Case Law Details

Kalyan Development Corporation Vs ACIT (ITAT Mumbai)

Conclusion: Since the addition pertained to the “receipt of money” from the sale of flats by the assessee and these amounts did not represent the actual receipts in the hands of the assessee, they could not be subjected to tax.

Held: AO made addition of Rs.5,30,280/-in respect of receipt of “on money in cash” from the customers who had purchased flats in the project of assessee “Mangeshi Sanskar”. AO noted that assessee had received on money from the purchasers of the flats over and above the agreement value from the computer data seized during the course of search action. Assessment was completed by making an addition of Rs.4,56,77,925/- representing the “on money” received as unaccounted income. Subsequently, an order u/s. 154 was passed, whereby the addition so made was reduced to Rs.31,48,018/-. In the said order passed u/s. 154 rectifying the mistakes apparent from record, the submission of assessee was that income had already been offered to tax in AY 2015-16, 2016-17 and 2017-18 and therefore impugned additions lead to double taxation. Assessee had offered these amounts to tax based on accepting their receipt in the respective assessment years. These facts were demonstrated evidently by the assessee which were accepted by AO and thus relief was granted and the original addition of Rs. 4,56,57,925/- was reduced to Rs.31,48,018/-. CIT(A) further reduced the addition to ₹5,30,280 and did not accept the assessee’s argument regarding amounts not received. Assessee took up the matter . It was held that since the addition was in respect of “receipt of on money” against the sale of flats by assessee and when these two amounts did not represent the actual receipt in the hands of the assessee, they could not be brought to tax. Accordingly, the addition so made was deleted.

FULL TEXT OF THE ORDER OF ITAT MUMBAI

PER GIRISH AGRAWAL, ACCOUNTANT MEMBER:

These captioned appeals filed by the assessees are against orders of Ld. CIT(A)- Pune-11, vide order nos.

i) ITBA/APL/S/250/2023-24/ 1057203905(1)

ii) ITBA/APL/S/250/2023-24/ 1057204125(1)

iii) ITBA/APL/S/250/2023-24/ 1057204357(1)

iv) ITBA/APL/S/250/2023-24/ 1057204632(1)

v ) ITBA/APL/S/250/2023-24/ 1057203103(1)

vi) ITBA/APL/S/250/2023-24/ 1057203349(1)

vii) ITBA/APL/S/250/2023-24/ 1057203595(1)

all dated 19.10.2023 passed against the assessment orders by Assistant Commissioner of Income Tax, Circle 2, Thane, dated 30.12.2019,

i) u/s 143(3) r.w.s. 153A of the Income Tax Act, 1961 (hereinafter referred to as the “Act”) for A.Y. 2016-17 and 2017-18 and u/s 143(3) for A.Y. 2018-19

ii) u/s 143(3) r.w.s. 153C of the Act for A.Y. 2014-15 Kalyan Development Corporation & ors,

iii) u/s. 143(3) r.w.s. 153A of Act for A.Y. 2014-15 and 2016-17 and u/s 143(3) of the Act for A.Y. 2018-19.

2. All these matters are arising out of a common search and seizure action u/s.132 of the Act, conducted on 25.10.2017. As all the issues relate to one search and form part of one group of assessees, all the appeals are taken up together by way of this consolidated order.

3. Grounds taken by each of the assessees are reproduced as under: A. Kalyan Development Corporation (KDC)

i) ITA No.4490/Mum/2023

1. The Learned CIT Appeals erred in confirming the addition of Rs. 1,50,00,000/-made by the Assistant Commissioner of Income Tax. Central Circle 2. Thane (hereinafter referred to as Assessing Officer),. u/s 68 of the Act on the following grounds

a) Loan of Rs. 1,50,00,000/- received by Your Appellant from Mis. Annex Tradelink Private Limited was an accommodation entry

b) Your Appellant has failed to prove the source, nature and credit worthiness of the lender.

and

2. The Learned CIT Appeal confirming the addition of Rs. 9.19.480 made by the Assessing Officer, disallowing the Interest paid by Your Appellant to Mis. Annex Trade Link Private Limited during the Financial year 2015-16 on their loan of Rs. 1,50,00,000/- on the ground that the said loan was an accommodation entry When:

a) The Assessment of Your Appellant has not abated as per the provisions of Sec 153A of the Act and accordingly the scope of the Assessment has to be restricted to incriminating material found in the course of the search.

b) The above additions of Rs. 1,50,00,000/- and Rs. 9,19,480/- were not made based on any incriminating material.

c) No enquiry was made during the course of assessment proceedings as regards genuineness of the above loan nor any question was posed in this regard and no show cause was issued to appellant in this connection. Thus. Your Appellant was not given proper opportunity of being heard and to rebut the conclusion of the Assessing Officer.

d) However, during Remand Proceedings the appellant has submitted all the evidence necessary to prove the identity and creditworthiness of the lender and the genuineness of the loan.

3 The Learned Assessing Officer erred in not giving proper opportunity to Your Appellant while framing his Assessment Year for the Assessment Year 20162017

4. The Learned CIT Appeals erred in not accepting the contentions of Your Appellant that the order passed by the Assessing Officer U/s 153A of the Act. 1961 after the approval of the Learned Joint Commissioner of Income Tax. Central Range. Thane under section 153D of the Act is bad in law, considering the fact that the approval was granted mechanically without application of mind and therefore the order may please be quashed.

ii) ITA No.4496/Mum/2023

1. The Learned CIT Appeals erred in confirming the addition of Rs.80,50,765/-made by the Assistant Commissioner of Income Tax, Central Circle 2, Thane (hereinafter referred to as Assessing Officer), while, framing the Assessment Order u/s 153A r.w.s.143(3) of the Act for the Assessment Year 2017-18 on the ground that Your Appellant has received “on money” in cash from their customers who have purchased flats in their project “Mangeshi Dazzle III”

2. The Learned CIT Appeals erred in not accepting the contentions of Your Appellant that the order passed by the Assessing Officer U/s 153A of the Act, 1961 after the approval of the Learned Joint Commissioner of Income Tax, Central Range, Thane under section 153D of the Act is bad in law, considering the fact that the approval was granted mechanically without application of mind.

iii) ITA No.4530/Mum/2023

1. The Learned CIT Appeals erred in confirming the addition of Rs.3,63,09,781/-made by the Assistant Commissioner of Income Tax, Central Circle 2. Thane (hereinafter referred to as Assessing Officer), while, framing the Assessment Order u/s 143(3) of the Act for the Assessment Year 2018-19 on the ground that Your Appellant has received “on money” in cash from their customers who have purchased flats in their project “Mangeshi Dazzle III”.

B. Mangeshi Enterprises (ME)

i) ITA No.4492/Mum/2023

1. The Learned CIT Appeals erred in confirming the following additions made by the Assistant Commissioner of Income Tax, Central Circle 2, Thane, while, framing the Assessment Order cs 153C r.ws. 143(3) of the Income Tax Act, 1961 (hereinafter referred to as “the Act”) for the Assessment Year 2014-15

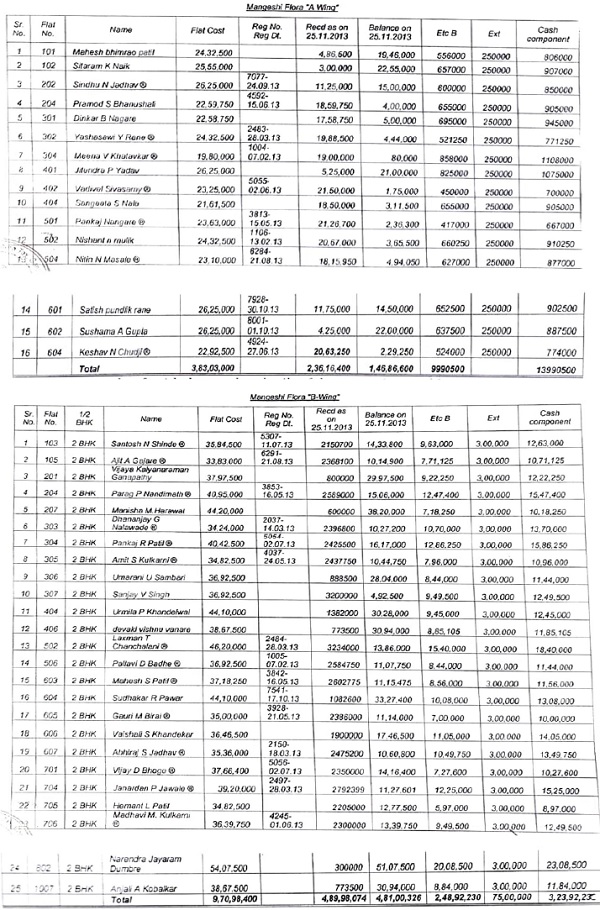

a) On account of alleged unaccounted Cash Receipts of Rs. 1,39,90,500/- from Sale of Flats in “A Wing’ of the project “Mangeshi Flora” constructed by Your Appellant

b) On account of alleged unaccounted Cash Receipts of Rs. 3,23,92,230/- from Sale of Flats in ‘B Wing of the project “Mangeshi Flora” constructed by Your Appellant

On the grounds that:

a) That there were clear evidence that Your Appellant Firm had been receiving unaccounted cash on account of Sale of Flats in its project “Mangeshi Flora”.

b) One of the partners of the firm, Mr. Mangesh Gaikar had admitted during the course of search the receipt of “On Money” in cash from Sale of Flats in his individual capacity.

