1. Investments in Stock Market may sometime turn negative value and the investor has to book losses and move on. In such circumstances, Income Tax Act provides relief to the investor from tax point of view. There is an option to set off such losses against gain in the same financial year. If a person cannot set-off a capital loss under the same head during the same financial year, he can carry forward such losses to the next financial year and can be set-off against Capital Gains (if any) arising in the next year. The details of setting off and carrying forward of Capital gain / Losses required to be reported in Income Tax Return.

2. The Article covers step by step procedure to report Set Off and Carry Forward of Losses in ITR 2 along with relevant provisions and Rules under Income Tax Act.

3 DOWNLOAD DEMAT ACCOUNT STATEMENT: The first step for a taxpayer is to download / obtain Demat Statement.

3.1 Demat Account statement is a summary of all the shares in demat account. The statement provides the relevant details like sale consideration, date of acquisition, Cost of acquisition, Period of holding, ISIN Code etc. These inputs are needed for preparing Capital Schedules of Income Tax Return.

3.2 Demat Statement can be download either directly from the website of the relevant national depository or through broker with whom the taxpayer maintains a demat account.

REPORTING TO PORTAL

(a) Login to www.incometax.gov.in

(b) The path is: – e-file>Income Tax Return > File Income Tax Return. Select: AY 2021-22(Current AY) > online. Start New filing > Individual> Select ITR Form > ITR 2> Let’s Get Started. Tick on the reason for filing Tax. Taxable income is more than basic exemption limit.

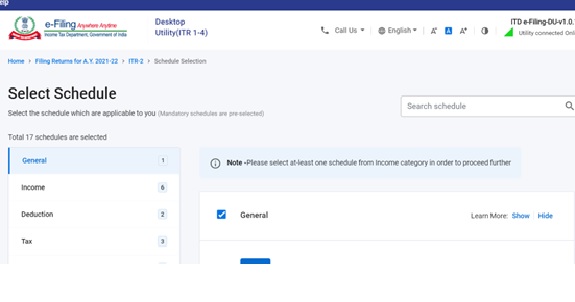

(c) Select Schedules – General

(d) Click on Continue. The following screen will be displayed\

(e) Click on the relevant schedules (i.e. Schedule Capital Gain, Sec 112 A)

(ei) Enter the details from Demat Statement & confirm.

ILLUSTRATION: – DETAILS FROM DEMAT STATEMENT

| Sl | Particulars | Amount ( Rs.) |

| (a) | Loss on sale of shares listed in BSE. Shares were held for 15 months and STT paid on Sales and Acquisition | (3,00,000) |

| (b) | Long Term capital Gain on sale of Bonds | (75000) |

| (c ) | Long Term Capital Loss on Listed Equity Shares (STT Paid) | ( 1,00,000) |

| (e) | Short Term Capital gain on Equity ( Sec 111A) | 1,90,000 |

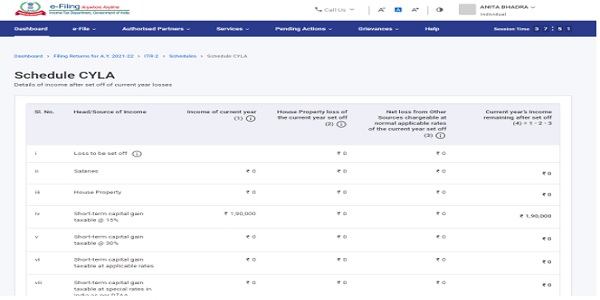

(f) The summary of the transactions entered in the schedules will be displayed in the following manner: –

(g) Now click on Schedule CYLA (Current Year Losses Adjustments). The details entered in Capital Gain Schedules will reflect in Set Off/ Carry Forward Schedules.

Note: Set off & carry Forward Schedules will fetch data from Capital gain Schedule. The taxpayer need not to enter the details again in these schedules.

Note: Long term capital Loss cannot be adjusted against Short Term Losses. Thus Short Term Capital Gain after set off remains unadjusted.

(g) Click on Schedule CFL (Carry Forward Losses)

(h) The unadjusted losses of 2021-22 will be carried forward for next 8 financial years. If a taxpayer cannot set-off a capital loss under the same head during the same financial year, he can carry forward such losses to the next financial year and can be set-off against Capital Gains (if any) arising in the next year.

