As you know an insurance is a means of protection from financial loss. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. Through insurance we analyse, evaluate, estimate and transfer outcomes of risk/perils to the insurance company. The insurance company generally in lieu of small payment called “Premium” issue an insurance policy( insurance contract) by insuring specified risks/perils. Please note that insurance company indemnified us in case of financial loss on happening of those insured risks/perils.

An entity which provides insurance is known as an insurer, an insurance company, an insurance carrier or an underwriter.

The insurance companies also have to secure themselves against large claim for its sustainability and make profit. The Re-insurance concept is insurance of insurance companies. In this process the original insurance company share (subject to its retention) a large portion of stake to other insurance company or they contract with another insurance company to underwrite its proposal in case of large sum assured.

In this case if insurers finds that they have entered into a contract of insurance which is an expensive proposition for them or if they wish to minimise the chances of any possible loss , without ,at the same time giving up the contract, resort to have a devise called reinsurance.

Please note that “ Re-insurance Contract” is between the re-insured and the re-insurer, the assured has nothin to do with it, except so far as it guarantees him against default by his own re-insurance. He cannot sue on it. But the re-insurer’s liability would be discharged by the payment to the assured of the amount at the time of loss. The Original Contract of Insurance and Re-insurance Contracts are two distinct contracts and the re-assured remains solely liable on the original insurance and alone has any claim against the re-insurer.

A policy of re-insurance stipulates for payment by the re-insurer “ as may be paid” by the re-insured. This means that the liability of the re-insurer is coextensive with the liability of insurers.

When the loss or the event insured against occurs, the liability of the re-insurer under the policy of re-insurance comes into existence but the re-insurer shall have to be satisfied by evidence or admission before they may called upon to indemnify the reinsured. It means an re-insurer have all rights to ask evidences and asked by the insurer against a claim from the insured to verify genuineness of the claim.

The liability of re-insurer becomes fixed as soon as the amount payable under original policy is admitted and ascertained. Ex-gratia payments do not bind re-insurer and note that under a policy of re-insurance ,if insurer pay any ex-gratia payment to the original insured ,then re-insurer is not liable to pay his share in the Ex-gratia payment.

Please Note That– in case of an re-insurance contract , the insurer is bound to prove the loss against the re-insurer in the same manner as the original insurer must have proved against him irrespective of the fact whether the insurer has paid the insured or not. [Re,London county commercial Re-insurance Office(1922), 2 Ch 67].

LIMITATION OF TRADITIONAL INSURANCE METHODS:

The inefficiencies of traditional insurance have contributed substantially to the development of Alternative Risk Transfer . An analysis of the costs of traditional insurance covers shows that the difference between the premium and the expected value of the loss is comparatively high. This is often explained as a result of the information asymmetry between (re)insurers and policyholders.

Traditional insurance prices are arrived at, on the basis of average risks, and are therefore higher than the risk-adjusted premium rates for good risks. As a result, good risks are becoming increasingly reluctant to cross-subsidise bad risks, and are turning to self- insurance instead. As such there is inequity in rating. With insurance there is a danger that the policyholder has little incentive to prevent or contain a loss, which means the insurer has to demand a higher average premium (moral hazard problem).

In the case of self- financing, the policyholder has a direct incentive to adopt suitable risk management measures to prevent losses to a reasonable level. Moreover as a result of this phenomenon (moral hazard) insurance companies have set high deductibles (first loss amount met by the insured), which have resulted in the diminishing marginal utility of insureds, because intuitively, risk transfer fails.

Various ART solutions eliminate the problem of moral hazard by defining the loss event on the basis of an independent index or a physical event. However there arises a new phenomenon of basis risk.

There is usually capacity constraint in the industry. Some risks are well understood but considered uninsurable due to their sheer size. For example some natural catastrophe scenarios range from USD50 billion to USD100 billion, depending on the location and intensity of the event. Commodity risks and financial risks aggregate exposures of magnitudes that challenge the capital strength of many commercial insurers. Securitisation for example can supplement the capacity of the commercial insurance market by tapping directly into the capital markets. Other ART products shift the focus from risk transfer to risk financing and hence increasing the scope of risk management solutions.

