Office of the Commissioner of CGST (Audit) vide letter dated 10.10.2022 has informed that M/s Aegis LifeSciences Pvt. Limited having GSTN 24AARCA8892L1ZS and Adgis Lifescience, Partnership concern having GSTIN 24AARCA8892L1ZS are still operating /running both partnership firm as well as Pvt. Limited Company under GST even after the change in constitution of the business at the same premises under different name and legal entities at the same address registered with CGST Act, 2017, Gujarat GST Act, 2017 and ROC departments under Companies Act, 1956/2013. Thus it is prima facie revealed that the company carried out its business activities on a fraudulent and unlawful purpose and also breach of Main object No. 1 of the Company as stated under clause 3A on Memorandum of Association (MOA). Therefore, the Company/Officers have violated the aforesaid provisions of the Companies Act, 2013 and liable to penalize under section 450 of the Companies Act, 2013.

Mr. Ajay Patni, CA submitted that due to the pendency of the issuance of the Management System Certification and NC Certification the company had to continue manufacturing goods under the name of Partnership i.e. M/s Aegis Lifesciences but at the same time all revenue was booked in the name of Aegis Lifescience Pvt. Limited and Income Tax Returns were filed accordingly. He further submitted that due to technical/regulatory difficulties of various countries the Directors had to keep the Partnership firm working although there was no intension to run two separate entities. Ld. CA pleaded for not charging any penalty.

The Presenting Officer responded that company was converted from Firm w.e.f. 05.02.2019. The Office of the Commissioner of CGS’I’ (Audit) vide dated 10.10.2022 informed that Taxpayer M/s. Aegis Lifescience (GSTN 24AA0FA0927G1Z0 of M/s. Aegis Lifesciences and M/s. Aegis Lifescience Pvt Ltd (GSTN 24AARCA8892LZS) have registered at the same address also they are still operating /running both partnership firm as well as Pvt Ltd under GST even after the change in constitution of the business. The 0/o Commissioner of CGST (Audit) has requested to take necessary action required under the provisions of the Companies Act, 1956. Since, the company operating /running both partnership firm as well as Pvt Ltd company under GST even after the change in constitution of the business and breached the object for which the company was formed, then it would be ultra vires the company and void. Therefore, it is concluded that the company and its Officers in default are liable for penalty under Section 450 of the Companies Act, 2013 for default under section 10 of the Act.

The Presenting Officer further submitted that it is observed from the Balance Sheet/financial statement as at 31.03.2022 that the paid-up capital of the company is Rs. 10,00,000/- and Turnover is Rs. 26,10,76,376/-. The company is not Holding of Subsidiary of any other company. Also company is not registered under Section 8 or a company or body corporate governed by any special Act. Hence, as per the Ministry’s Notification No. G.S.R. 700(E) dated 15.09.2022, in light of Companies (Specification of definition details) Amendment Rules, 2022 with respect to the provisions of Section 2(85) of the Companies Act, 2013, the Company does fall under the ambit of “small company”. Therefore, the provisions of imposing lesser penalty as per the provisions of Section 446B of the Companies Act, 2013 shall be applied to the company.

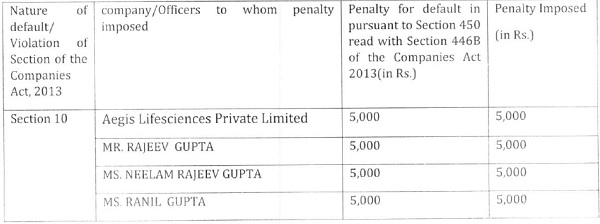

Penalty imposed on company and its directors as prescribed under Section 450 read with Section 446B of the Companies Act, 2013 for violation of section 10 of the Companies Act, 2013,

GOVERNMENT OF OF INDIA

MINISTRY OF CORPORATE AFFAIRS

OFFICE OF THE REGISTRAR OF COMPANIES.