(i) Similarly, Schedule BFLA will reflect Brought Forward Losses Adjustments and Schedule SI will show summary of Capital gain/ Losses at special rates.

(j) The Tax computation will do at the end i.e. after the set off of losses if any.

6. CAPITAL LOSSES PROVISIONS AND RULES UNDER INCOME TAX ACT

(a) The losses in Stock market can be a Short Term Capital Loss (STCL) or a Long Term Capital Loss (LTCL) depending upon the ‘Period of Holding’.

(b) Shares, Equity Mutual Fund, Listed Debentures & Bonds, held for less than 12 months are short term Capital Assets and tax rate is 15%. Capital Gain / Losses from sale of such Assets covered under sec 111A of the Act

(c) Debt Mutual Funds, Gold ETFs unlisted debentures etc. considered as short term if, a period of holding is less than 36 months. The STCG tax rate on such Non-Equity funds (or) Debt funds is as per the investor’s income tax slab rate.

(d) Equity Shares & Equity Oriented funds, which are subject to Security Transaction Tax, held for more than 12 months are Long Term Capital Assets. The tax rate is 10%, on LTCG exceeding Rs 1 Lakh. – Sec 112A is applicable for Capital gain/ Loss on such Assets.

(e) The Capital Assets other than Equity shares and Equity Oriented Funds are Long Term Capital assets, if period of holding is more than 36 months. The tax rate on such assets is 20% with indexation.

RULES: –

(a) Capital Losses can’t be set off against any other head of income: – Capital losses such as loss on stock investment cannot be set off against any other head like Income from Salary, Income from Business or Profession. Rental Income from house property and other sources of income.

(b) Short Term Capital Losses can be set off against Long term capital Gain but Long term capital Loss cannot be adjusted against Short Term Losses

(c) A capital loss can be carried forward for 8 years from the end of the financial year in which the loss has been incurred. If a person cannot set-off a capital loss under the same head during the same financial year, he can carry forward such losses to the next financial year and can be set-off against Capital Gains (if any) arising in the next year.

(d) A capital loss can be carried forward to the next year only if the person had declared such losses in ITR and the tax return is filed before the due date.

8. SALIENT POINTS TO REMEMBER

(a) Long term Capital Gain (LTCG) on debts Funds (Tax rate 20%) can be adjusted against LTCG on Equity Shares/MF (Tax rate 10%) and vice versa.

(b) Capital Loss on Equity Stock, Equity Oriented Mutual funds sale prior to 31st Jan 2018 is not subject to set off as there was no capital gain tax prior to 31st Jan 2018

(c) LTCL on sale of shares cannot be set-off against STCG on sale of shares

(d) STCG on sale of shares cannot be set-off against LTCL on sale of shares, where other conditions are met, i.e. deal on NSE/BSE, and STT paid on both legs of purchase/sale

(e) Accumulation of losses by not setting off in the year where there is eligible income is not possible. A taxpayer cannot carry forward losses in spite of having capital gain in financial years.

For Example, Mr. Anupam has brought forwarded losses of Rs 20000 from FY 2019-20 and his Long Term capital gain in 2020-21 is 25000/-. He cannot opt to carry forward losses in next year without setting off with the gain in the year 2020-21

(f) There is no standard rule that the short-term capital loss has to be first set off against short-term capital gains before being set off against long-term capital gains. One need to look at the applicable tax rate on various Capital Gains and try to set-off capital loss against the capital gain which has the lowest tax rate, considering his tax slab.

Disclaimer: The article is for education purpose only.

The author can be approached at caaniabhadra@gmail.com

Hi,

Does the off market debit & credit transactions happened between family members need to be reported in itr ,if yes then where under which head.

In my view, not required to be reported.

However, I am not very sure, Request views/ comments from learned professionals on this forum.

If, I got __ 2.5 lakhs LTCG,

i have __ 8 lakhs LTCL

So can one first offset & exhaust LTCG exemptions u/s 112 of Rs. 1 lakh from 2.5 lakh LTCG?

and then adjust balance 1.5 lakh LTCG with carry forward LTCL of Rs. 8 lakhs in iTR ?

can u please provide procedure and where to do it while filing ITR?

