Resolutions requiring special notice- Interpretation of Section 115 with Section 140(4) and 139(9) of Companies Act, 2013

Text of Section 115 of Companies Act, 2013

Resolutions requiring special notice.

115. Where, by any provision contained in this act or in the articles of a company, special notice is required of any resolution, notice of theintention to move such resolution shall be given to the company by such number of members holding NOT LESS THAN one percent of the total voting power or holding shares on which such aggregate sum of NOT exceeding five lakh rupees [rule 23(1)], as may be prescribed, has been paid-up AND the company shall give its members notice of the resolution in such manner as may be prescribed [Rule 23 of Companies (Management and Administration) Rules, 2014].

There are ONLY two cases in the whole Companies Act, 2013 where Special Notice is required

1. Section 140(4) – appointment of auditor other than retiring auditor. [requires Special Resolution]

2. Section 169(3) – removal of director. [Ordinary Resolution]

Definition of “total voting power” – section 2(89)

(89) “total voting power”, in relation to any matter, means the total number of votes which may be cast in regard to that matter on a poll at a meeting of a company if all the members thereof or their proxies having a right to vote on that matter are present at the meeting and cast their votes;

Rule 23 of Companies (Management and Administration) Rules, 2014:

23. Special Notice: – (1) A special notice required to be given to the company shall be signed, either individually or collectively by such number of members holding not less than one percent of total voting power OR holding shares on which an aggregate sum of NOT LESS THAN five lakh rupees has been paid up on the date of the notice.

[After harmonising the interpretation of Section 115 with Rule 23(1) – AT LEAST a minimum of Rs. 5,00,000 shall be paid up on the date of the notice]

(2) The notice referred to in sub-rule (1) shall be sent by members to the company NOT earlier than three months but at least fourteen days before the date of the meeting at which the resolution is to be moved, exclusive of the day on which the notice is given AND the day of the meeting [May be AGM or EGM].

If Special Notice is given under Section 140(4) then only and only AGM.

If Special Notice is given under Section 169(3) then may be AGM or EGM.

(3) The company shall immediately after receipt of the (special) notice, give its members notice of the resolution at least seven days before the meeting, exclusive of the day of dispatch of notice and day of the meeting, in the same manner as it gives notice of any general meetings. [This would mean that provisions of Section 101 and 102 shall be complied for giving the special notice.]

(4) Where it is not practicable to give the notice in the same manner as it gives notice of any general meetings, the notice shall be published in English language in English newspaper AND in vernacular language in a vernacular newspaper, both having wide circulation in the State where the registered office of the Company is situated AND such notice shall also be posted on the website, if any, of the Company.

(4) The notice shall be published at least seven days before the meeting, exclusive of the day of publication of the notice AND day of the meeting.

Analysis of Section 140(4): –

(4) (i) Special notice(Section 115 and Ruke 23) shall be required for aresolution [this should be read as Special Resolution]* at an ANNUAL GENERAL MEETING appointing as auditor a person other than a retiring auditor, or providing expressly that a retiring auditor shall not be re- appointed [same wordings as that of Section 139(9)], except** where the retiring auditor has completed a consecutive tenure of five years or, as the case may be, ten years, as provided under sub-section (2) of section 139.

(ii) On receipt of notice of such a resolution, the company shall forthwith send a copy thereof to the retiring auditor.

(iii) Where notice is given of such a resolution and the retiring auditor makes with respect thereto representation in writing to the company (not exceeding a reasonable length) and requests its notification to members of the company, the company shall, unless the representation is received by it too late for it to do so,—

(a) in any notice of the resolution given to members of the company, state the fact of the representation having been made; and

(b) send a copy of the representation to every member of the company to whom notice of the meeting is sent, whether before or after the receipt of the representation by the company,

and if a copy of the representation is not sent as aforesaid because it was received too late or because of the company’s default, the auditor may (without prejudice to his right to be heard orally) require that the representation shall be read out at the meeting:

Provided that if a copy of representation is not sent as aforesaid, a copy thereof shall be filed with the Registrar:

Provided further that if the Tribunal is satisfied on an application either of the company or of any other aggrieved person that the rights conferred by this sub-section are being abused by the auditor, then, the copy of the representation may not be sent and the representation need not be read out at the meeting.

*Section 139(9)(c)– Special Resolution shall be required for-

(a) appointment of person as auditor other than the retiring auditor.

Or, if (new auditor is not appointed then)

(b) providing expressly that the retiring auditor shall not be re- appointed.

**Note: – Provisions of Section 140(4) shall not apply in cases where a company falls under Section 139(2) as there is no concept of auditor re-appointment for such company.