GUJARAT, DADRA & NAGAR HAVELI

ROC Bhavan, Opp. Rupal Park,

Nr. Ankur Bus Stand, Naranpura, Ahmedabad (Gujarat) – 380013.

Tel. No.: 079-27438531, Fax : 079-27438371

Website : www.mca.gov.in E-mail : -roc.ahmedabad@mca.gov.in

Order No. ROC-GUADJ-Order/Sec. 454/AEGIS LIFESCIENCES /2022-23/6550 to 54 Dated: 17 Jan 2023

BEFORE THE ADJUDICATING OFFICER

REGISTRAR OF COMPANIES, GUJARAT, DADRA & NAGAR HAVELI

ORDER IN THE MATTER OF ADJUDICATION OF PENALTY UNDER SECTION 454 (3) OF THE COMPANIES ACT 2013 READ WITH RULE 3 OF THE COMPANIES (ADJUDICATION OF PENALTIES) RULES, 2014 FOR VIOLATION OF SECTION 10 OF THE COMPANIES ACT, 2013

IN THE MATTER OF M/S. AEGIS LIFESCIENCES PRIVATE LIMITED

(U24302GJ2019PTC106437)

Date of hearing- 10.01.2023

PRESENT:

1. Shri R.C. Mishra (ROC), Adjudicating officer

2. Mr. Indrajit Vania (DROC), presenting Officer

Company/Officers/Directors/KMP/Authorized Representative : Mr. Ajay Patni, CA Partner of M/s Kherada and Company, Authorised representative of Company/Directors

Appointment of Adjudication Authority:-

1. The Ministry of Corporate Affairs vide its Gazette Notification No. A 42011/112/2014-Ad.11 dated 24.03.2015 has appointed the undersigned as Adjudicating Officer in exercise of the powers conferred under section 454 of the Companies Act, 2013 (hereinafter known as Act) read with Companies (Adjudication of Penalties) Rules, 2014 (Notification No. GSR 254(E) dated 03.2014) ;or adjudging penalties under the provisions of Act.

Company:

2. AEGIS LIFESCIENCES PRIVATE LIMITED is a company registered under the provisions of the Companies Act, 1956/2013 in the State of Gujarat, having CIN: U24302C42019PTC106437 and presently having its registered office situated at “215/216, MAHAGUJARAT INDUSTRIAL ESTATE, MORAIYA, AHMEDABAD, GUJARAT-382213, India”

Fact about of the case

3. Company was incorporated with object to convert/acquire/takeover the existing business, assets and liabilities of kils Aegis Lifesciences, Partnership concern of Mr. Rajiv Gupta, Ms. Neelam Gupta, Ms. Ranil Gupta, Mr. Lal Chand Agarwal, Ms. Om Lata Agarwal, Ms. Mithlesh Agarwal and Kamlesh Agarwal, as a going concern.

Office of the Commissioner of CGST (Audit) vide letter dated 10.10.2022 has informed that M/s Aegis LifeSciences Pvt. Limited having GSTN 24AARCA8892L1ZS and Adgis Lifescience, Partnership concern having GSTIN 24AARCA8892L1ZS are still operating /running both partnership firm as well as Pvt. Limited Company under GST even after the change in constitution of the business at the same premises under different name and legal entities at the same address registered with CGST Act, 2017, Gujarat GST Act, 2017 and ROC departments under Companies Act, 1956/2013. Thus it is prima facie revealed that the company carried out its business activities on a fraudulent and unlawful purpose and also breach of Main object No. 1 of the Company as stated under clause 3A on Memorandum of Association (MOA). Therefore, the Company/Officers have violated the aforesaid provisions of the Companies Act, 2013 and liable to penalize under section 450 of the Companies Act, 2013.

4. Relevant Provisions of Companies Act, 2013:

Section 10(1) provides that, “Subject to the provisions of this Act, the memorandum and articles shall, when registered, bind the company and the members thereof to the same extent as if they respectively had been signed by the company and by each member, and contained covenants on its and his part to observe all the provisions of the memorandum and of the articles”.

