EPCG Scheme is a very Beneficial Export Promotion Scheme through which Capital Goods required for Export Production is allowed Duty Free.

Objective

The objective of the EPCG Scheme is to facilitate import of capital goods for producing quality goods and services and enhance India’s manufacturing competitiveness.

As per Para 5.01 of Foreign Trade Policy, EPCG Scheme allows import of capital goods (except those specified in negative list in Appendix 5 F) for pre-production, production and post-production at zero customs duty.

Capital goods imported under EPCG Authorisation for physical exports are also exempt from IGST and Compensation Cess upto 31-03-2019 only

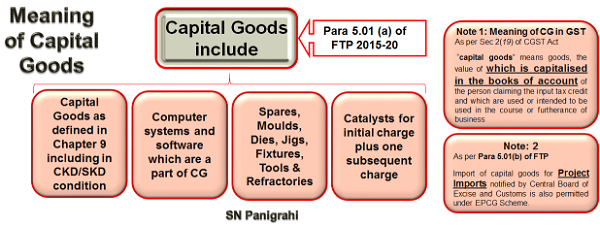

Capital goods for the purpose of the EPCG scheme shall include:

(i) Capital Goods as defined in Chapter 9 including in CKD/SKD condition thereof;

(ii) Computer systems and software which are a part of the Capital Goods being imported;

(iii) Spares, moulds, dies, jigs, fixtures, tools & refractories; and

(iv) Catalysts for initial charge plus one subsequent charge.

Import of capital goods for Project Imports notified by Central Board of Excise and Customs is also permitted under EPCG Scheme.

Page Contents

- Meaning of Capital Goods:

- Coverage of EPCG Scheme

- Intimation of Blockwise Fulfiment of Export Obligation

- Conditions for Export Obligation

- Validity for Import

- Actual User Condition

- Certificate of Installation of Capital Goods

- Indigenous Sourcing of CG: Benefits to Domestic Supplier

- Monitoring of Export Obligation

Meaning of Capital Goods:

Para 9.08 of FTP : “Capital Goods” means any plant, machinery, equipment or accessories required for manufacture or production, either directly or indirectly, of goods or for rendering services, including those required for replacement, modernisation, technological up-gradation or expansion. It includes packaging machinery and equipment, refrigeration equipment, power generating sets, machine tools, equipment and instruments for testing, research and development, quality and pollution control.

Capital goods may be for use in manufacturing, mining, agriculture, aquaculture, animal husbandry, floriculture, horticulture, pisciculture, poultry, sericulture and viticulture as well as for use in services sector.

Coverage of EPCG Scheme

> Manufacturer exporters with or without supporting manufacturer(s),

> Merchant exporters tied to supporting manufacturer(s) and service providers.

> Name of supporting manufacturer(s) shall be endorsed on the EPCG Authorisation before installation of the capital goods in the factory / premises of the supporting manufacturer (s).

> Export Promotion Capital Goods (EPCG) Scheme also covers a service provider who is designated / certified as a Common Service Provider (CSP) by the DGFT, Department of Commerce or State Industrial Infrastructural Corporation in a Town of Export Excellence subject to provisions and conditions of Foreign Trade Policy 2015-2020.

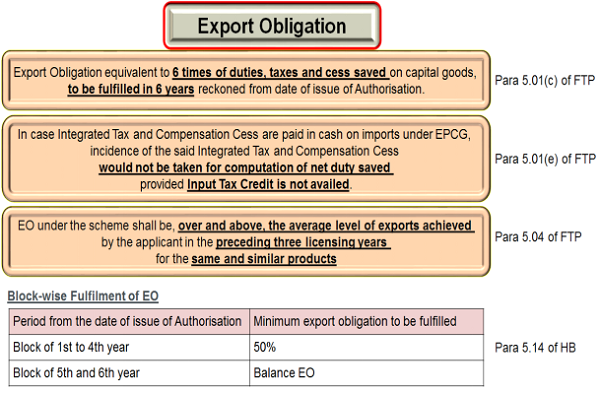

Intimation of Blockwise Fulfiment of Export Obligation

As per Para 5.14 of HBP

(b) The Authorisation holder would intimate the Regional Authority on the fulfilment of the export obligation, as well as average exports, within three months of completion of the block, by secured electronic filing using digital signatures.