WHAT IS ALTERNATE RISK TRANSFER -LET’S DISCUSS ; ART is an umbrella term for a range of products, other than conventional annual insurance or reinsurance, which handle financial risk. Generally, these products import techniques, attitudes and language from corporate finance and the capital markets into areas normally dominated by insurers, or vice versa.

Alternative risk transfer (ART) refers to the products and solutions that represent the convergence or integration of capital markets and traditional insurance. The increasingly diverse set of offerings in the ART world has broadened the range of solutions available to corporate risk managers for controlling undesired risks, increased competition amongst providers of risk transfer products and services, and heightened awareness by corporate treasurers about the fundamental relations between corporation finance and risk management. [https://link.springer.com/chapter/10.1007/3-540-26993-2_18].

INVESTOPEDIA– The alternative risk transfer (ART) market is a portion of the insurance market that allows companies to purchase coverage and transfer risk without having to use traditional commercial insurance. The ART market includes risk retention groups (RRGs), insurance pools, and captive insurers, wholly-owned subsidiary companies that provide risk mitigation to its parent company or a group of related companies.

- The alternative risk transfer (ART) market allows companies to purchase coverage and transfer risk without having to use traditional commercial insurance.

- The ART market includes risk retention groups (RRGs), insurance pools, captive insurers, and alternative insurance products.

- Self-insurance is a form of alternative risk transfer when an entity chooses to fund their own losses rather than pay insurance premiums to a third party.

A number of insurance products are available on the ART market, such as contingent capital, derivatives, and insurance-linked securities.

EXAMPLES OF ART

- Securitisation and insurance derivatives

- Insuratisation

- Finite and financial reinsurance

- Captives

1. Insurance Securitisation

Transferring bundles of risk directly to the capital markets

2. Insuratisation

i) Using insurance capital and skills to price and assume banking risk

ii) Expands the insurable universe of risk towards the inclusion of any surprise which can impact corporate earnings

a) Revenue guarantee

b) Residual value

c) Credit derivatives

d) Enterprise risk.

3. Finite

Usually multi-year contracts in which the loss experience and time value of money is explicit.

4. Captives and protected cells

Businesses bundle up their risks before transfer to reinsurers or the capital markets.

We an insurance company generally secure its financial security arising from policy claims through re-insurance and retrocession. These are the traditional methods of financial security , but through passes of time , there are various products available in the market , by utilising those a insurance company transfer its risks or pay its liabilities arising in future by utilising capital market instruments and derivatives. The Alternative Risk Financing market is a huge market.

This is not replacement in whole or part of the regular and traditional insurance market but it plays as an Alternate Market for the insurance Companies. It relegates insurance to just one of a complete range of risk financing techniques and is transforming the insurance industry to deal with hitherto uninsurable business risks such as fluctuation in interest rates, rate in foreign exchange, temperature fluctuation and commodity prices.

The new forms are financial hybrid and their intention is to cover a customised combination of ;

1. Event Risks ( natural disaster etc.) and;

2. Financial Risks ( interest rates fluctuation, foreign exchange fluctuation, commodity prices, etc.).

ALTERNATIVE TRANSFER includes alternative type of risk carriers such as –

1. Self Insurance;

2. Risk Retention Groups ;

3. Pools ; and

4. Captive Insurance Company, rent-a-captive insurance company and protected cell insurance companies;

5. Finite or Financial Insurance;

6. Muti year ,multi line ,aggregate or blended or integrated programme.

Please Note That : – Self Insurance, Risk Retention Groups and Pools are largely US based concepts for ART.

1. SELF INSURANCE- it is a retained level of deductible. This can be through a mutual group or pool within an association o body to share retained risk. This can also be a fund constituted to address a loss if it were to occur. Self-insure is a risk management technique in which a company or individual sets aside a pool of money to be used to remedy an unexpected loss. Theoretically, one can self-insure against any type of damage (like from flood or fire) In practice, however, most people choose to purchase insurance against potentially significant, infrequent losses. Self-insuring against certain losses may be more economical than buying insurance from a third party. The more predictable and smaller the loss is, the more likely it is that an individual or firm will choose to self-insure.