Section 450 of the Companies Act, 2013:

If a company or any officer of a company or any other person contravenes any of the provisions of this Act or the rules made thereunder, or any condition, limitation or restriction subject to which any approval, sanction, consent, confirmation, recognition, direction or exemption in relation to any matter has been accorded, given or granted, and for which no penalty or punishment is provided elsewhere in this Act, the company and every officer of the company who is in default or such other person shall be liable to a penalty of ten thousand rupees, and in case of continuing contravention, with a further penalty of one thousand rupees for each day after the first during which the contravention continues, subject to a maximum of two lakh rupees in case of a company and fifty thousand rupees in case of an officer who is in default or any other person.

Show Cause Notice, reply and personal Hearing:-

5. An Adjudication Notice was issued to company and its directors vide No. ROC-GUAM/Section 454/STA(V)/2021-22/5710 to 5713 dated 21.11.2022 in pursuant to Section 454 of the Companies Act, 2013 read with Companies (Adjudication of Penalties) Rules, 2014 for violation of Section 10 of the Companies Act, 2013. The reply of the company dated 29.12.2022 received in this office on 03.01.203 has been examined in detailed. However, before, imposing penalty in the aforesaid matter, the onus of Adjudicating Officer to give a reasonable opportunity of being heard to company/ Officers in default in pursuant to Section 454(4) of the Companies Act, 2013 read with Rules made thereunder. Accordingly, a “written Notice” vide No. ROC-GUAM-Section 454/ Aegis/STA(V)/2021-22/ 6257 to 6260 dated 22.12.2022 were issued to the company and its officers as per sub-section 4 of 454 of the Companies Act, 2013 read with Rule 3 of Companies (Adjudication of Penalties) Rules, 2014 and a hearing was fixed for 10.01.2023.

6. On the scheduled dated of hearing i.e. on 10.01.2023, Mr. Ajay Patni, CA, Partner of M/s Kherada and Company, Authorised representative of Company/Directors appeared and attended the hearing conducted on 10.01.2023 on behalf of the company and /or the director(s)/applicant(s) and submitted their submission in the line of company reply dated 29.12.2022. Mr. Ajay Patni, CA submitted that due to the pendency of the issuance of the Management System Certification and NC Certification the company had to continue manufacturing goods under the name of Partnership i.e. M/s Aegis Lifesciences but at the same time all revenue was booked in the name of Aegis Lifescience Pvt. Limited and Income Tax Returns were filed accordingly. He further submitted that due to technical/regulatory difficulties of various countries the Directors had to keep the Partnership firm working although there was no intension to run two separate entities. Ld. CA pleaded for not charging any penalty.

7. The Presenting Officer responded that company was converted from Firm w.e.f. 05.02.2019. The Office of the Commissioner of CGS’I’ (Audit) vide dated 10.10.2022 informed that Taxpayer M/s. Aegis Lifescience (GSTN 24AA0FA0927G1Z0 of M/s. Aegis Lifesciences and M/s. Aegis Lifescience Pvt Ltd (GSTN 24AARCA8892LZS) have registered at the same address also they are still operating /running both partnership firm as well as Pvt Ltd under GST even after the change in constitution of the business. The 0/o Commissioner of CGST (Audit) has requested to take necessary action required under the provisions of the Companies Act, 1956. Since, the company operating /running both partnership firm as well as Pvt Ltd company under GST even after the change in constitution of the business and breached the object for which the company was formed, then it would be ultra vires the company and void. Therefore, it is concluded that the company and its Officers in default are liable for penalty under Section 450 of the Companies Act, 2013 for default under section 10 of the Act.

8. While adjudging quantum of penalty under section 450 of the Act, the Adjudicating Officer shall have due regard to the following factors, namely;

a. The amount of disproportionate gain or unfair advantage, whenever quantifiable, made as a result of default.

b. The amount of loss caused to an investor or group of investors as a result of the default.

c. The repetitive nature of default.