I got one online reference mentioned below , but not very lucid , if you can share some light on this.

“”Manner of Set off of loss:

We may have a scenario where there may be an STCL in a year and LTCG specified u/s 112A in the same year. Now the question is whether such exemption of Rs. 1 lakhs should first be applied and then set off the loss? or should losses first be set off and exemption of Rs.1 applied later? Let’s take a simple example, Mr.A holds an investment in equity-oriented Mutual Fund (Short term and covered u/s 111A) and he also holds an Equity share in Company X. During the FY Mr.A incurred a loss of Rs. 50,000 on sale of equity-oriented MF and had a gain on sale of equity share from the sale of a share in company X amounting to Rs. 90,000. Now, Mr.A is caught up in the middle of sec 112A and sec 70 whether to use the exemption u/s 112A first or to use set-off of loss u/s 70. …? If we look at the above scenario, it is prudent for Mr.A to apply the exemption provision u/s 112A first and arrive at the gain and the arrived balance gain be netted off against STCL by virtue of u/s 70. However, from Mr. A’s point of view, this may seem like the best option. He gets to claim the exemption and still have STCL carry forwarded for the next year. Though the Department has not come up with any explanation on the manner of set-off of loss u/s 70 and using of exemption provision u/s 112A, it would be wise to look at the situation based on the below-mentioned point. “It is a usual practice to first arrive at the gain or loss under one source and then move on to the other source under the same head. Sec 112A deals with LTCG or LTCL (one source) and sec 111A deals with STCG or STCL on sale of specified short-term asset (another source under the same head). In the given case it is natural to arrive at the final solution u/s 112A ( Rs. 90,000 less exemption to the extent of Rs. 1,00,000) first and then move on to sec 111A. Based on the above analogy, the final solution u/s 112A would be Nil and there would be no gains available under 112A to be netted off against loss under the head STCL.”

Conclusion: i) Based on the above analysis, exemption available u/s 112A should first be exhausted and then set off of loss under sec 112, sec 111A or any other STCL should be netted off to arrive at the final answer under the head Capital Gains. ii) However, it is up to the department to come up with an explanation on the above issue.

No, it cannot be done.

First Intra head adjustments will take place. LTCL of Rs 2.5 lakhs will be set off against LTCG and balance LTCL of Rs 5.5 lakhs will be carried forward.

While filing ITR, you simply need to enter the details in Schedule CG and confirm other schedules i.e. CYLA (Current Year Loss Adjustments) & CFL (Carry forward losses)

System will automatically do the adjustment and calculate the amount to be carried forward.

Madam, Pls clarify the following:

Cost of Acquisition (CoA) shall be Share Value + Brokerage charges etc. (excl. STT)

Sale Value (SV) shall be Sales Consideration – Brokerage charges etc. (excl. STT).

Hence, Actual Gain shall be [SV – CA – Total Brokerage charges etc. during buying & selling (excl. STT)] & this Actual Gain figure needs to be reported while filing ITR. Am I right?

You are right.

where to report in current year’s ITR, previous years carry forward short term capital losses on trading in shares

You need not to report previous year capital losses. Just click and confirm the schedules BFLA, & Schedule CFL

Filling ITR2.

STC Gain in period 15Jun is 10000, in 15 Sept is 10000, in 15 Dec is 15000, in 15 Mar is 5000. But in the period 16th March to 31 Mar, there is a STC Loss of (20000). How do I offset this loss against the gains?

STCL can set off with STCG at source itself. Just add 15th Jun 10000 & 15th Sep 10000 as STCG.

STCG of last 2 quarter is not required to be reported as it is set off against loss of Rs 20000 on 31st March itself.

Thanks mam.

Just to be sure, the Gains occurred before the Losses.

Upto 15th June 22: Gain

Between 16th June to 15th Sept 22: Gain

Between 16th June to 15th Dec 22: Gain

Between 16th Dec to 15th Mar 22: Gain

Between 16th Mar to 31st Mar 23: Loss

Is it still OK to offset the loss of 5th period from that of the Gains from period 3rd and 4th?

Thanks!

