Under GST law, there is a provision of deemed approval of fresh registration and amendment of registration in case the departmental officer fails to take any action on the taxpayer’s application within the prescribed period. This provision is being there in the law since the inception of GST but it was not in practical application on the GST Portal. The registration was not provided even after the passage of the prescribed period of approval or rejection of application by the departmental officer. Now this provision of providing the deemed approval of the application has been actually implemented on the GST Portal.

Page Contents

Provisions of Deemed Approval of Registration Under GST Law:

The provisions under the CGST Act, 2017 read with CGST Rules, 2017 (as amended) with respect to deemed approval of registration application are as under:

A. Fresh GST Registration:

> Section 25(10) of the CGST Act, 2017:

The registration or the Unique Identity Number shall be granted or rejected after due verification in such manner and within such period as may be prescribed. – [Prescribed under Rule 9(1)]

> Rule 9(1) of the CGST Rules, 2017:

The application shall be forwarded to the proper officer who shall examine the application and the accompanying documents and if the same are found to be in order, approve the grant of registration to the applicant within a period of seven working days from the date of submission of the application.

Provided that where-

(a) a person, other than a person notified under sub-section (6D) of section 25, fails to undergo authentication of Aadhaar number as specified in sub-rule (4A) of rule 8 or does not opt for authentication of Aadhaar number; or

(b) the proper officer, with the approval of an officer authorised by the Commissioner not below the rank of Assistant Commissioner, deems it fit to carry out physical verification of places of business,

the registration shall be granted within thirty days of submission of application, after physical verification of the place of business in the presence of the said person, in the manner provided under rule 25 and verification of such documents as the proper officer may deem fit.

> Section 25(12) of the CGST Act, 2017:

A registration or a Unique Identity Number shall be deemed to have been granted after the expiry of the period prescribed under sub-section (10), if no deficiency has been communicated to the applicant within that period.

> Rule 9(5) of the CGST Rules, 2017:

If the proper officer fails to take any action, –

(a) within a period of seven working days from the date of submission of the application in cases where the person is not covered under proviso to sub-rule (1); or

(b) within a period of thirty days from the date of submission of the application in cases where a person is covered under proviso to sub-rule (1); or

(c) within a period of seven working days from the date of the receipt of the clarification, information or documents furnished by the applicant under sub-rule (2),

the application for grant of registration shall be deemed to have been approved.

B. Amendment of GST Registration:

> Section 28(2) of the CGST Act, 2017:

The proper officer may, on the basis of information furnished under subsection (1) or as ascertained by him, approve or reject amendments in the registration particulars in such manner and within such period as may be prescribed. – [Prescribed under Rule 19(2)]

> Rule 19(2) of the CGST Rules, 2017:

Where the proper officer is of the opinion that the amendment sought under sub-rule (1) is either not warranted or the documents furnished therewith are incomplete or incorrect, he may, within a period of fifteen working days from the date of the receipt of the application in FORM GST REG-14, serve a notice in FORM GST REG-03, requiring the registered person to show cause, within a period of seven working days of the service of the said notice, as to why the application submitted under sub-rule (1) shall not be rejected.

> Rule 19(5) of the CGST Rules, 2017:

If the proper officer fails to take any action,-

(a) within a period of fifteen working days from the date of submission of the application, or

(b) within a period of seven working days from the date of the receipt of the reply to the notice to show cause under sub-rule (3),

the certificate of registration shall stand amended to the extent applied for and the amended certificate shall be made available to the registered person on the common portal.

Thus, in case of fresh registration or amendment of registration, if the departmental officer fails to take any action within seven or fifteen or thirty days as may be applicable, the applicant shall be provided deemed approval of the application and registration certificate shall be issued to him on the GST Portal.

