Understanding the intricacies of Public Offers and share price valuation is essential for any investor or aspiring investor. This guide explores the basics of these concepts, shedding light on how the stock market operates, and how prices are determined for an Initial Public Offering (IPO) or a Follow-on Public Offering (FPO).

Public Offers serve as the mechanism by which companies issue shares to the public. An IPO is the first instance of this, while any subsequent offers are considered FPOs. The latter can be further classified into dilutive or non-dilutive types, depending on whether they change the ownership of the company. Valuation of these offers is achieved through fixed-price or book-building processes, taking into account parameters such as the number of shares sold, the organization’s setup, market trends, and the company’s growth potential.

Valuing the price of shares, a complex procedure involving either the Intrinsic Valuation (IV) or the Relative Valuation approach, is crucial in determining the fair price of a company’s shares. Registered valuers use these methods to evaluate whether shares are overvalued, undervalued, or just right for investment.

What is Public Offer : It can be simply understood as offer to public. Public Offer is selling of the securities (shares) to the general public where there are large numbers of investors.

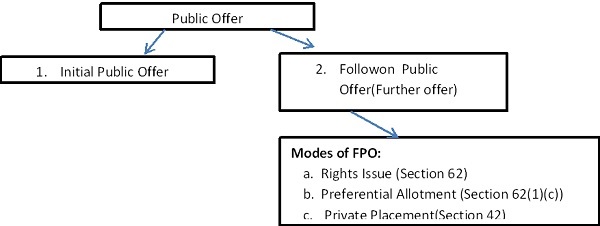

Types of Public Offer (PO):-

1. Initial Public Offer (IPO):-It is the process of first time offering of shares to the public in a stock market. It is the first action for listing of shares of any organization.

Follow on Public Offer (FPO):- It is the process of the additional issuance of a company’s shares after its initial public offering (IPO). Any issue or offer of securities after first time is follow on public offer. FPO can be issued through various modes such as: Rights issue, preferential allotment, private placement, etc.

FPOs are of two types. One of the types results in diluting the ownership, while the other results in no valuation change.

- Dilutive FPO: Dilutive FPO is a type of FPO where the companies issue additional shares, increasing the share float in the market.

- Non-Dilutive FPO: In a non-dilutive FPO, the issuing company does not issue new shares in stock market. Instead, the company’s existing shareholders, such as institutional investors or insiders, sell their shares to the public. The sale does not alter the current shareholders’ valuation or ownership percentage.

PROCESS OF VALUATION OF PUBLIC OFFER OF SHARES

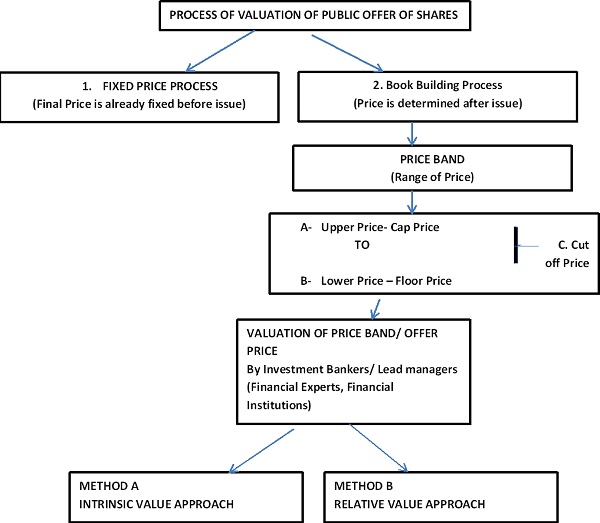

There are two types of process for valuation of Public Offer of shares:

1. Fixed-Price Process:- A fixed price process as name suggests, offers the company shares at a fixed price. The price is decided by the company, and the investors are aware in advance about the share prices before the company even goes up for the Public Offering.

2. Book Building Process:-The book-building offering involves a bidding process. The price per share is not fixed before Public Offer. It is determined by price band through a bidding process, and the cut off price is decided after the bidding is closed. The investor must specify how many shares to buy and how much they would pay for the same.

