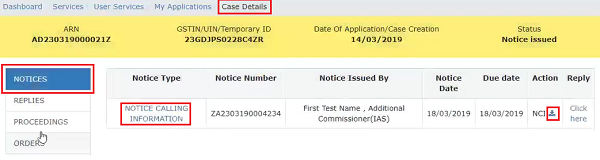

2. Click the hyperlink in the “Notice Type” column to download the issued Notice.

3. Click the download icon in the “Action” column to download the supporting documents that have been attached by the Enforcement Officer, along-with this Notice.

B(2). Take action using NOTICES tab of Case Details screen: File Reply to the Issued Notice

To file your reply to the issued Notices, perform following steps:

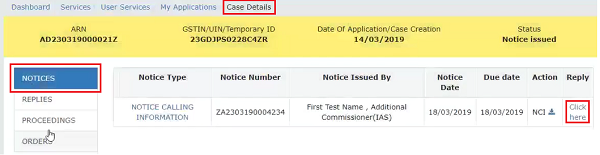

1. On the Case Details page of that particular Case ID, select the NOTICES tab, if it is not selected by default. This tab displays all the notices issued by the Enforcement Officer to you. Click the hyperlink “Click here” in the “Reply” column.

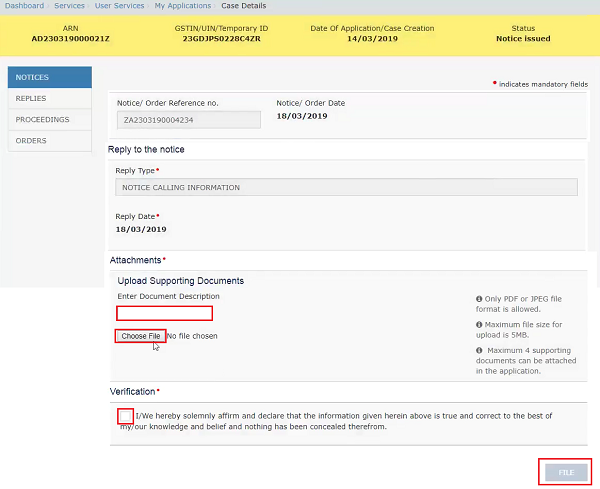

2. REPLY page is displayed. Click BACK to go to the previous page or enter data as mentioned in the following steps.

2a. In the Upload Supporting Documents field, enter document description and click the Choose File button to upload the documents,related to your Reply. ADD DOCUMENT button gets displayed. Click it to upload the document(s) from your machine. You can delete the uploaded document by clicking the DELETE button.

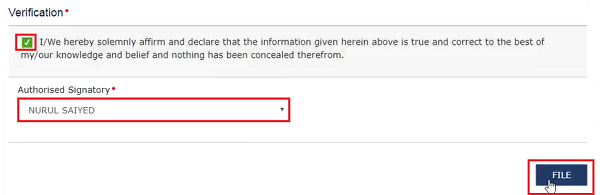

2b. Enter Verification details. Select the declaration check-box and select the name of the authorized signatory. This will enable the FILE button.

2c. Click FILE.

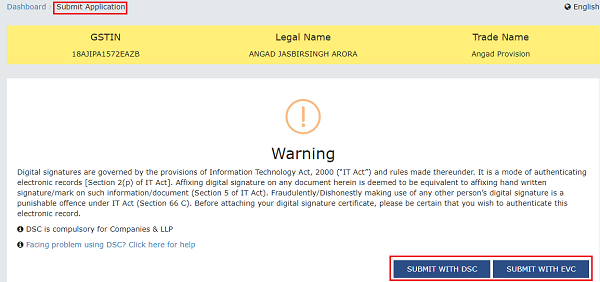

3. Submit Application page is displayed. Click ISSUE WITH DSC or ISSUE WITH EVC.

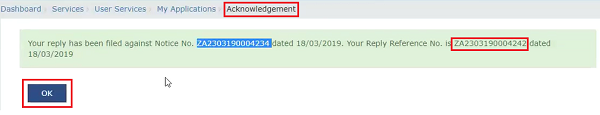

4. Acknowledgement page is displayed with the generated Reference number. Click OK.

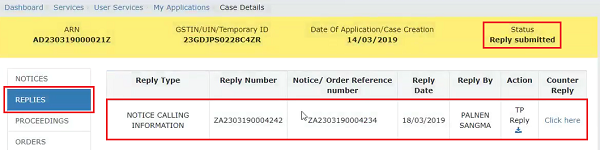

5. The updated REPLIES tab is displayed, with the record of the filed reply in a table and with the Status updated to “Reply submitted”. You can also click the download-icon in the Action section of the table to download your filed reply.

C(1). Take action using REPLIES tab of Case Details screen: View Filed Replies

To view Replies filed against your Case ID by you or the Tax Officials, perform following steps:

1. On the Case Details page of that particular Case ID, click the REPLIES tab.

2. Click the download icon in the “Action” column to download the filed Reply.

C(2). Take action using REPLIES tab of Case Details screen: File Counter-Reply

To file Counter-reply against your Case ID, perform following steps:

1. On the Case Details page of that particular Case ID, click the REPLIES tab.

2. Follow the steps mentioned in B(2). Take action using NOTICES tab of Case Details screen: File Reply to the Issued Notice

D. Take action using PROCEEDINGS tab of Case Details screen: View Proceeding Details

To view Proceeding Details of your Case ID uploaded by the Enforcement Officer, perform following steps:

<This is being developed and will be soon made available>

E. Take action using ORDERS tab of Case Details screen: View Order Issued Against Your Case

To download order issued against your case, perform following steps:

<This is being developed and will be soon made available>

(Republished with amendments)

****

Disclaimer: The contents of this article are for information purposes only and does not constitute an advice or a legal opinion and are personal views of the author. It is based upon relevant law and/or facts available at that point of time and prepared with due accuracy & reliability. Readers are requested to check and refer relevant provisions of statute, latest judicial pronouncements, circulars, clarifications etc before acting on the basis of the above write up. The possibility of other views on the subject matter cannot be ruled out. By the use of the said information, you agree that Author / TaxGuru is not responsible or liable in any manner for the authenticity, accuracy, completeness, errors or any kind of omissions in this piece of information for any action taken thereof. This is not any kind of advertisement or solicitation of work by a professional.