E-Way Bill and Process

Deepak Mata, Assistant Director, National

Academy of Customs, Indirect Taxes and

Narcotics (NACIN), Mumbai

E way Bill- Posers

- E way Bill- What is it?

- E way Bill- Why? Benefits?

- E way Bill- When is to be generated? By whom? How?

- E way Bill- What if no taxable supply?

- E way Bill- Is it mandatory? What if not done?

- E way Bill- Supply by unregistered persons?

- E way Bill- Concept of acceptance by recipient?

- E way Bill- Validity period? Whether extendable?

Legal & Administrative Framework

- Section 68 of the CGST Act, 2017

- Chapter XVI of CGST Rules, 2017

- Rule 138; 138 A, B,C,D

- Forms: GST-EWB-01, GST-EWB-02, GST-EWB-03, GST-EWB-04, GST-INV-01

- Notification No. 27/2017-Central Tax dated 30th August 2017

- Notification No. 74/2017-Central Tax dated 29.12.2017

- Portal: The facility for generation, modification and cancellation of e-way bills is being provided on trial basis on the portal ewaybill.nic.in. Once fully operational, the eway bill system will start functioning on the portal ewaybillgst.gov.in

Appointed Date for e-Way Bill

Notification No: 74/2017- Central Tax, Date: 29th December 2017

♠ Appoints s the notified date from which the provisions of Rule 138, 138(A) to 138 (D) will take effect.

♠ CGST Rules, 2017 amended

> Chapter XVI on E-way Bill Rules

> Rule 138 added by Notification No. 27 /2017-Central Tax dated 30th August, 2017

Trial Basis from : 16-01-2018

Compulsory : 01-02-2018

http://www.cbec.gov.in/resources//htdocs-cbec/gst/notfctn-74-central-tax-english.pdf

E-Way Bill Mechanism

- While the system for both inter-State and intra- State e-way Bill generation is ready by 16th January, 2018, the States may choose their own timings for implementation of e-way Bill for intra- State movement of goods on any date before 1st June, 2018.

- In any case, uniform system of e-way Bill for inter-State as well as intra- State movement will be implemented across the country by 1st June, 2018.

Eway bill introduction by States

- Four States -Karnataka, Rajasthan, Uttarakhand and Kerala have already started using E-way Bill

- Haryana, Bihar, Maharashtra,Gujarat, Sikkim and Jharkhand started trial run from 16.01.2018

- Maharashtra has issued notification on 29th December, 2017 for introduction of Eway bill w.e.f 1st February, 2018

- http://mahavat.gov.in/Mahavat/MyFold/DOWNLOADS/NOTIFICATIONS/KNOW NOTIFI MVAT/KNOW NOTIFI MVAT 01 09 18 10 50 6AM.pdf

E-way Bill-Rules

| RULE No: | Description |

| 138 | Information to be furnished prior to commencement of movement of goods and generation of e-way bill. |

| 138-A

|

Documents and devices to be carried by a person -in-charge of a conveyance. |

| 138-B | Verification of documents and conveyances. |

| 138-C | Inspection and verification of goods. |

| 138-D | Facility for uploading information regarding detention of vehicle |

E-way Bill – Forms

| Form No: | Description |

| GST EWB -01 | E – Way Bill |

| GST EWB -02 | Consolidated E-Way Bill |

| GST EWB -03 | Verification Report. |

| GST EWB -04 | Report of Detention |

| GST INV–1 | Generation of Invoice Reference Number |

E way Bill – Process

EWB Process is a new aspect for Central Tax Officers but is no New for State Tax officers across the country.

A Game Changer in GST system as it Streamlines transport system, Standardize the Business process and improves compliance mechanism resulting in improved revenue collections

A Government given Document for Movement of Goods One Nation-One Tax and One Document for movement across the states.

As and when a consignment enters a state separate EWB are to be generated. But Now one Document covering one nation will suffice.