While filing his Return of Income for the Assessment Year 2017-18, Mr. Mangesh Gaikar, the Partner of the Firm, in his individual capacity, had disclosed unaccounted income on account of receipt of Maintenance Charges, Extra Work, Stamp Duty & Registration Charges, Society & Grill Charges, Service Charges & VAT in cash, which were not recorded in his books of accounts.

When:

It was a consistent plea of Your Appellant, that

a) No incriminating documents were found and seized from the premises of Your Appellate during the course of search.

b) The documents found and seized from the premises of Mrs. Suvarna D. Amte were not incriminating material at all.

c) Such documents found from the Premises of Mrs. Suvarna D. Amte were nothing but flatwise details of units in the project “Mangeshi Flora” constructed by Your Appellart, containing details such as Flat Number, Area in Sq. Mtrs., Name of the Customer, Registration Number & Date, Amount received as on 25.11.2013 and Outstanding Balance as on 25.11.2013. These details do not lead to conclusion that Your Appellant Firm has been receiving “On Money” in cash out of Sale of Flats.

d) Mr. Mangesh Gaikar, the partner of the firm may have declared the cash receipts remaining unaccounted in his books from the projects constructed by him in his individual capacity, but that does not lead to a conclusion that Your Appellant Firm has also been receiving unaccounted income in cash. Mr. Mangesh Gaikar, though a Partner of Your Appellant Firm is a separate individual having a separate PAN and separately assessed to tax.

2. The Learned CIT Appeals erred in not accepting the contentions of Your Appellant that the Assessing Officer erred in not giving proper opportunity of being heard while making the additions of Rs. 4,63,82,730/- while framing his Assessment Order u/s 143(3) of the Act for the Assessment Year 2014-15

3. The Learned CIT Appeals erred in not accepting the contentions of Your Appellant that The learned Assessing Officer erred in issuing notice U/s 153C of the Income Tax Act, 1961 without recording proper satisfaction as per the tenets of that section.

4. The Learned CIT Appeals erred in not accepting the contentions of Your Appellant that in view of the above, the order passed by the Assessing Officer in case of Your Appellant for the Assessment Year 2014-15, U/s 153C of the Income Tax Act, 1961 is bad in law.

5. The Learned CIT Appeals erred ir not accepting the contentions of Your Appellant that the order passed by the Assessing Officer U/s 153A of the Act, 1961 after the approval of the Learned Joint Commissioner of Income Tax, Central Range, Thane under section 153D of the Act is bad in law, considering the fact that the approval was granted mechanically without application of mind.

6. Your Appellant humbly submits that the addition of Rs.4,63,82,730/-, made by the assessing officer may please be deleted.

C. Mangesh D. Gaikar (MDG)

i) ITA No.4577/Mum/2023

1. The Learned CIT Appeals erred in confirming the addition of Rs.1,50,00,000/-made u/s 69 of the Income Tax Act, 1961 (hereinafter referred to as the Act) by the Assistant Commissioner of Income Tax, Central Circle 2. Thane (hereinafter referred to as Assessing Officer), while, framing the Assessment Order u/s 153A r.w.s. 143(3) of the Act for the Assessment Year 2014-15 on the ground that Your Appellant has allegedly made payments in cash to Mr. Dinesh Krishna Patil which remained unaccounted in the books of Your Appellant.

when

a) It was consistent plea of Your Appellant that he has not entered in to any transaction with Shri Dinesh Krishna Patil either in Cash or in Cheque during the Financial Year 2013-14.

b) The 6 cash receipts showing the cash payments to Shri. Dinesh Krishna Patil totalling to Rs. 1,50,00,000/- were not found in the premises of Your Appellant during the course of the search but they were found from the premises of Shri Atul D Tanna who was also simultaneously searched alongwith Your Appellant, accordingly the onus u/s 132(4A) or us 292C of the Act does not lay upon Your Appellant.

c) These alleged cash receipts are undated and they are not in handwritings of Your Appellant nor they are signed by the Your Appellant.

d) The alleged cash receipts pertain to payment make to Dinesh Krishna Patil towards land bearing Survey No 69 Hissa No 1/1 Mauje Kanchangaon. The Appellant has enetered into a Development Agreement as regards land bearing Survey No 69 Hissa No 1/1 Mauje Kanchangaon with Shri Shatrughan Kapsha Patil and Shri Sushant Shatrughan Patil on 31/12/2014. However, Shri Dinesh Krishna Patil or any of his family member did not have any rights in this piece and parcel of Land and accordingly the question of making any payments to him does not arise and accordingly Your Appellant denies the allegation of the Assessing Officer that he has made Cash Payments to Shri Dinesh Krishna Patil.

e) During the course of Assessment proceedings, vide his letters dated 07th November, 2019 and 14th December, 2019, Your Appellant requested the Assessing Officer that, as the Assessing Officer was relying upon the statements of Shri. Atul Tanna, Shri. Ashok Sudam Patil, & Shri Dinesh Krishna Patil, as per the Law of Evidence, in fact, they were the witness of the department and accordingly the onus is on the Assessing Officer to prove the fact that your Appellant has made alleged cash Payment to Dinesh Krishna Patil.

f) Moreover, the Assessing Officer was also requested to:

i. Provide the document seized from the premises of Mr. Atul Tanna which allegedly implicate Your Appellant.

ii. Provide the copy of statements of Shri. Atul Tanna, Shri. Ashok Sudam Patil, & Shri Dinesh Krishna Patil recorded u/s 132/131 of the Act

iii. Provide cross examination of Shri. Atul Tanna, Shri. Ashok Sudam Patil, & Shri Dinesh Krishna Patil to enable Your Appellant to rebut the allegation of Assessing Officer.

g) The Assessing Officer provided the copies of the cash vouchers and one undated and unsigned Memorandum of Understanding which were seized from the premises of Mr. Atul Tanna. However, he did not provide copy of the statement of Shri. Atul Tanna, Shri. Ashok Sudam Patil, & Shri Dinesh Krishna Patil. The Cross examination of all these three persons was also not afforded to the Appellant.

2. In view of these circumstances, facts and law, Your Appellant pleads Your Honors that the addition of Rs.1,50,00,000/- made by the Assessing Officer u/s 69 of the Act was in violation of the principles of Nature, Law & Justice and merely based on conjecture and surmise and needs to be deleted.

3. The Learned Assessing Officer erred in not giving proper opportunity to Your Appellant while framing his Assessment Year for the Assessment Year 20142015.

4. The Learned CIT Appeals erred in not accepting the contentions of Your Appellant that the order passed by the Assessing Officer U/s 153A of the Act, 1961 after the approval of the Learned Joint Commissioner of Income Tax, Central Range, Thane under section 153D of the Act is bad in law, considering the fact that the approval was granted mechanically without application of mind and therefore the order may please be quashed.

ii) ITA No.4528/Mum/2023

1. The Learned CIT Appeals erred in confirming the addition of Rs.5,30,280/-made by the Assistant Commissioner of Income Tax, Central Circle 2. Thane (hereinafter referred to as Assessing Officer), while, framing the Assessment Order u/s 153A r.w.s. 143(3) of the Act for the Assessment Year 2016-17 on the ground that Your Appellant has received “on money” in cash from his customers who have purchased flats in his project “Mangeshi Sanskar”

2. The Learned CIT Appeals erred in confirming the addition of Rs. 50,00,000/- made by the Assessing Officer, u/s 68 of the Act on the following grounds:

a) Loan of Rs. 50,00,000/- received by Your Appellant from M/s. Annex Tradelink Private Limited was an accommodation entry.

b) Your Appellant has failed to prove the source, nature and credit worthiness of the lender.

and

3. The Learned CIT Appeal confirming the addition of Rs. 3,87,945/- made by the Assesing Officer, disallowing the Interest paid by Your Appellant to M/s. Annex Trade Link Private Limited during the Financial year 2015-16 on their loan of Rs. 50,00,000/- on the ground that the said loan was an accommodation entry

When:

a) The Assessment of Your Appellant has not abated as per the provisions of Sec 153A of the Act and accordingly the scope of the Assessment has to be restricted to incriminating material found in the course of the search.

b) The above additions of Rs. 50,00,000/- and Rs. 3,87,945/- were not made based on any incriminating material.

c) During the course of assessment proceedings the appellant has submitted all the evidence necessary to prove the identity and creditworthiness of the lender and the genuineness of the loan.

4. The Learned Assessing Officer erred in not giving proper opportunity to Your Appellant while framing his Assessment Year for the Assessment Year 20142015.

