Concerned GST refund sanctioning authority shall ensure that all GST refund applications are processed and decided within the prescribed time frame in order to avoid undue interest liability on the department.

GOVERNMENT OF NATIONAL CAPITAL TERRITORY OF DELHI

DEPARTMENT OF TRADE & TAXES, I.P.ESTATE

VYPAR BHAWAN: NEW DELHI-110002.

(POLICY BRANCH)

No. F. 3(433)/GST/policy/2022/1407-13

Dated: 20.07.2022

ORDER

Sub: Disposal of refunds within stipulated time framework and payment of interest amount on delayed refunds.

1 In a recent matter, Hon’ble Delhi High Court issued directions, dated 20-5-2022 in the matter of WP(C) 7110/2022 (Lord Krishna Traders Private Limited V/s Commissioner of Delhi Goods & Services Tax), that the Commissioner, DGST, will convene a formal meeting with Petitioner’s counsel and other practitioners, so that a robust mechanism is put in place for timely disposal of refund claims. The minutes of meeting held on 16.06.2022 in compliance to ‘aforesaid directions. has already been issued and circulated to all stakeholders.

2. The disposal of refund applications in a time bound manner is an integral part of the VAT/GST mechanism. In this regard, attention is drawn Section-38 of Delhi Value Added Tax Act, 2004 and Section 56 of the DGST Act as per which, if any tax is to be refunded under sub-section 5 of Section 54 but is not refunded within 60 days from the receipt of application under sub-section (1) of that section, interest at such rates not exceeding six percent as may be specified in the notification issued by the Government, shall be payable in respect of such refunds from the next day of the sixtieth day of the receipt of Similarly, under Section-42 of Delhi Value Added Tax Act, 2004, interest is liable to be paid on delayed refunds. Therefore, it becomes imperative upon the concerned refund sanctioning authority/proper officer that all refund applications are processed and decided within the prescribed time frame in order to avoid undue interest liability on the department.

3. In this regard, departmental instructions/orders/circulars were issued from time to time and a grievance redressal mechanism has already been circulated vide Circular No. F.3(433)/GST/Policy/2022/1268-77, dated 13-5-2022.

3. All Ward Inchrges/Proper Officers/Zonal Incharges are hereby directed to adhere to departmental guidelines issued by the department for timely disposal of all types of refunds and take utmost care to dispose off the refund application within stipulated time period.

4. Non – compliance will invite stringent action.

(Dr. S.B. Deepak Kumar)

Commissioner (State Tax)

No. F. 3(433)/GST/policy/2022/1407-13

Dated: 20.07.2022

1. All SCTTs/ACTTs/JCTTs, Trade and Taxes Department.

2 All Ward Incharges/Proper Officers through the Zonal Incharge, Trade and Taxes Department.

3 The President, Sales Tax Bar Association(Regd.), 2nd Floor, Vyapar Bhawan, I.P Estate, New Delhi-110002

4 Sh. Rajesh Jain, Advocate, A2/142. (GF) Safdurjung Enclave. New Delhi-110029

5 P.S. to Commissioner (GST), Deptt. of Trade & Taxes, GNCTD

6 Guard File.

(Sunita)

Asstt. Commiisioner(Policy)

GOVERNMENT OF NCT OF DELHI

DEPARTMENT or TRADE & TAXES,

VYAPAR IIIIAWAN, NEW DELHI – 110002.

(POLICY BRANCH)

No.F.3(433)/GST/Policy/2022/1268-77

Dated: 13.05.2022

Circular

Subject: Grievance redressal mechanism in case of pending Refunds- reg.

1. In terms of the Section 38 of the DVAT Act, 2004 and the rules made there under, the refund applications are required to be disposed within a stipulated period of 2 months.

2. Similarly, under Section 54 of the DGST Act, 2017, taxpayer can claim the refund of any payment and interest before the expiry of two years from the relevant date. The proper officer shall issue the order within sixty days from the date of receipt of application, else interest at the rate not exceeding 6% shall be payable on such refund application.

