1. An individual having Capital Gain on sale of Equity is required to file ITR 2. The article discusses the procedure to report Equity Capital Gain in Income Tax Return New Portal.

2. STEP BY STEP PROCEDURE

(a) Login to www.incometax.gov.in

(b) The path is: – e-file>Income Tax Return > File Income Tax Return. Select: AY 2021-22 (Current AY) > online. Start New filing > Individual> Select ITR Form > ITR 2> Let’s Get Started. Tick on the reason for filing Tax. Taxable income is more than basic exemption limit.

(c) Select Schedules – General

(d): Click on Income Schedule and select the following schedules: –

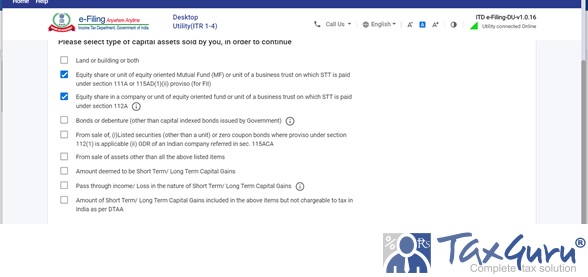

(e) Click on Schedule Capital Gain. Select Type of Capital Assets: –

3 DOWNLOAD DEMAT ACCOUNT STATEMENT: Demat Account statement is a summary of all the transactions in the Demat account. The statement provides the relevant details like sale consideration, date of acquisition, cost of acquisition, Period of holding, ISIN Code, etc. These details are required to be reported in Capital Gain Schedules of Income Tax Return.

Demat Statement can be download either directly from the website of the relevant national depository or through a broker with whom the taxpayer maintains a Demat account.

4. Capital gains tax on Equity can be long-term or short-term, depending on the duration for which the individual holds the Equity.

5. SHORT TERM CAPITAL GAIN (STCG): Equity shares, units of equity-oriented mutual funds, or units of business trust having a holding period of less than 12 months are considered Short Term Capital Assets.

Capital Gain arising on transfer of such Capital Assets, transferred through a recognized stock exchange and liable to Securities Transaction Tax (STT), is Short Term Capital Gain covered under section 111A of Income Tax Act.

Short-term capital gain under section 111A is taxed at a flat tax rate of 15% provided that such transaction is chargeable to Security Transaction Tax.

If total taxable income excluding short-term gains is below taxable income i.e. Rs 2.5 lakh the shortfall of basic exemption can be adjusted against short-term gains. The remaining short-term gains shall be then taxed at 15% + 4% cess on it.

Security Transaction Tax (STT) is a tax levied at the time of purchase and sale of securities listed on Stock Exchanges in India.

Equity Oriented Mutual Fund is the funds that invest 65% of the investible funds in the Equity Shares of the domestic companies.

Business trusts are like mutual funds that raise resources from many investors to be directly invested in realty or infrastructure projects.

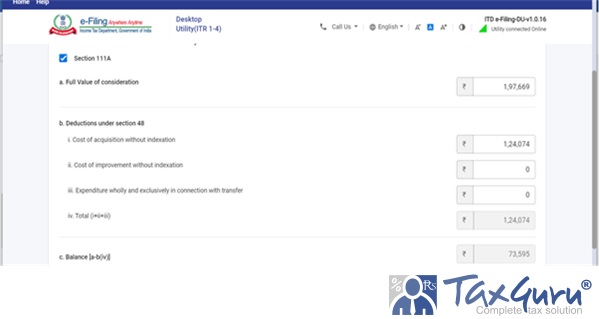

5.1 REPORTING OF STCG UNDER SECTION 111A

Click on Add details.

The example of Demat Account Statement indicating the details of Capital Gain is as follows: –

Enter Consolidated amount of consideration received from sale of short term Assets & cost of acquisition thereof in the financial year. CBDT vide press release dated 26 September 2020 clarified that script-wise reporting is not required for the sale of the short term listed shares

Note: Indexation is not considered for calculating the Cost of Acquisition / Improvement in the case of Short Term Capital Gain.

6. LONG TERM CAPITAL GAIN The Equity Share and Equity related instruments like Mutual Fund Units having more than one year of holding is Long Term Capital Assets.