5. The Learned CIT Appeals erred in not accepting the contentions of Your Appellant that the order passed by the Assessing Officer U/s 153A of the Act, 1961 after the approval of the Learned Joint Commissioner of Income Tax, Central Range, Thane under section 153D of the Act is bad in law, considering the fact that the approval was granted mechanically without application of mind and therefore the order may please be quashed.

iii) ITA No.4525/Mum/2023

1. The Learned CIT Appeals erred in confirming the addition of Rs.1,99,46,568/-made by the Assistant Commissioner of Income Tax, Central Circle 2, Thane (hereinafter referred to as Assessing Officer), while, framing the Assessment Order u/s 143(3) of the Act for the Assessment Year 2018-19 on the ground that Your Appellant has received “on money” in cash from his customers who have purchased flats in his various projects.

2. While adjudicating upon the Revised Computation filed by Your Appellant for the Assessment Year 2018-19, during the Assessment Proceedings (which was not considered by the Assessing Officer while framing his Assessment Order) (the computation was revised due to change in method of Accounting), the Learned CIT Appeals erred in:

a) not accepting the claim of Your Appellant that the revenue of Rs. 21,94,500/-should not have been taxed in the Assessment Year 2018-19 as it was already offered to tax in the Assessment Year 2019-20

b) not accepting the claim of the Your Appellant as regards downward revision of the closing stock as on 31/03/2018 by Rs.53,23,965/- due to change in the method of Accounting. The Learned CIT Appeals further erred in not accepting this contention of Your Appellant that such a change in stock valuation was revenue neutral on the ground that closing stock as on 31/03/2018 shall be opening stock as on 01/04/2018 and this income od Rs.53,23,965/- was already offered to tax in the subsequent Assessment Year being the Assessment Year 2019-20. The Learned CIT Appeals fail to appreciate that by not accepting this contention of Your Appellant the income of Rs.53,23,965/ has been taxed twice Le, in the Assessment Year 2018-19 as well as in the Assessment Year 2019-20, when the Returned Income of Your Appellant for the Assessment Year 2019-20 has already been computed reducing the Opening Stock as on 01/04/2018 by Rs.53,23,965/-, and such income was assessed u/s 143(1) of the Act.

3.1. In all these seven appeals, assessee has raised one common additional ground which is extracted below:

“The Assessing Officer erred in passing the assessment order dated 30.12.2019 without obtaining Document Identification Number (DIN).

The appellants contend that on the facts and in the circumstances of the case and in law, the Assessing Officer ought to have obtained and mentioned DIN on the assessment order, having not taken, the impugned assessment order is ab initio void and needs to be quashed.”

3.2. In the course of hearing, assessee did not press on these additional grounds, accordingly, the same is dismissed as not pressed in all these seven appeals.

4. Brief facts in general are that a search action u/s 132 of the Act was conducted on 25/10/2017, on the business and residential premises of Shri Mangesh D. Gaikar and Umesh Tanna group of cases including the Kalyan Development Corporation. Shri Mangesh D. Gaikar is the main person of the group and a partner in KDC and ME. During the search operation, various incriminating documents were found indicating that Shri Mangesh D. Gaikar is involved in unaccounted receipts and payments in his proprietorship concerns as well as partnership firms. When confronted, additional income of Rs. 7,72,93,087/- for AYs 2012-13 to 2018-19, was admitted by Shri Mangesh D. Gaikar in his individual case. Besides this, additional income was also admitted in the hands of partnership firms namely Mangeshi Enterprises (Rs. 1,59,45,634/-) and Kalyan Development Corporation (Rs. 4,64,71,835/-). This additional income was declared on estimated basis and was quantified @5% of total sales declared in each assessment year.

5. We first take up the matter in ITA No.4490/Mum/2023 for Assessment Year 2016-17 in the case of Kalyan Development Corporation (KDC) in which assessee has contested that scope of assessment u/s. 153A is restricted to incriminating material found and seized documents during the course of search for the relevant Assessment Year for making assessment in the case of unabated years. Considering the date of search, i.e. 25.10.2017 (Assessment Year 201819), the impugned Assessment Year 2016-17 is an unabated year within the meaning of section 153A. According to the assessee, relevant incriminating material is a must for making the addition of Rs.1,50,00,000/- towards unsecured loans from Annexe Tradelink Pvt. Ltd. u/s.68 by treating it as unexplained credit and holding it as accommodation entry.

5.1. Year-wise details of additional income declared in the returns filed u/s 153A of the Act are as under- Kalyan Development Corporation & ors,

| A.Y. | Date of filing of original return |

Returned income | Date of filing of return u/s 1534 | Income declared in1534 return | Additional income offered |

| 2016-17 | 29/09/2015 | Nil | 29/12/2018 | 14,23,22,510 | 14,23,22,510 |

| 2017-18 | 26/03/2018 | Nil | 29/12/2018 | 6,69,94,700 | 6,69,94,700 |

| 2018-19 | 31/10/2018 | 1,33,48,670 | Return was revised on 29/03/2019 to Rs.7,80,23,400/- | ||

5.2. Ld. Assessing Officer observed that during the search at the residential premise of Shri Mangesh D. Gaikar, Sukh Shanti Bunglow, Near Golden Park, Bhiwani Murbad Road, Kalyan, a tax audit report in Form 3CD was found for the assessee, i.e., KDC. From the perusal of the audit report for Assessment Year 2016-17 in clause no.31, assessee had furnished the details in respect of loans or deposits in an amount exceeding the limits specified in section 269SS taken or accepted during the previous year in which details relating to loan taken from Annexe Tradelinks Pvt. Ltd. were furnished. In this respect, ld. Assessing Officer asked the assessee to provide complete details of the said party. To enquire into this matter, ld. Assessing Officer noted about the post search proceedings for which commission was issue to DDIT(Inv), Kolkata. Based on this enquiry, a specific show cause was issued to the assessee as to why such accommodation entries appearing in the book of the assessee as loans should not be treated un-explained credit u/s.68 of the Act. Assessee furnished partial details which led to the addition which is under challenge before the Tribunal. Ld. Assessing Officer had also disallowed the corresponding interest payment on this loan, amounting to Rs.9,19,480/-, since the loan itself has been treated as unexplained credit.

5.3. Assessee took the matter before the ld. CIT(A) wherein additional evidences were placed on record which included.

| Sr. No. | Particulars |

| 1 | Copy of Confirmation from M/s Annex Tradelink P Ltd |

| 2 | Copy of Annual Audited Accounts of M/s Annex Tradelink P Ltd for the Financial Year 2015-16 |

| 3 | Copy of Acknowledgement of Return of Income filed for the Assessment Year 2016-17 by the Lender Company |

| 4 | Copy of PAN Card of M/s Annex Tradelink P Ltd having PAN AAICA7688K |

| 5 | Copy of Bank Statement of M/s Annex Tradelink P Ltd for A/c No 76694318 with Canara Bank, Bhawanipore, Kolkata |

| 6 | Details & Sources of funds available with M/s Annex Tradelink P Ltd while granting loan of Rs. 50,00,000/- to M/s Mangeshi Construction on 25/06/2015 |

| 7 | Copy of Bank Statement of Account No 757 of Thane Bharat Sahakari Bank Ltd. in case of Mangeshi Construction |

| 8 | Copy of certificate issued by Registrar of Companies Kolkata for change of name of the company |

5.4. Ld. CIT(A) called for a remand report from the ld. Assessing Officer on the additional evidence furnished by the assessee. In the said remand report, ld. Assessing Officer commented that statement of Shri Mangesh D. Gaikar was recorded u/s.132(4) in the course of search wherein questions were asked relating to the tax audit report in Form 3CD wherein transaction of loans taken by the assessee from Annexe Tradelinks Pvt. Ltd. was reported. Assessee furnished a rejoinder to the remand report stating that the loan transaction has been duly reflected in its audited book of accounts as well as in the books of the lender company. Assessee has paid interest on the said loan which has also been duly accounted for. The loan had been squared off and appropriate TDS has been done on the interest payment which has been deposited to the account of the government. It was also submitted that the lender company had adequate reserves and surplus as reported in its audited balance sheet as on 31.03.2016. Further, bank statement of the lender had sufficient balance for lending the amount to the assessee and there was no cash deposit before or at the time of granting loan to the assessee.

5.5. Assessee relied on the decision of the Hon’ble Supreme Court in the case of PCIT vs. Abhisar Buildwell Pvt. Ltd. reported in (2023) 149 taxmann.com 399 (SC) on the applicability of Section 153A in an unabated year where addition has been made without reference to the incriminating material found and seized during the course of search of the assessee, relevant to the addition and the Assessment Year.

5.6. Ld. CIT(A) by placing reliance on the statement of Shri Mangesh D Gaikar recorded u/s. 132(4), which according to him could not satisfactorily substantiate the genuineness of the loan, observed that assessee had declared additional income after the search operation in the return filed u/s.153A, which suggest that addition has been made on the basis of the material found during the search and therefore ld. Assessing Officer had proper jurisdiction to make addition in the hands of the assessee. He thus, rejected the applicability of ratio in the decision of Hon’ble Supreme Court in the case of Abhisar Buildwell Pvt. Ltd. (supra) and sustained the addition.