A Paradigm Shift

From

“Departmental Policing Model” – a post movement capture model

(Move and make him to account)

Towards

“Self Declaration Model”, a pre movement capture model

( Account First and Move Later)

Objectives

- One e-waybill for movement of the goods throughout the country

- Hassle free movement of goods for transporters throughout the country

- Controlling the tax evasion

- No need for Transit Pass in any state

- Easier verification of the e-waybill by officers with complete details

Benefits

1. The traders need not visit tax offices anymore.

2. Average waiting time at check-post reduces drastically

3. Scope for corruption eliminated in office or at check-posts.

4. Self-policing by traders. A trader while uploading gives the identification of the buying / trader who also has to account the transaction.

5. Environment friendly – nearly 50 tons of paper saved per day.

6. An accurate database created-useful for tax analysis.

7. Officials saved of monotonous work could devote time to analytical work.

8. Revenue growth will be more than normal.

9. Complete Transparency of Transaction

- E-way bill (FORM GST EWB-01) is an electronic document (available to supplier / recipient / transporter) generated on the common portal evidencing movement of goods of consignment value more than Rs. 50000/-. It has two Components-

- Part A comprising of details of GSTIN of recipient, place of delivery (PIN Code), invoice or challan number and date, value of goods, HSN code, transport document number (Goods Receipt Number or Railway Receipt Number or Airway Bill Number or Bill of Lading Number) and reasons for transportation; and

- Part B –comprising of transporter details (Vehicle number).

Generation of E-way Bill

Every registered person who causes movement of goods of consignment value exceeding fifty thousand rupees

> In relation to supply; or

> For reasons o/t supply;

> (sales returns; stock transfer; movement for job work etc)

or

> Due to inward supply from unregistered person, shall, before commencement of movement, furnish information relating to the said goods in Part A of FORM GST EWB-01, electronically, on the common portal

Who Causes Movement?

The movement of goods can be caused by the supplier, if he is registered and he undertakes to transport the goods. In case the recipient undertakes to transport or arrange transport, the movement would be caused by him.

In case the goods are supplied by an unregistered supplier to a recipient who is registered, the movement shall be said to be caused by such recipient if the recipient is known at the time of commencement of the movement of goods.

| Generation of E Way Bill |

Form GST EWB-01

> Two Parts – A( Information) and B (For generation of E way bill; relating to transporter)

Who will generate E Way Bill?

> One who transports

> Supplier / Recipient- Part B

> If not above, registered person to fill part B and transporter to generate e way bill

Whether an e-way bill is to be issued, even when there is no supply?

- Even if the movement of goods is caused due to reasons others than supply, the e-way bill is required to be issued.

- Reasons other than supply include movement of goods due to

- export/import,

- job-work,

- SKD or CKD,

- recipient not known,

- supply of liquid gas where quantity is not known,

- supply returns,

- exhibition or fairs,

- for own use,

- supply on approval basis and others etc.

What if

What if the value less than Rs. 50, 000/-

> E-way bill not compulsory

> Optional

Movement caused by unregistered person, and

Recipient is also unregistered or unknown

> E-way bill not compulsory

> Optional

Goods supplied by an unregistered supplier

What if

Change of conveyance? In the course of transit?

> Update the transport details on the common portal

Multiple Consignments in one conveyance? Individual consignments less than 50000/-, but total more than 50000/-

> Generate consolidated e-way bill prior to movement;

Transporter to issue consolidated E way Bill

What is the concept of acceptance of e-way bill by the recipient?

- The details of e-way bill generated shall be made available to the recipient, if registered, on the common portal, who shall communicate his acceptance or rejection of the consignment covered by the e-way bill.

- Deemed Acceptance:

- In case, the recipient does not communicate his

acceptance or rejection within seventy-two hours of the details being made available to him on the common portal, it shall be deemed that he has accepted the said details.

What if

E way Bill and EBN generated, but goods not transported?

