Customs Authorized Dealer (AD) Code Stepwise registration procedure

Warning: Undefined variable $show_all_cats in /home/taxguru/public_html/wp-content/themes/tgv5/single.php on line 63

Custom Duty |

Warning: Undefined variable $show_all_types in /home/taxguru/public_html/wp-content/themes/tgv5/single.php on line 71

Articles

Warning: Undefined variable $all_cats in /home/taxguru/public_html/wp-content/themes/tgv5/single.php on line 80

What is AD (Authorized Dealer) Code?

An Authorised Dealer Code (AD Code) is a 07-digit numerical code provided by the bank where your company has a current account. An AD Code must be registered at each port where your products are cleared by customs. During customs clearance, your Customs House Agent (CHA) will request the AD Code for that specific port.

The Importance of the AD Code?

Customs clearance requires a registered AD Code for export. You will be unable to generate your shipping bill number, which is required for customs clearance, if you do not have one. In the absence of a registered AD Code, the ICEGATE portal’s EDI system will not allow the generation of a shipping bill.

If you are qualified for government assistance, an AD Code registration with customs allows you to have the money deposited straight into your bank account. As a result, once you have obtained your Import Export Code, you should register for the AD Code at your customs port(s).

The following documents required for AD Code registration.

- Bank Certificate as Customs public notice no 93/2020 Dt:29.07.2020 (format attached) (https://www.jawaharcustoms.gov.in/pdf/PN-2020/PN-93-2020.pdf)

- Company Pan Card with seal and signature

- IEC Certificate With seal and signature

- GST Certificate with seal and signature

- Company cancelled cheque.

- Class 3 DSC

AD Code registration Procedure step by step as mentioned below.

Step: 1

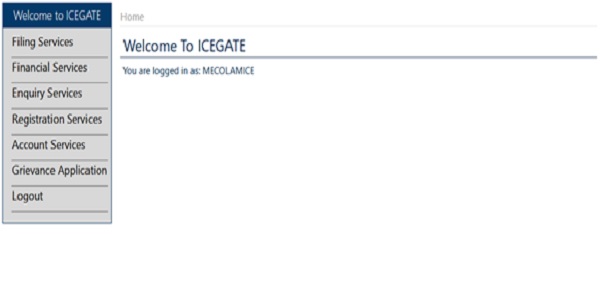

Login to ICEGATE Portal

Step: 02

Click On Filing Services ->Select e-Sanchit.

Step: 03

Upload all supporting documents and generate the DRN and IRN no

Step:04

Once the IRN has been generated, go to the ICEGATE main page and pick financial servicers, then Bank Account Management, and finally AD Code Registration.

Step:04

Once open the AD Code registration fill the required details then submit.

OFFICE OF THE COMMISSIONER OF CUSTOMS (NHAVA SHEVA-I)

JAWAHARLAL NEHRU CUSTOM HOUSE, NHAVA SHEVA,

URAN, RAIGAD, MAHARASHTRA – 400 707 FAX: 022-27243245

e-mail: edi@jawaharcustoms.gov.in

F. No. EDI/ Misc.-154/2017 /JNCH

Date:29.07.2020

Public Notice No.93/2020

SUB: Instructions for uploading documents in E-Sanchit for approval of AD

Code/IFSC with Bank Account in ICES – reg.

Attention of all stakeholders is invited to the Public Notice No. 79/2020 dated 08.07.2020. The Directorate General of Systems, CBIC has now enabled a functionality within ICEGATE login which allows the exporters to make an online request for registration/modification of their AD Code / Bank Account(s) and also electronically submit the required documents through E-Sanchit.

2. The following legible scanned documents are required to be uploaded in E-Sanchit

2.1 Fresh registration of AD Code with Bank Account for the purpose of foreign remittance and IFSC with Bank Account for the purpose of IGST refund /Drawback

(i) Bank authorisation letter in format attached as Annexure-A

(ii) Copy of IEC

(iii) Copy of GST registration Certificate

(iv) Copy of PAN Card of the Company/Partnership Entity

(v) Copy of PAN Card of Authorised Signatory (Director/Partner/Proprietor) in Bank Account

(vi) Copy of cancelled cheque

2.2 Modify/Change in registered IFSC with Bank Account for the purpose of IGST refund/Drawback.

(i) The documents as enlisted at 2.1 (i) to (vi).

(ii) NOC from bank, whose bank account registered in ICES, which is required to be changed.

2.3 The exporters are advised to request the respective Bank to send the abovementioned Bank Authorisation Letter and/or NOC from their branch Email ID directly to the E-mail ID-edi@jawaharcustoms.gov.in, EDI, Section, NS-I JNCH, Nhava-Sheva.

3. In case of non-receipt of Bank Authorisation Letter from the Bank E-mail ID as advised in para 2.3 above, the genuineness of Bank authorisation letter and/or NOC will be cross-checked with the Bank through email by this office after receipt of application through ICEGATE.

4. After verification of the genuineness of the request, the EDI Section shall process the same in the system on the same day.

5. Public Notice No. 103/2018 dated 27.06.2018 is hereby rescinded.

6. Difficulty, if any, in implementation of these instructions should be brought to the notice of the Additional Commissioner (EDI) or Deputy Commissioner (EDI), JNCH immediately.

Sd/-

(Sunil Kumar Mall)

Commissioner of Customs, NS- I

Copy to:

1. The Chief Commissioner of Customs, Mumbai Zone-II, JNCH for information.

2. The Commissioner of Customs, NS-G/ NS-II / NS-III/ NS-IV / NS-V, JNCH.

3. All the Additional/Joint Commissioner of Customs, JNCH, Nhava Sheva.

4. All the Deputy/Assistant Commissioner of Customs, JNCH, Nhava Sheva.

5. Notice Board, JNCH.

6. DC/EDI for Uploading on the JNCH Website.

7. BCBA / FIEO / AIIEO / Other Associations.

8. Office copy.

ANNEXURE-A

BANK AUTHORISATION LETTER

REFERENCE TO Public Notice No 93/2020 dated 29.07.2020

read with PUBLIC NOTICE 79/2020- DATED-08.07.2020,JNCH,

NHAVA-SHEVA, RAIGAD (MAHARASTRA)

It is certified that M/s. …… ……… …….. ….. Address of account holder…………………………………………….. ………………………………………………………… is holding CURRENT/CREDIT ACCOUNT SINCE……………………………… with our Branch. It is also certified that above mentioned name, address and Director/Partner/Proprietor details are matching with IEC…………………………………………………………………… The information of IEC Holder, Bank Account Details are as under:-

1. BANK ACCOUNT NUMBER:

2. AD CODE:

3. IFSC :

4. NAME OF AUTHORISED SIGNATORY (DIRECTOR/PARTNER/PROPIORTOR) IN BANK ACCOUNT:

5. EMAIL ID OF ACCOUNT HOLDER:

6. CONTACT NUMBER OF ACCOUNT HOLDER:

7. NAME OF BANK:

8. NAME OF BRANCH:

9. ADDRESS OF BRANCH:

10. EMAIL ID OF BRANCH:

11. CONTACT NUMBER OF BRANCH:

12. NAME & CODE OF ISSUING AUTHORITY:

Signature of issuing authority

Bank stamp

Email the Bank Authorisation Letter from bank branch mail id to edi@jawaharcustoms.gov.in for registration said AD Code/IFSC with Bank account with Customs for remittance /drawback/IGST refund.

Comments are closed.