Accounting Standard (AS) 7

Construction Contracts*

(This Accounting Standard includes paragraphs set in bold italic type and plain type, which have equal authority. Paragraphs in bold italic type indicate the main principles. This Accounting Standard should be read in the context of its objective and the General Instructions contained in part A of the Annexure to the Notification.)

Objective

The objective of this Standard is to prescribe the accounting treatment of revenue and costs associated with construction contracts. Because of the nature of the activity undertaken in construction contracts, the date at which the contract activity is entered into and the date when the activity is completed usually fall into different accounting periods. Therefore, the primary issue in accounting for construction contracts is the allocation of contract revenue and contract costs to the accounting periods in which construction work is performed. This Standard uses the recognition criteria established in the Framework for the Preparation and Presentation of Financial Statements to determine when contract revenue and contract costs should be recognised as revenue and expenses in the statement of profit and loss. It also provides practical guidance on the application of these criteria.

Scope

1. This Standard should be applied in accounting for construction contracts in the financial statements of contractors.

Definitions

2. The following terms are used in this Standard with the meanings specified:

2.1 A construction contract is a contract specifically negotiated for the construction of an asset or a combination of assets that are closely interrelated or interdependent in terms of their design, technology and function or their ultimate purpose or use.

2.2 A fixed price contract is a construction contract in which the contractor agrees to a fixed contract price, or a fixed rate per unit of output, which in some cases is subject to cost escalation clauses.

2.3 A cost plus contract is a construction contract in which the contractor is reimbursed for allowable or otherwise defined costs, plus percentage of these costs or a fixed fee.

3. A construction contract may be negotiated for the construction of a single asset such as a bridge, building, dam, pipeline, road, ship or tunnel. A construction contract may also deal with the construction of a number of assets which are closely interrelated or interdependent in terms of their design, technology and function or their ultimate purpose or use; examples of such contracts include those for the construction of refineries and other complex pieces of plant or equipment.

4. For the purposes of this Standard, construction contracts include:

(a) contracts for the rendering of services which are directly related to the construction of the asset, for example, those for the services of project managers and architects; and

(b) contracts for destruction or restoration of assets, and the restoration of the environment following the demolition of assets.

5. Construction contracts are formulated in a number of ways which, for the purposes of this Standard, are classified as fixed price contracts and cost plus contracts. Some construction contracts may contain characteristics of both a fixed price contract and a cost plus contract, for example, in the case of a cost plus contract with an agreed maximum price. In such circumstances, a contractor needs to consider all the conditions in paragraphs 22 and 23 in order to determine when to recognise contract revenue and expenses.

Combining and Segmenting Construction Contracts

6. The requirements of this Standard are usually applied separately to each construction contract. However, in certain circumstances, it is necessary to apply the Standard to the separately identifiable components of a single contract or to a group of contracts together in order to reflect the substance of a contract or a group of contracts.

7. When a contract covers a number of assets, the construction of each asset should be treated as a separate construction contract when:

(a) separate proposals have been submitted for each asset;

(b) each asset has been subject to separate negotiation and the contractor and customer have been able to accept or reject that part of the contract relating to each asset; and

(c) the costs and revenues of each asset can be identified.

8. A group of contracts, whether with a single customer or with several customers, should be treated as a single construction contract when:

(a) the group of contracts is negotiated as a single package;

(b) the contracts are so closely interrelated that they are, in effect, part of a single project with an overall profit margin; and

(c) the contracts are performed concurrently or in a continuous sequence.

9. A contract may provide for the construction of an additional asset at the option of the customer or may be amended to include the construction of an additional asset. The construction of the additional asset should be treated as a separate construction contract when:

(a) the asset differs significantly in design, technology or function from the asset or assets covered by the original contract; or

(b) the price of the asset is negotiated without regard to the original contract price.

Contract Revenue

10. Contract revenue should comprise:

(a) the initial amount of revenue agreed in the contract; and

(b) variations in contract work, claims and incentive payments:

(i) to the extent that it is probable that they will result in revenue; and

(ii) they are capable of being reliably measured.

