The Western Maharashtra Tax Practitioners’ Association has written a letter to FM and expected Urgent Relaxation in GST Compliance due to Outbreak of Covid19 again in whole country.They requested that Due Dates For March 2021 Of All GST Returns be extended, OTP Based GST Return Filing And Other Compliance, Should Be Allowed For All Kinds Of Taxpayer and requested for Clarification On Applicability Of GSTR 9C For FY 2020-21. Full text of the letter is as follows:-

Pay Taxes • Not Less • Not More

THE WESTERN MAHARASHTRA TAX PRACTITIONERS’ ASSOCIATION

Yadav Vyapar Bhavan, Shivaji Road, 602, Shukrawar Peth, Pune 411 002 Phone : 020-2447 0237.

Website : www.wmtpa.org Email: thewmtpa@gmail.com

Date: 18th April 2021

To,

| Smt. Nirmala Sitharaman

Chairman, Goods and Service Tax Council and Hon’ble Union Minister of Finance |

Shri Ajit Pawar

Member, Goods and Service Tax Council, Dy CM and Finance Minister of Maharashtra |

Subject: Expecting Urgent Relaxation in GST Compliance due to Outbreak of Covid 19 again in whole country

Respected Sir/Madam,

We, The Western Maharashtra Tax Practitioners’ Association, was formed in 1950 with the object to assist the professionals and resolve common problem faced by the tax professional. WMTPA represents Tax Consultants, Advocates, Chartered Accountants & Cost Accountants who are practicing in taxation, corporate and other allied laws. Association’s primary objective is, to help the member to get acquaint with changes in various laws as well to help the government, by representing, issues faced by taxpayer as well as professionals.

Unfortunately, Covid19 has hit the country again in very big way –

- In various parts of country, lockdown like restrictions is imposed.

- Many employees of companies, Partners, Directors, HOD, CEO, proprietor, Professionals are getting infected with Covid 19. This is impacting whole business operations and compliance

- Maharashtra has imposed almost lockdown up to 30th April 2021 and it might get UP, Gujrat, Delhi and other states has also imposed restriction or in the process of imposing lockdown like restriction.

Therefore, there is urgent need that, on humanitarian grounds, GST Council, Union Finance Minister and State Finance Minister should extent below compliance due date urgently, so that infected taxpayer and their staff can focus on recovery of their health.

Also, clarification is required at earliest from government on filing of GSTR 9C for FY 2020-21. Vide Finance Act 2021, government has amended the section.

Page Contents

- a) DUE DATES FOR MARCH 2021 OF ALL GST RETURNS:

- b) OTP BASED GST RETURN FILING AND OTHER COMPLIANCE, SHOULD BE ALLOWED FOR ALL KINDS OF TAXPAYER:

- c) GST ANNUAL RETURN FORM GSTR 9 FY 2020-21 IS NOT MADE YET AVAILABLE AND ALSO CLARIFICATION IS REQUIRED ON APPLICABILITY OF GSTR 9C FOR FY 2020-21 –

- d) WAITING FOR GOVERNMENTS STAND / REPLY ON OUR 76 POINTS GST RECOMMENDATION –

a) DUE DATES FOR MARCH 2021 OF ALL GST RETURNS:

Due dates for March 2021 GSTR 1 and GSTR 3B to be extended by 2-3 month for all taxpayer or late fee provisions should be waived off. In this regard, your kind attention is invited to Maharashtra Chief Minister letter dated 13th April 2021 addressed to Prime minister Shri Narendra Modi ji.

b) OTP BASED GST RETURN FILING AND OTHER COMPLIANCE, SHOULD BE ALLOWED FOR ALL KINDS OF TAXPAYER:

Currently under GST, Digital Signature (DSC) is required for filing GST Return for body corporates and some other taxpayer.

- Some taxpayer who has finalized their GST Return working and wish to pay the tax, are not able to file the return, as their Digital Signature is stuck in office, which is closed as per restriction of state government, or

- DSC is with staff who is infected due to Covid19 which impact GST Payment and Return filing, or

- DSC is available but there is some technical issue faced while submitting the return with DSC.

Therefore, it is urgently requested to Kindly allow OTP based GST Return filing. This will help government to get the taxes and unnecessary return filing will not be kept on hold.

Also, OTP based GST filing should be allowed always for types of taxpayer. (Even Banks also to do banking on OTP based mode). Therefore, under GST too, OTP based mechanism should be allowed to all taxpayer without any restriction and condition. And there is no loss to government for this.

Also OTP based facility should also be extended for Refund and other submission on GST Portal.

