Explore the intricacies of salary structures and income tax implications in this comprehensive guide. A valuable resource for HR and IT professionals, offering insights into tax exemptions, CTC calculations, and the impact of new wage codes.

Salient features of the Article:

While this Article is widely covered by many authors – I feel one place a blend of both Acts is a must and most of the time HR professionals are unacquainted with income tax provisions & accounts get stereo-type salary structures and accordingly they calculate TDS on salaries without giving the maximum benefit of tax exemptions to the poor employees who are killed by the income tax provisions made by the government. The accounts department gets already cooked salary structure by HR so they do not apply their brain before calculating income tax – and my experience says HR & Accounts may live in the same organization but they do not like each other.

Therefore, in favor of the organization, I tried my best to incorporate in this article solution for both and both benefited without interacting with each other.

Page Contents

- 1. Commonly referred salary structures:

- 2. Salary Structures – having implications of ESI/PF/LWF/PT etc.

- 3. Salary Structures – components attract income tax – provisions – taxable & rebates:

- 4. The benefit of old & new tax regime of Income Tax w.e.f. 1st April 2023

- 5. A suggestive – model salary structures

- 6. Modalities of new “Wage Codes” – taking care if implemented in the near future

1. Commonly referred salary structures:

You may have gone through many salaries slips or structures which are commonly used – due to provisions of applicable laws of Labour and Income Tax – the below list is inclusive, not exhaustive – some of them you may have seen and some of them will give you an idea for recommending a good salary structure as under:

i. Basic Salary

ii. Dearness Allowance (maybe not private organizations)

iii. Allowances

a. House Rent Allowance

b. Leaves

c. Bonus

d. Entertainment

e. Special

i. Tour & Travel

ii. Conveyance

iii. Helper

iv. Academic research & other professional pursuits

v. Uniform/Attire

vi. Compensatory Allowance – hills/mines etc

vii. Children Education

viii. Hostel

ix. Compensatory field allowance – medical raps etc

x. Transport Allowances

xi. Magazine/books & periodicals

xii. Armed forces

f. Tiffin

g. Fixed Medical

h. Servant Allowance

i. Foreign citizen

j. Compensatory – under article 222(2) of The Constitution

k. Teacher

l. Sumptuary Allowances to Judges

iv. Perquisites:

a. Furnished/un-furnished house without rent or concessional rent

b. Service of sweeper

c. Service of gardener

d. Service of watchman

e. Service of personal attendant

f. Supply of gas

g. Supply of electricity

h. Supply of water

i. Education facility for employee families

j. Leave travel concession LTC

k. Amount paid by the employer of an obligation that was otherwise payable by the employee

l. Premiums of LIC or other sums

m. Interest-free/concessional loans

n. Use of movable assets – like cars etc

o. Medical Facility

p. Car or any other automotive conveyance

q. Transport facility by the transport company

r. Free food or beverages

s. Traveling, Touring accommodation

t. Gift or gift vouchers

u. Credit Cards

v. Club

w. The tax of employees paid by the employer

x. ESOP shares allotment etc

y. Employer contribution towards RPF/NPS if in excess of 7.5 lacs per annum

z. Annual accretion to the employer’s contribution if in excess of 7.5 lacs

aa. Any other benefits/services/amenities provided by employer FOC by any name.

Most commonly CTC is defined:

There are many things that do not come apparently in your purse as an employee but your employer has to bear that with a rich cost. Most of the time in interviews both sides try to negotiate – the employee wants at least 30% markup on an earlier drawn salary and the employer tries to convince the employee that you are being offered more than 30% as compared to the last drawn salary of the previous employer.

How is Cost to Company (CTC) calculated in salary

CTC = Direct Benefits + Indirect Benefits + Savings Contributions

- Direct Benefits: This refers to the employee’s take-home or net salary or the amount paid to the employee monthly by the employer and is subject to government taxes.

- Indirect Benefits: These refer to the benefits that employees enjoy without paying for them. While the company pays them on behalf of the employee they are added to the employee’s CTC since it is an expense from the company’s point of view.

- Savings Contribution: This refers to the monetary value added to the employee’s CTC, for e.g.: EPF employer contribution, etc.

Most ignored the fact of CTC by employees – Tax savings formulated by prudent employers’ professional team whose basic function is to give most tax benefit to the employees by making salary structure in such manner that employees get tax benefits. Understand by below example:

Mr. Rohit is Sr Executive at XYZ Ltd. where he has the option to adopt a flexible salary structure now in the old tax regime or a new or break up of salary in such a manner that will save Rs.15k every month as compared to his previous employer then his CTC annually marked up by 1.80 lacs and this is a hidden benefit not visible but as an employee you are benefited by the employer without any extra cost.