For example, the owners of a building situated a top a hill adjacent to a floodplain may opt against paying costly annual premiums for flood insurance. Instead, they choose to set aside money for repairs to the building if in the relatively unlikely event floodwaters rose high enough to damage their building. If this occurred, the owners would be responsible to pay out-of-pocket for damages caused by a natural disaster, like a flood. [https://www.investopedia.com/terms/s/self-insure.asp]

2. RISK RETENTION GROUPS It was originated in US Market ,it is a corporation owned and operated by insurance companies , that band together as self-insurers and form an organisation that is chartered and licensed as an insurer in at least one state of US to handle liability insurance. In the US it addresses gaps in liability cover for its members such as for medical malpractices.

A risk retention group (RRG) is a state-chartered insurance company that insures commercial businesses and government entities against liability risks. Risk retention groups were created by the federal Liability Risk Retention Act, a federal law created in 1986( in US) . A member of a risk retention group must be a business.

Risk retention groups are treated differently from traditional insurance companies. They are exempted from having to obtain a state license in every state in which they operate, and also are exempt from state laws that regulate insurance.

For example, a risk retention group is exempt from having to contribute to state guaranty funds, which can lower premium costs but can also increase the possibility that policyholders will not have access to state funds in the event of group failure. All policies issued by a risk retention group are federally required to include a warning indicating that the policy is not regulated the same as regular policies.

Risk retention groups are mutual companies, meaning that they are owned by the members of the group. They can be licensed as a standard mutual insurer, but they can also be licensed as a captive insurer, which is a company organized by a parent company specifically to provide insurance coverage to the parent company.

Examples of risks protected by RRG policies include medical and legal malpractice, however, property damage caused by a flood is not a covered risk. Policies can be owned by a group of individuals, such as a law firm, but they can also be purchased by public universities or county administrations.

Members of an RRG must be engaged in similar activities or related with respect to liability exposures by virtue of any related or common business exposure, trade, product, service, or premise.

The number of risk retention groups is likely to increase when insurance is either unavailable or unaffordable. While they may be popular in some business climates they still must follow certain state regulations, including non-discrimination and anti-fraud requirements. Risk retention groups may also be required to provide regulators with more information about their financials in order to ensure that they are financially solvent. [https://www.investopedia.com/terms/r/risk-retention-group-rrg.asp]

Benefits of Risk Retention Groups

- Program control

- Long-term rate stability

- Customized Loss control and risk management practices

- Dividends for good loss experience

- Access to reinsurance markets

- Stable source of liability coverage at affordable rates

- Multi-state operations.

3. POOLS: A group of insurance companies that pools assets, enabling them to provide an amount of insurance substantially more than can be provided by individual companies to ensure large risks such as nuclear power stations are protected.

Insuranceopedia defines An insurance pool is a gathering of insurance companies for a specific business endeavor, usually when a financial risk is too high for a single company to take on and can only be addressed through shared resources. When a financial risk is too high or even catastrophic for one company’s financial status, companies can band together to form an insurance pool. These companies combine their resources as a form of risk management.

Companies might, for example, form an insurance pool to provide earthquake insurance in an earthquake-prone area. Or they may band together to provide insurance to people with serious medical problems.

Businesses can also create their own insurance pools rather than having insurance companies provide them with their insurance needs. They form, in essence, an insurance community and create their own insurance programs that might be more sustainable and affordable than the ones offered by insurance companies.

WIKIPEDIA defines as – A “Risk pool” is a form of risk management that is mostly practiced by insurance companies, which come together to form a pool to provide protection to insurance companies against catastrophic risks such as floods or earthquakes. The term is also used to describe the pooling of similar risks within the concept of insurance. It is basically like multiple insurance companies coming together to form one. While risk pooling is necessary for insurance to work, not all risks can be effectively pooled in a voluntary insurance bracket unless there is a subsidy available to encourage participation.

