The Central Board of Direct Taxes (CBDT) introduced a crucial change in July 2022, mandating electronic filing of Form 10F. While there was a relaxation granted to non-residents without PAN cards, this grace period has now come to an end. As of October 1, 2023, electronic filing of Form 10F is mandatory for anyone looking to claim treaty benefits, regardless of whether they have a PAN card or not.

Here’s a step-by-step guide to help non-residents navigate the electronic filing process for Form 10F:

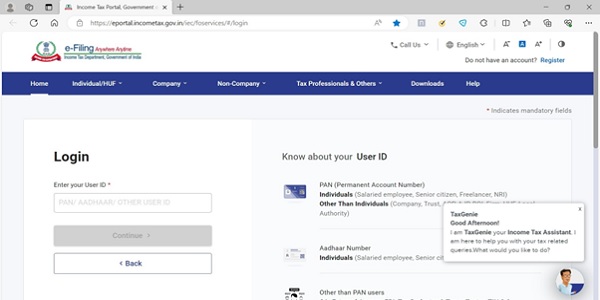

Step 1: Access the E-Filing Web Portal

- Visit the e-filing web portal at https://eportal.incometax.gov.in/.

- Click on “Register” located in the top right corner of the web page.

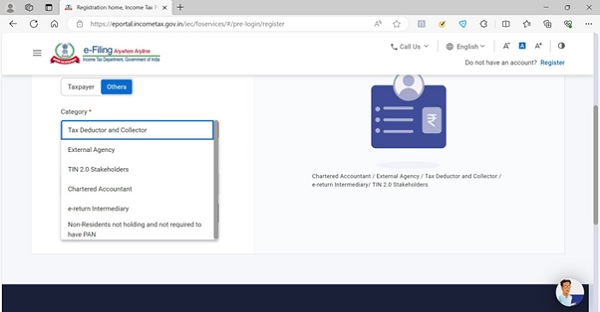

Step 2: Registration Category

- Select “Others” and then choose “Non-residents not holding and not required to have PAN” from the dropdown menu.

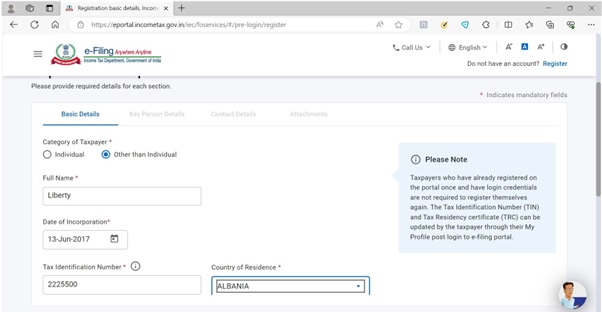

Step 3: Taxpayer Information

- Fill in the required information, including your full name, date of incorporation/birth, tax identification number, and country of residence.

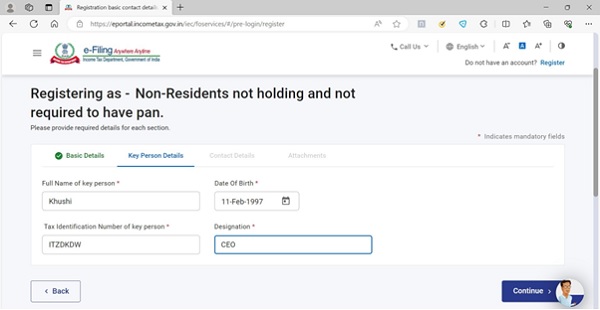

Step 4: Key Person Details

- Provide the details of the key person, including their name, date of birth, tax identification number, and designation.

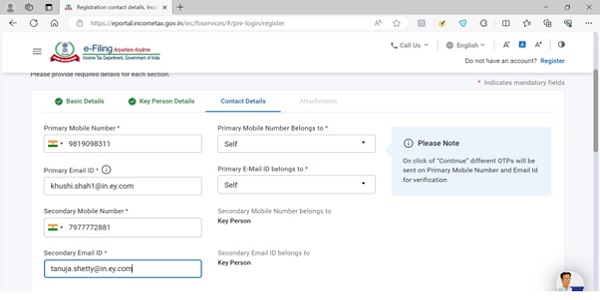

Step 5: Contact Information

- Offer contact details for the key person and provide a secondary email and contact details. Please note that you’ll receive a one-time password (OTP) on your primary mobile number and email ID.