So, such types of benefits must think by employees and employers should also reveal them appropriately at the correct forum to the employees so that they can better understand their employer’s care towards employees’ wealth.

2. Salary Structures – having implications of ESI/PF/LWF/PT etc.

The Indian government, as well as young employee strength, is not believing in conventional savings plans, and carrying home cash salary is a hot topic in “lunch room discussions”.

As per the statute, the maximum limit of salary where employer/employee is not bound to deduct ESI/PF is Rs.21,000/- (proposed Rs.25000/-) & Rs.15,000/- respectively – now here salary means – Basic + DA and no split of minimum wages.

Here prudency lies sometimes in employee salary coming within limits of statutory compliance then to keep them out of compliance if the salary negotiated is Rs.20,000/- then it is already above PF limit but within ESI limit so if it bargains Rs.21,100/- then for both compliance employer got free. At, the same time there is a loss of 13% of salary up to 15k as employer share in PF as well interest thereon given by Govt. of India & ESI benefits of notified hospitals as well salary compensation in any mishappening by ESI.

The way you calculate the liability of PF comes different it can be better understand by my two earlier articles on the same – links are provided below:

https://taxguru.in/corporate-law/implication-of-supreme-court-verdict-on-provident-fund.html

https://taxguru.in/corporate-law/calculate-amount-pf-deducted-post-sc-ruling.html

A table from my article is reproduced below:

Likewise “Professional Tax” is state matters and in many states, a certain level of employees are exempt from professional tax, therefore, this can be also term a saving plan for employers if they keep employees’ salaries within limits.

3. Salary Structures – components attract income tax – provisions – taxable & rebates:

A very basic principle of Income Tax is that- what else is being given by an employer is exclusively for the necessity of performing his duties and being utilized in performing duties that is non-taxable. This is defined in the case of “allowances”.

If you see carefully the list of allowances provided at the start of this article then you will find a rider with all allowances value of taxability – if fully used for official duties fully exempted from tax and if partial then partially taxed and if not at all utilized for official duties, then it is fully taxable.

You can better understand by a few examples – uniform, gardener, helper, car, etc

– Uniform – Mostly this term is being used as attire allowance – if your office culture and part of HR policy as well it has defined uniforms and you are being reimbursed for the same then it is not taxable. Now, think above it – actually, this is a part of informal CTC because your daily wear expenses are cut short up to substantial cost i.e. for 26 days job you at least use 12 pairs of clothes as well shoes/sweater/jacket, etc which costs you thousands of rupees as well you get relived from the tension of standing Infront of wardrobe – what to wear today or क्या पहनू कल तो यही पहना था really it is a big relief.

- Gardener – Suppose, you live in a private colony or bungalow of your own and the company is providing you with a gardener – taxable. If, as a term of employment you are bound to maintain the lawn in front of your house and client meets, etc happened often and it is the demand of your work then up to a certain limit it is non-taxable. Therefore, it should be properly documented – here HR’s responsibility comes to give confidence to accounts for not deducting tax on it and adequately supported tax authorities also.

– Car with chauffeur or not – Yes, it is taxable if used for personal purposes but for official it is not. Here again, the role of HR & Admin comes very prominently – what is that?

That is – in contract papers, everything should be mentioned and if not in the main contract, then there should be an addendum to that for all kinds of facilities that are being given for official use and necessary for official duties that should be mentioned – purpose, facility to be used, quantity, periodicity, etc.

Further, what is the admin role- adequate support like log-books of car, mileage control, places visited, signatures at proper place and then authorization, attendance of drivers, gardener helper etc.

Further, if you see a perquisite site then it is taxable but if components of salary keep in the correct place, then it saves taxes – because tax is based mostly on Basic Salaries like a free house or HRA somewhere it is linked with salary. So, a good combination of HR & Accounts will certainly help to tax savings of employees.

4. The benefit of old & new tax regime of Income Tax w.e.f. 1st April 2023

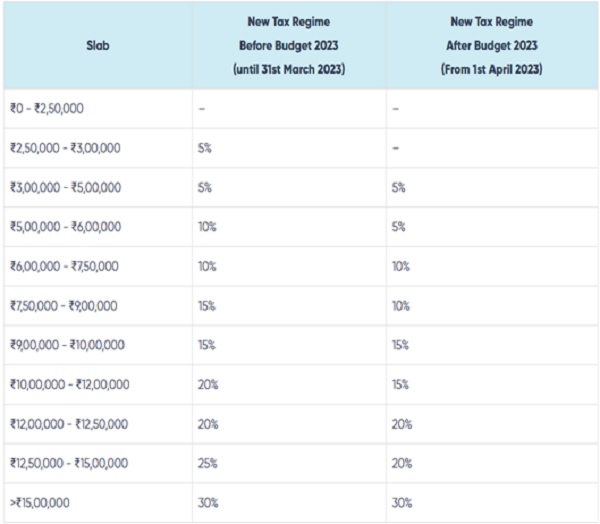

Before going to explain the benefits of the new regime, understand the tax slabs of the old and new regimes. The new regime of taxation to attract more employees Govt has come with new modifications in the new tax regime w.e.f. 1/4/2023:

