Analysis of Section 194Q and Section 206C(1H) of Income Tax Act, 1961

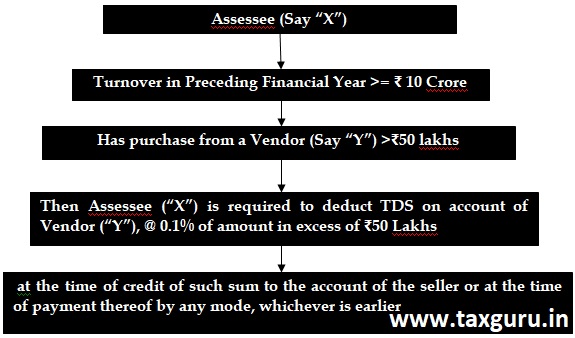

In Budget’2021 our honorable Finance Minister introduced Section 194Q, requiring deduction of TDS on purchase of Goods (w.e.f. 01st July, 2021). For the very first time in India such kind of section has been introduced under Direct Tax Law. The Section has been summarized as follow:

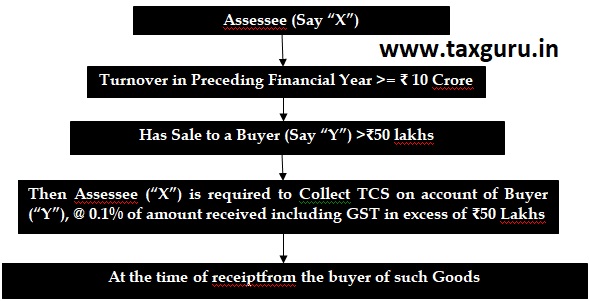

Also, Section 206C (1H) of Income Tax Act, 1961 (w.e.f. 01st October, 2020) has been summarized as follow:

A Comparative Study of both Section 194Q and Section 206C (1H)

| Sr. No. | Basis | Section 194(Q) – TDS | Section 206C(1H) – TCS |

| 1. | Person Responsible | Purchaser of Goods | Seller of Goods |

| 2. | Applicability | Turnover of assessee being buyer of goods is more than 10 Crores in preceding year | Turnover of assessee being seller of goods is more than 10 Crores in preceding year |

| 3. | With Effect From | 01-July-2021 | 01st Oct, 2020 |

| 4. | Threshold Limit | Value of “Purchases” from a vendor of goods exceeds Rs.50Lakhs during the current year | Value of “Sales Consideration” from a customer exceeds ₹50Lakhs during the current year |

| 5. | Point of Taxation | At the time of payment or credit whichever is earlier | At the time of receipt from the buyer of goods |

| 6. | Value on which deduction/ collection to be made | On Gross Value of Purchase without GST (Exceeding ₹50 Lakh) | To be collected on total value of receipt including GST (Circular No. 17 Dated 29.09.2020) (Exceeding ₹50Lakh) |

| 7. | Rate of Tax | 0.1%(5% in case of No PAN) | 0.1%(1% in case of No PAN) |

| 8. | Return Type | Form 26Q | Form 27EQ |

| 9. | Certificate of Credit | Form 16A | Form 27D |

| 10. | Option for Lower Deduction | Not Available | Not Available |

| 11. | Consequences of Non Compliance | 30% of Purchase amount on which TDS not deducted shall be disallowed u/s 40a(ia) of Income Tax Act, 1961 | Interest, Penalty and Prosecution under various sections of Income Tax Act, 1961 |

Points to be Remember: As per Second proviso to section 206C (1H) of Income Tax Act, 1961, no TCS on sale of goods to be collected if he buyer is liable to deduct tax at source under any other provision of this Act on the goods purchased by him from the seller and has deducted such amount.

Following are the possible scenarios of practical problems that can be faced while day-to-day working: (Assuming Buyer is “Mr.X” and seller is “Mr.Y”)

| Cases | Practical Situation | Solution |

| Case-I | The turnover of the Buyer (Say “X”) and the Seller (Say “Y”) in the preceding financial year exceeds₹10 Cr. and amount of Transaction (Purchase/Sale)between seller and buyer exceeds ₹50 Lakhs in the current year | Buyer (Mr.X)) would deduct TDS @ 0.1% u/s. 194Q of Seller (Mr.Y) |

| Case-II | The turnover of the Buyer exceeds Rs.10 Cr. in the preceding year but that of the seller is less than 10 Cr. and amount of Transaction (Purchase/Sale) between seller and buyer exceeds ₹50 Lakhs in the current year | Buyer (Mr.X)) would deduct TDS @ 0.1% u/s. 194Q of Seller (Mr.Y) |

| Case-III | The turnover of the Seller exceeds Rs.10 Cr. in the preceding year, however that of the buyer is less than Rs. 10 Cr. and amount of Transaction (Purchase/Sale) between seller and buyer exceeds ₹50 Lakhs in the current year | TCS (by Mr.Y) would be collected u/s. 206C(1H) @ 0.1% from Mr.X

(assuming that the entire amount has been paid) |

| Case-IV | The turnover of both buyer and seller is less than Rs.10 Cr. in the preceding year and amount of Transaction (Purchase/Sale) between seller and buyer exceeds ₹50 Lakhs in the current year | No TDS/ TCS is required to be deducted / collected. |

Disclaimer: The information contained in the article is purely the author’s analysis and does not entitled to any judgement.

Dear Sir,

We purchase services from ABC Ltd & Deducted TDS under 194C. If our purchase of service exceeds above 50 lakh. Can I deduct TDS under 194Q ?