We are unable to account Short Term Capital Gain or Loss in ITR 4 along with while I report Freelancers income. Alternatively, if I account Short Term Capital Gain or Loss in ITR 2, it does not take, or have column to report Freelancers income; Please guide us if we are not using the from correctly or income tax department want us to file two ITR forms separately for this incomes in one AY.

File ITR 3 – You can report both Capital Gain and income from free lance business/ services.

hello mam

where can I declare my short term loss in ITR 2 from shares, I only have loss in short term and I want that to be carried forward to next years. i have no gains against which it can be adjusted. kindly advise. i was thinking it can go under schedule CG under this heading “Pass Through Income/ Loss in the nature of Short Term Capital

Gain, chargeable @ 15%” column a7a with a -ve symbol.

In CG Schedule – under the heading STCG, enter the sale consideration & cost of acquisition. It will automatically calculate losses.

After that click “confirm” in Schedule CYLA, BFLA, and CFL & Schedule Special Income. No details are required to be entered in these schedules.

Dear Anita ,

Excellent article. However, my case is little different.

My question is w.r.t. Delisted stock long term capital loss (Post Corporate Insolvency Resolution Process at NCLT- Sintex Industires Ltd has been extinguished. Which Acquisition cost to be considered while filing ITR-2. There is stock spilt happened in 2016 after initial purchase.

I had purchased Sintex Industries Ltd in 2012, 6000 Nos at Rs. 67.57

Total invested value Rs. 405420 ( Rs.67.57 x 6000 = Rs.405420 )

In the year 2016 company was announced spilt and I was received

Sintex Industries Ltd – Qty – 6000 Nos

Sintex Plastics Technology Ltd -Qty-6000 Nos

At present

1) Sintex Industries Ltd – Qty – Zero

2)Sintex Plastics Technology Ltd -Qty-6000 Nos -CMP-Rs. 1.41

In above circumstances how to apportion cost between two companies.

Your reply with clarity on this regard will be highly appreciated.

Hello ma’am,

how to show breakup for oly losses as it does not take negative value.

In case , you have profit in any of the quarter , adjust the loss with the same and report the net profit in that quarter .

Thanks Anita ji. But similar issue.

Filling ITR2. STC Gain in period 15Jun is 10000, in 15 Sept is 10000, in 15 Dec is 15000, in 15 Mar is 5000. But in the period 16th March to 31 Mar, there is a STC Loss of (20000). How do I offset this loss against the gains?

Manish I am also facing same issue. Did u get any solution then please share

Good evening Madam

I am a salaried person. I had intraday Profit of 12250 and Long term losses of 78000. If I try to fill ITR-3, it demands for a business code to be filled mandatorily while doing Tax calculations. I had no business. Is it possible that I can file ITR-2 for Intraday and LTCL.

Hi Anita

I have 6 lakh plus FNO trading loss in last 2years. And this year have 5lakh profit. However have not filed the ITR as I had less than 2lakh minimal salary income.

Is there anyway I can file combined tax for all 2 years.?

What is the point of declaring stcl if it cannot be set off against any kinds of income?

how to show loss, without booking loss in equity stocks in ITR ??

Hi

I am filing ITR3. I am not able to see loss declared in my last years IT return in CFL/BFL schedule. Are these figure populated automatically or I need to check my last year return and enter the loss figure manually? (I have filed last year IT return before due date)

Enter the loss figure manually

Hi Ma’am

Thank you so much such an educative post.

On sale of shares, I have got profit in short term CG in first qtr and incurred loss in the last qtr ,how to adjust it??

Thanks for your humble comment .

Enter net profit ( Q1 Profit- Q2 Loss ) in any of the quarter .

I have stcg loss of Rs 1660 , how to show this in F of accrual gains in itr 2 ? Pls help

I had sold my property and there is Long term capital loss after indexation. In current year I have LTCG from shares. Can this be adjusted.

Yes , You can set off LTCL from assets against LTCG from Shares.

In case , you have profit in any of the quarter , adjust the loss with the same and report the net profit in that quarter .

If there is total net loss in the year , its not required to be reported in Point F of Schedule CG

in the above example, how does one fill F Accrual of capital gains quarterly in Sch CG since ltcg for equity and debt are both losses, in your example, and negative entries are not allowed.

