Introduction

It is essential to adopt a balanced approach that considers the industry’s long-term well-being and growth while ensuring fair taxation practices. The recent imposition of a 28% GST rate on the entire value of gaming, horse racing, and casinos has been seen as a disadvantage for online gaming companies. The online gaming industry in India has witnessed impressive growth in past years, leading to significant foreign investment, making it one of India’s fastest-growing sectors.

However, the recent decision by the GST Council to impose a 28% GST rate on the full-face value of gaming transactions is expected to have extensive consequences. The immediate and visible impact of this 28% GST implementation on online gaming will be seen in the total prize pools and the face value of games.

This tax will be applied to the funds collected by gaming companies from consumers, leading to increased costs for players. As a result, consumers will bear the burden of this tax. This is likely to discourage consumers from participating in online gaming, thereby negatively impacting the industry’s overall growth.

This major change has been recommended after the judgement has been pronounced in Gameskraft Technologies v. DGGSTI.

Background & Facts of the case

√ GTPL is a provider of online gaming systems.

√ Users play skill-based games like “Rummy” over the internet.

√ GTPL charges a “platform fee” that is subject to an 18% Goods and Services Tax (GST).

√ A search and seizure operation were carried out at GTPL’s facilities in November 2021 by agents of the Directorate General of Goods and Services Tax Intelligence (DGGSTI), which led to the issuing of a summons.

√ All GTPL’s bank accounts were frozen on November 17, 2021, when the DGGSTI issued a provisional attachment order in accordance with Section 83 of the Central Goods and Services Tax Act, 2017.

√ The provisional attachment order was upheld without giving any justification, despite GTPL’s challenges to the decision.

√ The GST Authorities asserted that GTPL’s operations comprised “betting and gambling,” making the sums wagered by participants on the GTPL platforms liable to taxation.

√ They also accused GTPL of lowering the taxable value by claiming discounts.

√ Users match their talents with other players who want to play for a comparable amount when choosing games based on the stake they intend to make.

√ On its platform, the firm serves as a host for various games.

Definitions

Black’s Law Dictionary, “bet” refers to the act of staking or pledging something, typically money, as a wager. “Wager” refers to the money or consideration that is put at risk on an uncertain event. “Gambling” is defined as the act of risking something valuable, usually money, in the pursuit of winning a prize. It typically involves multiple parties entering into an agreement to play a game of chance for a stake or wager.

Venkataramaiya’s Law Lexicon defines “betting” as a contractual agreement where parties agree to pay or deliver a sum of money or other item based on the occurrence or non-occurrence of an uncertain event. “Gambling” is described as engaging in games or gaming activities for money or other stakes, which not only involve chance but also the expectation of gaining something beyond the amount played.

The Advanced Law Lexicon further distinguishes “betting” as the act of pledging a forfeit to another party based on a future contingency in support of an affirmation or opinion. “Gambling,” in contrast, is a broad term encompassing various acts, games, or devices where individuals intentionally expose money or valuable items to the risk of loss by chance.

It clear that “betting” involves pledging or wagering on uncertain events, while “gambling” encompasses a wide range of activities where individuals risk money or valuable items in the hopes of achieving a win.

Res extra commercium this Principle has its roots in Roman law and states that certain things cannot be the subject of private rights and, as a result, cannot be traded or exchanged.

It pertains to activities like betting, gambling, and wagering under other laws, is applicable. However, in the context of GST law, the definition of business is broader and encompasses activities such as wagering or similar endeavours. Hence, for GST purposes, business includes betting, gambling, lottery, and similar activities. has

Considering the expansive scope of the definition of business under the CGST Act of 2017, it can be argued that the protection provided under Article 19(1)(g) of the Constitution of India applies to wagering, betting, gambling, lottery, etc. However, it is important to note that this does not imply that lottery, betting, and gambling are equivalent to other skill-based games.