3. Price Band: – A price band is a value-setting method in which a merchandiser indicates an upper price and lower price limit, between which buyers are able to place bids. The price band’s floor and cap price provide guidance to the buyers to quote their price.

4. Cap Price and Floor Price: – The highest price at which an investor can place a bid is known as the Cap Price of the PO. While the lowest price at which an investor can place a bid is known as the Floor Price of the PO. For example, if a company launches a PO with a price range of Rs.50-60, then. Cap Price = Rs.60, Floor Price = Rs.50.

5. Cut-Off Price: – Cut-off price is the offer price at which shares get allotted to investors. It plays an important role in price discovery, helping underwriters gauge the demand for the offering and the right price from within the predetermined range. This is usually involved in a book building issue instead of a fixed price mechanism. The company announces the price band or the floor price in its prospectus, and the actual discovered price is within the price range, or any figure above the floor price, called the ‘Cut-off’ price.

For example, if a company’s PO is priced between Rs. 300 and Rs.305, and one bid Rs. 303 for ten shares, but the price is determined to be Rs. 302, he will receive allotment at Rs. 302 per share, whereas, if the price is determined at Rs. 304, he will fail to receive any allotment.

By selecting the cut off option, one can stand to gain allotment no matter what the final price of the PO is, so long as it doesn’t extend beyond the established price range.

Investors will be eligible for allotment at any discovered issue price by selecting a cut-off option. This can significantly increase the chances of getting an allotment, especially in popular issues.

Without opting for this feature, investors who bid lower than the final price fail to receive any allotment and refund their amount. In contrast, investors who bid an amount higher than the final price receive a refund of the difference amount.

What is Valuation of Price of Shares:-

Valuation of price of shares is the process of determining the fair price of the company shares. Share valuation is done on the basis of quantitative techniques and will vary depending on the demand and supply at market. Valuers collect various information about any organization past, present and future inorder to determine the company’s current value. Through the value of price of shares they determine whether the shares of a company are overvalued or undervalued and viable for investments.

Why Valuation is required for Public Offer:-

Valuation is important for Public Offer for both the company as well as the investors. A company needs to fairly value the PO in order to attract investors. An investor should consider the PO valuation and be wary about applying for a PO for two reasons:

1. It gives them a clear idea of the company’s business prospects, key managerial persons and future growth opportunities.

2. They can get a clear picture of the company by analysing the financial, income, and cash flow statements instead of the overarching advertisements and promotions.

Who does Valuation:-

A person registered as Registered Valuer as per Section 247 of the Companies Act, 2013 read with the Companies (Registered Valuers and Valuation) Rules, 2017 are eligible to do valuation of Securities.

Parameters for valuation of offer price/ price band:-

Investment firms/ Valuers value the offer price of issuer company based on various parameters as:-

A. Parameters for IPO:-

- The number of stocks being sold in an IPO

- The organizational set-up of the private company

- The current prices of the stocks of similar companies in the same sector

- Company’s growth potential

- Company’s business model financial effectiveness

- General overall market trend

- The demand from the potential customers for the company’s stock

B. Parameters for FPO:-

- The Company’s financials

- Past performance

- Future performance

- Industry growth rate

- The performance of other companies in the same industry

- The potential demand for its shares

Methods of Valuation of Price Band/Offer Price:-

The company’s worth or the value of price of shares is calculated using either the Intrinsic Valuation (IV) approach or the Relative Valuation approach or a mix of the two. These are complex methods in which the Investment Bankers / Lead managers (who are usually Financial Experts, Financial Institutions, and Chartered Accountants having atleast 10 years’ experience) are trained and help companies put a price tag on their shares.

METHOD A: Intrinsic Value Approach: Intrinsic value is a way of describing the perceived or true value of an asset. It is not always identical to the current market price because assets can be overvalued- or undervalued. Intrinsic value is most common type of fundamental analysis used in stock market.