> Cancel E Way Bill within 24 hours of its generation

If E Way bill verified in transit,

> it cannot be cancelled

Validity of E way Bill

What is a day for e-way bill? How to count hours/day in e-way bill?

- This has been explained in Rule 138(10) of CGST Rules, 2017.

- The “relevant date” shall mean the date on which the e-way bill has been generated and

- the period of validity shall be counted from the time at which the e-way bill has been generated and each day shall be counted as twenty-four hours.

Can the validity period of e-way bill be extended?

- In general No. However, Commissioner may extend the validity period only by way of issuance of a notification for certain categories of goods which shall be specified later.

- Also, if under circumstances of an exceptional nature, the goods cannot be transported within the validity period of the e-way bill, the transporter may generate another e-way bill after updating the details in Part B of FORM GST E WB-01.

- Goods can not move once the validity expires; Commr may extend the validity

Acceptance by recipient

The details of e-way bill generated shall be made available to the recipient, if registered, on the common portal, who shall communicate his acceptance or rejection of the consignment covered by the e-way bill.

Non-communication of acceptance or otherwise

> within 72 hours shall be treated as deemed acceptance

Documents to be carried with conveyance

Invoice or bill of supply or delivery challan, as the case may be

> Or Invoice reference number generated on portal

A copy of the e-way bill or the e-way bill number, either physically or mapped to a Radio Frequency Identification Device (RFID) embedded on to the conveyance in such manner as may be notified by the Commissioner

> RFID mapping may be made compulsory for class of transporters ( Notn by Commissioner)

Interception & Verification

RFID readers to be installed at places meant for verification

Physical verification to be by authorized proper officers

On receipt of specific information of evasion of tax, physical verification of a specific conveyance after obtaining necessary approval of the Commissioner or an officer authorized by him in this behalf

Inspection & Verification of goods

A summary verification report of every inspection of goods in transit

> with in 24 hours (Part A of FORM GST EWB – 03) and

Final report

> With in three days of the inspection(Part B of FORM GST EWB – 03

Once physical verification done,

> NO further verification in the state

> Unless specific information

What if delay due to inspection?

Facility for uploading information regarding detention of vehicle Where a vehicle has been intercepted and detained for a period exceeding thirty minutes,

the transporter may upload the said information in FORM GST EWB- 04 on the common portal

Other Features of EWB

- E-Way Bill is invalid without vehicle number for transportation of more than 10 KMs

- Vehicle Number can be entered by generator of EWB or transporter

- E-way Bill with consignment should have latest vehicle which is carrying the consignment

- No E-Way Bill is required for

- goods exempted for e-Way Bill

- transported in non-motorized conveyance

- Consolidated E-Way Bill can be generated for vehicle

- carrying multiple EWB consignment

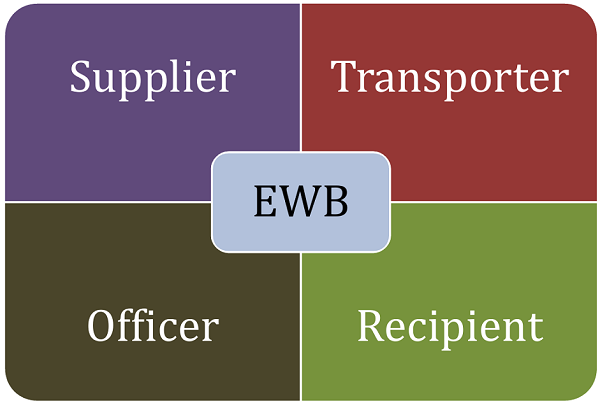

Stake Holders

Reasons other than Supply

> Exempted Supply;

> Export or Import;

> Job Work;

> Removal in SKD or CKD form;

> Line Sales;

> Sales Return;

> Exhibition or fairs ;

> For own use (stock transfers etc.)