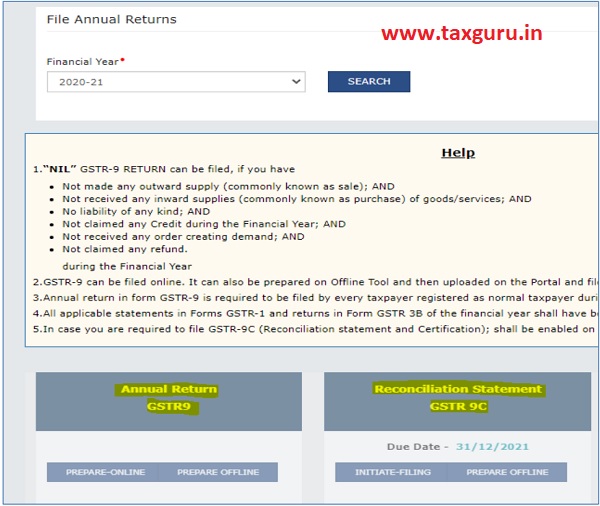

c) GST ANNUAL RETURN FORM GSTR 9 FY 2020-21 IS NOT MADE YET AVAILABLE AND ALSO CLARIFICATION IS REQUIRED ON APPLICABILITY OF GSTR 9C FOR FY 2020-21 –

- Annual Return for GSTR 9 for FY 2020-21 is not made available yet : It is assured by government in past that, all forms will be made available on 1st April of the It is observed in GST that, there is consistent demand on extension of due date for Annual Return 9/9C since inception. However now all Annual Return compliance in most of the taxpayer case is filed up to FY 2019-20. It’s time to start the compliance for FY 2020-21. However still GST Portal has not activated filing of GSTR 9 of FY 2020-21.

This will lead to situation of representation is being sent to government from all parts of country for date extension in Nov/Dec 2021 and writ to be filed in high court for extension of due dates unnecessarily. To avoid this, it is the duty of all government machinery to make the said forms available in time.

d) WAITING FOR GOVERNMENTS STAND / REPLY ON OUR 76 POINTS GST RECOMMENDATION –

On 29th Jan 2021, our association has submitted “All India Common Representation on Tax Issues” for your urgent attention and action. The said representation is submitted to various State Finance Ministers, GST Commissioners etc. by various associations.

Resolution to our All India Common 76 Points GST Recommendation, is a need of time. It is prepared by team of Expert from all parts of the country. Even after 3 years of GST implementation and huge efforts from government, still there are numerous issues under GST which are making GST complex structure. We are with the government and we want GST, however issues mentioned in our 76 GST Recommendation needs urgent resolution from the government. Export is getting taxed, Small error but loss in lakhs, Rs 1.20 lakhs + Rs 1.20 lakhs late fee for one year even in case of nil or negligible tax liability, no scope for revised return is engraved and painful issues under GST.

Our core committee delegation of 250 plus associations, had meeting with Hon’ble Finance Minister Smt. Nirmala Sitharaman ji on 15th Feb 2021. We are thankful to Hon’ble Finance Minister for giving time from her busy schedule and understanding issues and taking note of it. During meeting It is categorically asked by Hon’ble Finance Minister to GST Commissioner present in the meeting to reply of Government views on recommendation submitted by us and Hon’ble Finance Minister also asked our delegation to give their reply on it again. We appreciate this statement and action of FM during the meeting. In democracy, Dialogue and exchange of feedback between government and stakeholder helps to achieve desired results and issues can be addressed. However still we have not received reply of government on it. This is issue of whole India represented by 250 plus associations. We request you to kindly arrange to provide us government’s stand on 76 concerns raised by us in a democratic way.

We request you to kindly consider and give relief for above mentioned points. Hoping for early relief / action from government

For The Western Maharashtra Tax Practitioners’ Association

| Mr. Vilas Aherkar President, The WMTPA |

Mr. Narendra Sonawane Chairman CGST L & R Committee |

CA Swapnil Munot Convenors CGST L & R Committee |

CC:

1) Shri Narendra Modi ,The Prime Minister of India

152, South Block, Raisina hills, New Delhi 110011

2) Shri Anurag Thakur, The Minister of State finance and Corporate Affairs

North Block, New Delhi – 110 001

3) Hon’ble GST Council Secretariat

5th Floor, Tower II, Jeevan Bharti Building, Janpath Road,

Connaught Place, New Delhi-110 001

4) The Chairman of Central Board of Indirect Tax and Custom,

North Block, New Delhi – 110001

Read Also:-

3. Representation to Relax GST Compliance dates by Tax Practitioners’ Association Nashik

Respected Sir/Madam,

Relief for COVID.

Please extend the due date of all GST returns. As many employees of the companies are getting infected with COVID, due to which we are not being able to fetch data for reconciliation of party statement. And without matching the data from Party’s Statement we cannot just upload the GST Returns.

So, its a humble request to u all to kindly address the same and please do extend all the GST Return due date.

I hv filed wrong return of gstr1 in the month of march 21 for the month jan feb ndarch and now i can realize it was wrong return fille….please suggest when wee can file return revissed and penalty for the same.

it is not only d responsibility of d tax practitioners to raise voice. Taxpayers should also raise voice against d problems raised in GST.

It is not only responsibility of the tax practitioners only

it is not only d responsibility of d tax practitioners to raise voice. Taxpayers should also raise voice against d problems raised in GST.

If this pandemic is known to all and even our PM knows about it. Why do we have to submit a formal request for this? Is it not responsibility of Govt, the way they did in March 2020?

Government don’t bother about the COVID-19 pendamic. Govt want revenue at any cost, whatever happen, they want only revenue. They don’t bother people died or alive due to CORONA. Ruthless , Shameless Govenment.