Long Term Capital Gain on sale of Equity Share and Equity related instruments like Mutual Fund Units, liable for Security Transaction tax covered under Section 112A of Income Tax Act.

The rate of long-term capital gains tax on these listed securities is 10% for gains exceeding the threshold of Rs 1 Lakhs

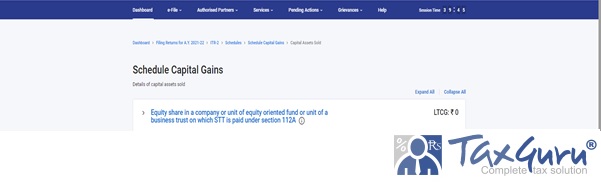

7. REPORTING OF LTCG – SHARES ACQUIRED AFTER 31ST JAN 2018

Capital Gains on sale of shares, acquired after 31.01.2018 is the difference between the selling price and the actual cost of acquisition, as no indexation benefit is provided under section 112A

The following screen indicating Long Term Capital Gain will be displayed

8. GRAND FATHERING PROVISION -SHARES ACQUIRED BEFORE 31ST JAN 2018

Capital gains from the sale of listed equity shares, units of the mutual fund, and business trust were exempted until FY 2017-18 (AY 2018-19)

The Finance Act, 2018 introduced the grandfathering provisions to exempt long-term capital gains earned until 31 January 2018.

A method of determining the Cost of Acquisition (COA) has been specifically laid down in the case of specified securities bought before 1 February 2018.

Cost of Acquisition will be calculated as follows:

| (a) | Fair Market value as of 31st Jan 2018 | F | |

| (b) | Actual Selling Price | S | |

| (c ) | Lower of (a) and (b) | L | |

| (d) | Original Cost of Acquisition( purchased before 31st Jan 2018 | P | |

| (e) | Cost of Acquisition ( Higher of the L & P ) | C |

ILLUSTRATION

| Sl. | Fair Market Value(F) | Actual Selling Price (S) | Lower of (F) & (S) = L | Original Cost of Acquisition (P) | Cost of Acquisition (Higher of L & P = C ) |

| (a) | 2,00,000 | 4,00,000 | 2,00,000 | 1,00,000 | 2,00,000 |

| (b) | 1,80,000 | 1,00,000 | 1,00,000 | 1,50,000 | 1,50,000 |

ILLUSTRATION

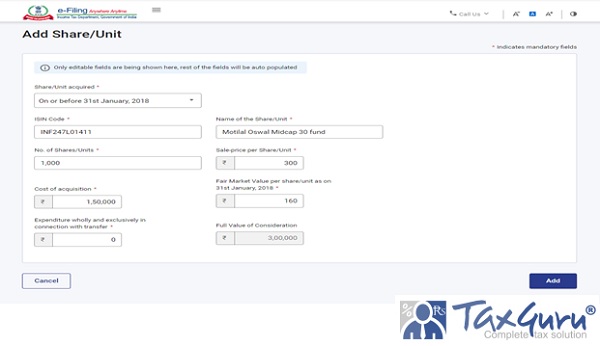

Mr. Anupam purchased 1000 shares @ Rs 150 in the year 2005. On 17.09.2021, he has sold the shares @ 300/- per share. Fair Market price of these shares as on 31st Jan 2018 is Rs 160/- per Share. The Cost of Acquisition and Long Term Capital Gain will be computed as follows

Cost of Acquisition

| Sl | Fair Market Value(F) | Actual Selling Price (S) | Lower of (F) & (S) = L | Original Cost of

(P) |

Cost of Acquisition (Higher of L & P = C ) |

| 1000*160 =1,60,000 | 1000*300 =3,00,000 |

1,60,000 |

1000*50 = 1,50,000 |

1,60,000 |

Capital Gain = Selling Price – Cost of Acquisition

3,00,000- 1,60,000

= Rs. 1,40,000

Tax on Long-term Capital gain on equity shares listed on a stock exchange are not taxable up to the limit of Rs 1 lakh.