Risk pooling is an important concept in supply chain management. Risk pooling suggests that demand variability is reduced if one aggregates demand across locations because as demand is aggregated across different locations, it becomes more likely that high demand from one customer will be offset by low demand from another. The reduction in variability allows a decrease in safety stock and therefore reduces average Inventory.

For example, in the centralized distribution system, the warehouse serves all customers, which leads to a reduction in variability measured by either the standard deviation or the coefficient of variation.

The three critical points to risk pooling are:

1. Centralized inventory saves safety stock and average inventory in the system.

2. When demands from markets are negatively correlated, the higher the coefficient of variation, the greater the benefit obtained from centralized systems; that is, the greater the benefit from risk pooling.

3. The benefits from risk pooling depend directly on relative market behavior. If two markets are competing when demand from both markets are more or less than the average demand, the demands from the market are said to be positively correlated. Thus, the benefits derived from risk pooling decreases as the correlation between demands from both markets becomes more positive.

4. CAPTIVES: is an insurer created and wholly owned by its sponsors to provide a facility to aggregate , insure and reinsure only their risks. This process is a legal and adopted in most of countries.

Investopedia defines – A captive insurance company is a wholly-owned subsidiary insurer that provides risk-mitigation services for its parent company or a group of related companies. A captive insurance company may be formed if the parent company cannot find a suitable outside firm to insure them against particular business risks, if the premiums paid to the captive insurer create tax savings, if the insurance provided is more affordable, or if it offers better coverage for the parent company’s risks.

Please Note That : The insurance companies forming Captives as its wholly owned subsidiary and to lower company’s insurance cost and provide more specific coverages, but also comes with additional overhead of running a distinct insurer. The main act of these Captives is to writing insurance policies of parent company or parent group companies. It does not insure any other company than its parent and parent group companies. This is a mode of tax savings for the parent companies.

IT MEANS THAT – A “captive insurer” is generally defined as an insurance company that is wholly owned and controlled by its insureds; its primary purpose is to insure the risks of its owners, and its insureds benefit from the captive insurer’s underwriting profits.

These points do not clearly distinguish the captive insurer from a mutual insurance company. A mutual insurance company is technically owned and controlled by its policyholders. But no one who is merely a mutual insurance company’s policyholder exercises control of the company. The policyholder may be asked to vote on matters requiring policyholder action. But this usually means that the policyholder will be presented with a proxy and advised by the board that runs the company as to how to exercise its vote. As soon as the insurance ceases, so does the policyholder’s ownership status. The policyholder has not invested any assets in the insurance company and does not actively participate in running it.

Captive insurance is utilized by insureds that choose to

- put their own capital at risk by creating their own insurance company,

- working outside of the commercial insurance marketplace,

- to achieve their risk financing objectives.

Reviewing these three essential features of captive insurance will help to clarify the nature of a captive insurance company.

FEATURES OF ALTERNATIVE RISK TRANSFER PRODUCTS;

Alternative Risk Transfer techniques have evolved over the last fifty years, and it would seem they have endured the test of time, and are not a fashion—that easily fades away, but are a fashionable risk management tool that will carry the insurance industry into the twenty-first century. It becomes imperative that the origins of ART be traced. This probing will unravel the motivation behind the use of ART techniques, the forms it take and the functionality of the ART products.

The key features of ART solutions that have evolved over the years can be enumerated as follows:

1. Tailored to specific problems.

2. Multi-year, multi-line cover.

3. Spread of risk over time and within a policyholder’s portfolio. This is what makes the assumption of traditionally uninsurable risks possible.

