Introduction of redeemable digital assets for payment of GST Liability: Can it solve the ITC crisis?

Introduction of redeemable digital assets for payment of GST Liability: Can it solve the ITC crisis?

1. Challenges faced by the current mechanism

Input Tax Credit under the GST regime has been a source of endless litigation placing stress on the resources of the government as well as businesses. At the cost of oversimplification, ITC allows a business to set off tax already paid to its suppliers in the supply chain against the tax demand arising out of the goods and services it supplies to its buyers. This mitigates, what is known as, the “cascading effect of taxation”, in other words tax being levied on tax components already paid. Therefore what lies at the root of the idea of ITC is not just beneficial but essential for competitive economies. However, the existing mechanism by which ITC is claimed and indirect taxes are collected in the GST regime carries several challenges with it. From the point of view of revenue, fraudulent ITC is a major challenge. An answer to a parliamentary question revealed that detection by GST officers in June Quarter of 21-22 fiscal was Rs 4000 Cr. Needless to mention several cases might go undetected by a risk based monitoring system. From the perspective of the trade, introduction of inward supply statements like 2A and 2B resulting in increased instances of SCNs being issued, unbridled resort to provisions of Rule 86A and an unreasonable onus to ensure tax compliance by suppliers in order to claim legitimate credit are common concerns. The problems cited are not exhaustive by any means. Therefore the existing mechanism for tax collection may be scrutinized for modification.

2. Discussion on the Constitutional propriety of current mechanism

We first put this existing mechanism under Constitutional lens. Article 265 of the Indian constitution prohibits levy and collection of tax without authority of law. Revenues received from levy of taxation are required to be credited to the Consolidated Fund of India as per Article 266(1). Further Article 114(3) prohibits withdrawal of money from the Consolidated fund except under authorization by law. This law, of course, is a part of the Annual Budget as we are all aware. The conclusion is inescapable in that once tax is duly levied and collected, it should be credited to the Consolidated Fund of India. Is it within legislative competence to delay or even forego the tax so collected especially if it is without express approval of the parliament as per prescribed parliamentary provisions?

Periodic return filing under GST poses this challenge. Unlike direct taxes where periodicity is inevitable in that profit cannot be ascertained by individual transactions, GST is levied and even quantified per transaction. However, the existing mechanism allows businesses to hold onto this tax component on behalf of the government till the due date of return filing when the duty liability is finally discharged. Section 31 of CGST Act makes it mandatory to mention the GST component on each GST invoice which is the major document quantifying and demanding such tax. Once payment is made by the recipient in lieu of the invoice, constitutional propriety requires that the amount collected as GST be made a part of the Consolidated Fund and not withdrawn except as per procedure. However, the practice sanctioned by legislation is that the GST collected becomes a part of the resource pool of the business, to be used in any manner subject to several risks that businesses carry with them. After allowing for tax payment through credit, the tax is paid only upon arrival of the due date. Even then, businesses may delay filing such returns at the cost of paying a penal interest rate and late fees. A valid objection may be raised at this point that while businesses collect GST from buyers, they also pay a substantial tax component to their suppliers which anyways squeezes the working capital available with them till credit thus available is utilized at the time of filing returns under Section 39. Such an argument though appealing is misplaced. The GST component paid by businesses to their suppliers has also been collected on behalf of the government. The business was not supposed to use it for any other purpose. Utilization of tax so collected by the supplier as a business resource is equally undesirable. Throughout the supply chain, any money, once collected as GST by any participant after specifically quantifying the same, cannot be put to any use except depositing it in favour of the government. The idea of periodic tax payment in respect of indirect taxes, therefore, facilitates a faulty understanding of the concept of Tax Credit and indeed the tax itself. It is erroneous to assume that the entire amount received from sale of goods or services is available to the business and GST is a tax to be paid at the end of every return period(in most cases a month) after availing credit. This is wrong on several accounts. First, such an understanding implies that GST is akin to direct taxes where it is a cost to the business like income tax. By definition, the burden of indirect taxes is borne by the final consumer of produced goods/services. Secondly, it paints an erroneous picture in that revenue from sale inclusive of the GST component is seen as ‘available’ whereas it is imperative to distinguish the money paid exclusively for sale from the GST component thereon.