6. We have heard both the parties and perused the material on record. We have also given our thoughtful consideration to the observations and findings arrived at by the authorities below. It is evident that the addition made is in respect of the disclosure made by the assessee in its tax audit report in Form No.3CD which was found from the residential premise of Shri Mangesh D. Gaikar, who is one of the partners in the assessee firm. Assessee has duly substantiated the requirements u/s.68 to establish the identity and credit worthiness of the company as well as the genuineness of transaction by furnishing the requisite documentary evidences and explanation for which a remand report had also been called for. It is a case where the addition is based on a reported transaction in the tax audit report which has been duly accounted for in the audited books of accounts and subsequently substantiated by requisite documentary evidences. To our mind, making an addition based on tax audit report found from the residential premise of one of the partners of the assessee firm cannot be said to be in reference to an incriminating material found and seized during the course of search for which the addition has been made.

6.1. We have considered the rival submissions. Perusal of the order of Ld. AO evidently demonstrates that there is no reference to any incriminating material found and seized during the course of search in respect of the addition towards loan taken from Annex Tradelinks Pvt. Ltd. It is also undisputed that the year under consideration is an unabated year considering the date of conduct of search within the meaning of section 153A of the Act. Admittedly, no incriminating material has been referred to which has been found in the course of search of the assessee for the impugned assessment year. Accordingly, as relied on by the Ld. Counsel for the assessee, the decision of Hon’ble Supreme Court in the case of Abhisar Buildwell Pvt. Ltd.(supra) applies squarely to the facts of the present case.

6.2. Hon’ble Supreme Court in para 14 in the above case has categorically held as follows :-

14. In view of the above and for the reasons stated above, it is concluded as under:

(i) that in case of search under section 132 or requisition under section 132A, the AO assumes the jurisdiction for block assessment under section 153A;

(ii) all pending assessments/reassessments shall stand abated;

(iii) in case any incriminating material is found/unearthed, even, in case of unabated/completed assessments, the AO would assume the jurisdiction to assess or reassess the ‘total income’ taking into consideration the incriminating material unearthed during the search and the other material available with the AO including the income declared in the returns; and

(iv) in case no incriminating material is unearthed during the search, the AO cannot assess or reassess taking into consideration the other material in respect of completed assessments/unabated assessments. Meaning thereby, in respect of completed/unabated assessments, no addition can be made by the AO in absence of any incriminating material found during the course of search under section 132 or requisition under section 132A of the Act, 1961. However, the completed/unabated assessments can be re-opened by the AO in exercise of powers under sections 147/148 of the Act, subject to fulfilment of the conditions as envisaged/mentioned under sections 147/148 of the Act and those powers are saved.

The question involved in the present set of appeals and review petition is answered accordingly in terms of the above and the appeals and review petition preferred by the Revenue are hereby dismissed. No costs.”

6.3. In these circumstances, respectfully following the decision of the Hon’ble Supreme Court in the case of Abhisar Buildwell (P.) Ltd. (supra), as no incriminating material has been unearthed during the course of search for the relevant assessment year, no addition can be made by the AO in the impugned assessment. Consequently, the assessment order passed for the impugned assessment year stands quashed.

6.4. Since the assessment order has been quashed in terms of above observations and finding, other grounds taken by the assessee are rendered academic in nature and therefore not adjudicated upon.

7. We now take up other two appeals of KDC for Assessment Year 2017-18 and 2018-19 in ITA No.4496/Mum/2023 and 4530/Mum/2023 wherein common issue is involved in respect of addition made on account of receipt of alleged “on-money” in cash from the customers who had purchased flats in the project undertaken by the assessee in the name of “Mangeshi Dazzle III”. Addition of Rs.1,58,75,825/- for Assessment Year 2017-18 and of Rs.6,64,56,865/- for Assessment Year 2018-19 were made on account of “on money” alleged to be received by the assessee as found recorded in the seized documents. Ld. Assessing Officer quantified the cash receipts for the two years under consideration as per the seized page No.103 and 104 of Bundle No.1, Party AB-6 which is tabulated as under:

| Sr. No. | Flat/Shop No. | Date of Booking |

Α.Υ. | Diff/T ch |

| 1 | Dazzle -III/E/206 | 16/04/2016 | 2017-18 | Rs.26,25,060/- |

| 2 | Dazzle -III/C/206 | 28/03/2017 | 2017-18 | Rs.26,02,730/- |

| 3 | Dazzle -III/C/1004 | 01/01/2017 | 2017-18 | Rs.8,78,890/- |

| 4 | Dazzle-III/C/1205 | 01/01/2017 | 2017-18 | Rs. 19,05,365/- |

| 5 | Dazzle-III/C/305 | 28/03/2017 | 2017-18 | Rs. 12,17,615/- |

| 6 | Dazzle-III/C/1002 | 28/01/2017 | 2017-18 | Rs.14,46,365/- |

| 7 | Dazzle -III/C/101 | 10/01/2017 | 2017-18 | Rs.26,01,500/- |

| 8 | Dazzle-III/E/101 | 10/01/2017 | 2017-18 | Rs.26,01,500/- |

| TOTAL | Rs.1,58,78,825/- | |||

–

| Sr. No. | Flat/Shop No. | Date of Booking |

Α.Υ. | Diff/T ch |

| 1 | Dazzle-III/C/305 | 03.04.2017 | 2018-19 | 16,26,615 |

| 2 | Dazzle-III/A/706 | 09.04.2017 | 2018-19 | 40,22,785 |

| 3 | Dazzle-III/D/102 | 16.04.2017 | 2018-19 | 25,81,110 |

| 4 | Dazzle-III/E/1203 | 23.04.2017 | 2018-19 | 17,00,560 |

| 5 | Dazzle-1/602 | 15.05.2017 | 2018-19 | 11,31,860 |

| 6 | Dazzle-III/F/804 | 20.06.2017 | 2018-19 | 18,00,001 |

| 7 | Dazzle-III/E/1104 | 01.07.2017 | 2018-19 | 8,93,063 |

| 8 | Dazzle-III/D/804 | 01.07.2017 | 2018-19 | 10,89,210 |

| 9 | Dazzle-III/A/705 | 01.07.2017 | 2018-19 | 33,50,000 |

| 10 | Dazzle-III/E/103 | 09.07.2017 | 2018-19 | 15,00,000 |

| 11 | Dazzle-III/E/1206 | 09.07.2017 | 2018-19 | 15,73,080 |

| 12 | Dazzle-1/304 | 09.07.2017 | 2018-19 | 16,00,000 |

| 13 | Dazzle-III/D/504 | 09.07.2017 | 2018-19 | 15,00,200 |

| 14 | Dazzle-III/E/1102 | 21.07.2017 | 2018-19 | 31,50,000 |

| 15 | Dazzle-III/E/1103 | 03.08.2017 | 2018-19 | 16,73,100 |

| 16 | Dazzle-III/E/1201 | 21.05.2017 | 2018-19 | 20,33,079 |

| 17 | Dazzle-III/E/206 | 16.04.2017 | 2018-19 | 21,98,060 |

| 18 | Dazzle-III/E/1201 | 21.05.2017 | 2018-19 | 20,33,079 |

| 19 | Dazzle-III/E/1203 | 21.04.2017 | 2018-19 | 13,71,000 |

| 20 | Dazzle-III/F/901 | 29.05.2017 | 2018-19 | 27,88,550 |

| 21 | Dazzle-III/602 | 15.05.2017 | 2018-19 | 7,78,180 |

| 22 | Dazzle-III/D/102 | 16.04.2017 | 2018-19 | 22,47,110 |

| 23 | Dazzle-III/D/804 | 30.06.2017 | 2018-19 | 7,64,210 |

| 24 | Dazzle-III/D/504 | 09.07.2017 | 2018-19 | 12,23,200 |

| 25 | Dazzle-III/E/103 | 09.07.2017 | 2018-19 | 12,72,900 |

| 26 | Dazzle-III/E/206 | 16.04.2017 | 2018-19 | 21,98,060 |

| 27 | Dazzle-III/E/1104 | 25.06.2017 | 2018-19 | 5,69,900 |

| 28 | Dazzle-III/E/1201 | 21.05.2017 | 2018-19 | 20,33,079 |

| 29 | Dazzle-III/E/1203 | 21.04.2017 | 2018-19 | 14,23,560 |

| 30 | Dazzle-III/E/1206 | 30.06.2017 | 2018-19 | 24,73,000 |

| 31 | Dazzle-III/F/804 | 20.06.2017 | 2018-19 | 15,23,001 |

| 32 | Dazzle-III/F/901 | 29.05.2017 | 2018-19 | 21,95,000 |

| 33 | Dazzle-III/A/705 | 30.06.2017 | 2018-19 | 33,62,960 |

| 34 | Dazzle-III/A/706 | 09.04.2017 | 2018-19 | 34,42,545 |

| 35 | Dazzle-1/304 | 09.07.2017 | 2018-19 | 13,71,000 |

| 36 | Dazzle-1/602 | 15.05.2017 | 2018-19 | 7,78,180 |

| 6,72,71,237 |

7.1. On confrontation of these details in the course of assessment proceedings, assessee submitted that these papers are un-dated and un-signed which contain details prepared for the purpose of sales management. According to the assessee, these documents do not contain factual data but the probable working of amounts receivable. Further, these documents in no way evidently record that assessee has received cash against the bookings except for society and maintenance charges. As regards society and maintenance charges, assessee submitted that these were collected from customers and handed over to the society when it was formed. In this respect unaudited annual accounts for the proposed society for financial year 2016-17 was furnished. It was also submitted that in the course of conduct of search at the premise of the assessee, no cash was found or seized which demonstrates that assessee had not received any cash as alleged. According to the assessee, ld. Assessing Officer had made the additions because Shri Mangesh D. Gaikar in his individual case had declared certain amounts in his individual return as additional income.