Methodology:-

I. Gordon Growth Model(GGM):- One variety of this Intrinsic Value is dividend-based model is the Gordon Growth Model (GGM), which assumes the company in consideration is within a steady state that is, with growing dividends in perpetuity. It is expressed as the following:

P=D1/(R-G)

where:

P=Present value of stock

D1=Expected dividends one year from the present

R=Required rate of return for equity investors

G=Annual growth rate in dividends in perpetuity

E.g.: Expected Dividends one year from the presemt =D1= Rs.5

Required rate of return for equity investors = R= 8%

Annual growth rate in dividends in perpetuity= G= 3%

Then, Present value of stock= P= D1/(R-G)=5/(8-3)= 5*100/(5)= Rs.100/-

As the name implies, it accounts for the dividends that a company pays out to shareholders, which reflects on the company’s ability to generate cash flows. There are multiple variations of this model, each of which factors in different variables depending on what assumptions you wish to include. Despite its very basic and optimistic assumptions, the GGM has its merits when applied to the analysis of blue-chip companies and broad indices.

II. Residual Income Models :- Another such method of calculating this value is the residual incomemodel, which expressed in its simplest form is as follows:

V0= BV0 + ∑ RIt/ (1+r) t

Where

V0= Value of Stock

BV0=Current book value of the company’s equity

RIt=Residual income of a company at time period t

r =Cost of equity

E.g.:- Beginning book value at time 0 = BV0=Rs.20.00

Residual income in Year 1 = RI1= Rs.0.50

Residual income in Year 2 = RI2= Rs.0.85

Cost of equity = r= 10%

Additionally, Assume: • Residual income in Year 3 = RI3= Rs.1.00 • The firm ceases operations in three years

Value of Stock = V0= Rs.20 + ( 0.50/1.101 + 0.85/1.102 + 1.00/1.103)

V0= Rs.20+Rs.1.91

V0=Rs.21.91/-

The key feature of this formula lies in how its valuation method derives the value of the stock based on the difference in earnings per share and per-share book value (in this case, the security’s residual income) is used to arrive at the intrinsic value of the stock.

METHOD B: Relative Value: Relative value is a method of determining an asset’s worth that takes into account the value of similar assets. The relative value of an asset is derived from comparing it to a collection of similar assets, referred to as a “peer group.”

If you were attempting to sell your home, you would likely look into the estimated prices of similar nearby homes in the same neighborhood. Likewise, assets such as the shares of publicly traded companies can be valued under a similar method.

Methodology:-

The two main relative valuation methodologies are:

1. Comparable Company Analysis- The accuracy of relative valuation depends directly on picking the “right” peer group of companies or transactions (i.e. an “apples-to-apples” comparison).

To quickly recap on key assumptions and projections that we need to make when performing a Comparable Company analysis:

- Peer Universe: A selection of competitor/similar companies used to determine a benchmark valuation.

- EBITDA: Historical & projected Earnings before Interest, Taxes, Depreciation & Amortization.

- EPS: Historical & projected Earnings per Share.

2. Precedent Transactions: – Precedent transaction analysis is a valuation method in which the price paid for similar companies in the past is considered an indicator of a company’s value. Precedent transaction analysis is a method of valuing a company based on the purchase multiples recently paid to acquire comparable companies.

Finding the right Precedent Transaction Peer Universe can therefore be somewhat subjective, it can be based on:-

- Same business & industry

- Similar business size

- Similar sales growth rates and profitability margins

- Similar capital structure

- Similar reasons for transaction (e.g. fire sale, bankruptcy, or strategic motive).

- Same geographic location of operations

Conclusion: Being knowledgeable about the terminology, processes, and methodologies related to share price valuation is a necessity for anyone dealing with the stock market. This understanding helps in making informed decisions regarding investing in IPOs or FPOs. Furthermore, it provides clarity on the valuation of the shares and how a price band is calculated, contributing to a more successful investment journey.

References:-

- “Terminology.” Wikipedia.

- “Stock Market Analysis.” Economic Times.

- “Investment Basics.” Zerodha.com.

- “Understanding Public Offers.” 5 Paisa.com.

- “Share Valuation Explained.” IIFL.com.

- “Insights into IPOs and FPOs.” Icicidirect.com.

- “Investing in Public Offers.” Scripbox.com.

- “Detailed Guide on Share Valuation.” Investopedia.com.