3. Discussion on impact of Insolvency and IBC on GST collection

At this point another valid observation needs to be addressed. The statute prescribes penalty for late payment. In case the business, treating the taxpayer’s money as available cash, is ultimately unable to pay off the GST collected, the law contains provisions for recovery of such dues along with applicable penalty. That ironically brings us to the next anomaly. GST registrations are granted to corporate entities in most cases where the liability falls on a juristic person. Recovery is restricted by the assets available with such an entity. GST Act has enabling provisions in Chapter XVI in this regard in that it dilutes the corporate veil by starting with non obstante clause in Sections 89 and 90, thereby easing the scope of recovery from the directors or partners of such defaulting firms. However, for public companies such recovery is not feasible and also not backed by statute. If the liability of such firms is restricted, the delay caused in tax collection by periodic discharge of GST liabilities may lead to situations where tax collected and borne by the public as GST, rather than being used as per constitutional provisions for welfare, ends up being used for subsidising business adventures of private entities.

A bigger concern is the impact of Insolvency and Bankruptcy Code on revenue thus forgone. The objectives of the Act state that it aims to promote entrepreneurship and alter the precedence of government dues in order of priority for stakeholders during liquidation. Here the position of GST dues is different from those of financial institutions or other operational creditors. The risk associated with businesses is an integral part of lending risk. Banks or any other financial institution, after considering several factors including the viability of business proposals, take an informed decision about lending. GST burden on the other hand is borne by an unrelated person who is not aware of the use that this component collected as ‘GST’ is being put to. The constitutional provisions with respect to taxation as mentioned above exist precisely to ensure accountability in this regard. IBC law permits the National Company Law Tribunal to approve resolution plans of distressed business entities based on proposals submitted by the Committee of Creditors. The tax department is not even a part of this Committee. Hon’ble Supreme Court’s observations in para 54 of judgement in case of State Tax Officer Vs. Rainbow Papers Ltd raised this precise concern. To further aggravate the situation, Section 82 of GST Act saves IBC from charge of GST arising from CGST Act and IBC itself recognizes government dues as a part of operational debt as per Section 5(21) of IBC. Operational debt has lower precedence than claim of financial creditors as is explicitly provided for in Section 53 of the Act. Thus a constitutional mechanism to ensure accountability in use of money collected as Tax stands effectively bypassed and the role of parliament to authorise legitimate use of public money stands extinguished in favour of Creditors of the insolvent businesses. Parliamentary authorization aside, the oversight mechanism by way of CAG audits also stands extinguished. As to whether GST dues should be given absolute precedence to the disadvantage of all other dues in any resolution plan is not a question that is discussed in this article. In fact any solution to this conundrum must try to avoid the need for recovering dues that have already been collected as tax.

4. Analysis of the relevant features of ITC

Before suggesting possible solutions, it is necessary to analyse the nature of ITC. One peculiar condition for credit to be eligible is that the tax charged to create credit in favour of any registered person must have been paid to the credit of the government by way of cash or ‘eligible credit’. The definition therefore is self referential. While common in computer programming as recursive functions, such definition finds few parallels in legal lexicon. But the idea is that every credit available in the GST chain should correspond to an equivalent cash payment of tax somewhere in the chain. The correspondence is strictly one to one. Credit, in this way, is a near equivalent of cash or M1 money. In that case,knowingly utilising fake credit is the equivalent of printing counterfeit currency and using it for business purposes. The often cited argument that tax burden of GST is borne by the final consumer falls flat in this case. Fake credit is not recovery of money from any entity in the name of GST and then appropriating it. It is the creation of a highly liquid cash equivalent from thin air to generate illegitimate profits. Fraudulent credit generates very real profits for scrupulous elements. Akin to counterfeit currency, there is nothing stopping this money from fueling anti-social activities. Interestingly, IPC section 489A prescribes maximum punishment of life imprisonment for offenders while generating fake credit carries a maximum sentence of five years in GST law.