Income Tax Slab Rate FY 2022-23/20-23-24 (AY 2023-24/2024-25) – Applicable For New Tax Regime

Here pertinent to note in the new regime you have to forget all deductions in salary – except the standard deduction of Rs.50,000/- is allowed now what you lose in the new regime is as under:

List of common Exemptions and deductions ” not allowed” under the New Tax rate regime

- Leave Travel Allowance (LTA)

- House Rent Allowance (HRA)

- Conveyance allowance

- Daily expenses in the course of employment

- Relocation allowance

- Helper allowance

- Children education allowance

- Other special allowances [Section 10(14)]

- Standard deduction on salary

- Professional tax

- Interest on housing loan (Section 24)

- Deduction under Chapter VI-A deduction (80C,80D, 80E and so on) (Except Section 80CCD(2))

List of deductions “allowed” under the new Tax rate regime

- Transport allowance for specially-abled people

- Conveyance allowance for expenditure incurred for traveling to work

- Investment in Notified Pension Scheme under section 80CCD(2)

- Deduction for employment of new employees under section 80JJAA

- Depreciation u/s 32 of the Income-tax Act except for additional depreciation.

- Any allowance for traveling for employment or on transfer

Even you will not get the benefit of section 24(i) of the Income Tax Act for interest on housing loans. Principal paid on housing loan shall not be allowed to include in 80C limit.

Now this is you and your age/salary/employer etc where you have to decide your tax liability. If savings are more and you have loan repayment for the self-occupied property then it is not recommended to switch new era of tax otherwise better to switch and accordingly calculate your TDS and timely inform to your employer.

A comparative table for your reference – from tax point of view:

| Particulars | Old Tax Regime | New Tax Regime | New Tax Regime |

| (until 31st March 2023) | (From 1st April 2023) | ||

| Income level for rebate eligibility | ₹ 5 lakhs | ₹ 5 lakhs | ₹ 7 lakhs |

| Standard Deduction | ₹ 50,000 | – | ₹ 50,000 |

| Effective Tax-Free Salary income | ₹ 5.5 lakhs | ₹ 5 lakhs | ₹ 7.5 lakhs |

| Rebate u/s 87A (by this Govt is saying up to 7 lacs exempted) | ₹ 12,500 | ₹ 12,500 | ₹ 25,000 |

| HRA Exemption | ✓ | X | X |

| Leave Travel Allowance (LTA) | ✓ | X | X |

| Other allowances including food allowance of Rs 50/meal subject to 2 meals a day | ✓ | X | X |

| Standard Deduction (Rs 50,000) | ✓ | X | ✓ |

| Entertainment Allowance and Professional Tax | ✓ | X | X |

| Perquisites for official purposes | ✓ | ✓ | ✓ |

| Interest on Home Loan u/s 24b on: Self-occupied or vacant property | ✓ | X | X |

| Interest on Home Loan u/s 24b on: Let-out property | ✓ | ✓ | ✓ |

| Deduction u/s 80C (EPF | LIC | ELSS | PPF | FD | Children’s tuition fee etc) | ✓ | X | X |

| Employee’s (own) contribution to NPS | ✓ | X | X |

| Employer’s contribution to NPS | ✓ | ✓ | ✓ |

| Medical insurance premium – 80D | ✓ | X | X |

| Disabled Individual – 80U | ✓ | X | X |

| Interest on education loan – 80E | ✓ | X | X |

| Interest on Electric vehicle loan – 80EEB | ✓ | X | X |

| Donation to Political party/trust etc – 80G | ✓ | X | X |

| Savings Bank Interest u/s 80TTA and 80TTB | ✓ | X | X |

| Other Chapter VI-A deductions | ✓ | X | X |

| All contributions to Agniveer Corpus Fund – 80CCH | ✓ | It was not earlier | ✓ |

| Deduction on Family Pension Income | ✓ | ✓ | ✓ |

| Gifts upto Rs 5,000 | ✓ | ✓ | ✓ |

| Exemption on voluntary retirement 10(10C) | ✓ | ✓ | ✓ |

| Exemption on gratuity u/s 10(10) | ✓ | ✓ | ✓ |

| Exemption on Leave encashment u/s 10(10AA) | ✓ | ✓ | ✓ |

| Daily Allowance | ✓ | ✓ | ✓ |

| Conveyance Allowance | ✓ | ✓ | ✓ |

| Transport Allowance for a specially-abled person | ✓ | ✓ | ✓ |

5. A suggestive – model salary structures

An idea of standard pay salary break up is as under:

| Components | Recommendation |

| Basic | 40-50% of CTC |

| DA | 5 % of CTC |

| HRA | 50% of Basic + DA if metro and 40% if non-metro |

| Conveyance | Rs. 1600 per month – Tax benefit gone |

| Medical | Rs. 1250 per month – Tax benefit gone |

| LTA | 10% of basic (no benchmark) |

| ESIC (Employer Contribution) | 4.75% of Gross salary |

| ESIC (Employee Contribution) | 1.75% of Gross salary |

| Special | Balancing component |

| PF (Employer contribution) | 12% of Basic + DA |

| PF (Employee Contribution) | 12% of Basic + DA |

| Professional Tax | State-wise |

| Labor welfare fund | State-wise |

| Perquisites | As per the table given in this Article |

This is a conventional structure but not reconciling with my reason to write this article. Here is what I am trying to explain how your structure will help you in saving your tax liability for example if you keep the HRA component with reasonable care will give you the least amount as exemption with maximum benefit – i.e. 10% of salary or 50% of salary or actual rent or excess of rent paid over the 10% of salary whichever is lower so can salary structure redefined.

Or you can keep the terms of your employment in such a manner that can include your salary components as part of your contract well defined and eligible for tax exemption like in the case of allowances which are non-taxable if correctly defined in terms of employment.

A little idea of the new tax regime and the old tax regime is given in below:

- When total deductions are ₹1.5 lakhs or less: New regime will be beneficial

- When total deductions are more than ₹3.75 lakhs: Old regime will be beneficial

- When total deductions are between ₹1.5 lakhs to ₹3.75 lakhs: Will depend on various income levels

- What deductions and exemptions are allowed under the new tax regime?

6. Modalities of new “Wage Codes” – taking care if implemented in the near future

Dear all readers new wage codes have been accented by the President of India but states are subject to implementation.

As per the information gathered by me from news/media/notifications etc on the new 4 Labour uniform codes, few provisions are being implemented w.e.f. 1-7-22 by Central Govt and rest shall be notified by States as per their “State – Reforms of Labour Code” and dates for implementation shall be as per their state’s gazette notification, the central rules are as under:

NEW LABOUR LAW REFORM CODES: (*total 29 existing labour laws merged in 4 new Reform Codes)

The central government has notified four labour codes, namely,

1. the Code on Wages, 2019, on August 8, 2019; (amalgamated 4 laws)

2. the Industrial Relations Code, 2020, (amalgamated 3 laws)

3. the Code on Social Security, 2020, (amalgamated 9 laws) and

4. the Occupational Safety, Health, and Working Conditions Code, 2020 on September 29, 2020. (amalgamated 13 laws).

Once it is implemented the main features shall be:

1. Working hours can be varied from 10 to 12 hours but an aggregate 48 hours exists so can do 4 day week and three days layoff/weekly off – as per requirement. The Government is also working on the work-from-home concept.

2. Basic is mandatory 50% of CTC. So PF in any case 12% of Basic is 50% of CTC.

Important Note: Basic cannot be less than 50% of CTC but in Minimum wages – that consists of Basic + DA as part of basic therefore those employees who are getting minimum wages cannot further bifurcate.

INCOME NOT INCLUDED IN THE MINIMUM WAGE:

Some income components are not included in the calculation of the minimum wage:

1. overtime pay;

2. leave allowance;

3. profit shares;

4. special payments, e.g. incidental payments received for reaching sales targets;

5. future payments you receive are subject to certain conditions (e.g. pension and saving schemes to which the employer contributes);

6. expense allowances;

7. end-of-year allowances.

Benefits of Codification

- Single Registration; Single License; Single Statement; Minimum Forms

- Common definitions

- Reduction of Committees

- Web-based surprise inspection

- Use of technology – Electronic registration and licensing.

- Reduction of compliance costs and disputes

So it is very much recommended to keep in mind the coming wage codes’ provisions so that in the future your employees or employers should not be in trouble regarding conventional wage breakups. Special care is required for working hours & minimum wage breakups.

CONCLUSION AND REMARKS

As a whole a conclusive approach has to be followed by HR & Accounts – both should take the advice of professionals’ expertise in their field and especially HR must work out 3 to 4 models of salary structures that will be suitable for the needs of a variety of employees’ tax brackets.

There are many scopes of tax savings if provisions of taxation and labor laws are read carefully. Any all-time standard advice cannot be given by any professionals because laws amend very frequently.

******

Rajiv Nigam, FCA

Advocate Anant Nigam

Very well prepared. Thank you

Thanks

Very useful, elaborate write up 👍