11. Contract revenue is measured at the consideration received or receivable. The measurement of contract revenue is affected by a variety of uncertainties that depend on the outcome of future events. The estimates often need to be revised as events occur and uncertainties are resolved. Therefore, the amount of contract revenue may increase or decrease from one period to the next. For example:

(a) a contractor and a customer may agree to variations or claims that increase or decrease contract revenue in a period subsequent to that in which the contract was initially agreed;

(b) the amount of revenue agreed in a fixed price contract may increase as a result of cost escalation clauses;

(c) the amount of contract revenue may decrease as a result of penalties arising from delays caused by the contractor in the completion of the contract; or

(d) when a fixed price contract involves a fixed price per unit of output, contract revenue increases as the number of units is increased.

12. A variation is an instruction by the customer for a change in the scope of the work to be performed under the contract. A variation may lead to an increase or a decrease in contract revenue. Examples of variations are changes in the specifications or design of the asset and changes in the duration of the contract. A variation is included in contract revenue when:

(a) it is probable that the customer will approve the variation and the amount of revenue arising from the variation; and

(b) the amount of revenue can be reliably measured.

13. A claim is an amount that the contractor seeks to collect from the customer or another party as reimbursement for costs not included in the contract price. A claim may arise from, for example, customer caused delays, errors in specifications or design, and disputed variations in contract work. The measurement of the amounts of revenue arising from claims is subject to a high level of uncertainty and often depends on the outcome of negotiations. Therefore, claims are only included in contract revenue when:

(a) negotiations have reached an advanced stage such that it is probable that the customer will accept the claim; and

(b) the amount that it is probable will be accepted by the customer can be measured reliably.

14. Incentive payments are additional amounts payable to the contractor if specified performance standards are met or exceeded. For example, a contract may allow for an incentive payment to the contractor for early completion of the contract. Incentive payments are included in contract revenue when:

(a) the contract is sufficiently advanced that it is probable that the specified performance standards will be met or exceeded; and

(b) the amount of the incentive payment can be measured reliably.

Contract Costs

15. Contract costs should comprise:

(a) costs that relate directly to the specific contract;

(b) costs that are attributable to contract activity in general and can be allocated to the contract; and

(c) such other costs as are specifically chargeable to the customer under the terms of the contract.

16. Costs that relate directly to a specific contract include:

(a) site labour costs, including site supervision;

(b) costs of materials used in construction;

(c) depreciation of plant and equipment used on the contract;

(d) costs of moving plant, equipment and materials to and from the contract site;

(e) costs of hiring plant and equipment;

(f) costs of design and technical assistance that is directly related to the contract;

(g) the estimated costs of rectification and guarantee work, including expected warranty costs; and

(h) claims from third parties.

These costs may be reduced by any incidental income that is not included in contract revenue, for example, income from the sale of surplus materials and the disposal of plant and equipment at the end of the contract.

17. Costs that may be attributable to contract activity in general and can be allocated to specific contracts include:

(a) insurance;

(b) costs of design and technical assistance that is not directly related to a specific contract; and

(c) construction overheads.

Such costs are allocated using methods that are systematic and rational and are applied consistently to all costs having similar characteristics. The allocation is based on the normal level of construction activity. Construction overheads include costs such as the preparation and processing of construction personnel payroll. Costs that may be attributable to contract activity in general and can be allocated to specific contracts also include borrowing costs as per Accounting Standard (AS) 16, Borrowing Costs.

18. Costs that are specifically chargeable to the customer under the terms of the contract may include some general administration costs and development costs for which reimbursement is specified in the terms of the contract.

19. Costs that cannot be attributed to contract activity or cannot be allocated to a contract are excluded from the costs of a construction contract. Such costs include:

(a) general administration costs for which reimbursement is not specified in the contract;

(b) selling costs;

(c) research and development costs for which reimbursement is not specified in the contract; and

(d) depreciation of idle plant and equipment that is not used on a particular contract.

20. Contract costs include the costs attributable to a contract for the period from the date of securing the contract to the final completion of the contract. However, costs that relate directly to a contract and which are incurred in securing the contract are also included as part of the contract costs if they can be separately identified and measured reliably and it is probable that the contract will be obtained. When costs incurred in securing a contract are recognised as an expense in the period in which they are incurred, they are not included in contract costs when the contract is obtained in a subsequent period.