7.2. Before the ld. CIT(A), assessee submitted that addition made by the ld.AO is on the basis of page No.103 and 104 of Bundle No.1, Party AB-6, wherein no such details are mentioned as to “on-money” received by the assessee. On this, ld. CIT(A) noted that contentions of the assessee are prima facie found to be correct and thus called for a remand report from the Assessing Officer for his comments after due verification. In the remand report, ld. Assessing Officer pointed out that the page numbers for seized document pertaining to Assessment Year 2017-18 had been wrongly mentioned in the show cause as well as the assessment order, which is merely a clerical mistake though the bundle number and the party number were mentioned correctly. The correct page number of the seized material is page no.85 for Assessment Year 2017-18.

7.3. To proceed on the issue contested before us, copy of the seized material for both the years, i.e., Page No.85 for Assessment Year 201718 and Page No.103 & 104 for Assessment Year 2018-19 are reproduced below for ease of reference.

a) Assessment Year 2017-18

b) Assessment Year 2018-19

7.4. On the above documents, assessee submitted that the details contained in these documents are nothing but the details of booking in the projects undertaken by it. These documents also contain column for sales tax/VAT. According to assessee, sales tax and VAT was not applicable from 01.07.2017 as GST was applicable thereafter. It was also submitted that customers at times request to make certain modifications in the flat or carry out some extra work which are charged separately by the assessee. For this additional work or modification, a tentative amount is noted which is collected only upon undertaking of the required work. According to the assessee, the excel sheets do not mention any date of receipts of the sums mentioned in various columns and thus there cannot be a presumption that assessee had received cash for these amounts noted in the excel sheets.

7.5. Further, assessee pointed out certain discrepancies from the seized documents to demonstrate that these are tentative figures and do not reflect the exact data contained therein vis-à-vis the additions made by the ld. Assessing Officer. In respect to Assessment Year 201718, it was pointed out that ld. Assessing Officer has made an addition of Rs.26,01,500/- each for Flat No. C/101 and E/101 which nowhere finds its noting in the seized documents. Similarly, for Flat No. E/206, the amount has been taken incorrectly and also that it relates to Assessment Year 2018-19 and not Assessment Year 2017-18. Assessee also demonstrated that there are certain notings in the excel sheet for Flat No. C/1205 and C/305 which were on account of personal booking of Shri Mangesh D. Gaikar, who is one of the partners of the assessee firm and Shri Sunil Singh, who is the landlord, contributing land to the said project.

7.6. Similarly, in respect of Assessment Year 2018-19, assessee pointed out various discrepancies in respect of the additions made by the ld. Assessing Officer wherein certain entries had been counted twice or thrice or had certain transactions which had been completed with different real set of data. After considering all these submissions and contentions or in respect of discrepancies in the additions made by the ld. Assessing Officer in reference to the seized documents, partial relief had been granted by deleting the additions on account of the discrepancies pointed out by the assessee.

7.7. Assessee has strongly contested that the addition made are based on inference drawn by the ld. Assessing Officer on the seized documents by relying on the submissions of Shri Mangesh D. Gaikar which was recorded in the course of search at his residential premise and recorded in his individual capacity. From the said statements, ld. Assessing Officer inferred that assessee received “on money” from the purchasers of the flats over and above the value which is mentioned in the seized value “DIFF” or “T CH”. In this respect, attention of the Bench was invited to para 8.3 of the assessment order of Assessment Year 201819, wherein ld. Assessing Officer has dealt with the statement of Shri Mangesh D. Gaikar and the disclosure made by him in the course of search where the disclosure was made on a estimate basis by offering the net additional income @5% of the total sales declared in the last six years. In this respect, Shri Mangesh D. Gaikar submitted in his statements that there are certain cash receipts and cash expenses related to his business activities including extra work and incidental charges or likewise which may not have been recorded in his regular book of accounts. By drawing inference from this disclosure made by Shri Mangesh D. Gaikar, ld. Assessing Officer observed that, assessee, i.e. KDC had also received actual “on-money” which on analysis of the seized material is much less than the 5% of the sales offered by Shri Mangesh D. Gaikar and thus made the addition based on the notings in the seized documents.

7.8. The observations of ld. Assessing Officer if Para 8.3 are extracts below:

“8.3 The submissions of the assessee have been carefully examined and found to be not acceptable for the following reasons:

1. During the course of the Search action in the case of Shri Mangesh D Gaikar evidences in respect of Cash receipts and Cash expenses relating to his business activities were found and seized. Mr. Gaikar was confronted with the evidences regarding such transactions.

2. Various evidences related with the receipt of cash by Mr. Mangesh D. Gaikar in relation with sale of flats in the projects under taken by the assessee in form of Excel sheets found at Office of Kalyan Development Corporation, Hari Dasrshan Society. Thakurli East. (PARTY AB-6, Bundle no. 1 and Bundle no. 4 are important) were found and seized. On being confronted the partner of the firm in reply to Q.No.70 of the statement recorded u/s.132(4) of the act Mr. Mangesh Gaikar has stated as under:

“I admit that during the course of Search action u/s 132 at various premises related to my concerns, various incriminating documents regarding Cash transactions i.e. Cash receipts and cash expenses related to my business activities have been found and seized. These documents were confronted to me while recording of my statement, vide question numbers 21-52 and 61, 63 and 65 above. I am unable to recollect the exact details of such cash transactions, however, I admit that certain cash receipts and cash expenses related to my business activities including extra work and incidental work charges or likewise may not have been recorded in my regular books of accounts. On the basis of the seized documents as mentioned in above questions, I estimate my net additional income (after considering expenses) from such transactions @ 5% of total sales declared in last six years i.e. for AY 2012-13 to AY 2017-18 and for current year i.e. AY 2018-19 (till date) in the case of my proprietary concerns M/s Himali Construction and M/s Mangeshi constructions and my partnership concerns namely M/s Kalyan Development Corporation and M/s Mangeshi Enterprises. The detailed working of such additional income offered for taxation is as under:

| Name of the person | AY | Additional Income |

| M/s Kalyan Development Corporation | AY 2018-19 | 4,64,71,835/- |

The project-wise and year-wise details of Total sales declared in Books of accounts and Net additional income @ 5% estimated thereon is as per separate sheet submitted as Annexure-3″.

Thus, in this manner, Mr. Gaikar admitted that certain cash receipts and cash expenses related to his business activities including extra work and incidental work charges or likewise may not have been recorded in his regular books of accounts. On the basis of the seized documents, Mr. Galkar estimated net additional income of assessee firm (after considering expenses) from such transactions @ 5% of total sales declared AY 2018-19 (till date) and offered Net amount of 4,64,71,835/- in the hands of M/s Kalyan Development Corporation.

iii. During the post-search proceedings analysis of some important excel sheets was done. The analysis pointed towards following facts

- From the sheets found for the period of April 2017 to August 2017, it was found that quantum of On-money was around 18% of Agreement value. (Excel sheet named All Bookings found in Bundle no.4, Party AB-6, Office of M/s Kalyan Development Corporation)

- From the analysis of sheets found for the year 2013, it was observed that quantum of On-money was around 25% of Agreement value. (Excel sheet named SALE DETAIL 25.11.13 in Bundle no.2, Pen drive named as ‘madam’, found at residence of sales executive Suvarna Amte).

Assessee has made declaration of 5% of the sales as his income. This is much below the actual on-money received by assessee. Thus it is evident that the partner of the assessee firm has admitted to the undisclosed income based on the documentary evidences found and confronted to him and not on any assumptions and surmises.”