> Supply on Approval Basis

e-waybill System

Stake Holders

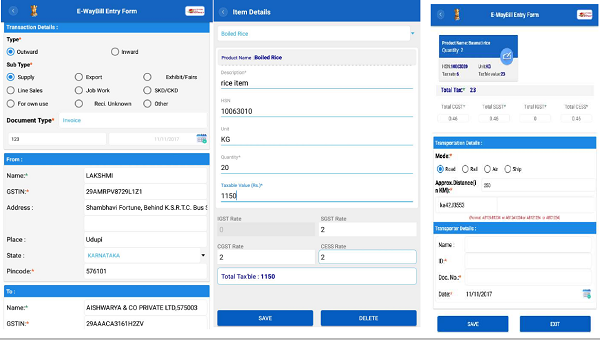

E-Way Bill Format-EWB-01

PART A

- GSTIN of Recipient -GSTIN or URP

- Place of Delivery -PIN Code of Place

- Invoice/Challan No -Number

- Invoice/Challa n Date -Date

- Value of Goods –

- HSN Code -At least 2 digit of HSN Code

- Reason for Transport -Supply/Exp/Imp/Job Work/…

- Transporter Doc. No -Document No provided by trans.

PART B

- Vehicle Number -Vehicle Number

Features of New System

MoDeS of generation of E-way bill

Officer Activities

Other Features

How to Start

IN PIPELINE

Volume of Transactions

| No. | Description | Total | Expected/ day |

| 1 | No of Tax payers to login | 1 crore | 20 Lakhs |

| 2 | No of Transporters | 2 Lakhs | 2 Lakhs |

| 3 | No of GST Officers | 30,000 | 8,000 – 10,000 |

| 4 | No of e-waybill generation | NA | 40 – 50 lakhs |

| 5 | No of e-waybill updating with Vehicle No. | NA | 10 – 15 Lakhs

|

| 6 | No of e-waybill verification by Officers | NA | 5 – 8 Lakhs

|

| 7 | No of e-waybill acceptance/ rejection by recipients | NA | 25 – 30 Lakhs |

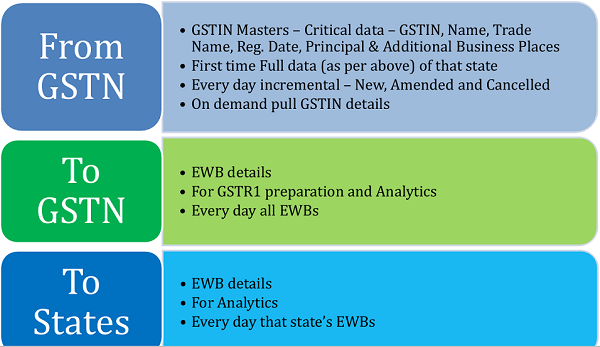

Data Exchange with GSTN and States

E-Way -Bill Important Points

Important Points

One Consignment ⇒ One Document ⇒ One E-waybill

> Multiple documents can not be clubbed to generate one e-way bill

One Invoice ⇒ Multiple Consignments with Multiple challans ⇒ Multiple E-way bills

> In case of SKD/CKD/Ship consignments, one invoice will result in making multiple consignment for movements with challans and resulting in multiple e-way bills

One e-way bill can not be generated with multiple documents

Multiple Documents >< One E-way Bill – Not Possible

No way the e-way bill can be edited or amended

> It can be cancelled within 24 hours if required and generate new Transportation (vehicle) details can be updated

> any number of times till the goods reaches the destination within validity period

E-way bill generated is invalid for movement of goods, if it is not updated with Part-B, if the travel distance is more than 10 KMs

> Validity of the e-way bill starts from time of first entry of Part-B (vehicle details), not from the time of generation of e-way bill.

> Part-B updation is not must for first and last mile of travel, if the distance is less than 10 KMs

Consolidated E-way bill does not have any specific Validity. It depends upon the e-way bills attached to it.