(c) Where EO of the first block is not fulfilled in terms of the above proportions, except in cases where the EO prescribed for first block is extended by the Regional Authority subject to payment of composition fee of 2% on duty saved amount proportionate to unfulfilled portion of EO pertaining to the block, the Authorization holder shall, within 3 months from the expiry of the block, pay duties of customs (along with applicable interest as notified by DOR) proportionate to duty saved amount on total unfulfilled EO of the first block.

Conditions for Export Obligation

As per Para 5.04 of FTP :

Following conditions shall apply to the fulfilment of EO:-

(a) EO shall be fulfilled by the authorisation holder through export of goods which are manufactured by him or his supporting manufacturer / services rendered by him, for which the EPCG authorisation has been granted.

(b) EO under the scheme shall be, over and above, the average level of exports achieved by the applicant in the preceding three licensing years for the same and similar products within the overall EO period including extended period, if any; except for categories mentioned in paragraph 5.13(a) of HBP. Such average would be the arithmetic mean of export performance in the preceding three licensing years for same and similar products.

(c) In case of indigenous sourcing of Capital Goods, specific EO shall be 25% less than the EO stipulated in Para 5.01.

(d) Shipments under Advance Authorisation, DFIA, Drawback scheme or reward schemes under Chapter 3 of FTP; would also count for fulfillment of EO under EPCG Scheme.

(e) Export shall be physical export. However, supplies as specified in paragraph 7.02 (a), (b), (e), (f) & (h) of FTP (Deemed Exports) shall also be counted towards fulfillment of export obligation, along with usual benefits available under paragraph 7.03 of FTP.

(f) EO can also be fulfilled by the supply of ITA-I items to DTA, provided realization is in free foreign exchange.

(g) Royalty payments received by the Authorisation holder in freely convertible currency and foreign exchange received for R&D services shall also be counted for discharge under EPCG.

(h) Payment received in rupee terms for such Services as notified in Appendix 5D shall also be counted towards discharge of export obligation under the EPCG scheme.

Validity for Import

Vide Public Notice No. 47/2015-20; Dated the 16th November, 2018, Para 5.01(d) of FTP was amended to extended Validity period for import from 18 months to 24 months.

Actual User Condition

As per Para 5.03 of FTP, Imported CG shall be subject to Actual User condition till export obligation is completed and EODC is granted.

Certificate of Installation of Capital Goods

Public Notice No. 31/2015-20, Dated 29th August, 2018; Dated the 29th August, 2018

Para 5.04(a) of HBP:

Authorization holder shall produce, within six months from date of completion of import, to the concerned RA, a certificate from the jurisdictional Customs authority or an independent Chartered Engineer, at the option of the authorisation holder, confirming installation of capital goods at factory / premises of authorization holder or his supporting manufacturer(s).

The RA may allow one time extension of the said period for producing the certificate by a maximum period of 12 months with a composition fee of Rs.5000/-.

Where the authorisation holder opts for independent Chartered Engineer’s certificate, he shall send a copy of the certificate to the jurisdictional Customs Authority for intimation/record.

Para 5.04(b) of HBP

In the case of import of spares, the installation certificate shall be submitted by the Authorization holder within a period of three years from the date of import.

Shifting of Capital Goods imported under EPCG Scheme

Public Notice No. 31/2015-20, Dated 29th August, 2018; Dated the 29th August, 2018

Para 5.04(a) of HBP:

The authorization holder shall be permitted to shift capital goods during the entire export obligation period to other units mentioned in the IEC and RCMC of the authorization holder subject to production of fresh installation certificate to the RA concerned within six months of the shifting.