The long term capital gain of more than Rs 1 lakh on the sale of equity shares or equity-oriented units of the mutual fund will attract a capital gains tax of 10% and the benefit of indexation will not be available to the seller

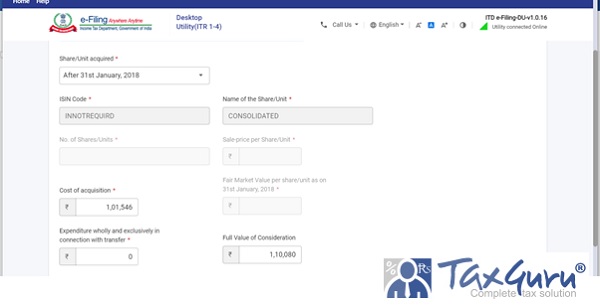

8.1 REPORTING OF CAPITAL GAIN UNDER GRANDFATHERING PROVISION

Scrip-wise details are required to be reported in ITR 2 for LTCG eligible for Grandfathering clause. Script-wise details include the name of the scrip, ISIN, purchase price, sales price, and the dates of these transactions.

The purpose is to ensure that tax officials can verify and validate the computation of capital gain after factoring in the grandfathering clause.

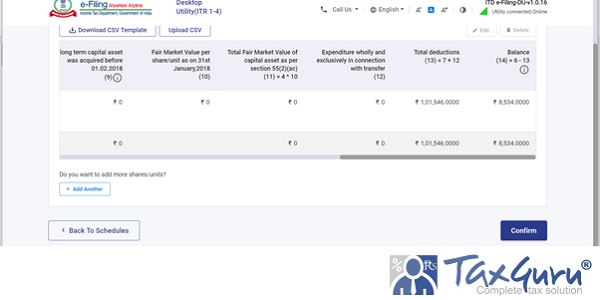

Once you enter script-wise detail in 112A Schedule and click on Add, the cost of Acquisition and Capital gain will be auto calculated by the portal and will be displayed as indicated below: –

8.2 CHALLENGES: – The biggest challenge is to obtain script-wise details in an appropriate format from broking and mutual fund aggregator firms. “Many do not provide ISIN codes in their transaction statements. The taxpayer needs to search manually and feed this data into the return filing software. Further, most demat and mutual fund statements are provided in PDF format, which means that each transaction detail has to be manually copied and pasted in return filing software. This is particularly cumbersome when it comes to disclosing systematic investment plans (SIP). It is better to ask brokerage, fund house, or mutual fund aggregator to provide the details in excel to facilitate easy copying and pasting on to online ITR form as also ISIN of each scrip.

9. SCHEDULE SI The taxpayer having Short term – long-term Capital gain is required to select Schedule SI: – Income chargeable to tax at special rates. This schedule is nothing but a summary of taxable Capital gain, special tax rate, and tax thereon.

10. ADJUSTMENT AGAINST BASIC EXEMPTION LIMIT: A resident individual and resident HUF can apply for adjustment of the exemption limit against Long Term Capital Gain.

In the above illustration, Mr. Anupam does not have any other income. The total income including the LTCG is below the basic exemption limit, hence there is no tax liability.

No tax deduction under sections 80C to 80U is allowed from long-term capital gains.

*****

Disclaimer: The article is for educational purposes only.

The author can be approached at caanitabhadra@gmail.com

Any body one can file ITR 2 after reading your article.well explained with original window’s page .I like it this most among all other so many websites and CA. it differentiates u from others who are from same field.

Thank you Sir for your humble comment .

It really motivates to do even better.

m com accounts tancy

My CG on shares ( long and short) is Rs.83036/-

It is getting added to my other income including pension and asking me to pay tax?

Secondly I have booked a flat for which I want to claim deduction under sec 54 F I am trying to fill clause D under schedule CG but they are not accepting my total consideration figure and show following error

Error :Deduction u/s. 54F claimed here (Table D) should match with total of deduction(s) claimed in respective asset. What should I do?

It will first be added to ascertain Gross Total Income & then be deducted for tax calculation purpose.

For more clarity & understanding the steps , refer my article dated 05 June 2023

https://taxguru.in/income-tax/itr-2-capital-gain-tax-sale-land-building.html