8. We have heard both the parties and perused the material placed on record. We have also gone through the orders of the authorities below. Prima facie, from the perusal of the seized documents as extracted above, there is no specific noting or mention about the receipt of cash by the assessee. It is only by inference that the addition has been made and sustained by the authorities below which is solely based on the statement recorded u/s. 132(4) of Shri Mangesh D. Gaikar, who had offered certain additional income without pointing out to specific seized materials and the entries or notings made therein. His disclosure was in general terms so as to cover certain cash receipts and cash expenses relating to his business activities which may not have been recorded in his regular books of accounts. He adopted an estimate of 5% on total sales already declared in the last six years to offer additional income which was bifurcated towards the business activities carried out by him in his proprietary concerns M/s. Himali Constructions and M/s. Mangeshi Constructions as well as for KDC and Mangesh Enterprises which are partnership firms in which he is also a partner.

8.1. The disclosure made by him in his statement, while answering to question No.74, is extracted below for ready reference to demonstrate that there is no reference to any seized material for which addition has been made in the hands of KDC in the present case before us.

“Q.74 Do you want to say anything else?

Ans: I admit that during the course of Search action u/s 132 at various premises related to my concerns, various incriminating documents regarding Cash transactions i.e. Cash receipts and cash expenses related to my business activities have been found and seized. These documents were confronted to me while recording of my statement, vide question numbers 21-52 and 61,63 and 65 above. I am unable to recollect the exact details of such cash transactions, however, I admit that certain cash receipts and cash expenses related to my business activities including extra work and incidental work charges or likewise may not have been recorded in my regular books of accounts. On the basis of the seized documents as mentioned in above questions, I estimate my net additional income (after considering expenses) from such transactions @ 5% of total sales declared in last six years i.e. for AY 2012-13 to AY 2017-18 and for current year i.e. AY 2018-19 (till date) in the case of my proprietary concerns M/s Himali Construction and M/s Mangeshi constructions and my partnership concerns namely M/s Kalyan Development Corporation and M/s Mangeshi Enterprises. The detailed working of such additional income offered for taxation is as under:

| Sr. No. | Name of the person | Assessment Year |

Additional Income |

| 1 | Shri. Mangesh D. Gaikar (Prop. M/s Himali Construction and M/s Mangeshi constructions) | AY 2012-13

AY 2013-14 AY 2014-15 AY 2015-16 AY 2016-17 AY 2017-18 AY 2018-19 TOTAL |

50,38,425/-

2,06,52,159/- 98,62,107/- 2,10,87,162/- 63,56,284/- 60,07,912/- 82,89,038/- 7,72,93,087/- |

| 2 | M/s Kalyan Development Corporation | AY 2018-19 | 4,64,71,835/- |

| 3 | Mangeshi Enterprises | AY 2016-17

AY 2017-18 AY 2018-19 TOTAL GRAND TOTAL |

1,35,50,172/-

18,99,213/- 4,96,250/- 1,59,45,634/- Rs. 13,97,10,556/- |

The project-wise and year-wise details of Total sales declared in Books of accounts and Net additional income @ 5% estimated thereon is as per separate sheet submitted as Annexure-3.

I offer this additional income of Rs. 13,97,10,556/- for taxation and I assure to pay the income tax on it as per existing rules and regulation.”

8.2. We take not of the observations made by the ld. CIT(A) in reference to the reliance placed on the statement of Shri Mangesh D. Gaikar and offering of his additional income on an estimated basis which has formed the basis for sustaining the addition in the hands of the assessee.

“48.1 The next argument of the appellant is that the said page no. 85 is a dumb document because it does not carry any signature as well as details of dates on which alleged cash was received. The appellant has also denied of receiving any cash as alleged by the Assessing Officer. I have considered this argument of the appellant firm. It is seen that during the search conducted on Mangeshi Gaikar group, a large number of Excel Sheets, similar to page no. 85 as reproduced above, were found indicating that Shri Mangesh Gaikar in his proprietorship concerns as well as his partnership firms including the appellant were receiving on-money. When confronted during the search proceedings, Shri Mangesh Gaikar accepted that he is receiving a part of sale consideration in cash which is not recorded in the books of accounts. Accordingly, additional income of Rs. 7,72,93,087/- was declared by him in his individual hands. Further, additional income of Rs. 4,64,71,835/- was declared in the hands of appellant firm and an amount of Rs. 1,59,45,634/- was declared in the hands of another partnership firm namely M/s Mangeshi Enterprises.”

8.3. To our mind, correlating the disclosure made by Shri Mangesh D. Gaikar which is general in nature without pinpointing to the specific seized documents in respect of which additions have been made in the hands of the assessee and drawing inferences from his individual case to make an addition in the hands of KDC is uncalled for. It is evident from the column headings of the seized material extracted above which do not have any notings to demonstrate and establish that cash has actually been received or cash has actually been paid by the buyers, as alleged by the ld. Assessing Officer. It is also important a fact to note that there are several discrepancies which have been pointed out by the assessee in the notings made in the seized documents which have been substantially accepted by the ld. CIT(A) granting relief in respect of those discrepancies for which Revenue is not in appeal. This fact also adds force to the contentions of the assessee that it is the document which was prepared for probable working of the amounts receivable against various flats booked and do not contain the correct actual and factual data. Assessee has also evidently demonstrated by documentary evidence that entries in respect of “MDG” and Sunil Singh had actually been transacted directly by those persons and not by the assessee. It is worth noting a fact that seized document for Assessment Year 2017-18 contains contact numbers of the buyers listed therein with the aid of which, ld. Assessing Officer could have enquired from them directly. But he chose not to do so despite all the powers available to him under the Act.

8.4. Accordingly, considering the above observation and facts on record corroborated by documentary evidences, we find force in the submissions made by the assessee which makes us to decide in its favour and delete the addition made by the ld. Assessing Officer towards “On money” alleged to be received by the assessee from the buyers of the flats. Accordingly, additions made on this account of Rs.80,50,765/- in AY 2017-18 and of Rs.3,63,09,781/- in AY 2018-19 are deleted. In the result, grounds taken by the assessee for both the years are allowed. Since we have deleted the additions on merits of the case, other legal grounds raised by the assessee are not adjudicated upon.

8.5. In the result, both the appeals in ITA No.4496/Mum/2023 and 4530/Mum/2023 are allowed.

9. We now take up the matter in the case of Mangeshi Enterprise in ITA No. 4492/Mum/2023 for AY 2014-15. In this case the impugned assessment order is passed u/s. 143(3) r.w.s. 153C, since there was no search and seizure action on this assessee, but seized material pertaining to the assessee was alleged to be found in the course of search conducted in this group of assessees. On merit, the issue contested before us is in respect of addition on account of “on money receipt” against sale of flats by the assessee in the project undertaken by it in the name and style of Mangeshi Flora, A-Wing – Rs.1,39,90,500/- and B-Wing – Rs.3,23,92,230/-.

10. Brief facts of the case are that during the course of search and seizure operation on 25/01/2017, page no. 14 to 17 of bundle No. 1, were found and seized from the house of Smt. Suvarna D. Amte at D602, Mangeshi Shrushti Phase-I, Vasant Valley Road, Opp. Heena Garden, Khadakpada, Kalyan (West)-421301. The pages contain details of rates, cost of the flats in Mangeshi Flora, A-Wing, which includes various component including “Etc B” and other cash components. Details are tabulated as under: –

10.1. Assessee was issued notice dated 25/11/2019 to show cause as to why the amount of Rs. 1,39,90,500 & Rs. 3,23,92,230/- should not be added to the total income as unaccounted income. Relevant seized pages from the show cause notice issued by ld. Assessing Officer are extracted below:

10.2. Assessee furnished the details in respect of the material confronted to it wherein it was submitted that Page no 13 to 17 are nothing but the flat wise details of units in the project Mangeshi Flora containing particulars such as Sr. No., Flat No., area in Sq.mts., area in Sq.ft, 1/2 BHK, name of customer, address, contact no, rate, regn no, regn date, Recd as on 25/11/2013, Balance as on 25/11/2013, NOC details, Etc. B,S. Tax & VAT and Ext. Column ‘Flat Cost’ in the sheet reflects agreement value of the flat & column ‘Recd as on 25/11/2013’ and ‘Balance as on 25/11/2013 reflects amount received towards flat cost and the balance amount outstanding as on 25/11/2013. The sheet also contains details of regn no., registration date and NOC details of the project. According to the assessee, it receives the advance for booking of the flat since it has policy to receive minimum 10% advance but the same is negotiable based on the customers requirement. Sometimes, customers pay adhoc lump sum amount or more than 10%. All the said amounts are duly reflected in the books of accounts. It was further explained that normally customers make certain alternations, modification and carry out extra interior work for which cost estimations are noted. Assessee submitted that the amounts in Column ‘Etc B’ and ‘Ext’ which are alleged as cash component are nothing but the estimated amount for extra work and modification of flats, if finally carried out on the request of customers. According to assessee, the sheet is undated and the only date reflected in it is the reference of agreement value “Received till 25/11/2013” and “Balance on 25/11/2013”.

10.3. Assessee strongly contested that the sheet does not say that assessee received any money in cash towards column ‘Etc B’ and ‘Ext’. It also does not bear signature of any of the partners of the firm nor signature of any of the flat buyers. The amount which is reflected in column ‘Etc B’ and ‘Ext’, which is alleged to be received as cash component is nothing but an assumption. Assessee claimed that in fact, it did not carry out any additional work nor it had received any payment towards the same.

