1. Reference articles Reporting of Intraday & F&O Transactions in ITR 3, Reporting of Capital Gain on Sale of Equity – ITR 2 & How to Report Stock Market Capital Loss in ITR 2. There is a lot of confusion among assessees about Income Tax on Share Market Transaction.

2. In this article, an attempt has been made to further simplify the computation and adjustments of Share Market Transactions for Income Tax purposes. Let’s try to understand the computation with the help of Illustrations.

3. ILLUSTRATION: Mr. Arindam is a salaried employee, having income / Loss from Salary, dividend & Share Market Transactions. The particulars of his Income & Transactions for FY 2021-22 are as indicated below:

|

SI |

Particulars | Amount (Rs.)I |

| a | Salary ( Net of Std De d) | 175000 |

| b | Dividend Income | 28260 |

| c | Loss from F&O business | -120000 |

| d | Gain from Intra day transaction | 40W0 |

| e | STCG from Equity Funds(Sec 111A) | 150000 |

| f | LTCG from Equity Funds ( Sec 112A) | 220W0 |

| g | Investment in PF (80C) | 21600 |

4. CURRENT YEAR LOSS ADJUSTMENT (SCHEDULE CYLA): The first step is to set off F&O Losses against Current Year Income. The computation, relevant provisions along with explanations are tabulated below:

|

Sl |

Particulars | Amount (Rs) | Remark/ Relevant Provision |

| (a) | Loss from F&O Business | (120000) | |

| (b) | Income from Intraday Business | 40000 | Intraday equity transactions are speculative in nature and hence income gained from intraday stock trading is treated as speculative business income.

Non-speculative business loss can be set off against income from speculative business. |

| (c ) | Dividend Income | 28260 | After making the intra-head adjustment, the next step is to make the inter-head adjustment. If in any year, the taxpayer has incurred a loss under one head of income and is having income under other head of income, then he can adjust the loss from one head against income from other head, |

| (d) | STG from Equity Fund | 51740 | After adjusting F&O losses with Intraday & Other Source Income, the balance loss of Rs {120000-(40000+28260)}= 51740 will be set off from STCG |

| Loss from business and profession cannot be set off against income chargeable to tax under the head “Salaries”. | |||

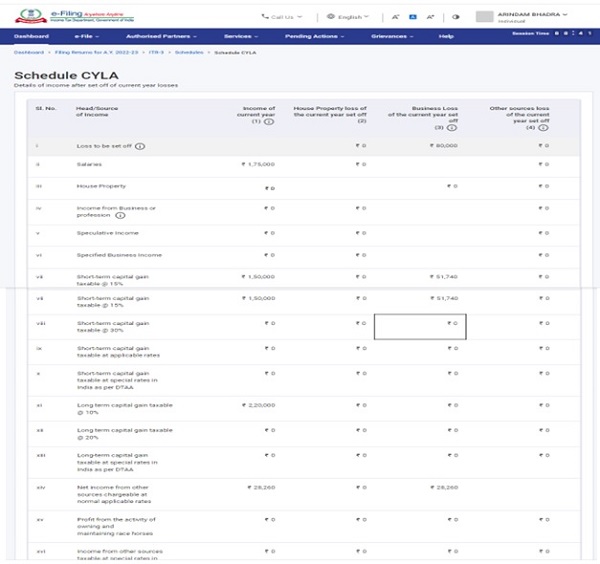

4.1. SCHEDULE CYLA OF ITR

5. ADJUSTMENT OF CAPITAL GAIN AGAINST BASIC EXEMPTION LIMIT: A resident individual is entitled to adjust the Basic Exemption limit against LTCG/ STCG, after making adjustments to other income. The basic Tax Exemption Limit for an individual taxpayer depends on their age and residential status. For an individual below 60 years of age, the basic exemption limit is Rs 2.5 lakh, for Senior citizens (60 + years), it’s Rs 3 lakh, and Rs 5 lakh for very Senior Citizens (80+years).

5.1 The law does not prescribe any specific order in which the shortfall can be used so the taxpayer can choose it the way he wants it to be set off.

5.2 However, the Form ITR 2 &3 sets off LTGC on which 20% taxes are payable first and then the STCG on equity shares schemes on which tax is payable @ 15%. Lastly, the other LTCG on which 10% tax is payable is adjusted against the shortfall in basic exemption. The order of adjustment is logical and beneficial for taxpayers.

5.3 ILLUSTRATION: Further to the Illustration above, the maximum exemption limit will be adjusted in the following manner:

|

1 |

Total Income ( taxable at normal rate | 175000 |

| 2 | Less : Deduction U/5800 | 21600 |

| 3 | Taxable Income @normal rate(1-2) | 153400 |

| 4 | Basic Exemption Limit | 250000 |

| 5 | Shortfall ( 250000-153400)to be adj from STCG | 96600 |

6. COMPUTATION OF INCOME TAXABLE AT SPECIAL RATE: For taxation purposes, Capital assets are divided into two categories- Equity-oriented Investments and other than Equity investments. This can be further categorized as Short Term Capital Gain and Long Term Capital Gain.

6.1 Gains on Equity-oriented Mutual Funds held for a year or more are treated as long-term capital gains and taxed at 10% for gains exceeding Rs 1 lakh in a year.

6.2 Gains on Equity-oriented Mutual Funds held for less than a year are treated as short-term capital gains and taxed at 15%.