3. It has been observed that many refund cases are still pending in the Wards beyond the permissible time limit. In this regard Department has been issuing Circulars from time to time for disposal of the refund application in a time bound manner. Some of the taxpayers have also approached the Hon’ble High Court with their grievances and the Hon’ble Court has highlighted the need to decide the applications within statutory timelines. It is therefore incumbent upon the concerned officers to ensure that the refund applications are disposed strictly in accordance with the statutory timelines. A circular regarding time bound disposal of GST refunds has again been issued on 04.05.0222 which needs to be complied with strictly. Similarly the pending VAT refund applications which may have remained pending due to various reasons, have to be disposed in a mission mode.

4. In order to further streamline the process of disposal of refund applications and to provide a platform for the dealers/taxpayers to register their grievances related to the pending refund applications, a mechanism is being put in place, wherein, such dealers/taxpayers can file their grievances with the department through the DVAT Portal by filling a simple Refund Grievances Redressal Form. Grievances received on the refund grievances redressal form shall be handled as per the process laid down as under:

(i) The dealer will submit an application in the Refund Grievances Form, which is available on the home page of DVAT Portal at https://dvat.gov.in/Grievance Forms/Grievance-page.html

(ii) EDP Branch will forward the details to the concerned Ward and Zonal incharge on the same day.

(iii) The Ward in-charge will dispose of the application on merit within 10 working days of receiving the information.

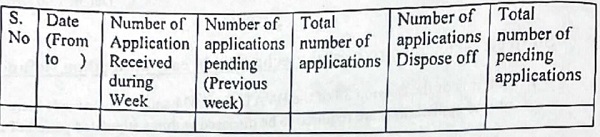

(iv) Zonal incharges will supervise the progress of disposal on daily basis and furnish on taken report to the EDP Branch on weekly basis in the following format

Name of Zone:

(v) Special Commissioner-I, shall be the Nodal Officer for monitoring the disposal of grievances in time bound manner and may issue necessary direction to the Zonal as well as Ward incharges wherever required. EDP Branch will submit a consolidated report to the Special Commissioner -I every week. Special Commissioner-I will submit a weekly report to Commissioner every Monday regarding cases which continue to remain pending even after the lapse of 10 days despite his directions to the Zone/ward.

(vi) In case the ward officer doesn’t report compliance to the nodal officer within 10 days, the nodal officer will bring it to the notice of the zonal incharge for appropriate entry in the APAR of the responsible officer.

6) EDP branch shall inform about this facility to the registered taxpayers by SMS and email.

This issues with the approval of Commissioner, State Tax.

(ANAND KUMAR TIWARI)

Special Commissioner (Policy)

No.F.3(433)/GST/Policy/2022/1268-77

Dated: 13/05/2022

Copy forwarded for information and necessary action to:

1. All SpL/Addl./Joint Commissioners, Department of Trade & Taxes, GNCT of Delhi, Vyapar Bhawan I.P. Estate, New Delhi-02.

2. Special Commissioner (PR), Department of Trade & Taxes, GNCT of Delhi, Vyapar Bhawan I.P. Estate, New Delhi-02 for wide publicity of the contents of this circular.

3. Joint Director (IT), Department of Trade & Taxes, GNCT of Delhi, Vyapar Bhawan I.P.

4. Estate, New Delhi-02 for uploading the circular on the website of the department.

5. The President/General Secretary, Sales Tax Bar Association (Regd.), Vyapar Bhawan.

6. I. P. Estate, New Delhi-02.

7. All Assistant Commissioner/AVATOs Department of Trade & Taxes, GNCT of Delhi.

8. Vyapar Inman I.P. Estate, New Delhi-02.

9. PS to the Commissioner, VAT Department of Trade & Taxes, GNCT of Delhi, Vyapar.

10. Bhawan LP. Estate, New Delhi-02.

11. Guard File.

(VIVEK MITTAL)

Assistant Commissioner (Policy)