9. The Presenting Officer further submitted that with regard to the above factors to be considered while determining the quantum of penalty, it is noted that the disproportionate gain or unfair advantage made by the noticee or loss caused to the investor as a result of the delay on the part of the notice to redress the investor grievance are not available on the record. Further, it may also be added that it is difficult to quantify the unfair advantage made by the noticee or the loss caused to the investors in a default of this nature.

10. The Presenting Officer further submitted that it is observed from the Balance Sheet/financial statement as at 31.03.2022 that the paid-up capital of the company is Rs. 10,00,000/- and Turnover is Rs. 26,10,76,376/-. The company is not Holding of Subsidiary of any other company. Also company is not registered under Section 8 or a company or body corporate governed by any special Act. Hence, as per the Ministry’s Notification No. G.S.R. 700(E) dated 15.09.2022, in light of Companies (Specification of definition details) Amendment Rules, 2022 with respect to the provisions of Section 2(85) of the Companies Act, 2013, the Company does fall under the ambit of “small company”. Therefore, the provisions of imposing lesser penalty as per the provisions of Section 446B of the Companies Act, 2013 shall be applied to the company.

ORDER

1. Having considered the facts and circumstances of the case and submissions made by the Presenting Officer and oral submission made by Mr. Ajay Patni, CA and after taking into accounts the factors above, I hereby imposed following penalty on company and its directors as prescribed under Section 450 read with Section 446B of the Companies Act, 2013 for violation of section 10of the Companies Act, 2013, I am of the opinion that penalty is commensurate with the aforesaid failure committed by the Noticees:

Penalty on company and Officers in default for the aforesaid default are as under:

2. The noticee shall pay the amount of penalty individually for the company and its officers from their personal sources/income by way of e-payment available on Ministry website www.mca.gov.in under “Pay miscellaneous fees” category in MCA fee and payment Services under Rule 3(14) of Company (Adjudication of Penalties) (Amendment) Rules, 2019 within 60 days from the date of receipt of this order and copy of this adjudication order and Challan/SRN generated after payment of penalty through online mode shall be filed in INC-28 under the MCA portal without further reference.

3. Appeal against this order may be filed in writing with the Regional Director, North Western Region, Ministry of Corporate Affairs, ROC BHAVAN, OPP. RUPAL PARK, NR. ANKUR BUS STAND, NARANAPURA, AHMEDABAD (GUJARAT)-380013 within a period of sixty days from the date of receipt of this order, in Form ADJ setting forth the grounds of appeal and shall be accompanied by the certified copy of this order. [Section 454(5) & 454(6) of the Companies Act, 2013 read with the Companies (Adjudication of Penalties) Rules, 2014 as amended by Companies (Adjudication of Penalties) Amendment Rules, 2019].

4. Your attention is also invited to Section 454(8)(i) and 454(8) (ii) of the Companies Act, 2013, which state that in case of non-payment of penalty amount, the company shall be punishable with fine which shall not less than Twenty Five Thousand Rupees but which may extend to Five Lalchs Rupees and officer in default shall be punishable with Imprisonment which may extend to Six months or with fine which shall not be less than Twenty Five Thousand Rupees by which may extend to one Lakhs Rupees or with both.

The adjudication notice stands disposed of with this order.

(R.C.MISHRA, ICLS)

REGISTRAR OF COMPANIES &

ADJUDICATING OFFICER

MINISTRY OF CORPORATE AFFAIRS

GUJARAT, DADRA & NAGAR HAVELI

(R.C. MISHRA, ICLS)

REGISTRAR OF COMPANIES &

ADJUDICATING OFFICER

MINISTRY OF CORPORATE AFFAIRS

GUJARAT, DADRA & NAGAR HAVELI

No. ROC-GJ/ADJ-Order/Sec. 454/ AEGIS LIFESCIENCES /2022-23/ Dated:13.01.2013