10.4. The seized documents found by the search party for Wing-A and Wing-B in respect of which addition has been made by the ld. Assessing Officer are reproduced below in order to understand and corroborate contention raised by the assessee that in the excel sheets as originally found, there is no column with the header “cash component” which the ld. Assessing Officer has incorporated in the tables reproduced in the show cause notice issued to the assessee.

–

–

–

10.5. Assessee had strongly contested that the alleged incriminating documents were not found from the premises of the assessee but were found and seized from the residence of one Mrs. Suvarna Amte, an ex-associate/employee of Shri Mangesh D Gaikar. Assessee also referred to the statement recorded under oath of Shri Mangesh D Gaikar u/s. 132(4) at his business premise on 27.10.2017 wherein several questions from question Nos. 63 to 68 were asked in relation to search action conducted at the residential premise of Smt. Suvarna Amte and loose papers and other material were found and seized therefrom. Assessee thus submitted that presumption u/s. 292C applies only in the case of persons searched and not against the assessee.

10.6. It was further contended that the year under consideration is an unabated assessment year which had attained finality. Assessment u/s.143(3) was completed vide order dated 25.08.2016 by ITO, Ward – 3(3), Kalyan, wherein returned income of the assessee was accepted as assessed total income. Accordingly, addition if any, which could be made can only be based on incriminating material found and seized during the course of search after recording proper satisfaction by the ld. Assessing Officer of the searched person and handing over of the material to the Assessing Officer of the assessee as contemplated u/s.153(C) of the Act. According to the assessee, Smt. Suvarna Amte is not connected to it. In fact, she had been an employee of Shri Mangesh D. Gaikar who is one of the partners of the assessee firm. The sheet of loose papers is a print copy of excel sheets contained in a pen drive found at the residential premise of Smt. Suvarna Amte.

10.7. In order to demonstrate that the details mentioned in said loose papers are nothing but charts prepared for the purpose of sales management and do not contain actual figures, assessee submitted that for item at Sr.No.14 on page 13 of the loose paper of bundle 1, (refer Sr. No.5 of table for Wing-B, extracted in para 10.1 of this order), it is stated that there is a sale of 2BHK flat B/207 to Manisha M. Harawat for an agreed consideration of Rs.44,20,000/-. In column “ETC B” and “EXT”, the amounts mentioned are Rs.7,18,250/- and Rs.3,00,000/- totalling to Rs.10,18,250/- for which addition has been made in the hands of the assessee. Against all these details, the correct set of facts as submitted by the assessee is that the said flat B/207 was actually sold to Archana Deshmukh on 20.12.2014 by way of registered sale deed. Assessee provided a copy of the same to corroborate this submission. Thus assessee demonstrated that these excel sheets and their print outs do not contain actual and correct figures and were prepared merely for the purpose of sales management by the third person who worked under the control and management of Shri Mangesh D. Gaikar and not the assessee.

10.8. In this case also, assessee has strongly contested that the addition made are based on inference drawn by the ld. Assessing Officer on the seized documents by relying on the submissions of Shri Mangesh D. Gaikar which was recorded in the course of search at his residential premise and recorded in his individual capacity. From the said statements, ld. Assessing Officer inferred that assessee received “on money” from the purchasers of the flats over and above the value which is mentioned in the seized value ‘ETC B’ or ‘Ext’. In this respect, we had already taken note of para 8.3 of the assessment order of Assessment Year 2018-19, wherein ld. Assessing Officer has dealt with the statement of Shri Mangesh D. Gaikar and the disclosure made by him in the course of search where the disclosure was made on an estimate basis by offering the net additional income @5% of the total sales declared in the last six years. In this respect, Shri Mangesh D. Gaikar submitted in his statements that there are certain cash receipts and cash expenses related to his business activities including extra work and incidental charges or likewise which may not have been recorded in his regular book of accounts. By drawing inference from this disclosure made by Shri Mangesh D. Gaikar, ld. Assessing Officer observed that, assessee had also received actual “on-money” which on analysis of the seized material is much less than the 5% of the sales offered by Shri Mangesh D. Gaikar and thus made the addition based on the notings in the seized documents. We have already given our observations and findings on this aspect in above para – 7.7 to 8.4, which applies mutatis mutandis in this case also.

10.9. In furtherance to the above, on the contention raised by the assessee that the seized loose sheets do not contain the column of “cash component”, ld. CIT(A) called for remand report from the ld. Assessing Officer wherein no specific submission was made by the ld. AO to clarify the issue. From our verification of the seized documents extracted above and the table contained in the show cause notice issued by the ld. Assessing Officer, we note the difference exits for the column with the header “cash component” which justifies the contentions raised by the assessee. We also note that ld. Assessing Officer has not made any enquiry with Mr. Suvarna Amte in respect of the excel sheets and their print outs. Further, it is not discernible if any statement was recorded in her case seeking clarification on the material so found and seized from her residential premise, during the conduct of her search. The contention raised by the assessee in respect of presumption u/s.292C applies on the persons searched holds good.

10.10. We note that these seized documents are print copies of excel sheets found in the pen drive from the residential premises of Shri Suvarna Amte during the search in her case. If the ld. AO is using these excel sheets found and seized from a third person against the assessee, then its mandatory requirement u/s 65 B of the Evidence Act to comply with the procedures given therein. This has been categorically held by the Hon’ble Supreme Court in the case of Arjun Panditrao Khotkar ITA No.3001/Mum/2024 Shri Jayant Hiralal Shah 12 vs. Kailah Kushanrao Gorantyal vide judgment and order dated 14/07/2020, wherein three Judges Bench of the Supreme Court have held that electronic evidence has to be certified u/s.65B(4). There is no such certificate brought on record. Though there is no specific provision of digital data validity under the Act, however, it is imperative that the Income-tax department / investigation wing has to adhere with the condition stipulated u/s.65A and 65B of the Evidence Act before relying on such digital evidence. Here none of these aspects have been discussed by the ld. AO.

11. Accordingly, considering the above observation and facts on record, corroborated by detailed explanations and documentary evidences, we find force in the submissions made by the assessee which makes us to decide deleting the addition made by the ld. Assessing Officer towards “On money” alleged to be received by the assessee from the buyers of the flats. Accordingly, addition made on this account of Rs.4,63,82,730/- (both the Wings taken together) in AY 2014-15 is deleted. In the result, grounds taken by the assessee are allowed. Since we have deleted the addition on merits of the case, other legal grounds raised by the assessee are not adjudicated upon.

12. In the result, appeal of the assessee is allowed.

13. We now take up the last set of three appeals in the case of Shri Mangesh D. Gaikar. Appeal for AY 2014-15 in ITA No. 4577/Mum/2023 is in respect of addition of Rs.1,50,00,000/- made u/s. 69 towards cash paid to Mr. Dinesh Krishna Patil. In this appeal, assessee has raised one more additional ground in addition to the additional ground already dismissed in para-No. 3.2 above.

13.1. The additional ground taken is on a legal issue whereby assessee is contesting that the assessment ought to have been framed u/s.153(C) and not under 153A, as there was no jurisdiction with the ld. Assessing Officer because the seized material on the basis of which addition has been made was found from the premises of Shri Atul D Tanna in whose case also a search was conducted simultaneously. The said ground goes to the root of the matter and there being no objection on its admission from the ld. DR, the same is admitted for adjudication.

14. Brief facts as noted from the impugned assessment order, in this respect are that page No. 01-14 of Bundle No.6, Party AB-12 were found and seized from the house of Shri Atul D. Tanna A-1, 1201, Mangesh Sahara, Near Chhatri Bunglow, Chikanghar, Kalyan (West), which are the advanced agreement receipts, dated 02.09.2013, totalling to Rs. 1.5 Crores, entered by the assessee with Shri Dinesh Krishna Patil. From these receipts, ld. Assessing Officer noted that assessee had paid an amount of Rs.1.5 Crores to Shri Dinesh Krishna Patil. He further observed that Shri Ashok Sudam Patil had given statement on oath that he had received a cash of Rs.50 lakhs in relation to Joint Development Agreement with Shri Dinesh Krishna Patil. Assessee was issued a show cause notice for explaining these documents and transactions noted therein. Assessee contended before the ld. Assessing Officer that since these documents were not seized from the premises of the assessee but were seized from another person, i.e. Shri Atul D. Tanna, therefore no presumption lies against the assessee. Assessee strongly submitted that he had not done any cash dealings with the persons namely, Shri Dinesh Krishna Patil and Shri Ashok Sudam Patil. Assessee also requested for providing the copies of the seized documents for which he had been implicated. He also requested cross examination of Shri Atul D. Tanna, Shri Dinesh Krishna Patil and Shri Ashok Sudam Patil.