6.3 ILLUSTRATION

|

Sl |

Particulars | Rs | Rs. |

| (a) | STCG from Equity Fund | 150000 | |

| (b) | Less: Adjusted with F&O Losses | 51740 | |

| (c) | Less: Adjusted with Basic Exemption Limit | 96600 | |

| (d) | Total Adjusted (b+c) | 148340 | |

| (e) | Taxable STCG =( a-d ) | 1660 | |

| (f) | Tax on STCG @ 15% | 249 | |

| (g) | Tax on LTCG ( 220000-100000)*10% | 12000 |

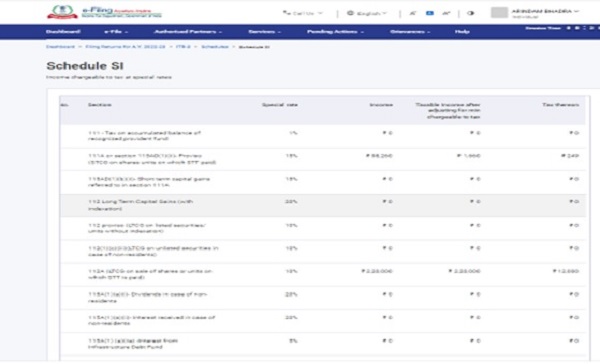

6.4 SCHEDULE SI OF ITR

7. REBATE UNDER SECTION 87A : The Rebate under Sec 87A can be claimed if total income, i.e. after Chapter VIA deductions, does not exceed Rs 5 lakh in a financial year.

7.1 Rebate under Section 87A cannot be adjusted against tax on long-term capital gains on equity shares and equity-oriented mutual funds (Section 112A).

7.2 It is available on listed equity shares and equity-oriented schemes of mutual funds under Section 111A of the Act, on which tax is payable at a flat rate of 15%.

7.3 The rebate can be applied to the total tax before adding a health and education cess of 4%

8. COMPUTATION OF TAX ON TOTAL INCOME

|

Sl |

Particulars | Rs | Rs. |

| (a) | Income From Salary | 175000 | |

| (b) | Income From Other Sources | 28260 | |

| (c ) | Income from Capital Gain ( 220000+150000) | 370000 | |

| (d) | Current Year Loss from Business (Net) | (80000) | |

| (e ) | Gross Total Income (a+b+c+d) | 493260 | |

| (f) | Deduction Under Sec 80C | 21600 | |

| (g) | Total Income (e-f) | 471660 | |

| (h) | Income chargeable at special rate (included in g above) = 220000+1660 | 221660 | |

| (i) | Taxable Income at Normal Rate (g-h) | 250000 | |

| (j) | Tax at Normal rate | NIL | |

| (k) | Tax at Special Rate ( SGST ) | 249 | |

| (l) | Rebate U/S 87A | (249) | |

| (m) | Tax at Special Rate ( LTCG) (220000-100000)*10% | 12000 | |

| (n) | Education Cess @ 4% | 480 | |

| (o) | Total Tax Liability | 12480 |

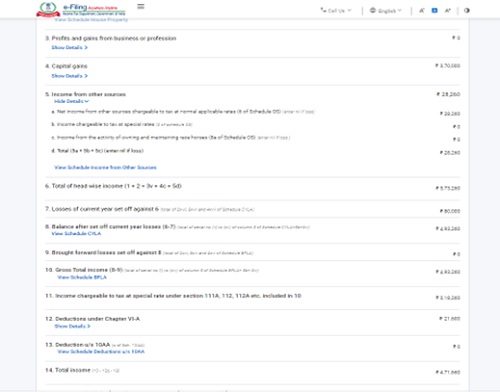

9 ITR SCHEDULE – COMPUTATION OF TOTAL INCOME

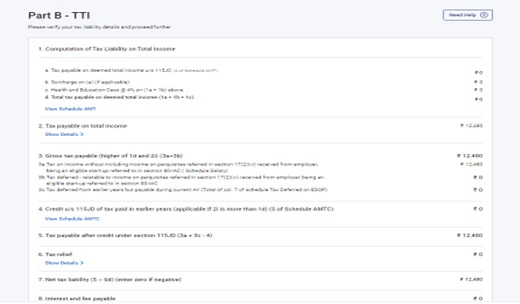

10. ITR SCHEDULE – COMPUTATION OF TAX LIABILITY

Disclaimer: The article is for tax purposes only.

The author can be approached at caanitabhadra@gmail.com

Dear Ms Anita,

Thanks for the information. Last year I have filed my IT return through ITR-II form as I am a salaried person with some income from the sale of shares. I paid an additional amount of INR 5000+ as self-assessment tax in the month of July last year. But still, I received an email from the IT department saying that you have to pay an additional 1400 as tax under rule 143. although the table reflects that I have paid an excess amount of Rs. 5000 to the department. Please suggest what to do in this case.

For sale of share you were required to compute tax liability, disclose in the ITR and pay accordingly. Extra Rs 5000/- will not be automatically set off against your share income

Thanks for informing about the correct Category to be chosen while reporting on taxable portion of interest earned on GPF/EPF. it was very confusing first provision 10(11), second provisio….. etc.

Thanks a lot .Glad that it helped you to choose correct category.

Thank you Sir for your humble comment.

CA ANITA BHADRA MAM ‘S ARTICLES ARE VERY USEFUL