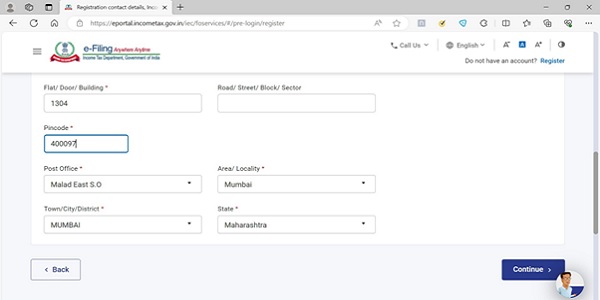

Step 6: Postal Address

- Input the postal address of the company.

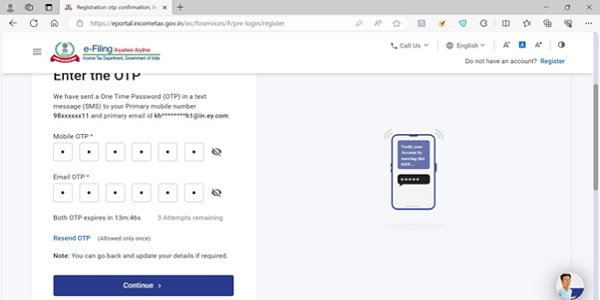

Step 7: OTP Confirmation

- Enter the OTP received on your primary email ID and primary mobile number.

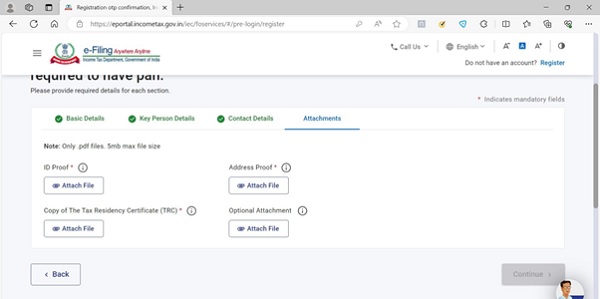

Step 8: Document Attachments

- Attach the required documents, such as the Tax Residency Certificate, as necessary

Step 9: Submission

- Once you’ve completed all the previous steps, submit the Form.

By following these steps, non-residents can efficiently file their Form 10F on the Income Tax portal. Electronic filing of Form 10F is crucial for claiming Tax Treaty benefits, and this guide ensures that you meet all the requirements seamlessly.

While e verification of Form 10 F using Mobile OTP an error message keeps coming up – ” Invalid Format for ARN”. Kindly help us to resolve this issue

How did your issue get resolved ?

Hi, looking to register as Non-Residents not holding and not required to have pan. What are the requirements for the Key person? Would this need to be a statutory director or can this be finance leadership?

Hello ., Our supplier in china and hongkong are unable to open the website . Please check and advise.

Hi, Im facing an issue with the mobile OTP, can someone guide me on this?

This is a dreadful system I’ve spent days trying to register – no help arrives.

I’ve done everything correctly but no OTP comes to my phone – I get email OPT number ok, but no phone. I’m still waiting for a call back. We are based in Europe.

Hi, I am from Nepal and want to register as “Non-Residents not holding and not required to have PAN” for generating 10F form online, however I didnt get OTP on our mobile number.

While e verification of Form 10 F using Mobile OTP an error message keeps coming up – ” Invalid Format for ARN”. Kindly help us to resolve this issue

How did you resolve it?

How did you resolve it ?

Hi, could anyone please guide on how to recover USER id for Non-Residents not holding and not required to have pan.

Facing issue while submitted Password and Personalise Massage.

Below error showing

Error :Your current request has been expired due to idle time limit exceed.Kindly proceed with fresh request.

We already tried in different browser/different laptop/different Internet Network and cleared all Cookies also.

Suggest how to resolve this issue we tried 7-8 times.

hi.. did the error get resolved ? if yes, please share how.. we are facing the same issue for many days now and no help.

Error :Your current request has been expired due to idle time limit exceed.Kindly proceed with fresh request.

our vendor is not receiving Mobile OTP please advice how to get OTP in foreign number ?

At the last step, the system throws up an error “Your current request has been expired due to idle time limit exceed.Kindly proceed with fresh request.” but keeps throwing up this error despite re-doing a fresh reqeust.

Dear, Sir,

I’m working on Korean law firm and our India client requires us to submit Form 10F on the site. Our firm has PAN and we registed the site with this information, however, we failed submit the form. (Fail message: Warning :Either your Principal contact has not registered a DSC with e-filing or validity of the Digital Signature Certificate registered by your Principal Contact in e-filing has expired. Please ask your Principal Contact to login to his e-filing account and register a Valid DSC by navigating to Profile -> Register DSC) In this regard, how we can submit Form 10F on the site? Is is possible if we re-regist our ID on the site as a “Non-residents not holding and not required to have PAN” and then submit the form? Otherwise, if there are any solutions about this matter, please help us.

Hi,

DSC which you are using is of Indian Resident or Non Resident?

Our client does not get OTP on their mobile number. Please help