Summary: The GST Amnesty Scheme 2024, effective from November 1, 2024, introduces Section 128A and Rule 164 into the CGST Act, focusing on waiver provisions for interest and penalties on tax demand raised under Section 73. This scheme applies to the tax periods from July 1, 2017, to March 31, 2020, offering a waiver of interest (Section 50), penalties, or both, provided that the full tax amount is paid by March 31, 2025, and the waiver application is submitted by June 30, 2025. Importantly, no tax amounts are waived, and there will be no refunds for already paid interest or penalties. Separate applications are required for each notice, statement, or order, and eligibility for waiver is restricted if any appeal or writ petition is pending. Additional limitations apply if any erroneous refund is involved or if there’s an issue with Section 16(4) compliance. Applications for waiver are to be submitted via specified forms (GST SPL-01 or GST SPL-02) depending on the stage of the case, with the forms and payments processed through specific modes (DRC-03 or ELR). The scheme specifies guidelines for cases involving appeal withdrawal, tax adjustments, and the use of Input Tax Credit (ITC) in certain situations. Key references include Notification Nos. 20/2024 and 21/2024, along with Circular No. 238/32/2024-GST, guiding the implementation of this scheme.

GST Amnesty Scheme -2024 w.e.f. 01.11.2024

Introduction of Sec.128A & Rule 164 in the CGST Act

Section 128A: Waiver of Interest or penalty or both relating to demand raised u/s 73.

Rule 164 : Procedure and conditions for closure of proceedings u/s 128A of CGST Act.

Key Highlights :

- Applicable for tax period between 01.07.2017 to 31.03.2020

- Waiver of Interest u/s 50 or Penalty or both is provided, not Tax.

- To avail benefits of amnesty, full amount of tax must be paid before specified dates i.e. 31.03.2025

- Application for waiver must be submitted before 30.06.2025.

- No refund will be made, if interest & penalty already paid.

- If multiple notices/statements/orders issued, file separate application for each notice/statement/order.

- Waiver is not applicable if an appeal or writ petition filed is pending and not withdrawn the same.

- Waiver is not applicable, if any amount payable on account of erroneous refund.

- Section 128(4) prohibits further appeal against the concluded order.

Procedure for filing a waiver application

| Activity | Form to be filed |

Due date of Tax Payment |

Due date to file application for waiver |

| Notice issued u/s 73(1) or 73(3) but no order u/s 73(9) issued | GST SPL-01 | 31.03.2025 through DRC03 |

30.06.2025 |

| Order passed u/s 73(9) but no order u/s 107(11) or u/s 108(1) issued | GST SPL-02 | 31.03.2025 through ELR* |

30.06.2025 |

| Order passed u/s 107(11) or 108(1) but no order u/s 113(1) passed | GST SPL-02 | 31.03.2025 through ELR* |

30.062025 |

| Original notice issued u/s 74(1) but reassessed the tax u/s 73(1) in accordance with provision of Sec.75(2) | GST SPL-02 | Within 6 months from redetermination order u/s 73 |

Within 6 months from redetermination order u/s 73 |

Queries

Q.1 What if the order of withdrawal of appeal/writ petition not issued till the date of filing of application?

Ans. Upload copy of application along with GST SPL-01/GST SPL-02 and Upload the final order for withdrawal of appeal/petition within 1 month of the issuance of such order.

Q.2 What if tax demanded has already paid through form GST DRC-03 in respect of orders referred to 128A(1)(b) or (c)?

Ans. File an application in Form GST DRC-03A as per the prescribed rule in order to adjust the amount already paid through DRC-03 towards demand created in ELR Part II.

Q.3 Whether payment to avail waiver u/s 128A can be made by utilizing ITC?

Ans. Yes, However where tax to be paid by recipient under RCM or by electronic commerce operator u/s 9(5) then said amount is paid by debiting electronic cash ledger only.

Q.4 What if notice/statement/order was issued due to contravention of provisions of Sec.16(4)?

Ans. Full amount of tax payable u/s 128A(1) for eligibility of waiver shall be calculated after deducting the amount which is not payable anymore as per Sec 16(5) or 16(6) as per sub rule (5) of Rule 164.

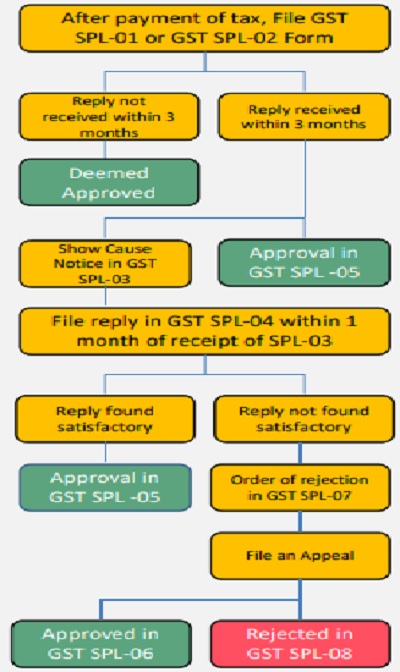

Processing & issuance of Order

Reference

√ Notification No. 20/2024 – Central Tax