Recognition of Contract Revenue and Expenses

21. When the outcome of a construction contract can be estimated reliably, contract revenue and contract costs associated with the construction contract should be recognised as revenue and expenses respectively by reference to the stage of completion of the contract activity at the reporting date. An expected loss on the construction contract should be recognised as an expense immediately in accordance with paragraph 35.

22. In the case of a fixed price contract, the outcome of a construction contract can be estimated reliably when all the following conditions are satisfied:

(a) total contract revenue can be measured reliably;

(b) it is probable that the economic benefits associated with the contract will flow to the enterprise;

(c) both the contract costs to complete the contract and the stage of contract completion at the reporting date can be measured reliably; and

(d) the contract costs attributable to the contract can be clearly identified and measured reliably so that actual contract costs incurred can be compared with prior estimates.

23. In the case of a cost plus contract, the outcome of a construction contract can be estimated reliably when all the following conditions are satisfied:

(a) it is probable that the economic benefits associated with the contract will flow to the enterprise; and

(b) the contract costs attributable to the contract, whether or not specifically reimbursable, can be clearly identified and measured reliably.

24. The recognition of revenue and expenses by reference to the stage of completion of a contract is often referred to as the percentage of completion method. Under this method, contract revenue is matched with the contract costs incurred in reaching the stage of completion, resulting in the reporting of revenue, expenses and profit which can be attributed to the proportion of work completed. This method provides useful information on the extent of contract activity and performance during a period.

25. Under the percentage of completion method, contract revenue is recognised as revenue in the statement of profit and loss in the accounting periods in which the work is performed. Contract costs are usually recognised as an expense in the statement of profit and loss in the accounting periods in which the work to which they relate is performed. However, any expected excess of total contract costs over total contract revenue for the contract is recognised as an expense immediately in accordance with paragraph 35.

26. A contractor may have incurred contract costs that relate to future activity on the contract. Such contract costs are recognised as an asset provided it is probable that they will be recovered. Such costs represent an amount due from the customer and are often classified as contract work in progress.

27. When an uncertainty arises about the collectability of an amount already included in contract revenue, and already recognised in the statement of profit and loss, the uncollectable amount or the amount in respect of which recovery has ceased to be probable is recognised as an expense rather than as an adjustment of the amount of contract revenue.

28. An enterprise is generally able to make reliable estimates after it has agreed to a contract which establishes:

(a) each party’s enforceable rights regarding the asset to be constructed;

(b) the consideration to be exchanged; and

(c) the manner and terms of settlement.

It is also usually necessary for the enterprise to have an effective internal financial budgeting and reporting system. The enterprise reviews and, when necessary, revises the estimates of contract revenue and contract costs as the contract progresses. The need for such revisions does not necessarily indicate that the outcome of the contract cannot be estimated reliably.

29. The stage of completion of a contract may be determined in a variety of ways. The enterprise uses the method that measures reliably the work performed. Depending on the nature of the contract, the methods may include:

(a) the proportion that contract costs incurred for work performed upto the reporting date bear to the estimated total contract costs; or

(b) surveys of work performed; or

(c) completion of a physical proportion of the contract work.

Progress payments and advances received from customers may not necessarily reflect the work performed.

30. When the stage of completion is determined by reference to the contract costs incurred upto the reporting date, only those contract costs that reflect work performed are included in costs incurred upto the reporting date. Examples of contract costs which are excluded are:

(a) contract costs that relate to future activity on the contract, such as costs of materials that have been delivered to a contract site or set aside for use in a contract but not yet installed, used or applied during contract performance, unless the materials have been made specially for the contract; and

(b) payments made to subcontractors in advance of work performed under the subcontract.

31. When the outcome of a construction contract cannot be estimated reliably:

(a) revenue should be recognised only to the extent of contract costs incurred of which recovery is probable; and

(b) contract costs should be recognised as an expense in the period in which they are incurred.