14.1. After considering the submissions made by the assessee, ld. Assessing Officer proceeded to make addition of Rs. 1.5 Crores by treating it as unexplained investment u/s.69 of the Act representing assessee’s cash investment out of unexplained sources of income not recorded in his book of accounts. It is important to mention that while making such additions, ld. Assessing Officer noted in para 5.3 that “though the documents were seized from different premises, since the vouchers were issued by the assessee on his vouchers bearing his address and prepared and signed by his accountant, the onus is on assessee to disprove the allegation against him.” He further, noted that “the party concerned from whose premises these documents were found and seized is stated to be into the business of real estate brokerage and categorically stated that several people visit his premises daily and someone might have forgotten this in his premises”.

15. On the strength of the above factual observations of the ld. Assessing Officer, assessee has strongly contested that the addition made is on the basis of material found and seized from the third party in the course of search of that third party, i.e., Shri Atul D. Tanna and therefore the assessment ought to have been undertaken by complying with the provisions of the Section 153(C), which otherwise has been done by applying the provisions of section 153A. Therefore, impugned assessment is bad in law and ought to be quashed ab initio. To buttress his contention, ld. Counsel placed reliance on the decision of Coordinate Bench of ITAT, Kolkata in the case of Krishna Kumar Singhania and Ors. Vs. DCIT in IT(SS)A Nos.109,110/Kol/2017 and Ors, dated 06.12.2017 wherein similar issue had arisen and was held in favour of the assessee that the material found during the course of search of third party cannot be used in section 153A, against the assessee. The relevant observations and finding of the Coordinate Bench in para-10 is extracted below:

“10. We have heard the rival submissions. We find that it is not in dispute that there were no documents that were seized from the premises of the assessee except loose sheets vide seized document reference KKS /1 comprising of 8 pages, for which satisfactory explanation has been given by the assessee and no addition was made by the Id AO on this seized document. The seized document used by the Id AO for making the addition in section 153A assessment is CG/1 to 11 and CG/HD/1 which were seized only from the office premises of Cygnus group of companies in which assessee is a director. In this regard, it would be pertinent to note that as per section 292C of the Act, there is a presumption that the documents, assets, books of accounts etc found at the time of search in the premises of a person is always presumed to be belonging to him / them unless proved otherwise. This goes to prove that the presumption derived is a rebuttable presumption. Then in such a scenario, the person on whom presumption is drawn, has got every right to state that the said documents does not belong to him / them. The Id AO if he is satisfied with such explanation, has got recourse to proceed on such other person (i.e the person to whom the said documents actually belong to) in terms of section 153C of the Act by recording satisfaction to that effect by way of transfer of those materials to the AO assessing the such other person. This is the mandate provided in section 153C of the Act. In the instant case, if at all, the seized documents referred to in CG/1 to 11 and CG/HD/1 is stated to be belonging to assessee herein, then the only legal recourse available to the department is to proceed on the assessee herein in terms of section 153C of the Act. In this regard, we would like to place reliance on the recent decision of the Hon’ble Delhi High Court in the case of CIT vs Pinaki Misra and Sangeeta Misra reported in (2017) 392 ITR 347 (Del) dated 3.3.2017, wherein it was held that, no addition could be made on the basis of evidence gathered from extraneous source and on the basis of statement or document received subsequent to search. Hence we hold that the said materials cannot be used in section 153A of the Act against the assessee. This opinion is given without going into the merits and veracity of the said seized documents implicating the assessee herein.”

16. On merits of the case, it was pointed out that ld. Assessing Officer relied on the statement on oath given by Shri Ashok Sudam Patil that he had received cash of Rs.50 lakhs from Shri Dinesh Krishna Patil in relation with the joint development agreement. However, the correct fact is that assessee had entered into a joint development agreement on 31.12.2014 in respect of land at Survey No.69, Hissa 1/1 Mauje Kanchangaon, Thakurli, with the owners Shri Shatrughan Kapshya Patil and Sushant Shatrughan Patil. The consideration payable by the assessee to these two owners was in kind, being 40% of the built up area. Thus, according to the assessee, Shri Dinesh Krishna Patil was in no way connected with the said land. He was neither the owner nor the occupant of the land at Survey No.69, Hissa No.1/1, Mauje Kanchan Gaon. Accordingly, there was no question of making any payment by the assessee to Shri Dinesh Krishna Patil, more so in cash. For the reference to statement on oath of Shri Ashok Sudam Patil, assessee submitted that he cannot be implicated for the transaction between Shri Ashok Sudam Patil and Shri Dinesh Krishna Patil.

16.1. On the seized documents, assessee submitted that cash vouchers are undated and not signed by the assessee. They are also not in the handwriting of the assessee and not found from the premises of the assessee. In respect of Memorandum of Understanding, it was submitted that it is typed on a plain paper and is undated. It is purportedly entered into between Shri Dinesh Krishna Patil and assessee and bears signature only of Shri Dinesh Krishna Patil and not of the assessee. It also does not have any witnesses’ signatures. According to the assessee, both the cash vouchers and the MOU fall under the category of dumb documents and do not have any legal or evidentiary value.

17. We have heard both the parties and perused the material on record. We have also given thoughtful consideration to the contentions raised by the ld. Counsel of the assessee in respect of the additional ground raised contending that on the basis of the material found in the course of search conducted in the case of another person, without invoking the provisions of section 153C, the assessments concluded u/s. 153A is illegal. Since the additional ground raised by the assessee goes to the root of the matter, we take up the same for its adjudication.

17.1. We note that provisions of section 153C of the Act enables the ld. Assessing Officer of other person to take cognisance of the material seized in the course of search of person searched u/s.132 of the Act. Section 153C requires recording of satisfaction that material found in the course of search of a person belongs to or pertains to some other person, i.e., the person other than the searched person. Thereafter, the said material is required to be transmitted to the Assessing Officer having jurisdiction over such other person. The ld. Assessing Officer of the other person must thereupon record satisfaction that the said material has a bearing on the assessment of income of such other person. It is only thereafter that the proceedings can be taken up for framing an assessment for the such other person.

17.2. In the present case, admittedly it is a fact on record as noted by the ld. Assessing Officer in the assessment order in para 5.1 itself that the seized material was found from the house of Shri Atul D Tanna. It is therefore, clearly established that the Assessing Officer has used the seized material/document found in the course of search conducted in the case of third party, i.e., search of Shri Atul D Tanna, for making addition in the hands of assessee. We hold that under the given set of facts, the said material cannot be used for making assessment u/s.153A of the Act in the case of the assessee. For holding so, we find force from the decision of the Coordinate Bench of ITAT Kolkata in the case of Krishna Kumar Singhania and others (supra) which in turn had placed reliance on the decision of Hon’ble Delhi High Court in the case of CIT vs. Pinaki Misra and Sangeeta Misra (2017) 293 ITR 347 (Del). Accordingly, the assessment made on the assessee u/s. 153A by using seized material found in the course of a search of third person is bad in law and hence quashed. The finding arrived at by us is without going into the merits of the said seized documents implicating the assessee herein. Since the additional ground raised by the assessee has been held in favour of the assessee quashing the impugned assessment order, other grounds raised in the appeal in Form no.36 are rendered academic and not adjudicated upon.

18. In the result appeal of the assessee is allowed.

19. In appeal for assessment year 2016-17 in ITA No.4528/Mum/2023, ground no.1 relates to addition of Rs.5,30,280/-in respect of receipt of “on money in cash” from the customers who had purchased flats in the project of assessee “Mangeshi Sanskar”. Ld. Assessing Officer had noted that assessee had received on money from the purchasers of the flats over and above the agreement value from the computer data seized during the course of search action. Assessment was completed by making an addition of Rs.4,56,77,925/- representing the “on money” received as unaccounted income. Subsequently, an order u/s. 154 was passed dated 05.03.2020, whereby the addition so made was reduced to Rs.31,48,018/-. In the said order passed u/s. 154 rectifying the mistakes apparent from record, the submission of the assessee was that income had already been offered to tax in AY 201516, 2016-17 and 2017-18 and therefore impugned additions lead to double taxation. Assessee had offered these amounts to tax based on accepting their receipt in the respective assessment years. These facts were demonstrated evidently by the assessee which were accepted by the ld. AO and thus relief was granted and the original addition of Rs. 4,56,57,925/- was reduced to Rs.31,48,018/- Assessee took up the matter before the ld. CIT(A) who gave further relief by restricting the said addition to Rs.5,30,280/- which comprised of three amounts:

i) 1,66,738/-

ii) 550/-

iii) 3,62,992/-

19.1. In respect of the amounts at Sr. No .i) and iii), assessee submitted that these are the amounts which were never received by the assessee and therefore not offered to tax which otherwise had been offered by the assessee in the respective assessment years and accepted by the ld. Assessing Officer while passing the rectification order u/s. 154. These two amounts are reflected in the column with the header “Bal in Ch” in the seized paper. Ld. CIT(A) did not accept the argument of the assessee that out of the total amount receivable shown on the seized paper, part of it was received and balance was receivable since the sale transaction of flat was completed and the agreement was duly registered with the possession given to the concerned customer.