For one e-way bill multiple modes of transportation can be updated – like First Ship, then air and road

For one e-way bill multiple modes of transportation can be updated – like First Ship, then air and road

Multiple e-way bills passing through transhipment from one place to another in different vehicles to reach the destinations

Sometimes the consignments move to 8-10 branches of the transporter before they reach its destination.

The consignments reach the particular branch of transporter from different places in different vehicles and again these consignments will be split to different places in different vehicles.

Best solution for transhipment of consignment is generation of consolidated eway bill from one place to another

Best solution for transhipment of consignment is generation of consolidated eway bill from one place to another

Multiple Modes for Generation of EWB

> Rudimentary way through Internet

> EWB through SMS

> EWB through Mobile APP (Android and iOS)

> API interface, Site to site integration

E-WAY BILL SYSTEM – SMS Mode

SMS based E-way bill

Operations

- Generate the E-Way Bill

- Update the Vehicle details

- Cancel the E- Way Bill

Pre- requisite

- Registering the mobile number with the GSTIN on the EWB system

SMS – Generating Ewb Examples

SMS Alerts to Tax Payers

Every day the following message is sent to all the tax payers who using EWB system

GSTIN: 29AAWPR3924N1ZM:

Your E-waybill statistics for : 06/12/2017-GENERATED BY YOU as

♠ Outward: 7 (Value Rs. 3584882) ;

♠ Rejected by you:1 (Value Rs 28000) ;

♠ GENERATED BY OTHER PARTY as outward: 3 (Value Rs. 1872500)

E-WAY BILL SYSTEM – Mobile APP

Mobile App for EWB operations

> Mobile (Android and ios) based app is developed for e-way bill operations

> All the activities of e-way bill can be done on this app

> IMEI of the mobile number needs to be registered on the EWB system to use the app

E-Way Bill Registration and Login

E-Way Bill Menu Options

Adding My CLIENTs

Adding My SUPPLIERs

Adding My TRANSPORTERs

Adding My PRODUCTs

E-Way Bill Entry Form

E-Way Bill Generate Form

Updating Vehicle Number

Printing EWB

E-WAY BILL SYSTEM API Interface

E-WAY BILL SYSTEM API Interface

API based EWB Generation

> This is site-to-site integration of Tax payer system with EWB system

> All the activities of e-way bill can be done on the API system

> This can be used by tax payers who generates more than 200-300 EWB/day

> APIs are Restful Web service based with JSON format

> The pre- requisite is Tax Payer systems should have SSL and Static IP

> Tax Payer should test on the sandbox before going for production

> Same APIs can be used by Suvidha Provider, if the Tax Payer has authorized him.

API Interface

Benefits of API Interface

> No need of double or duplicate entry – one for Invoice generation and other for E-Way Bill

> Mistakes are avoided

> No need of one more print – Invoice can have EWB No

> EWB No can be updated in Tax payer system with related invoice

> E-way Bill data to GST System for GSTR-1

> Readiness for Form INV – 1 (Invoice Reference Number)

> Same API interface can be used in other states with requesting for those GSTIN

Example – API Interface for Tax Payer system

1. Tax payer enters invoice details in his system

2. Tax payer generated Invoice from his system

3. Tax payer system calls EWB system through API with relevant information

4. EWB system after authentication and verification of information, generates EWB and returns EWB No.

5. Tax payer system gets this EWB No. and writes to his database along with EWB No. on the Invoice Copy and moves the goods.

Example – API Interface for Transporter system

1. On hourly basis , TRANS system pulls all the ewaybills assigned to him from EWB system

2. Before movement of goods, transporter enters vehicle no. for his LR and saves in his system

3. Now, TRANS system calls EWB system with EWB No. and other details requesting to update Part B.

4. EWB system after authentication and verification of details, updates vehicle details and gives ACK.

5. TRANS system updates this ACK and prints the Trip sheet.

Now, transporter moves the goods.

A few Posers

- Can the vehicle be changed? How many times?