I am facing this problem and am not able to validate my return.Last date is approaching fast.

The losses can be adjusted with profit in any quarter . Need not to provide details in each quarter .

If there is no profit in any of the quarter , there will not be any validation error for no entering quarter wise details

Hello. Can u please advise which Schedules do I need to fill in ITR 2, as I have loss on Sale of Property in Fy 21-22.

Thanks

Schedule Capital gain ” Land or building or both “

Maam…Iam having some very small amount of long and short term capital losses..my salary is around 9lacs….shall I have to fill ITR-2 or ITR -1?

For Capita Gain , ITR 2 is required to be filed ( irrespective of the fact that amount of gain is small or huge.

Very well explained regd carry forward losses in equity shares. It is enlightening for me while filing IT returns.

Thanks for your humble comment. Glad that it helps you

Very well explained in a simple manner step by step.

Thank you Sir for humble comment.

It really motivated to work even better .

WHAT IS THE DIFFERENCE BETWEEN ITR-2 AND ITR -3

WHAT IS THE LAST DATE FOR SUBMISSION OF ITR FOR CLAIMING STCL/LTCL

INTT PAID TO BROKERS OR TO BANK ON OVERDRAFT A/C,BROKERAGE AND STT AMOUNT CAN CLAIM AGAINST ACQUISITION COST

In addition to Salary Income , Interest etc , If you are dealing with F&O , Intraday – ITR 3 need to be filed ( These are treated as Income from Business )

For Capital Gain – ITR 2 is required to be filed.

Due date to file all the returns where tax audit is not required is 31st July 2022 ( For FY 2021-22)

short term profit 16000 है, F&O loss 17000 है, तो क्या F&O loss ,short term profit से adjust हो जायेगा, क्या ITR file करना पड़ेगा। कृपया उचित सलाह दें।

Yes , Adjust ho jayegaa

If you have other income above the maximum exemption limit of Rs 250000 , filing ITR is Mandatory.

For F&O transactions , ITR 3 is to be filed.

I am salaried person. In the FY 2021-22, I am in loss of about 15 lacs in F&O segment. Which ITR form is to be filled. Is this loss is necessary to be shown in ITR

File ITR 3

Yes , it is always advisable to file Return & report losses for 2 reasons

U can carry forward and set off losses in next 8 years.

All the details are reflecting in your AIS .Better to report transactions in ITR .

I am salaried individual and total income is rupees 7 lakh. First time l do intraday trading and having loss rupees 90k and short-term capital loss is rupees 70k.LTCG 20K. .There is no net income from stock market. I wouldn’t show my losses and carry forward it. I want to disclose all my income. I want to file ITR-1 .Is it possible?

You need to file ITR 2 irrespective of the point whether you wish to carry forward losses or not .

Report Salary Income , LTCG , Short Term Loss and Intra day Loss in ITR 2 . Automatically , losses will be carry forward by the system.

Many thanks for your reply Anita 🙂

As I informed you i am salaried and my salary is above the basic exemption limit. I have intra day losses as well.

So on this case, to carry forward the intra-day losses, I need to carry out audit with CA. I wouldn’t require audit if my salary income is less than basic exemption limit or I decalare my profit above 6% of my turnover (I don’t meet any of these conditions).

On the other hand I think I shouldn’t report intraday losses under presumptive scheme as my taxable income will go up by around 70k?

For more details salary 6 lac pa

Intraday turnover 11, 94,000

I think best treatment on this case to avoid report intra day losses?..

You need not to carry out audit with CA for carry forward intraday losses.

Your salary is nothing to do with audit requirement. However, Total income less than basic exemption limit is one of the criteria for no audit.

Declaring profit above 6% is applicable if you opted presumptive taxation scheme in this year (or any of the previous five years).

You may get notice for defective return for not reporting intraday losses

Many thanks Anita ji for ur reply.

I fulfill one of the crieteria that my salary is above the basic exemption limit, and due to that i would need to carry out an audit with CA to carry forward the losses?

No , you don’t required

Refer your query dated 30th Dec 2021:

(a) Yes , report intraday losses under “No Account” case.