4. Risk assumption by non- (re)insurers.

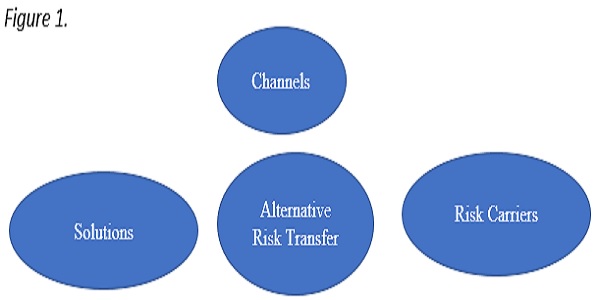

Factoring into account these attributes, the domain of ART techniques is as depicted in Figure 1.

Firstly, alternative distribution channel to specialised direct insurers and reinsurers are for example companies’ own captives, which are potential purchasers of traditional and/or alternative risk transfers products.

Secondly alternative solutions embrace finite risk products whose main aim emphasis is on financing rather than the transfer of risks. Multi-year contracts also play an increasingly important role.

These solutions combine different classes of insurance such as property and casualty risks. Although these products are not essentially new, they are considered to be alternative as they provide the basis for wider ranging covers. These solutions bundle together insurance, finance and in some cases general business risks as well, in the form of multi- year contracts with aggregate retentions.

Other covers that fall into the category of alternative solutions include multi-trigger products, i.e. those which only come into play if insurance and non-insurance loss events occur simultaneously within a specific time frame as well as financing of losses at conditions agreed upon in advance (contingent capital.) Lastly, alternative risk carriers are ultimately capital market investors directly involved in insurance risks. These mainly concern insurance—linked bonds and derivatives.

PLEASE NOTE THAT It is instructive to note that ART techniques have evolved to be used by insurance companies, to satisfy the insured and have also evolved to be used by reinsurance companies to satisfy the requirements of insurance companies. As such there are two forms of ART solutions, one peculiar to the cedant and the other peculiar to the insured, in other words, the two classes are—

- insurance alternative risk transfer and

- reinsurance alternative risk transfer.

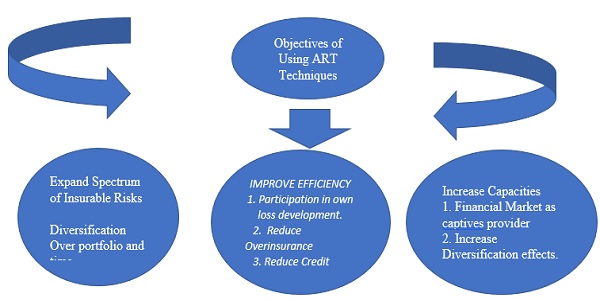

Thus the point of convergence for all ART techniques can be enumerated as in Figure 2 below.

REASONS FOR USE OF ART PRODUCTS;

The salient features of Alternative Risk Financing techniques are that the primary objective is that they are developed to complement those already in use in order to improve efficiency of risk transfer. The second goal is to expand the spectrum of insurable risks. The third goal is to generate additional capacity via the capital markets.

Increasingly since the 1960’s larger corporations have created and used their own in house operation, primarily as a means of co-ordinating insurance buying across the global enterprise. It is found that the earliest forms of ART programmes developed in response to the hard insurance markets. Companies turned to large deductible, loss sensitive rating and retrospective rating insurance programmes to gain independence. This led to the development of wholly owned offshore captives for large corporations and rent-a-captive for small to medium size companies. Please note that, in the hard insurance, high- interest environment of the early 1990’s finite programmes emerged as another finance tool.

The motives behind finite programme were similar to captives with additional tax and financial benefits.

In the main there are three types of such techniques—

1. finite risk insurance,

2. insurance derivatives and

3. securitisation of insurance risks directly on to the capital markets.

What is instructive to note is that finite programmes began the trend towards a more holistic approach to risk while facilitating the creation of sophisticated coverages that blurred the lines between financial and insurance markets.

According to Culp (2002) finite risk insurances and financial insurances are an extension of conventional insurance in that the contracts typically last for three to five years and they often involve a packaging of different kinds of insurance including some risks that are difficult to place.