Practical Implementation on GST Portal:

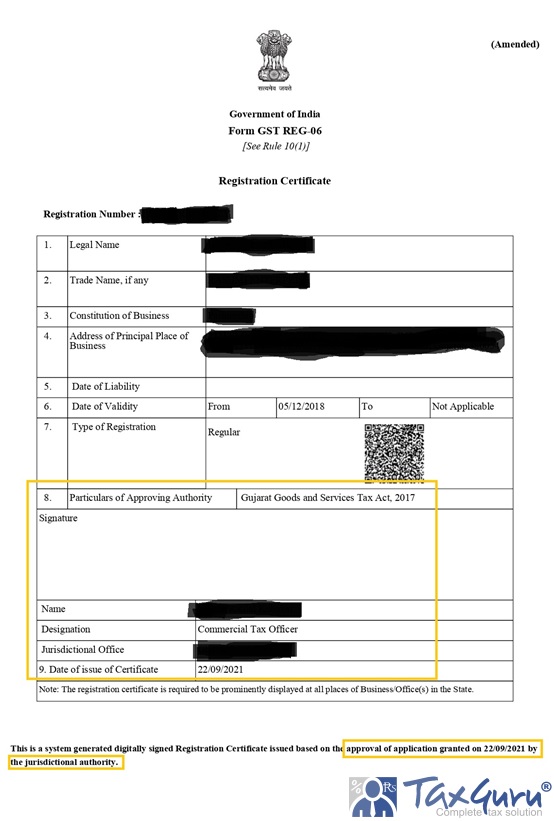

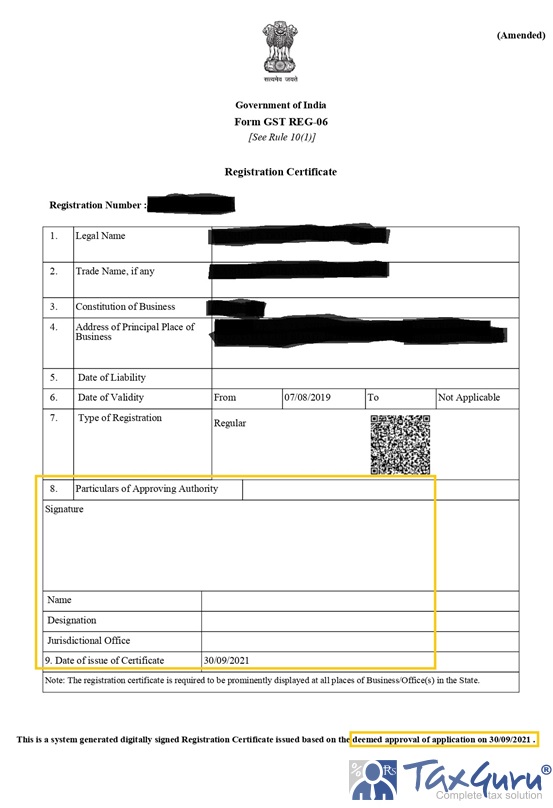

The GST Portal has started issuing the certificates to the applicants if the departmental officer fails to take any action within the time prescribed. The certificates are being issued by the GST Portal itself without any approval from the departmental officer. It is being specifically mentioned on the registration certificate that the registration is issued based on deemed approval of application and no particulars of the jurisdictional approval authority are mentioned on the registration certificate. The certificates are being issued by the GST Portal immediately once the prescribed time limit expires. Below are the images of GST registration certificates in two different scenarios – one in case of approval by jurisdictional officer and another in case of deemed approval.

GST Certificate In Case of Approval by Jurisdictional Officer

GST Certificate In Case of Deemed Approval

This is a good sign in the current period when the new applicants and the existing registered taxpayers are facing many difficulties in GST registrations and its amendments due to requirements of various documents and physical visits being conducted by the departmental officers.

******

(Author can be reached at cakushalfofaria@gmail.com)

Disclaimer: The contents of this article are for information purposes only and does not constitute an advice or a legal opinion and are personal views of the author. It is based upon relevant law and/or facts available at that point of time and prepared with due accuracy & reliability. Readers are requested to check and refer relevant provisions of statute, latest judicial pronouncements, circulars, clarifications etc. before acting on the basis of the above write up. The possibility of other views on the subject matter cannot be ruled out. By the use of the said information, you agree that Author is not responsible or liable in any manner for the authenticity, accuracy, completeness, errors or any kind of omissions in this piece of information for any action taken thereof. This is not any kind of advertisement or solicitation of work by a professional.