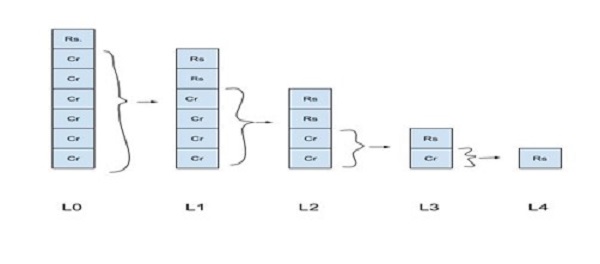

Fig 1 : It may be noticed how every credit at any level of supply corresponds to some cash payment in the following chain of supply

Another aspect of ITC that is widely misunderstood is its claim as a ‘vested right’ by some businesses. Hon’ble Supreme Court’s judgement in case of Eicher Motor Ltd Vs. Union of India is offered in support of the argument. However, a careful reading of this judgement shows that ITC would become a vested right only when conditions associated with its availment are fulfilled. These conditions are to be strictly construed and the legislature is empowered to prescribe conditions for eligibility as held by hon’ble Supreme Court in case of ALD Automotives Pvt Ltd Vs. The Commercial Tax Officer. Right to trade under Article 19 or the right to property under Article 300A cannot be resorted to if due process for tax collection and use of public money, as prescribed constitutionally, is at stake. Thus any proposed framework must give precedence to tax collection over making credit available to registered persons. AT the cost of repetition, GST credit is not in the nature of temporary liquidity being made available to businesses by the government. It is the result of a necessary tax reform and a mechanism to avoid cascading effects of taxation,

5. A possible Solution for problems discussed above

Keeping these two points in mind, one possible solution is to distinguish quantified GST payment against any document(most commonly a GST invoice) from the payment in lieu of supply of goods or services. While this may be difficult to implement in a cash based economy, India has come far in terms of enabling access to banking framework and digital payments infrastructure. The Rupee has already been tokenized by RBI. Would it not, then be possible, to create a digital asset in the nature of ‘GST Coin’ where one coin is worth one rupee and can be bought at that cost using India’s extensive banking infrastructure? The difference is that this coin can be used only for payment of GST dues. Its convertibility back into rupee would be easy and possible subject to a few constraints. Of course the coin would be in the nature of a digital asset like much of the money circulating in the economy. The name is irrelevant. For all transactions attracting GST, payment corresponding to exchange of goods and services may be made in cash but the GST component is to be paid by registered GST taxpayers only by use of this special digital asset. For unregistered persons in the supply chain, the use is optional. What this essentially means is that GST transactions are denominated and discharged by use of a liquid asset, designed specifically for such purpose. Creating an infrastructure for holding, transfer and exchange of digitised assets and settlement of such transactions in cash is nothing new. The vibrant secondary market for equity trading already implements such an architecture with more complicated conditions. This GST coin has innumerable advantages but let us understand the mechanism first.

Under the current scenario, every supply under GST attracts a particular tax rate and for a pair of buyer and seller in the supply chain, the buyer pays the seller and settles the transaction inclusive of the GST component in cash. Under the new proposed mechanism, for the GST component, the buyer may obtain GST coins from participating banks against payment of cash and make the same available to the seller to settle the GST component of any transaction attracting the same. For purposes of holding these coins, a special wallet or a ledger may be created much like demat accounts hold digital assets in the form of company shares. GST Credit may be claimed by the buyer as a registered Taxpayer against transfer of these GST coins, which, in the current scenario is claimed against payment in cash to the seller, which may be deferred. What this essentially means is that GST credit units are required to be backed by real currency. For every return filing period, the taxpayer, who is a supplier to some and a buyer from some may calculate the duty liability and use either the GST coins paid by his buyers, available with him in his wallet or credit availed by paying coins to his supplier to discharge this liability. To address the cascading effect of taxation, any surplus coins available after filing of returns may be exchanged back for cash. In the rare eventuality of GST coins not being available to pay the dues, duty may be discharged in cash. This mechanism gives precedence to tax collection over making credit available to taxpayers.

