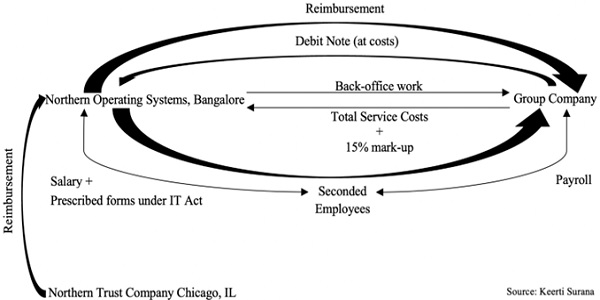

A. The Transaction

B. Issue and Scope of Enquiry

Issue: Whether the overseas group company or companies, with whom the assessee has entered into agreements, provides it manpower services, for the discharge of its functions through seconded employees.

The crux of the issue is the taxability of the cross charge. The Supreme Court boiled this down to an issue of determining the employer of the seconded employees[1] –

→ If the Indian company is treated as an employer, the payment would in effect be reimbursement and not chargeable to tax in the hands of the overseas entity.

→ If the Overseas company is treated as an employer, the arrangement would be treated as service by the overseas entity and taxed.

C. Impugned Order

Prior to the amendment, the definition of taxable service under S.65(105)(k) of the Finance Act, 1994, included service provided “to any person by a manpower recruitment or supply agency in relation to the recruitment or supply of manpower, temporary or otherwise”. After the amendment, the “manpower and recruitment services was per se included since it did not form part of the negative list”[2]. S.65B(44)(b) excluded the service provided by an employee or employer by/in relation to employment.

The CESTAT had culled out the following elements for an activity to be classified as a “manpower recruitment or supply agency” – )Any person who engages in the service of recruitment of manpower temporarily or otherwise, providing it directly or indirectly in any manner, to some other person. Such a service was only taxable if provided by a “manpower recruitment or supply agency”.

On examination, the CESTAT found that the subject matter of the multiple agreements was not supply of manpower, and the overseas group were not engaged in the supply of manpower. The seconded employees were on the payroll of the group companies was for disbursement purposes. The Indian Company obtained these expatriate employees directly or by way of transfer and paid social security and other statutory benefits under law applicable to the group company situate abroad. Employer-employee relationship existed, and therefore the group company could not be categorised as “manpower recruitment or supply agency”.

D. Contentions

a. Revenue’s contentions

Aggrieved by the above order, present appeal was filed by the Revenue. It contended on the following grounds:

(i) The assessee was to provide “general back office and operational support”. For this, it was remunerated by actual cost + 15% mark-up.

(ii) Though the assessee was to perform and provide services to the foreign group companies, such services could be delivered to other parties nominated by the Northern Trust Company (HoldCo).

(iii) The assessee agreed to request for secondment of employees to be remunerated through the payroll of the foreign company. Assessee agreed to reimburse expenses paid during the secondment period.

(iv) The secondment was for a limited duration, where the employee had the right to terminate the engagement.

(v) In addition to salary payable to the seconded employee, various allowances including a hardship allowance of 20% base salary was payable.

(vi) The above shows that the overseas employer provided the services of its employees to the assessee for the performance of the agreed tasks.

(vii) The seconded employees were only operationally under the control of the assessee. The temporary control did not take away the fact that the real employer was the overseas group company, where after their secondment, these employees reverted to their original position.

(viii) The conditions outlined above are characteristic of a contract for The real purpose of the secondment was economics optimisation while ensuring experts were utilised.

b. Assessee’s contentions

The Assessee argued that:

(i) The seconded employees are contractually hired by the assessee’s employees. The assessee exercised control over them as the employees were required to devote all their time and efforts under the direction of the assessee, that too at remuneration fixed by it.

(ii) The process of dispersal of the salaries and allowances is solely for the sake of convenience and continual of the social security benefits in the expats home county.

(iii) The foreign group companies are in the business of Personal Finance Services and Corporate & Institutional Services. They cannot be considered to be “manpower recruitment or supply agency”.

(iv) Service tax is leviable only on gross amount charged for the provision of service. Arguendo – if service is indeed provided, the value of consideration paid towards service ought to be excluded. The present demand is untenable because service tax has been claimed on salaries and allowances.

(v) Debit note was evidence that there no mark-up was charged by the foreign company.

(vi) The assessee was under the bona fide belief that the seconded employees were its own employees. They had no intention to evade taxes, as if service tax is leviable, the assessee was entitled to claim refund under Rule 5 of the CENVAT Rules read with Rule 6A of the Service Tax Rules.

E. Court’s Analysis and Conclusion

The Court held in favour of the Revenue for the following reasons:

(i) Analysis of the different tests to determine employment: Discussed various case laws, and concluded that the “control” test is not necessarily determinative to discern the real employer. Citing additional tests such as the “three-tier test” followed by English Courts and “economic reality test” prevalent in American jurisprudence, conclude that “[n]o one test of universal application can ever yield the correct result”; a court performs “a balancing act weighing all relevant factors which point in one direction as against those which point in the opposite direction to arrive at the correct conclusion on the facts of each case”.[3]

(ii) Analysis of the various agreements: “One of the cardinal principles of interpretation of documents, is that the nomenclature of any contract, or document, is not decisive of its nature. An overall reading of the document, and its effect, is to be seen”.[4]

Upon undertaking analysis in terms of the law stated above, the Court made the following factual findings:

(i) The assessee had operational/functional control over the seconded employees and was potentially liable for the performance of the tasks assigned to the them.

(ii) The assessee paid (through reimbursement) the amounts equivalent to the salaries of the seconded employees – because of the obligation of the overseas employer to maintain them on its payroll.

(iii) The Court preferred the “substance over form” test to determine employment. Despite the seconded employees remaining under the control of the assessee for the duration of the secondment, these employees remained under the payroll of the overseas employer. This is because of a legal requirement because these seconded employees are entitled to the social security benefits in the country of their origin.

(iv) The secondment is part of the overseas company’s global policy of loaning their services on a temporary basis. After the end of the secondment period, these employees resume their original roles in the overseas company. Additionally, the terms of employment during the secondment period is in accord with the policy of the overseas company.

(v) The salaries and allowances were denoted in foreign currency. The seconded employees were given a 20% hardship allowance for shifting to India. These sums are substantial amounts and could have been only by resorting to a standardised policy of an overseas employer.

On the basis of the above factual findings, the Supreme Court –

(i) Disregarded the assessee’s argument (iv) above, and noted that the payment in the form of remittances or amounts, by whatever manner, either for the duration of the secondment, or per employee seconded, is just one method of reckoning if there is consideration.

(ii) Disregarded the assessee’s argument (vi) above and noted that whether “a particular rate of tax or no tax, is payable, or that if and when liability arises, the assessee, can through a certain existing arrangement, claim the whole or part of the duty as refund, is an irrelevant detail. The incidence of taxation, is entirely removed from whether, when and to what extent, Parliament chooses to recover the amount.”[5]

(iii) Held that the assessee was the service recipient for service (of manpower recruitment and supply services) by the overseas entity, in regard to the employees it seconded to the assessee, for the duration of their deputation or secondment.

[1] 34 of the Judgment.

[2] 6 of the Judgment.

[3] 41 of the Judgment.

[4] 47 of the Judgment.

[5] 59 of the Judgment.

I am working MNC.