Text of Section 139(9): –

(9) Subject to the provisions of sub-section (1) and the rules made thereunder**, a retiring auditor may be re-appointed at an annual general meeting, if—

(a) he is not disqualified for re-appointment; (or)

(b) he has not given the company a notice in writing of his unwillingness to be re-appointed; and*(or)

(c) a special resolution has not been passed at that meeting appointing some other auditor or providing expressly that he shall not be re- appointed.

Important Observation:

An Ordinary Resolution will be sufficient for appointment of an auditor or re-appointment of the retiring auditor. In cases where an auditor who has completed his one term of appointment of his first appointment or subsequent re-appointment, and if the Company has received any Special Notice for appointment of new auditor or for providing that the retiring auditor shall not be re-appointed requires special resolution, hence, filing of MGT-14 shall also be necessary in terms of Section 117 and further, the Form ADT-1 has also been specifically updated for inclusion of such appointment where the retiring auditor is not re-appointed. In ADT-1, field 3(b) for Nature of appointment if we look the options in the drop-down there is a specific option for this and is required to be selected in this case, that is, “Auditor appointed in case of non-reppointment/removal of the previous auditor” therefore, we need to select this for new auditor appointment in place of retiring auditor.

* This and shall be read as or as there is no relation between three clauses of this Section.

**the wordings would mean that all the provisions of Section 139(1) shall be complied even if the retiring auditor is not appointed i.e. Form ADT-1 shall be filed with the RoC and the new auditor shall hold office up to the sixth AGM from the AGM (i.e. for 5 financial years) at which the new auditor is appointed by passing SR, also Form MGT-14 shall be filed to Roc under Section 117(3)(a).

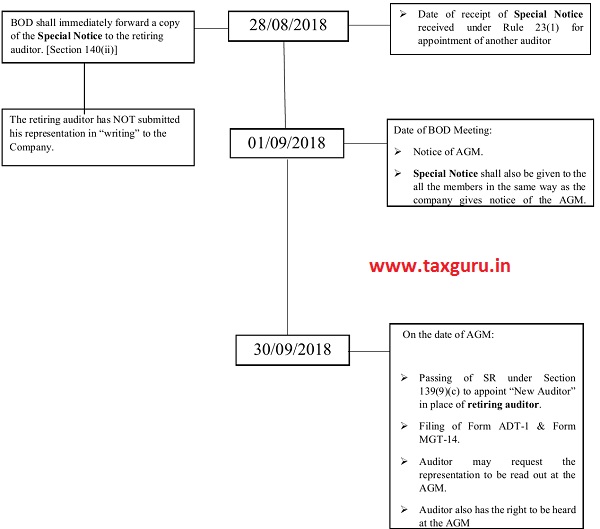

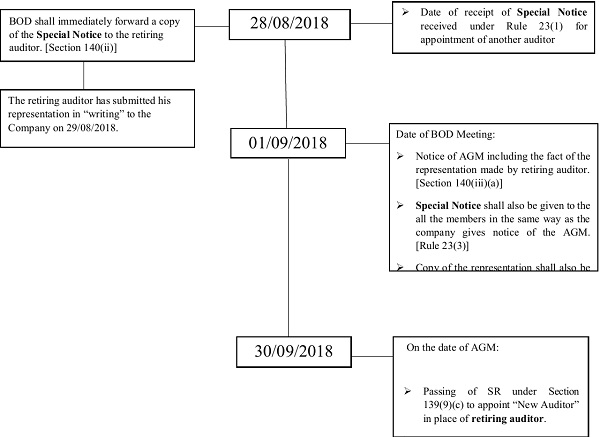

Diagrammatic Example of Special Notice and new auditor appointment

Case 1: Where auditor has submitted his representation too late, or he has not given any representation.

Case 2: Where the Auditor has given his representation to the Company

Note:

All the views represented here are purely based on the interpretation of the provisions of the Companies Act, 2013 and views represented here might vary on case to case basis and the factual merits of each case.

i want to know more about the exception from co-operative audit for three years which form should be used?

Pls clarify below:

A Company who is not falling under section 139 (2), being a small private Co., have appointed an Auditor from 2014-19 i.e., for a term of 5 years and now appointing some other firm under the same network for another term of 5 years.

Here, in this scenario, the Auditor is asking special resolution under section 139(9) and special notice under section 140(4) for being appointed stating that the retiring Auditor is not getting re-appointed. My view is that as their 5 yrs term is over, we have to appoint a new Auditor in AGM by means of an ordinary resolution only and not a special resolution and also no special notice is required.

Hi,

Special notice required in case of removal of auditor under section 140, not in case of appointment of new auditor in place of retiring auditor.

Kindly correct me if i am wrong.