Figure 2 : Payment of GST under the current mechanism

Figure 3 : Illustration of new Mechanism proposed

6. Effects of implementing the new proposed mechanism

This may appear as a superfluous change at first glance but the effects are pervasive. First, this will eliminate any possibility of fraudulent credit since credit can be generated only against payment of cash. It is not possible to generate credit from thin air. Any unintended subsidisation of businesses due to non recovery of GST dues as discussed in detail above, would be avoided. The returns are filed by the Taxpayers to claim benefit of surplus coins available and there is no reason to delay the filing. The enormous resource drain on Revenue in ensuring that returns are filed on time and interest recovered would be done away with. In fact, in the majority of cases, interest liability on delayed return filing would not arise at all. Government revenues are boosted due to immediate collection and the role of bureaucracy remains restricted to tackling violation of substantial law rather than ensuring basic compliance. The complexity surrounding investigation of fake ITC cases and raising demands across jurisdictions is easily resolved. Question of the GST department filing claims before IRP during insolvency of distressed firms does not arise. If at all, firms would be readily compliant in filing tax returns to claim benefit of surplus tax paid.

Benefits for genuine trade are even more remarkable. The unreasonable onus of ensuring that supplier files their returns for availing GST credit is done away with. Cash is paid directly to the government and credit claimed against it. Genuine taxpayers are not penalised for fake credit, existing several layers inside the supply chain. Compliance burden is considerably reduced. Timely payment by buyers is promoted and the moral hazard of availing credit without payment to the seller is discouraged, reducing instances of bad operational debt. Clear accountability exists for each individual registered taxpayer.

The only drawback in this scheme that can be argued is that the GST component on sale transactions is locked and unavailable till the filing of returns. However, I have argued in depth that such capital, strictly speaking, was not available for businesses in the first place. Credit, in this regard, should be viewed as a concession and not as a vested right.

What capital was inadvertently and unintentionally being supplied by delayed collection of tax would have to be obtained as debt and the same is subject to scrutiny by creditors. Indeed, financial institutions specialise in this task and substantial lending space would be made available to them if such a reform is implemented.

7. Key Concerns to be addressed

What is proposed here is a solution in its most abstract form. Indeed, introduction of this new digital asset for use by registered taxpayers changes every facet of GST law. Several questions need to be addressed. Is sale on credit not at all possible under the new mechanism ? What about the time of supply provisions which direct as to when the liability to pay tax would arise ? Does this mean that tax is collected qua bank transactions and this is just the much-touted Bank Transaction Tax in a new guise ? How is the digital infrastructure to be created ? Does this necessitate the creation of a new regulatory framework ? If so, what changes in law will be required for its implementation ? What about credit that is blocked under GST Law or that is required to be reversed monthly if inputs are used for producing both exempted and taxable goods ? Can this mechanism do away with the need to refer refunds for accumulated credit to Tax authorities ? If it were to be implemented tomorrow what transitional mechanisms would be required in place ? Would these challenges be so overwhelming as to discourage the adoption of this mechanism ?

8. Conclusion

In my next article or a series thereof, I will try to address all of the topics mentioned above. Vagaries of implementation aside, as an abstract concept, the idea merits serious discussion.

It may kindly be noted that all views mentioned here are personal. They are not in any way related to official Government policy or in any way endorsed by any government authority. The article is intended for academic discussion only.

*****

Author Profile – Adeeb Pathan

Adeeb Pathan, with a strong academic foundation holding an M.Sc. in Economics, brings a wealth of knowledge and experience to the table. He is a proud member of the Indian Revenue Service (Customs and Indirect Taxes) from the 2015 batch. Currently serving as a Deputy Commissioner with the Central Board of Indirect Taxes and Customs (CBIC) in New Delhi, his expertise in the field of economics and taxation is commendable. With a distinguished career path, Adeeb is currently awaiting his posting after repatriation from the Enforcement Directorate.