In addition, finite risk insurance usually poses a profit sharing feature such that if the claims costs of the corporation vary unexpectedly there is some form of ex post adjustment in the premium cost. Because of its tailor made character finite risk insurance represented an attempt by insurance companies to develop longer-term risk sharing relationships with corporations. As the name implies, there are limits to the degree of risk transfer in finite risk programs and thus they provide a mezzanine layer of risk financing between self-insurance and conventional types of insurance.

Further, Doherty (2000b) contends that insurance derivatives evolved in the mid 1990’s. For a long time, insurance had been seen as a potential area of product development for derivatives, in part because a conventional contract can theoretically be seen as a put option sold by an insurance company. However the development of derivatives as a mechanism of risk financing for corporate risks has been limited for two main reasons.

1. Firstly there are no suitable indices on which derivatives can be based.

2. Secondly derivatives require that the underlying economic variable being tracked is relatively homogeneous.

This requirement is often not met for-corporate insurance risks since these represent a heterogeneous bundle of risks many of which may be specific to an industry.

In 2000 the only active traded derivative market, was the property catastrophe options market at the Chicago Board of Trade and the Catastrophe Risk Exchange (CATEX) in New York. More recently weather derivatives have been introduced based on indices of rainfall, snowfall and temperature.

One of the latest ART solutions relates to the securitisation of insurance risks directly onto the capital markets. Growth there is likely to continue in the longer term especially for longer-term potential losses facing corporations and for important projects. Two mechanisms for securitisation have evolved, one based on bond instruments and the other on equity instruments. Specialist divisions of insurers and brokers have often collaborated with investment banks to develop tailor made products for corporations to transfer their risks on to the capital markets.

Doherty (2000b) goes on to say that the risk securitisation is likely to expand in the future and companies might switch from bond based to equity based instruments. The theoretical advantage of equity-based instruments is that they are a form of Just-In-Time (JIT) capital, since capital is only raised when a large loss takes place. Equity based products extend the concept of contingent capital that exists in conventional insurance and thus has the effect of removing the capital cost constraint imposed on insurance and reinsurance companies.

The Alternative Risk Transfer sector has continued to grow in leaps and bounds over the years. All of these classes have exhibited significant and continuous growth, despite the soft market conditions prevailing.

CONCLUSION: The opinion from above discussion is that, ART solutions are an innovation that will stand the test of time. They are not a fashion that is going to fade away, but will endure forever. They are a must buy for corporates, insurance and reinsurance companies. The growth of the insurance industry is going to be largely underpinned by the development of the ART segment. Insurance companies should embrace ART techniques as they the crown jewels in the risk management arena. They must be best understood as compliments rather than substitutes of the traditional insurance products. The insurance companies must realise that the paradigm is shifting from indemnity to that of value creation. There must be a realisation that ‘a risk is a risk’ and as such it must be treated as such. The very basis of insurance is to provide risk protection.

In a highly competitive environment where other financial players such as banking institution are waiting on the wings, to invade the insurance terrain, it would be folly for insurance companies to decline risks and categorise them as uninsurable. This would create gaps in the market and they would have afforded the other players to attack their segment. There have been lost opportunities, which should never have been. It is important for insurance companies to shift not all but major part of their risks on these ART products. By shifting some part of risk on capital market products they will improve their profitability and create value addition in their capital exposures. The ART products will provide a vide an opportunity to the insurance companies to retain more and more risk exposures and cede less premium to re-insurers , this way they retain and increase their solvency margins and profitability respectively.

DISCLAIMER: above article is an attempt to provide information and knowledge to readers. The article has been prepared on the basis of information available on various forums at the time of preparation. The views expressed are the personal views of the author and same should not be considered as professional advice. In case of necessity do consult with Insurance Advisors.

Footnotes:

1. http://www.virtusinterpress.org/IMG/pdf/10-22495_rgcv5i4c1art11.pdf

2. Re,London county commercial Re-insurance Office(1922), 2 Ch 67.

3. https://www.captive.com/captives-101/what-is-captive-insurance.

4. https://en.m.wikipedia.org/wiki/Risk_pool

5. https://www.insuranceopedia.com/definition/2425/insurance-pool