An expected loss on the construction contract should be recognised as an expense immediately in accordance with paragraph 35.

32. During the early stages of a contract it is often the case that the outcome of the contract cannot be estimated reliably. Nevertheless, it may be probable that the enterprise will recover the contract costs incurred. Therefore, contract revenue is recognised only to the extent of costs incurred that are expected to be recovered. As the outcome of the contract cannot be estimated reliably, no profit is recognised. However, even though the outcome of the contract cannot be estimated reliably, it may be probable that total contract costs will exceed total contract revenue. In such cases, any expected excess of total contract costs over total contract revenue for the contract is recognised as an expense immediately in accordance with paragraph 35.

33. Contract costs recovery of which is not probable are recognised as an expense immediately. Examples of circumstances in which the recoverability of contract costs incurred may not be probable and in which contract costs may, therefore, need to be recognised as an expense immediately include contracts:

(a) which are not fully enforceable, that is, their validity is seriously in question;

(b) the completion of which is subject to the outcome of pending litigation or legislation;

(c) relating to properties that are likely to be condemned or expropriated;

(d) where the customer is unable to meet its obligations; or

(e) where the contractor is unable to complete the contract or otherwise meet its obligations under the contract.

34. When the uncertainties that prevented the outcome of the contract being estimated reliably no longer exist, revenue and expenses associated with the construction contract should be recognised in accordance with paragraph 21 rather than in accordance with paragraph 31.

Recognition of Expected Losses

35. When it is probable that total contract costs will exceed total contract revenue, the expected lossshould be recognised as an expense immediately.

36. The amount of such a loss is determined irrespective of:

(a) whether or not work has commenced on the contract;

(b) the stage of completion of contract activity; or

(c) the amount of profits expected to arise on other contracts which are not treated as a single construction contract in accordance with paragraph 8.

Changes in Estimates

37. The percentage of completion method is applied on a cumulative basis in each accounting period to the current estimates of contract revenue and contract costs. Therefore, the effect of a change in the estimate of contract revenue or contract costs, or the effect of a change in the estimate of the outcome of a contract, is accounted for as a change in accounting estimate (see Accounting Standard (AS) 5, Net Profit or Loss for the Period, Prior Period Items and Changes in Accounting Policies). The changed estimates are used in determination of the amount of revenue and expenses recognised in the statement of profit and loss in the period in which the change is made and in subsequent periods.

Disclosure

38. An enterprise should disclose:

(a) the amount of contract revenue recognised as revenue in the period;

(b) the methods used to determine the contractrevenue recognised in the period; and

(c) the methods used to determine the stage of completion of contracts in progress.

39. An enterprise should disclose the following for contracts in progress at the reporting date:

(a) the aggregate amount of costs incurred and recognised profits (less recognised losses) upto the reporting date;

(b) the amount of advances received; and

(c) the amount of retentions.

40. Retentions are amounts of progress billings which are not paid until the satisfaction of conditions specified in the contract for the payment of such amounts or until defects have been rectified. Progress billings are amounts billed for work performed on a contract

whether or not they have been paid by the customer. Advances are amounts received by the contractor before the related work is performed.

41. An enterprise should present:

(a) the gross amount due from customers for contract work as an asset; and

(b) the gross amount due to customers for contract work as a liability.

42. The gross amount due from customers for contract work is the net amount of:

(a) costs incurred plus recognised profits; less

(b) the sum of recognised losses and progress billings for all contracts in progress for which costs incurred plus recognised profits (less recognised losses) exceeds progress billings.

43. The gross amount due to customers for contract work is the net amount of:

(a) the sum of recognised losses and progress billings; less

(b) costs incurred plus recognised profits for all contracts in progress for which progress billings exceed costs incurred plus recognised

profits (less recognised losses).

44. An enterprise discloses any contingencies in accordance with Accounting Standard (AS) 4, Contingencies and Events Occurring After the Balance Sheet Date2. Contingencies may arise from such items as warranty costs, penalties or possible losses.

Illustration

This illustration does not form part of the Accounting Standard. Its purpose is to illustrate the application of the Accounting Standard to assist in clarifying its meaning.