Impact of Relevant Provisions in Making a judgement

| Act | Section | |

| Finance Act, 1994 | 65B | Betting or gambling refers to the act of risking something valuable, often money, with an awareness of the potential risks involved and the expectation of gaining based on the outcome of a game or competition, where chance or unforeseen events may determine the result, or based on the probability of certain events happening or not happening. |

| Public Gambling Act 1867 |

14 | The game of rummy is safeguarded by Section 14 of the Hyderabad Gambling Act, indicating that the provisions of the Act do not apply to this game. As a result, any profits or gains obtained from playing rummy would not classify the organizer as running a common gambling house under the Act. |

| CGST | 31(3)(b) | The Petitioner has complied with the Act, which permits an assessee to forgo issuing an invoice if the value of the supply is below INR 200. The contested Show Cause Notice (SCN) does not challenge the fact that over 99.5% of the supplies facilitated by the Petitioner’s platform had a value below INR 200, hence there was no obligation to issue an invoice. The contested SCN has failed to demonstrate how the non-issuance of invoices has resulted in GST evasion. |

| CGST | 2(1) | An actionable claim refers specifically to unsecured debt, which involves the transfer of debt from one person to another without any form of security. Debt can fall into various categories, such as existing debt, accruing debt, conditional debt, or contingent debt. The term “actionable claim” carries the same definition as assigned to it in the Transfer of Property Act, 1882. |

| CGST | 2(17) | Although wagering contracts are recognized as part of business, it should not be assumed that lottery, betting, and gambling are synonymous with games of skill. Furthermore, the Court clarified that a game involving chance, regardless of whether there are stakes involved, is classified as gambling. Conversely, a game that primarily relies on skill, regardless of the presence or absence of stakes, is not considered gambling.

The Court specifically stated that online/electronic/digital Rummy, whether played with or without stakes, does not fall into the category of gambling. Similarly, other |

| CGST | Entry 6 of Schedule III | Act relates to specific activities or transactions that do not fall under the category of supplying goods or services. Entry 6 within this Act specifically exempts actionable claims, except for lottery, betting, and gambling, from being classified as supplies for GST purposes. Consequently, these actionable claims are not liable to be taxed under GST. However, it should be emphasized that lottery, betting, and gambling activities are still considered supplies and may be subject to GST. |

| Constitution of India | Entry 34 of List II of the Seventh Schedule | It grants the State Governments the authority to legislate on the subject of “betting and gambling.” This means that each state has the power to enact laws and regulations concerning betting and gambling activities within its jurisdiction. |

| Indian Contract Act | 30 | Agreements by way of wager are void, and no suit shall be brought for recovering anything alleged to be won on any wager, or entrusted to any person to abide by the result of any game or other uncertain event on which any wager is made. |

| Transfer of Property Act, 1882 | 3 | An “actionable claim” refers to a claim made for any debt that is not secured by a mortgage of immovable property or by the hypothecation or pledge of movable property. It can also refer to a claim for any beneficial interest in movable property that is not currently in the possession of the claimant, whether it is an existing, accruing, conditional, or contingent debt or beneficial interest. These claims are recognized by civil courts as providing grounds for legal relief. |

–

| CONTENTIONS OF THE TAXPAYERS | CONTENTIONS OF THE TAX AUTHORITIES |

|

Therefore, betting on a game’s outcome would be considered “gambling,” whether the game is one of talent or chance |

AUTHORITIES

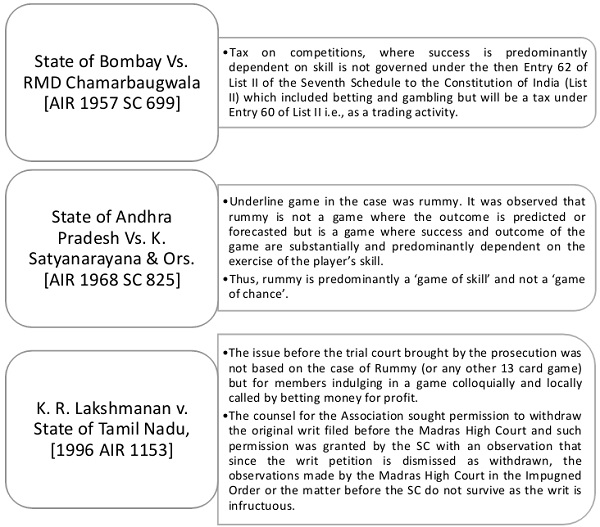

In Dr. K.R. Lakshman v. State of Tamil Nadu, wherein it held as follows: – Horse racing is “neither ‘gambling‘ nor ‘betting‘ but a game of mere skill and that expression mere skill would mean substantial degree or a preponderance of skill”, and to rummy in State of Andhra Pradesh v. K. Satyanarayana observing that it “requires a certain amount of skill because the fall of the cards has to be memorised and the building up of rummy requires considerable skill in holding and discarding cards”.

