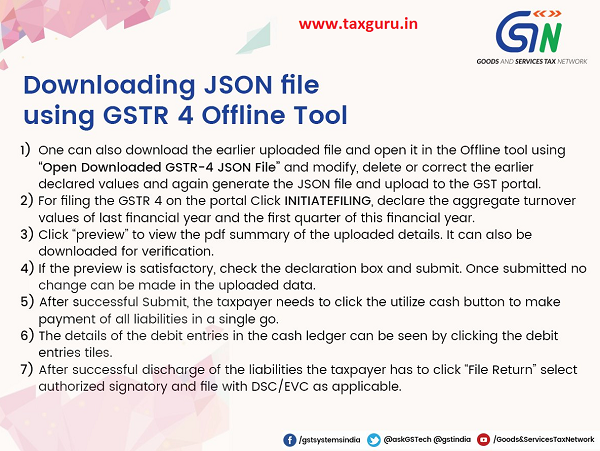

Downloading JSON file using GSTR 4 Offline Tool

1) One can also download the earlier uploaded file and open it in the Offline tool using “Open Downloaded GSTR-4 JSON File” and modify, delete or correct the earlier declared values and again generate the JSON file and upload to the GST portal.

2) For filing the GSTR 4 on the portal Click INITIATEFILING, declare the aggregate turnover values of last financial year and the first quarter of this financial year.

3) Click “preview” to view the pdf summary of the uploaded details. It can also be downloaded for verification.

4) If the preview is satisfactory, check the declaration box and submit. Once submitted no change can be made in the uploaded data.

5) After successful Submit, the taxpayer needs to click the utilize cash button to make payment of all liabilities in a single go.

6) The details of the debit entries in the cash ledger can be seen by clicking the debit entries tiles.

7) After successful discharge of the liabilities the taxpayer has to click “File Return” select authorized signatory and file with DSC/EVC as applicable.