CA Yash Kapadia

Introduction:

Recent intimation orders issued u/s. 143(1) of the Income Tax Act, 1961 (“the Act”), have highlighted a glaring inconsistency in the application of rebate u/s. 87A of the Act. The erroneous restriction of this rebate has led to undue tax liabilities, the issuance of demand notices, and significant financial hardships for small taxpayers. The irony lies in the fact that while small taxpayers are being unfairly denied their rightful rebates, other cases have surfaced where rebates have been incorrectly granted, leading to inconsistencies in tax administration.

The Problem at Hand

1. Erroneous Restriction of Rebate u/s. 87A of the Act Leading to Tax Demand

Notices:

Several small taxpayers have received intimation orders wherein the rebate u/s. 87A of

the Act has been disallowed or restricted incorrectly, leading to creation of tax demand or

a substantial reduction in refunds.

Key Obser vations:

vations:

- Denial of Rebate to Eligible Taxpayers: Assessees with total income below Rs. 7 lakhs, who qualify for the rebate u/s. 87A of the Act, have been denied the rebate on tax computed on capital gain chargeable to special rates.

- Legislative Intent Ignored: The proviso to Section 87A of the Act explicitly restricts the rebate only on tax on long-term capital gains from shares & securities. No such restriction has been placed on short-term capital gain on shares & securities and long term capital gain on properties, indicating that the legislative intent was never to exclude such taxpayers from claiming the rebate u/s. 87A of the Act.

- Financial Burden on Small Taxpayers: Due to this incorrect adjustment, taxpayers who should have rightfully availed of the rebate are now facing undue tax liabilities and compliance burdens.

The Stark Inconsistency in Tax Treatment

2. Contradictory Application of Rebate Provisions

In contrast to the unfair restriction imposed on small taxpayers, we have observed cases

where:

- Rebate Incorrectly Granted in Some Cases: Assessees with total income exceeding Rs. 7 lakhs (e.g., Rs. 14-15 lakhs), but with income other than capital gains (chargeable at a special rate) below Rs. 7 lakhs, have been allowed the rebate u/s. 87A of the Act, leading to excess refunds.

- Disparity in Tax Treatment: This discrepancy results in an ironic situation where small taxpayers are denied rightful benefits, while certain cases have seen unintended allowances.

Snapshot of Intimation Orders

Below are extracts from actual intimation orders that showcase the irregular application of rebate u/s. 87A of the Act:

Case 1:

- Total Income: 8 Lakhs (Including Short-Term Capital Gains)

- Rebate u/s. 87A Denied

- Tax Demand Raised

| Net tax liability [23=(21i-22d)] | 0 | 25,482 |

| (a) Interest u/s 234A | 0 | 0 |

| (b) Interest u/s 234B | 0 | 1,645 |

| (c) Interest u/s 234C | 0 | 389 |

| (d) Fee u/s 234F | 0 | 0 |

| (e) Total Interest and fee payable[24e=(24a+24b+24c+24d)] | 0 | 2,034 |

| Aggregate liability 125=(23+24e)1 | 0 | 27,516 |

| (a) Advance Tax | 0 | 0 |

| (b) TDS | 1,337 | 1,337 |

| (c) TCS | 596 | 596 |

| (d) Self Assessment Tax | 0 | 0 |

| (e) Total Taxes Paid [26e=(26a+26b+26c+26d)] | 1,933 | 1,933 |

| Balance payable [27=(25-26e)] | 0 | 25,583 |

| Click Here to E-PAY TAX | 26,600 |

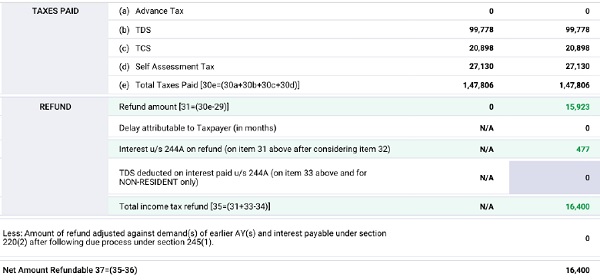

Case 2:

- Total Income: 5 Lakhs (Excluding Special Rate Income: 6.8 Lakhs)

- Rebate u/s. 87A of the Act Allowed

- Refund Issued

| Total income [11-13(0-14] | 14,11,580 | 14,11,580 |

| Income which is included in 15 and chargeable to tax at special rates | 8,28,160 | 8,28,160 |

| Net agricultural income/ any other income for rate purpose | 0 | 0 |

| Aggregate income [18=(15-16+17)] | 5,83,420 | 5,83,420 |

| Losses of current year to be carried forward | 0 | 0 |

| Deemed income u/s 115JC | 0 | 0 |

| (a) Tax payable on deemed total income u/s 115JC | 0 | 0 |

| (b) Surcharge [on (a)] | 0 | 0 |

| (c) Health and education cess, @4% on (21a+21b) above | 0 | 0 |

| (d) Total Tax Payable on deemed total income (21a +21b+21c) | 0 | 0 |

| (a) Tax at normal rates on 18 above | 14,171 | 14,171 |

| (b) Tax at special rates | 1,26,018 | 1,26,018 |

| (c) Rebate on agricultural income | 0 | 0 |

| (d) Tax Payable on Total Income (22a+22b-22c) | 1,40,189 | 1,40,189 |

| (e) Rebate u/s 87A | 0 | 14,171 |

| (f) Tax Payable after Rebate (22d-22e) | 1,40,189 | 1,26,018 |

This paradoxical treatment contradicts the principles of fairness and natural justice.

3. Urgent Need for Rectification:

The disparity in the application of tax provisions has caused undue distress for taxpayers who are entitled to the rebate. It is imperative that corrective measures be undertaken to address the following:

- Ensure Uniform Application of Rebate: Taxpayers with total income below Rs. 7 lakhs should be allowed the rebate u/s. 87A of the Act, including tax on short-term capital and long term capital gain properties, as per the legislative intent.

- Prevent Erroneous Allowances and Restrictions: Rectify both the unjust denial of rebate and any erroneous allowances that contradict the prescribed tax framework.

- Issue Clarifications and Suo Moto Rectifications: The CPC and field officers should reassess intimation orders and facilitate corrections where needed.

4. The Need for Immediate Redressal

Given the wide-ranging impact of these discrepancies, we urge the CBDT and the Ministry

of Finance to:

- Issue a clarification on the correct interpretation and application of Section 87A of the Act.

- Facilitate suo moto rectifications of incorrect intimation orders.

- Provide necessary relief measures to affected taxpayers.

In an era where compliance is becoming increasingly digital, such inconsistencies in tax application must be addressed urgently to uphold the principles of fairness and equity.

Conclusion

A correct interpretation of Section 87A of the Act will ensure both fair tax treatment for small taxpayers and the prevention of erroneous rebates granted which will eliminate inconsistencies and will reduce undue financial hardship caused to the taxpayers.

*****

Author: CA Yash Kapadia | Partner | HTKS & Co. | Chartered Accountants

Sir

The problem faced by many assessees is highlighted with live cases in your article. Hope it was sent to CBDT by your good self. Once it reaches CBDT, definitely they will take corrective action like suo moto rectification. Thank you sir for highlighting the problem faced by many assesses.

Thank you for your appreciation. I have already informed the CBDT and the Finance Ministry regarding the issue. Hopefully, appropriate corrective action will be taken soon in the interest of all affected assessee.