However, the Court distinguished this game of skill from a three-card game which goes by different names like flush or brag which is a game of chance and it was hinted in the same case that “if the owner of the house or the club is making a profit or gain from the game of rummy or any other game played for stakes, the offence may be brought home.”

Judgements that played a major role

Concern about separation of power

The 50th GST Council meeting, recommendations are set to have significant implications for the online gaming, horse racing, and casino industries. The judgment clarified that online games are not considered betting/gambling but rather games of skill and certain other judgements like Bangalore Turf Club Ltd vs. State of Karnataka have favoured the assessee, and were of the view that certain activities, like horse racing and online gaming, involve skills rather than pure chance. It ruled that skill-based online games like Rummy are not subject to GST under Schedule III of the CGST Act, 2017.

GST Council on the contrary plans to include online gaming and horse racing under GST, regardless of whether they are considered games of skill or chance. The amended provisions would apply the 28% tax on the full value of bets placed from a future date onwards. This would lead to a hefty taxation rate of 28%, be it games of skill or games of chance leading to a severe blow to the entire gaming industry and sharp reduction in winnings may deter gamers and significantly alter the dynamics of the gaming industry. These moves by the executive raise concerns about the separation of powers with the taxation structure in place, every game could now be considered a game of skill.

In the case State of Andhra Pradesh v. K. Satyanarayana Paying membership fee/ Service Fee/ overtime fee is not gambling. HC reverse this judgement saying beside the membership charges, service charges and overtime charges the clubs have been issuing point games which is the resulting profit. Extra profit was made out in that game through the stakes. Therefore, protection under the gambling act is not available and is punishable.

Open issues and lack of legal basis

The legal system faces challenges in distinguishing between different individuals engaging in betting activities and determining the appropriate taxation for online gaming, casinos, and horse racing. The revenue department believes that there should be no differentiation between the person placing a bet, the spectator betting from the stadium, and the viewer betting from home, even if the game involves an element of skill. The online gaming industry, including domestic companies and some foreign investors, has urged the prime minister’s office to review the tax, as they believe it will discourage investments in the sector.

An open issue also arises regarding clarity on what constitutes the full-face value if players use their winnings to play another game. There are concerns about whether this will lead to repetitive taxation, and therefore, the law must be clear and unambiguous.

This sub-categorization of betting lacks a legal basis. The Goods and Services Tax (GST) council will convene a virtual meeting on August 2 to consider legal amendments necessary for the 28% levy on online gaming, casinos, and horse racing. The meeting aims to address issues such as repetitive taxation and determining the full-face value, as highlighted by the gaming industry.

The central government is expected to introduce a GST amendment bill in the ongoing monsoon session of parliament after the council’s deliberations. The GST council, as the apex decision-making body for indirect tax, had decided to impose the maximum 28% slab on the full-face value in online gaming, casinos, and horse racing.

It also decided not to differentiate between online games of skill and games of chance. Currently, games of skill attract 18% GST on gross gaming revenue, while 28% GST is levied on the total bet value in games of chance.

Moreover, the new GST rules do not differentiate between games of skill and games of chance. This means that taxes on online gaming will be imposed uniformly, regardless of whether the games require skill or are based on chance. This lack of distinction could potentially subject the entire online gaming sector to judicial scrutiny, as it effectively brings the industry under the gambling umbrella, which may raise legal concerns based on the definitions provided by the Constitution and various State laws.

Views expressed are strictly personal and cannot be considered as a legal opinion in case of any query. For feedback or queries email us yash@hnaindia.com.