GST NEWS LETTER JULY MONTH

1) NIL GSTR-1 & GSTR-3B CAN BE FILED THROUGH SMS

- W.e.f. from 8th June 2020 NIL return in form GSTR-3B & w.e.f. 1st July, 2020 NIL return in form GSTR-1 can be furnished by SMS and the same shall be verified by registered mobile number based OTP facility.

(NN.58/2020-CT dated 1st July 2020 read with NN.44/2020-CT dated 8th June, 2020 & NN.38/2020-CT dated 5th May, 2020-CT)

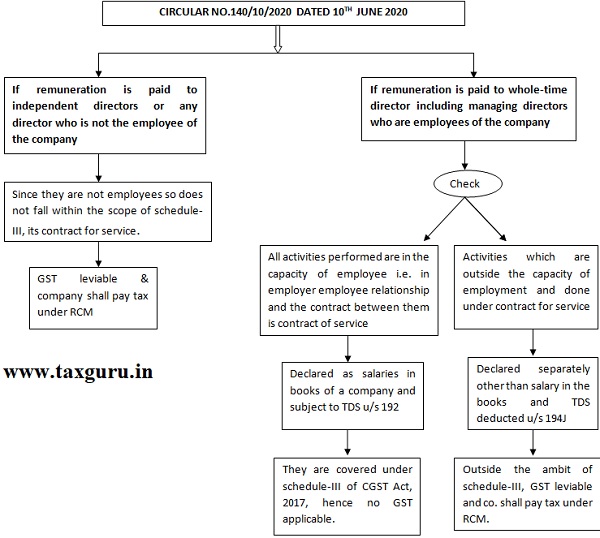

2) GST ON DIRECTORS REMUNERATION- A CONTROVERSY CREATED BY AAR RULING NOW STANDS RESOLVED BY CBIC-

(3) EXTENSION OF TIME-LIMIT FOR ISSUANCE OF REFUND ORDERS U/S 54(7)

- Cases where notice has been issued for rejection of refund claims in full or in part and where the time-limit for issuance of refund orders is falling between the period 20th March, 2020 to 30th August, 2020 the same shall be extended to

- 15 days after the receipt of reply to the notice from regd. Person OR

- 31st August Whichever is later

(NN.56/2020 dated 27th June 2020-CT & NN.46/2020-CT dated 9th June 2020)

(4) VALIDITY OF E-WAY BILLS EXTENDED TILL 30TH JUNE 2020

- Validity of E-way bills generated on or before 24th March 2020 & has expired on or after 20th March, 2020 shall be deemed to have been extended till 30th June, 2020.

(NN.47/2020-CT dated 9th June, 2020)

(5) GSTR-1 & GSTR-3B CAN BE VERIFIED THROUGH EVC

- GSTR-3B : for the period April, May, June , July, August

- GSTR -1 :for the period of May ,June ,July, August (NN.48/2020-CT dated 19th June 2020)

(6) RATE OF TAX PRESCRIBED FOR PERSONS OPTING COMPOSITION SCHEME UNDER SECTION 10(2A) w.r.e.f. 1st April,2020

- Section 10(2A) inserted by finance Act 2019 w.e.f. 1st Jan,2020 gives option to those taxpayers to pay tax under composition scheme who are not eligible to pay tax under sub section (1) & (2) and whose aggregate turnover in the preceding financial year did not exceed INR 50 lacs.

- Till now no rate of tax was prescribed for them in rules only maximum rate was mentioned in the Act.

