Background:

Article 19 (1)(g) of the Constitution of India gives freedom to practice any profession or to carry on any occupation, trade or business to the citizens of India, there are restrictions on closure of any industrial undertaking. Such restriction is justified on the ground that it is in public interest to prevent unemployment. As a result of such policy there is a freedom to undertake any industrial activity, but there is no freedom to exit.

Jurisdiction:

It extends to the whole of India. Provided that Part III (INSOLVENCY RESOLUTION AND BANKRUPTCY FOR INDIVIDUALS AND PARTNERSHIP FIRMS) of this Code shall not extend to the State of Jammu and Kashmir.

Effectiveness of the Code:

Insolvency & Bankruptcy code, 2016 (IBC) received the assent of president on 28/05/2016. The code has become an Act and provisions will be effective from a date to be notified. Still not date of notification of the same.

Even those different dates may be appointed for different provisions of this Code and any reference in any such provision to the commencement of this Code shall be construed as a reference to the commencement of that provision.

Applicability: The provisions of this Code shall applying relation to their insolvency, liquidation, voluntary liquidation or bankruptcy, as the case may be.

- Companies under Companies Act

- Special Companies under special Act

- Limited Liability Partnerships

- Other body Corporate as notified by CG

- Individuals

- Partnership Firms

Purpose of I & B Code:

The incidence of corporate failure has adverse implications for various stakeholders including the shareholders, creditors, employees, suppliers and customers. Corporate failure can also have a ripple effect on the economy, affecting the solvency of many other businesses. Therefore, it is necessary that there be a highly efficient corporate insolvency regime to improving the Corporate Insolvency in India.

One of the main purposes of this Code is to suggest certain immediate reforms for improving the Corporate Insolvency regime in India.

General Reasons Behind Insolvency:

The main reasons behind insolvency are primarily poor management and financial constraints. This is much more prevalent in smaller companies. Specifically, the reasons are:

- Market – Company did not recognize the need for change

- Bad debts – obviously money owed by customers

- Management – failure to acquire adequate skills, imprudent accounting, lack of information systems

- Finance – loss of long term finance, over gearing or lack of cash flow

- Knock on effect – i.e. from other insolvencies

- Other – for example excessive overheads etc

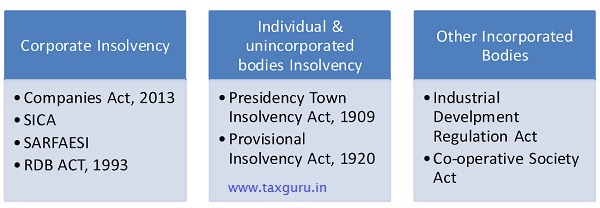

THE LEGAL LANDSCAPE

‘Bankruptcy and Insolvency’ falls in List III i.e. concurrent list. Therefore both the state as well as the centre has the power to make law on the subject. In case of conflict between laws made by the Parliament and State Legislature the parliamentary law will prevail. The stream of insolvency laws in India can be segregated under following heads:

A. Companies

There are three laws (Companies Acts of 1956 and 2013; and Sick industrial Companies Act 1985) which handle the corporate insolvency procedures in India.

REVIVAL AND REHABILITATION OF SICK COMPANIES:-

The Sick Industrial Companies (Special Provisions) Act, 1985 (“SICA”) remains to date the only Central rescue law in force (although, it applies to industrial

Companies only). This is because other legislative attempts to overhaul the corporate rescue regime in India have not been made operational yet.

*THE SICK STORY*. _*Sick Companies provisions were themselves sick.*_

Following enactments were brought in:-

1. SICA -1985 read with 1991 &1993 Amendment

2. Companies (Amendment ) Act, 2002_ – Chapter VIA of the CA 1956, inserted by the Companies (Second Amendment) Act, 2002, which provided for the National Company Law Tribunal (“NCLT”) to exercise powers in relation to sick industrial companies could not be notified for commencement because the operationalization of the NCLT remained entangled in litigation

3. SICA (Special Provision) Repeal, Act – Not yet effective & now amended by IBC

4. Companies Act, 2013- Never made effective & now omitted by IBC

5. IBC – provisions to be notified

Therefore, as of today, all aspects of rehabilitation of sick/potentially sick industrial companies continue to be governed by SICA and there is no similar statutory rescue mechanism for other categories of companies (other than mechanisms under certain statutes applicable to banking companies and some State Relief Undertaking Acts.

LIQUIDATION/WINDING-UP OF COMPANIES:-

The current legal framework governing the winding-up of companies is contained in the CA 1956. The provisions contained in Chapter XX of the CA 2013 relating to winding up of companies have not been notified yet. The winding up proceedings under the CA 1956 are carried out voluntarily (members’ voluntary liquidation, which is a liquidation procedure for solvent companies, and creditors’ voluntary liquidation), or compulsorily by the High Court. It may be noted that insolvency of a company is only one of the grounds for compulsory winding up a company. I & B code, 2016 delete all the section of Voluntary winding up from the Companies Act, 2013.

