Removal of Denied Entity List (DEL)?

a) If an Authorization holder violates any condition of such Authorization or fails to fulfill export obligation, or fails to deposit the requisite amount within the period specified in demand notice issued by Department of Revenue and /or DGFT, he shall be liable for action in accordance with FT (D&R) Act, the Rules and Orders made there under, FTP and any other law for time being in force.

b) With a view to raising ethical standards and for ease of doing business, DGFT has provided for self-certification system under various schemes. In such cases, applicants shall undertake self-certification with sufficient care and caution in filling up information/particulars. Any information/particulars subsequently found untrue/incorrect will be liable for action under FTDR Act, 1992 and Rules therein in addition to penal action under any other Act/Order.

c) A firm may be placed under Denied Entity List (DEL), by the concerned RA, under the provision of Rule 7 of Foreign Trade (Regulation) Rules, 1993. On issuance of such an order, for reasons to be recorded in writing, a firm may be refused grant or renewal of a license, certificate, scrip or any instrument bestowing financial or fiscal benefits. If a firm is placed under DEL all-new licences, scrips, certificates, instruments etc. will be blocked from printing/ issue/renewal.

d) DEL orders may be placed in abeyance, for reasons to be recorded in writing by the concerned RA. DEL order can be placed in abeyance, for a period not more than 60 days at a time.

e) A firm`s name can be removed from DEL, by the concerned RA for reasons to be recorded in writing, if the firm completes Export Obligation/ pays penalty/ fulfils requirement of Demand Notice(s) issued by the RA/submits documents required by the RA.

DEL online application Process

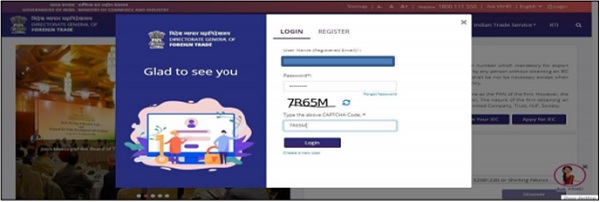

Step 01: Visit the DGFT website (https://www.dgft.gov.in/CP/) and login into the portal with valid credentials

Step 02: Login Click on Services >> IEC Profile Management >> Request Remove from DEL

Step 03: Fill the mandatory fields and with reason and upload the supporting documents

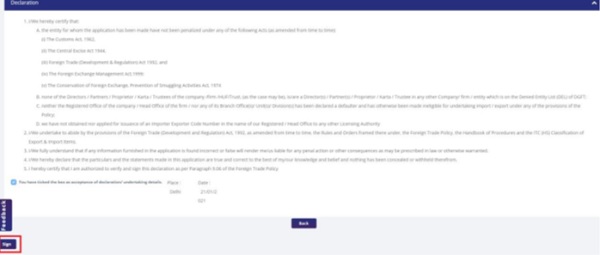

Step 04: User will sign the declaration submit the application with DGFT DSC