- CBIC now amended rules by NN.50/2020-CT to prescribe rate of tax @3% (CGST & SGST each) of the [turnover of] supplies of goods & services in the state or Union Territory w.r.e.f. 1st April, 2020. (NN.50/2020 dated 24th June 2020)

(7) RELIEF PROVIDED BY LOWERING INTEREST RATES FOR TAX PERIODS FEB –JULY 2020

| Taxpayers having aggregate turnover | Tax Periods | Interest Rates for late payment of taxes in GSTR-3B | Remarks |

| More than INR 5 Crores | Feb, March & April 2020 | NIL-For first 15 days from due date

9% -Thereafter till 24th June 2020 18%-After 24th June 2020 |

Earlier NN. 31/2020 stated that if return is not filed by 24th June then interest rate @ 18% shall be applicable from due date. |

| Upto INR 5 Crores | Feb-July 2020 | NIL-Till specified date

9%-Thereafter till 30th September 18% -After 30th September |

A relief provided to small taxpayers by specifying different dates for different states. |

(NN.51/2020-CT dated 24th June 2020 read with Circular No.141/11/2020-GST)

(8) WAIVING OF LATE FEES ON LATE FILING OF GSTR-3B FOR TAX PERIODS FEB-JULY AND ONE TIME AMNESTY BY LOWERING /WAVING LATE FEES FOR TAX PERIODS JULY 2017-JULY 2020

| Taxpayers having aggregate turnover | Tax Periods | Condition:-

GSTR-3B furnished |

Remarks/Conditions |

|

More than INR 5 Crores |

Feb- April 2020 |

On or before 24th June 2020 | Full Late fees waived otherwise late fees leviable from due date |

| Till 30th Sept,2020 | Maximum late fees INR 250 each for CGST & SGST and no late fees if no tax payable in the said return | ||

| After 30th Sept 2020 | No Capping on maximum late fees | ||

|

May-July 2020 |

After due date but till 30th Sept,2020 | Maximum late fees INR 250 each for CGST & SGST and no late fees if no tax payable in the said return | |

| After 30th Sept 2020 | No Capping on maximum late fees | ||

|

Upto INR 5 crores |

Feb-July 2020 |

Till specified dates | No late fees

|

| After specified dates but till 30th Sept,2020 | Maximum late fees INR 250 each for CGST & SGST and no late fees if no tax payable in the said return | ||

| After 30th Sept 2020 | No Capping on maximum late fees |

Note-

For those taxpayers who failed to furnish GSTR-3B for the tax periods July-17 to Jan-2020 by due dates but furnishes the same between the periods 1stJuly to 30th September 2020-

- Maximum late fees shall be INR 250 each for CGST & SGST and

- No late fees if no tax is payable in the said return.

(NN.52/2020-CT dated 24th June read with NN.57/2020-CT dated 30th June 2020)

(9) LATE FEES FOR FILING OF GSTR-1 WAIVED FOR TAX PERIODS JAN-JUNE 2020

No late fees if GSTR-1 for below mentioned tax periods filed by the dates mentioned therein-

| TAX PERIODS | GSTR-1 TO BE FILED BY DATE |

| March – 2020 | 10th July 2020 |

| April-2020 | 24th July 2020 |

| May-2020 | 28th July 2020 |

| June-2020 | 5th August 2020 |

| Jan-March 2020 | 17th July 2020 |

| April-June 2020 | 3rd August 2020 |

(NN.53/2020-CT dtd 24th August 2020 read with Circular No.141/11/2020-GST)

(10) GSTR-3B DUE DATE FOR AUG MONTH EXTENDED FOR SMALL TAXPAYERS

Taxpayers whose aggregate turnover in preceding FY Upto INR 5 crores can now file GSTR-3B for the month of August,2020 without any interest or late fees-

- On or before 1st October &

- On or before 3rd October 2020

Respectively depending upon the state where the taxpayer is having a place of business. (NN.54/2020-CT dated 24th August 2020)

(11)DUE DATE OF COMPLIANCES FALLING BETWEEN THE PERIOD 20TH MARCH TO 30TH AUGUST 2020 EXTENDED UPTO 31ST AUGUST,2020:

However such extension not applicable for-

- Persons opting out of composition scheme due to crossing of threshold limit

- Time & Value of Supply

- Issuing of tax invoices

- Liability for registration

- Generation of E-way bills

- Liability of firm partners to pay tax

- Power to levy interest on delayed payment of taxes

- Furnishing of GSTR-3B except for TDS return, ISD return and return for NRTP

(NN.55/2020-CT dated 27th June 2020 read with NN.35/2020-CT dated 3rd April 2020)