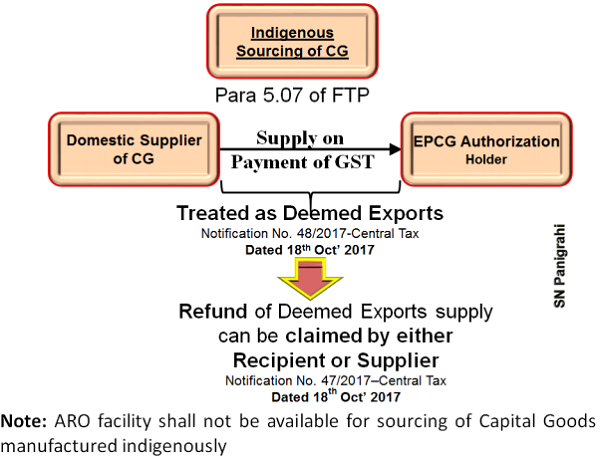

Indigenous Sourcing of CG: Benefits to Domestic Supplier

Para 5.07 of FTP

A person holding an EPCG authorisation may source capital goods from a domestic manufacturer. Such domestic manufacturer shall be eligible for deemed export benefits under paragraph 7.03 of FTP and as may be provided under GST Rules under the category of deemed exports.

Such domestic sourcing shall also be permitted from EOUs and these supplies shall be counted for purpose of fulfilment of positive NFE by said EOU as provided in Para 6.09 (a) of FTP.

The Domestic Supplier to EPCG Authorization holder has to Collect and Pay GST and then claim such GST paid as Deemed Export Refund.

Monitoring of Export Obligation

Para 5.15 of HBP

Authorisation holder shall submit to RA concerned by 30th April of every year, report on fulfilment of export obligation by secured electronic filing using digital signatures/ or hard copy thereof.

Comments :

Though the EPCG Scheme is a beneficial Export Promotion Scheme is most misused scheme, as there is no proper monitoring of Export Obligation. Even after expiry of the authorization no actions are being taken by the Concerned authorities. If the cases are opened up it may turn to be a biggest scam since such defaults are happening in collusion with corrupt officials.

More over the scheme is not WTO Compliant and face any time exit.

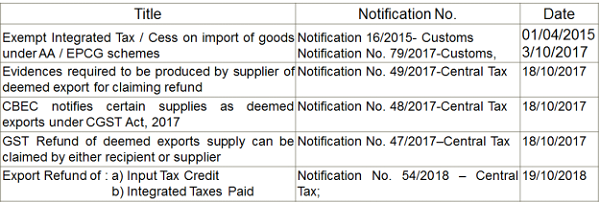

Notifications

For more details please see the You Tube @ the following Link

Disclaimer : The views and opinions; thoughts and assumptions; analysis and conclusions expressed in this article are those of the authors and do not necessarily reflect any legal standing.

Author : SN Panigrahi, GST Consultant, Practitioner, Corporate Trainer & Author

Can be reached @ snpanigrahi1963@gmail.com

Iam a trader and can I mention a EPCG licence nuber of my supplier and make a sales , so that he can take benifit of EPCG

Hi sir,

We have got two EPCG Licence in the year 2013 with value of 11 lacs and 4.20 lacs and for 6 years, completed in the year 2019, we also got extension for two years up to 2021 but now only we got export order with our sister concern, its possible to extend one more year. please clarify.

thanks

Mani

9941628208

SIR

PLEASE ADVISE CAN WE IMPORT SOFTWARE REQUIRED FOR UPGRADATION OF IMPORTED EQUIPMENTS UNDER EPCG

If I am manufacturer selling to one company and he sell to another company in domestic area and the last vender export then can we take benifit of EPCG scheme

Dear Sir,

kindly advise how can we get EPCG license if past exports is Zero.

Need to apply for Pre-production EPCG license but we have not exported our product in last three years.

kindly advise.

Dear Sir,

kindly advise how can we get EPCG license if past exports is Zero.

Need to apply for Pre-production EPCG license but we have not exported our product in last three years.

kindly advise.

Dear Sir,

how can we get EPCG if past export is Zero.

kindly advise.

i AM SUPPLYING PACKING MATERIAL TO EXPORTERS WHETHER I CAN IMPORT MACHINE UNDER EPCB SCHEME AND MY PACKING MATERIAL WILL BE ILIGABLE FOR OBLIGATION FULFILLMENT AS EXPORT

Sir, one of the EPGC Licence holder procure the capital goods from us as treat deemed import. they demand 0% IGST under epgc. this is possible ? please advice