- The e-way bill for transportation of goods always should have the vehicle number that is actually carrying the goods.

- If the goods having e-way bill has to pass through transshipment and through different vehicles, how it has to be handled?

- For each movement from one place to another, the transporter needs to update the vehicle number in which he is transporting that consignment.

- More than one transporter???

- How to generate the e-way bill from different registered business places?

- The registered person can generate the e-way bill from his account from any registered business place. However, he/she needs to enter the address accordingly in the e-way bill. He/she can also create multiple sub-users and assigned to these places and generate the e-way bills accordingly.

- How can the taxpayer use the Android App to generate the e-way bill?

- The tax payer has to register the EMEI numbers of the mobiles through which he wants to generate the e-way bill on the e-way bill system.

- What has to be done to the e-way bill, if the vehicle breaks down?

- repair the vehicle and continue

- change the vehicle, Use ‘Update vehicle number’ option and enter the new vehicle details

- Can Part-B of e-way bill be entered by any transporter?

- Part-B can be entered only by the generator of the EWB and transporter assigned in it. That is, the generator of EWB indicates who is authorized to move the goods by entering his transporter id. Only such transporter can login and update the Part-B.

- Can Part-B entry be assigned to another transporter by authorized transporter?

- Part-B can be entered by the transporter assigned in the EWB or generator himself. But the assigned transporter cannot re-assign to some other transporter to update Part-B on the EWB system.

- Whether e-way bill is required, if the goods are being purchased and moved by the consumer to his destination himself.

- Who causes movement?

- Yes. As per the rules, e-way bill is required along with the goods, if it is more than Rs 50,000.00. Under this circumstance, the consumer can get the e-way bill generated from the tax payer or supplier, based on the bill or invoice issued by him. Or the consumer can enroll and log in as the citizen and generate the e-way bill.

- Can the e-way bill be modified or edited?

- The e-way bill once generated, cannot be edited or modified. Only Part-B can be updated to it.

- However, if e-way bill is generated with wrong information, it can be cancelled and generated freshly again. The cancellation is required to be done within twenty four hours from the time of generation.

- When to enter transport document details for rail/air/ship mode of transportation, as it is available only after submitting goods to the concerned authority?

- Collect transport document from rail/air/ship authority.

- Update transport document details in Part B

- within one hour

- Ideally, Part-B has to be updated before movement of goods from the place to submission.

- What has to be done by the transporter if consignee is refuses to take goods or rejects the goods for quality reason?

- Return the goods

- Get one more e-way bill generated with the help of supplier or recipient by indicating supply as ‘Sales Return’ and with relevant document details and return the goods to supplier as per his agreement with him.

“Bill to” and “Ship to” Case

- Two Invoices and two E-way bills to be issued

- How does the tax payer become transporter in the e-way bill system?

- select the option ‘Register as Transporter’ under registration and update profile.

- Once it is done with logout and login, the system changes tax payer as transporter and allows him to enter both supplier and recipient as per invoice

TRANSIN or Transporter ID?

- TRANSIN or Transporter id is 15 digits unique number generated by EWB system for unregistered transporter once he enrolls on the system. TRANSIN is 15 digits number on similar lines with GSTIN and it is based on state code, PAN and Check digit. This can be shared by transporter to his clients to enter this number while generating e-waybills.

- How to generate e-way bill, if the goods of one invoice is being moved in multiple vehicles simultaneously?

- CKD/SKD;

- Issue complete invoice before despatch of 1st Consignment

- Issue delivery challan for Each subsequent consignments + self certified copy of invoice

- original copy of the invoice shall be sent along with the last consignment

- How does the tax payer or recipient come to know about the e-way bills generated on his GSTIN by other person/party?

- on the dashboard, once he logs into the system

- get one SMS everyday indicating the total e-way bill activities on his GSTIN

- go to report section and see the ‘EWBs by other parties’

- go to reject option and select date and see the e-way bills