| S. No. | Section | Particulars |

| Complete process of Voluntary Winding up | ||

| 1. | 304 | Circumstances in which company may be wound up voluntarily |

| 2. | 305 | Declaration of Solvency in case of proposal to wind up voluntarily |

| 3. | 306 | Meeting of creditors |

| 4. | 307 | Publication of Resolution to wind up voluntarily |

| 5. | 308 | Commencement of voluntary Winding up |

| 6. | 309 | Effect of Voluntary Winding up |

| 7. | 310 | Appointment of Company Liquidator |

| 8. | 311 | Power to remove and fill the vacancy of company liquidator |

| 9. | 312 | Notice of appointment of company Liquidator to be given to the Registrar |

| 10. | 313 | Cesser of Board’s Power on appointment of company liquidator |

| 11. | 314 | Power and duties of Company Liquidator in Voluntary Winding up |

| 12. | 315 | Appointment of Commitees |

| 13. | 316 | Company Liquidator to submit the report on progress of winding up |

| 14. | 317 | Report of Company Liquidator to Tribunal for the Examination of persons |

| 15. | 318 | Final meeting and dissolution of the company |

| 16. | 319 | Power of company liquidator to accept the shares etc. as the consideration for the sale of property of the company |

| 17. | 320 | Distribution of the property of the company |

| 18. | 321 | Arrangement when binding on Company and liquidator |

| 19. | 322 | Power to apply to Tribunal to have questions determined Cost of Voluntary Winding Up |

| 20. | 323 | Cost of Volunary winding Up |

| 21. | 325 | Application of insolvency rules in winding up of insolvent Companies. |

| 22. | The heading “Part II.—Voluntary winding up” shall be omitted | |

| 23. | 342(2)(3)(4) | Prosecution of delinquent officers and members of Company. |

B. Individual and Partnership

Personal insolvency is preliminary governed under two acts in Indi:

i. The Presidency Towns Insolvency Act, 1909 (for the erstwhile presidency towns, i.e. Kolkata, Mumbai and Chennai) and

ii. The Provincial Insolvency Act, 1920 (for the rest of India).

Though above are the Central Law, it should be noted that both these Acts have a number of state specific amendments. The substantive provisions under the two Acts are largely similar. There have not been any substantial changes to this regime over the years and it has proved to be largely ineffective in practice

Limited Liability Partnership: The Limited Liability Partnership Act, 2008 includes provisions not only related to winding up and dissolution of a LLP but also compromise, arrangement or reconstruction of LLP. In addition, the LLP Rules, 2012 contain detailed provision regarding the procedure of winding up and dissolution of LLP in various circumstance, including insolvency.

C. Co-operative Society

Co-operative societies fall under the State List in the Constitution and there are State specific legislations for co-operative societies which often include provisions relating to winding up. In addition,

- The Co-operative Societies Act, 1912 and

- The Multi-State Co-operative Societies Act, 200212,

which are both central acts, also include provisions for the dissolution and winding up of co-operative societies registered under them. However, these Acts do not provide for the rehabilitation or revival of sick co-operative societies.

ASSET RECONSTRUCTION UNDER THE SARFAESI ACT:-

The SARFAESI Act envisages specialized resolution agencies in the form of Asset

Reconstruction Companies to resolve Non-performing Assets and other specified bank loan under distress. This mechanism is largely seen as a debt recovery tool and not an insolvency resolution tool (i.e. it does not facilitate rescue in practice).

DEBT ENFORCEMENT/ RECOVERY:-

The RDDBI Act set up the framework for the establishment of Debt Recovery Tribunals (“DRTs”) and the Debt Recovery Appellate Tribunals (“DRATs”) in India. The primary objective of RDDBFI Act was to ensure speedy adjudication of cases concerning recovery of debts due to banks and notified financial institutions. Cases pending before the civil courts where the debt amount exceeded Rs 10,00,000 were automatically transferred to DRT. There are some key differences between DRTs and ordinary civil courts.

STATE RELIEF UNDERTAKING ACTS:-

Several State governments have their own Relief Undertaking legislations that seek to provide for rehabilitation of sick undertakings established or funded by the government. Many such legislations were specifically enacted for the purpose of preventing unemployment (and thus allowed many unviable businesses to continue operating even at the cost of creditors).

THE INDUSTRIES DEVELOPMENT AND REGULATION ACT, 1951

It may be noted that the Central Government is authorised to take-over the management of a scheduled industrial company under the Industries Development and Regulation Act, 1951 several grounds and provide relief similar to those available under insolvency laws (suspension of claims etc.)

Present nature of Insolvency Process in India

Conclusion:-

Though there are no prefect laws and bankruptcy code anywhere in the world, the presence of a strong framework is essential to deal with corporate insolvency and creditor and debtor protection in a hassle-free manner. The Insolvency and Bankruptcy Code would provide such environment to ensure easy exit for sick companies and help the country to improve its position in easy of doing business.

(Author – CS Divesh Goyal, ACS is a Company Secretary in Practice from Delhi and can be contacted at csdiveshgoyal@gmail.com)

(Author – CS Divesh Goyal, ACS is a Company Secretary in Practice from Delhi and can be contacted at csdiveshgoyal@gmail.com)

Read Other Articles Written by CS Divesh Goyal

Disclaimer: The entire contents of this document have been prepared on the basis of relevant provisions and as per the information existing at the time of the preparation. The observations of the author are personal view and the authors do not take responsibility of the same and this cannot be quoted before any authority without the written consent of the author.

Do the Provisions of IB Code apply to a society registered under the Societies Registration Act