(b) If the FY 2020-21 was your first year of business and you had not opted PTS in ANY of the preceding 5 years, Audit is not required

Many many thanks Anita for all your help on multiple queries. 🙂

Hi Anita,

Now I am little confused. As you said “Total income less than basic exemption limit is one of the criteria for no audit”

My salary income is around 6 lakh, so this way i need to go for tax audit to carry forward the losses.

This is only one of the criteria . It is not that all the taxpayers whose salary / total income is above basic exemption limit are required to get tax audit.

if your total income exceeds basic exemption limit AND you had opted presumptive taxation scheme in any of the last 5 years and now you wish to declare losses – tax Audit is required

Many many thanks Anita.

100’s of stars and many more for to you be proactive and answers each and every comment in very simple language.

You really helped me a lot. 🙂

Actually I have gone through some articles but didn’t find one of the condition that you mentioned in the last comment that; a person only need to required audit if he/she has opted presumption scheme in last 5 years and want to declare losses in current year.

As last financial year was my 1st year of trading, so I can happily claim my intraday losses without Audit. 🙂

One point, I need to report my intra-day losses under No account case. Right?

No , this is not the correct treatment.

Do not opt for Presumptive Scheme .

For carry forward losses, you need not to carry out audit with CA

Simply report Salary Income 6.00 Lakhs.

Net Loss from Intraday (turnover minus cost of acquisition) . This will not be set off from salary income but will be carried forward and can be set off for 4 years from any profit from intra day

I have a loss of 4 lakh in options trading and have turn over of 1 crore.

Can I show this as business loss in itr2

Or need to use itr3 is audit necessary

Can this loss be set off against FD intrest

No

ITR 3 is to be filed

Audit is not necessary if you have not opted presumptive taxation scheme in any of the last 5 previous years

F&O loss like any business loss can be set off other income except income from salary

Hi,

Thank you very much for detailing the procedure.

It really helped me while doing it for first time. Appreciate your knowledge share.

Thanks for your humble comment

Hello Mam,

Thanks for writing down such a detailed article.

I have started trading last year and have the following query.

Short term capital gain and long term capital gain:

Cost of acquistion – Should I also include the brokerage and all other costs (including STT) paid on purchase of shares while calculating cost of acquistion of shares?

2) is indexation required to be used to long term capital gain. I have minor ltcg on shares purchased last year. I think cost of acquistion need to be xalcualte on the same manner as we need to do on short term capital gain?

In case of Capital Gain Tax , Cost of acquisition includes brokerage etc.

STT is not to be included for the purpose.

Indexing is allowed for LTCG ( other than equity shares and mutual funds)

Many thanks mam for your help 🙂

Hi Anita,

Just need to check can intra-losses can be against short term profits.

Secondly, if i have intra-day losses, do i have to file ITR 3 and report intraday losses seperately under speculation income?

Intra day trading is considered as speculative business under I tax . Losses from Intraday can be set off only against profit from intra day / speculative business .

Yes , You need to file ITR 3 and report Intraday losses

Thank you very much Anita,

You are so promt and explain everything in simple language.

Like; I am a salaried but I do gud amount of trading everyday. So isn’t possible to show all of my income/loss(stch, ltcg, intra-day) as business income/loss?

No , you can’t show all the income from LTCG/ STCG etc under business head.

Tax rates are different and now with AIS , the Government has all the information about your businesses/ transactions.

You will get notice for defective return if u report everything under business head

Many thanks for your reply Anita 🙂

As I informed you i am salaried and my salary is above the basic exemption limit. I have intra day losses as well. Do i need to carry out audit with CA to carry forward the loss.

I think I shouldn’t report intraday loss else my taxable income will go up by around 70k and also would need to carry out audit?

ITR 2 portal is not accepting negative value for STCG values for 16 June – 15 Sep period and other periods as well.

In my view , the quarter wise break up of Capital Gain or any other income for that matter is relevant for Advance Tax

The losses can be adjusted against profit of subsequent quarter and report accordingly.

Where in the ITR-2 do I subtract my last year’s STCL against this year’s STCG? Been scratching my head over this simple issue since long!

Enter the details of brought forward losses in BFLA ( Brought Forward Loss Adjustment ) schedule and confirm .

