Federation Of All India Vyapar Mandal requested Ministry of Corporate Affairs that to facilitate small and startups who are willing to carry on their businesses in organized sector, it is further requested that the form INC-22A last date of which is 25th April and DIR- 3 last date of which is 30th April, may kindly be deferred for the time being and same may be merged with Annual Return which is filed by 30th November every year.

FEDERATION OF ALL INDIA VYAPAR MANDAL

FAIVM/1904/MCA/068-070

April 23 , 2019

Chief Executive Officer

NITI Aayog

Sansad Marg

New Delhi 110001

Secretary,

Department for Promotion of Industry and Internal Trade

Ministry of Commerce and Industry

Government of India

Udyog Bhawan

New Delhi

Sub : 1. For ease of doing Business for domestic and small , various forms being filed with MCA portal to be merged with Annual Return.

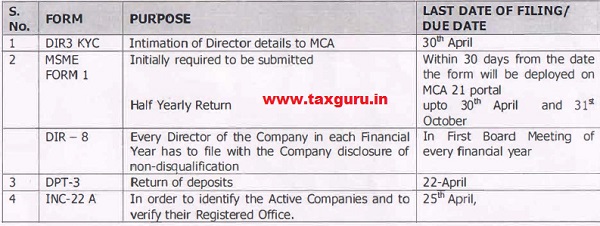

2. Dates for INC 22A and DIR 3 to be deferred

We invite your kind attention to recently notified Rule 25A of Companies (Incorporation) Rules, 2014 notified by the Government of India, as per the form INC-22A – ACTIVE (Active Company Tagging Identities and Verification). The details of the status of their registered offices and their geographical location (latitude and longitude) will be sent to the government by April 25. In this month again DIR-3 needs to be filed by 30th April Apart from above, there are few other information and returns which are filed /provided on different time to Registrar of Companies through MCA portal.

There is no objection in the pursuance of the aforesaid law, but businessmen have difficulty in adhering to new rules regularly every month. About 12 lakh companies are active in India, which at the time gives their income tax, GST, annual statement of company law etc. to the government.

Today, when we talk about Digital India or talk about encouraging startup, filing of pictures and locations of registered office seems contradictory.

The Government is working hard to push unorganized sector, most of which is done as a business proprietorship and partnership form, to the organised sector, which is mainly done as a company in the business. If this kind of burden of compliance is put on entrepreneurs, they will be reluctant to do business in organized sector.

MCA put it mandatory to get every form digitally verified by practicing Chartered Accountant or Company Secretary. In every form company is forced to shell out Rs 1000 to Rs 2000 as professional charges.

For the sake of Ease of Doing Business for small and domestic businesses, we propose following

a. As in income tax and GST , assesse files /upload all desired information and returns themselves as self-certified/Self Verified , in the same way all forms filed under company law should accept the self-certified / self-verified by the company directors and the obligation of verification by a chartered accountant or company secretary Should be done away. Even in Government working, self-attested Affidavits are being accepted and attestation of signature by Notary or any Government official has been done away.

b. An annual return is filed under the provisions of Company Law. Therefore all information which Government wish to have, as cited above, should be clubbed with Annual return and frequent compliances should be minimized. This will boost level of compliances as small businesses often forget to adhere to periodic compliances.

For the above a letter has been sent to Ministry of Corporate Affairs on 4th March 2019 with a copy of Honorable Prime Minister. However any action is still awaited.

We urge upon you that to facilitate small and startups who are willing to carry on their businesses in organized sector, it is further requested that the form INC-22A last date of which is 25th April and DIR- 3 last date of which is 30th April, may kindly be deferred for the time being and same may be merged with Annual Return which is filed by 30th November every year.

Thanking you

V K Bansal

National General Secretary

8076435958