Disclosure of Accounting Policies

The following are illustrations of accounting policy disclosures:

Revenue from fixed price construction contracts is recognised on the percentage of completion method, measured by reference to the percentage of labour hours incurred upto the reporting date to estimated total labour hours for each contract.

Revenue from cost plus contracts is recognised by reference to the recoverable costs incurred during the period plus the fee earned, measured by the proportion that costs incurred upto the reporting date bear to the estimated total costs of the contract.

The Determination of Contract Revenue and Expenses

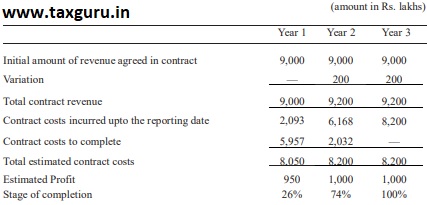

The following illustration illustrates one method of determining the stage of completion of a contract and the timing of the recognition of contract revenue and expenses (see paragraphs 21 to 34 of the Standard). (Amounts shown herein below are in Rs. lakhs)

A construction contractor has a fixed price contract for Rs. 9,000 to build a bridge. The initial amount of revenue agreed in the contract is Rs. 9,000. The contractor’s initial estimate of contract costs is Rs. 8,000. It will take 3 years to build the bridge.

By the end of year 1, the contractor’s estimate of contract costs has increased to Rs. 8,050. In year 2, the customer approves a variation resulting in an increase in contract revenue of Rs. 200 and estimated additional contract costs of Rs. 150. At the end of year 2, costs incurred include Rs. 100 for standard materials stored at the site to be used in year 3 to complete the project.

The contractor determines the stage of completion of the contract by calculating the proportion that contract costs incurred for work performed upto the reporting date bear to the latest estimated total contract costs. A summary of the financial data during the construction period is as follows:

The stage of completion for year 2 (74%) is determined by excluding from contract costs incurred for work performed upto the reporting date, Rs. 100 of standard materials stored at the site for use in year 3.

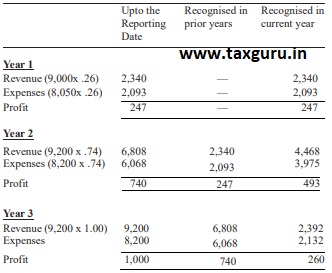

The amounts of revenue, expenses and profit recognised in the statement of profit and loss in the three years are as follows:

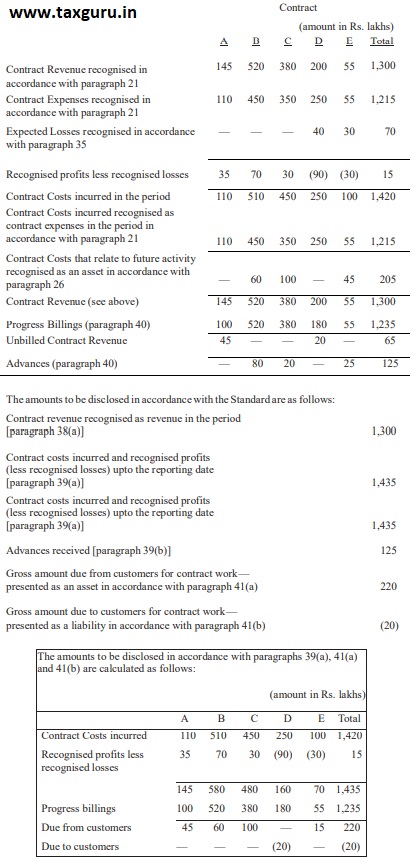

Contract Disclosures

A contractor has reached the end of its first year of operations. All its contract costs incurred have been paid for in cash and all its progress billings and advances have been received in cash. Contract costs incurred for contracts B, C and E include the cost of materials that have been purchased for the contract but which have not been used in contract performance upto the reporting date. For contracts B, C and E, the customers have made advances to the contractor for work not yet performed.

The status of its five contracts in progress at the end of year 1 is as follows:

The amount disclosed in accordance with paragraph 39(a) is the same as the amount for the current period because the disclosures relate to the first year of operation.