It will automatically set off the same

Thanks a lot. Providing the right data in CFL, and using “Compute Set off” in BFLA helped. There is a bug in the app, as schedule BFLA doesn’t calculate the set-off automatically and needs us to click the “Compute Set off” in BFLA.

Thanks for the Article. I have a query –

In last FY, i had no income from any source but had invented in stock market and made a loss of 70K in intraday trading. Which ITR form can i file and is it mandatory to file ITR ?

If your total income from all sources is less than basic exemption limit , it is not mandatory to file ITR.

However, if you want to carry forward losses and set off from intra day trading profits in subsequent 4 years, you need to file return within due date

Hi Anita , it’s great to get a detailed article like this.

I have query related to cost of sale and cost of purchase i need to consider while filing thr income tax return. Like you are aware there are lots of charges and fees are charged when we purchase and sale shares in stock market say; stamp duty, STT, brokerage charges, sgst, sebi turnoover fees etc. So I just need to know that; does i need to consider all of these as cost of sales and cost of purchase. As last year i have done trading in heavy volumes and have to pay around 1.5 lacs of these additional cost and i am having losses as well .

Thank u in advance for your help.

Sir,

Thanks for your humble comment.

All the expenses ( except Security Transaction Tax )incurred in connection with transfer like brokerage, turnover charges, stamp duty, GST etc will be allowed to be deducted from the sales price to arrive at the amount of gain or loss.

Anita, you are a star 💫

Thanks for the quick response.

I just to clearify one point; do u mean that i only need to deduct STT from my net losses for the year?

Thank You Sir.

It means , your profit will be reduced by the exp incurred towards share transactions.

For example : Sales consideration Rs 2000/-, Expenditure Rs 400 towards brokerage etc. and cost of acquisition is Rs 600/-

Your sales consideration will be Rs 1600( 2000-400) and profit will be Rs 1000( 1600 – 600)

Only Expense towards SST will not to be adjusted like this.

Thank you for writing a detailed post & appreciate the effort & sharing our knowledge.

My question on below point 8(a), could you please explain with an example

8. SALIENT POINTS TO REMEMBER

(a) Long term Capital Gain (LTCG) on debts Funds (Tax rate 20%) can be adjusted against LTCG on Equity Shares/MF (Tax rate 10%) and vice versa.

Hello Anita, thanks for information. Have a query on unlisted equity shares. I have capital gain both short and long on equity shares list in US exchange (ESOP sale). Can you please tell me where and how are these to be reported. Thanks

Is it mandatory to file.long term capital.loss or capital gain upto below one lac if reported in tis

Yes , It is mandatory to report Capital gain / Losses even it is less than Rs 1,00,000/- as the exemption of 1 lakh is to be considered only at the time of final tax on Gross Total Income

Hi, thanks for the detailed article. I have one query related to it.

In 2019-20 AY, my Long Term Capital Loss shown was Rs.870 and in 2020-21 it was Rs.59944. Total carry forward is Rs.60814.

In current Assessment Year (2021-22), my Long Term Capital Gain is Rs.27135.

In the portal this LTCG amount is getting adjusted with previous year losses and amount carried forward to next year is Rs.33679.

My query is – LTCG from Equity is non-taxable upto Rs.1 lakh. And my current year profit is Rs.27135, hence it is non-taxable profit, then why the previous year losses (LTCL) is getting adjusted with non-taxable LTCG? Is this how Income Tax calculation happens? Ideally the full previous year losses should be carry forwarded to next year w/o any adjustment.

Please suggest and guide.

Thanks in advance.

First all the brought losses will be adjusted against current year LTCG .

LTCG Exemption upto Rs 1,00,000 will be considered at the time of calculation of tax on Gross Income

If the stock exchange listed shares or debentures which have become valueless because of RBI notification ( Lakshmi vilas bank bond became valueless on merger accepted by RBI between LVB and DCB bank).How can we disclose the LT capital loss which has been extinguished but not sold .

In Item Number 6 the RULES are mentioned. Rule b) L T CAP LOSSES cannot be set off against S T Cap Losses means nothing Probably it should read as LTCL cannot be setoff against STCG

Can you tell how to file speculation business loss return which requires profit and loss and balance sheet as well

I will be writing separate article on the topic .